Mints

History of mints

Mints have existed for thousands of years, since the earliest use of coins as a currency. The first example of a mint was by the Lydian people of modern-day Turkey, who were producing their own gold coins as early as 600 BC. Not long after this time, the popularity of coined currency spread across the Mediterranean where regions like Persia, Athens, Aegina, and Corinth all developed their own coins. There has also been evidence of mints existing in ancient Chinese civilizations.

We may use the term ‘coin’, but early forms of metal as money weren’t exactly coins as we know them today. Early mints used manual or mechanical methods to produce coins, often involving the hammering of metal blanks (planchets) with engraved dies to imprint the design. In the mid-16th century, machine-made milled coins were developed, leading to the production of higher-quality coins. The world’s oldest continuously running mint is France's Monnaie de Paris, which was founded in 864 AD.

Just as they are today, metals in the past were a symbol of strength and stability. For many cultures across the globe, precious metals represented wealth due to their scarcity and durability. This hasn’t changed much today, where gold and silver bars and coins are purchased by investors looking for a way to preserve their wealth across generations.

Government mints vs private mints

There are two types of mints that produce precious metals items: government mints and private mints. Let’s look at the difference between these mints and the products they produce.

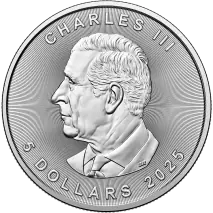

Government mints are facilities operated or authorized by national governments to produce official currency for circulation within the country's economy. They primarily produce circulating coins used in everyday transactions, but also mint commemorative and collectible coins as well as gold and silver bars and other bullion products. Being official sovereign entities, government mints are subject to regulatory oversight to ensure quality, integrity, and authenticity of their products. Well-known government mints include the China Gold Coin Inc. Mint, Austrian Mint, New Zealand Mint, Rand Refinery, The Royal Canadian Mint, United States Mint, The Royal Mint, and Perth Mint.

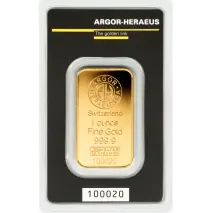

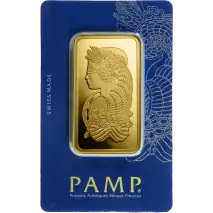

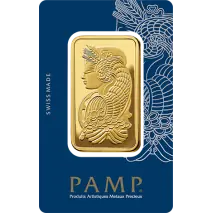

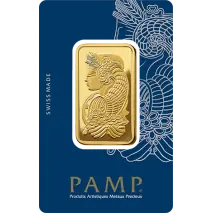

Private mints, sometimes called refineries, are independent facilities operated by private companies or organizations. They're run like a business and focus on producing bullion bars and coins made from precious metals like gold, silver, platinum, and palladium. They do not have the authority to produce legal tender. Highly-reputable private mints include PAMP, Valcambi, Argor Heraeus, C-Hafner, Heraeus, Metalor, Asahi Refining Mint, and Credit Suisse Mints.

Compared to government mints, private mints often have more flexibility to innovate and experiment with different coin designs, finishes, and packaging. Some private mints collaborate with designers and sculptors to mint special collectible works of art while others choose to focus on niche products. Some products produced by private mints include bullion bars, coins (called ‘rounds’ to distinguish them from government-minted coins), wafers (thin bars), and ‘grain’ (e.g. silver grain), which is often melted and used to make jewelry.

Government-minted coins

With that in mind, let’s look at the different types of coins produced by government mints. Most government mints produce three types of coins:

- Circulating coins

- Collectible or commemorative coins

- Bullion coins.

Let’s look at each of these different coin types in more detail.

Circulating coins

These are the coins produced by a government mint to be used as everyday currency. They’re typically made from base metals like copper, nickel, or zinc and produced in large quantities to meet the demand for everyday transactions within a country’s economy.

Depending on the country’s currency, circulating coins will come in different denominations (for example, 1c, 2c, 5c, 10c, 25c, 50c, $1, $2). Each denomination features a standard design (though this can be changed from time to time) and is minted for regular circulation.

Proof coins are a type of circulating coin that has more collectible (numismatic) value. These are early samples of a coin issue that are often struck twice, giving them a shinier finish than standard coins.

Collectible or commemorative coins

These government-produced coins are special editions released to commemorate significant events, honor historical figures, or celebrate cultural significance. Collectible coins often feature unique designs, finishes, and limited mintages which makes them desirable to collectors and investors alike.

Because of their rarity, collectible coins often carry a value much higher than their face value and bullion content. Generally speaking, the rarer the coin, the higher its value.

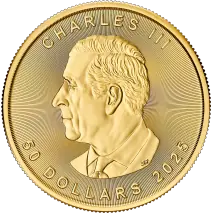

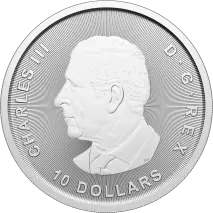

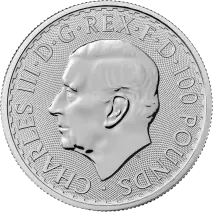

Bullion coins

These are investment-grade coins made from precious metals like gold, silver, platinum, or palladium. Bullion coins are minted in specific weights and purities and are valued based on the metal they contain. For example, the American Gold Eagle has a face value of $50 however its true value will be based on the price of gold per troy ounce.

Gold and silver bullion coins are highly sought-after by investors looking to diversify their portfolios or carry a hedge against inflation. With precious metals being one of the most enduring investments over time, bullion coins are an excellent way to maintain or grow wealth over time.

Examples of government-produced bullion coins include:

- Gold bullion coins: These are coins minted from gold, such as the infamous 1oz Gold Krugerrand, 30 g Gold China Panda, and Gold Sovereign Coin.

- Silver coins: These bullion coins are made from silver, including the 1oz Australian Silver Kangaroo, 1oz Vienna Silver Philharmonic, or 1oz American Eagle Silver Coin.

- Platinum bullion coins: These coins are minted from platinum, such as the 1oz Britannia Charles III Platinum Coin and 1oz Platinum Maple Leaf.

- Palladium bullion coins: These are made from palladium, and include the American Eagle Palladium Coin.

Bullion from private mints

Don’t be fooled into thinking buying from a government mint is the only way to guarantee a high-quality bullion investment. Many private mints have strong reputations worldwide and produce products on par with government mints.

Private mints produce bullion from all precious metals, including gold, silver, platinum, palladium, and sometimes even copper, in the shape of bars or rounds. Investors buying from private mints will find a greater variety of products to choose from, such as the famous Valcambi Gold CombiBar®, made from breakable pieces of 1g gold. Just like government mints, many private mints employ advanced refining and minting techniques to ensure the authenticity and integrity of their products.

Of course, the quality of your investments all comes down to which private mint you choose to buy from. Our recommendation when buying bullion from gold and silver mints is to choose a mint that's on the Good Delivery List issued by the London Bullion Market Association (LBMA). This means they meet international standards of quality and approval.

Highly-esteemed private mints include:

- PAMP Suisse: As one of the most reputable precious metals refineries in the world, PAMP Suisse have state-of-the-art refining facilities. Every product is made to the highest standards of craftsmanship and purity, and the mint is dedicated to sustainability and responsible sourcing.

- Valcambi: This internationally recognized gold refinery has more than 50 years history under their belt. In 2020, the renowned company was refining 6.6 tons of gold each day. Valcambi produce gold bars that are cast by a master craftsman and hand poured from pure, molten gold. It doesn’t get any better than that!

- Argor-Heraeus: This prestigious precious metals refinery and mint is highly-respected in the precious metals industry. It has a widely-known reputation for excellence, quality, and craftsmanship.

Why knowledge of mints is important for investors

Serious investors don’t just purchase any product from any bullion mint. They seek high-quality, high-purity, investment-grade products sourced from or produced by trusted mints that have a strong reputation in the precious metals market and bullion industry.

This not only provides peace of mind that the weight and purity of their investments is accurate, but also that their investments are high-quality, will maintain their value over time, and will be easy to authenticate and resell. Anyone who’s looking to invest in precious metals should take the time to recognize the world’s best mints so they can make informed purchases.

How to choose the right mint for your investments

Now that you know the difference between government mints and private mints, how can you choose the best one for your investments? We share some helpful guidelines below:

- Good Delivery List: Our first recommendation is to check whether the mint has a spot on the Good Delivery list. This always provides assurance that their products are of a high standard, ensuring not only a quality investment but ease of reselling.

- Reputation: Researching the reputation and track record of a mint before you buy is essential. Government mints generally have a long-standing history and are backed by the authority of the issuing government, providing a large degree of confidence. If you’re buying from a private company, look for one that has a proven track record of quality and reliability. Generally speaking, mints that have been operating for a long time tend to have an established reputation and more trust than newer mints.

- Product selection: With a good idea of a mint’s reputation and product quality, you might want to then look at their selection. Government mints typically produce a standard lineup of bullion coins with recognizable designs and high liquidity while private coins might offer a broader range of products with unique designs. Consider what you’re looking for in your investment and what each mint offers.

- Collectibility and premiums: With that in mind, think about whether your priority is collectibility or investment value. Government-issued bullion coins might carry higher premiums due to their numismatic appeal and limited mintages, while private bullion mints’ products may carry lower premiums.

Buy bullion coins and bars from a trusted dealer

Beyond choosing a trusted and reputable mint, you need to rely on a trusted precious metals dealer for your products. At StoneX Bullion, we only purchase high-quality, investment-grade bullion products from trusted mints with an international reputation for quality.

As an affiliate member of the London Bullion Market Association (LBMA), we stand out in the market for our commitment to good trading practices and quality products. Each bullion bar or coin we stock comes from the best-known mints in the world, allowing us to assure authenticity and integrity of our products.

Still, you’ll find our prices are competitive as we rarely use intermediaries. Instead, we buy our stock straight from the producers to save you from paying too much for your investments. We also allow you to monitor the prices of gold, silver, and the rest of the metals we sell right here on our site, so you’re constantly aware of any changes in the market.

You can be sure to have the opportunity to make the most of your money with StoneX Bullion. Browse through our collection of high-quality gold, silver, platinum, and palladium coins and bars from esteemed mints and start growing your investments today.