Feb 2026

Feb 2026

Precious snapshot

We wrote last week -

"Gold has pierced $5,000 at the start of this week, with silver clearing $100 last Friday. The press is using words like “frenzy” and that’s not an over-exaggeration as people rush to join the party. I fear for the hangover, but it’s not looking as if it’s coming quite yet. Fall-out from the Japanese bond market developments this weekend provided the latest boost to gold and by association the white metals. This silver move, in particular, could end in tears.

"This massive recent gain in silver fills me with dread. In over 40 years covering this market I have seen many cataclysmic falls after aggressive bull runs. While this time it is a little different as the geopolitical background and industrial demand prognoses look to be supportive for the short-to-medium term and longer-term respectively, nonetheless there are some signs that we may be near the peak. Gold still has upside given the geopolitics that surround the market and this will help to keep silver supported for now.

So while there is, in our view, still scope for further upside in both (silver is up 9% today alone, and London silver remains tight), once cracks in silver appear they could easily turn into chasms".

Herewith a very brief encapsulation of what has been happening

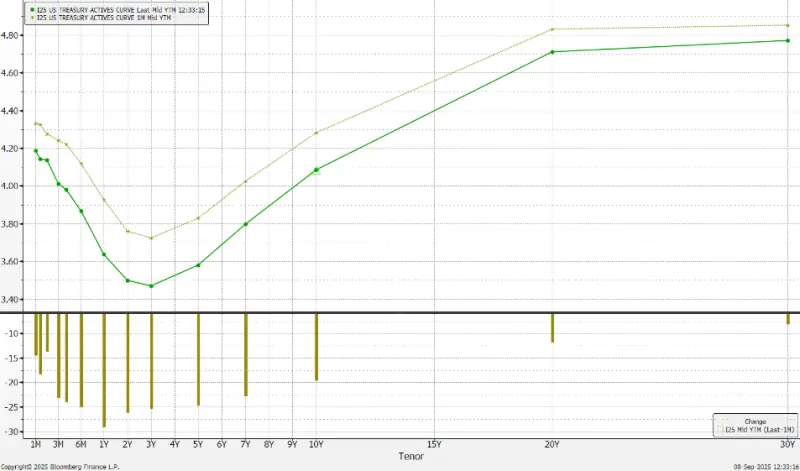

Main hook for the correction? Friday’s announcement of the nomination for Fed Chair. I don’t think the fact that it’s Kevin Warsh makes any difference, given that the Fed is a voting Board, not a one-man band. It could have been any-one, on that basis. The key here is that an important element of financial and political uncertainty has been removed from the equation. The changes to CME margins, applicable this evening, are financially prudent moves but are likely also to have played their part in market liquidation.

The upward momentum had been extended by technical trading and almost certainly option-hedging against both delta and gamma and this will also have contributed to the steepness of the fall. Silver is notorious for this kind of move - not for nothing have I used the term "Cinderella" for years, and "Icarus" in the past few weeks. The fundamentals in terms of underlying physical mine+scrap supply and industrial and decorative usage remain sound overall (but with the latter clearly suffering recently), with the market in a medium-to-long term deficit.

This latest move is obviously vicious and painful, but standing back and taking a longer-term view, it is shaking out a lot of the recent market noise and will hopefully lead to more cautious tones in the near future.

It also goes to show how fragile the market can be and we do not expect to see $100 regained at any point in the near future.

The CFTC numbers for the close of business on Tuesday 27th show that on COMEX at least, the silver Managed Mloney pariticpants were ahead fo hte physuical with outright longs contracting for the seventh week in succession, dropping from 398.798t to 20,613 over the period, while shortsflucutated and stood most reevetnly at 10,667t.

Gold outright olongs, by contrast, had continued to nudge higher, adding 15t over hte week toi stand at 509t, still 12% belwo the 12-month roling average; shoerts were up seven tonnes to 82t.

Platinum sentiment has soured, with lngos comnig off and shorts expanding,taking hte net long postition to very nearly flat; palldaium saw small contractions on both sides of the narke,t to stand at a small net short.

Gold – next Fib level $4,225

Silver – next level $66

Pt – on the next level already at $1,954. Next level is $300 lower

Pd – almost there, $1,560.

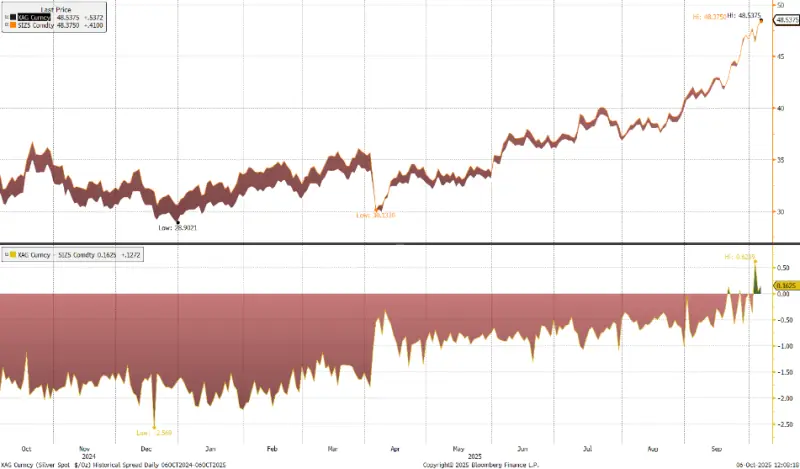

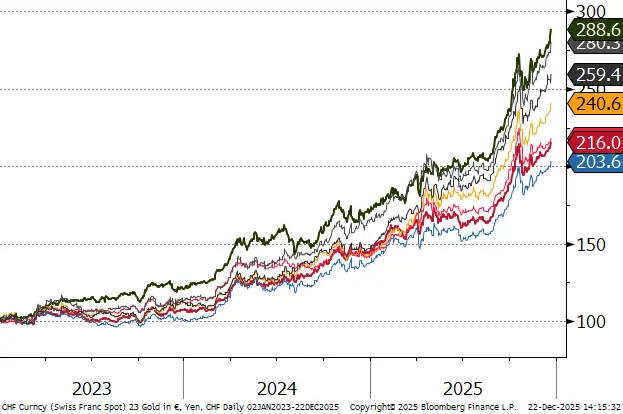

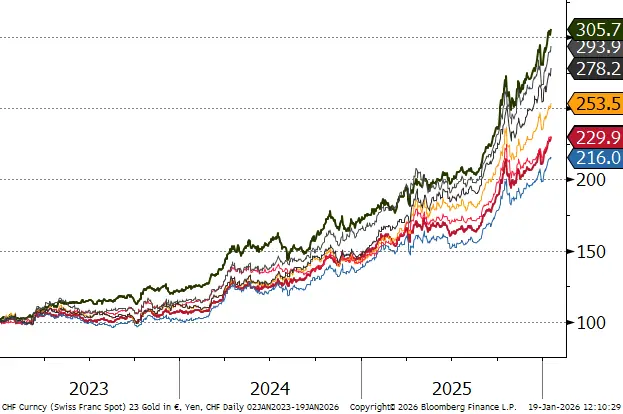

Fresh Illustration of silver’s extreme price position.

It is instructive to look at silver on a log-chart rather than a linear scale (i.e. the y-axis is expressed in logarithmic terms so that each move is shown in proportion to other moves. Thus a $10 move off a base of $10 is 100%; $10 of a $100 base is 10%, etc). That latest move was very strong by any-one’s standards and should have been flashing warnings.

Log-chart of silver’s longer term price action; not quite as big as the ’78-’80 move – but very close – and see what happened back then!

And the shorter term

Gold COMEX positioning, Money Managers (t) –

OMEX Managed Money Silver Positioning (t)

Source for both charts: CFTC, StoneX

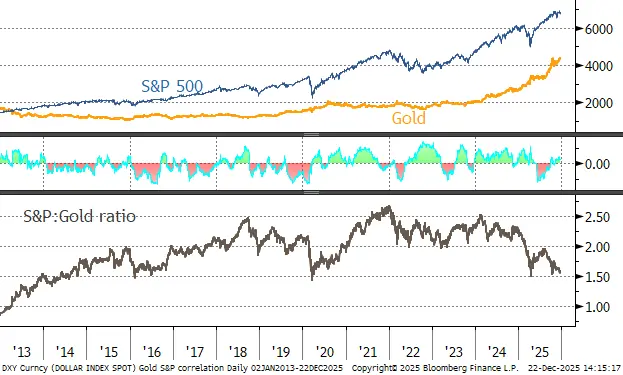

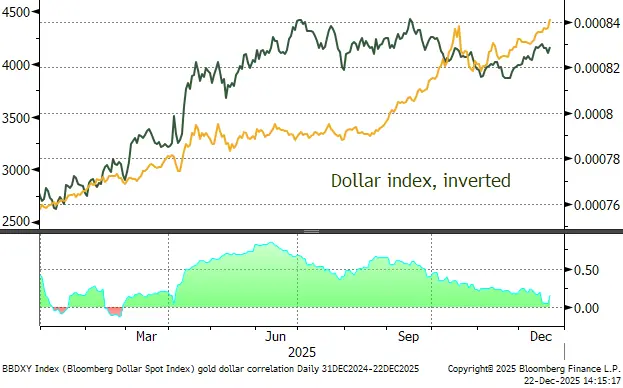

The S&P, gold and the dollar; gold:S&P tighter at 0.46

Source; Bloomberg, StoneX

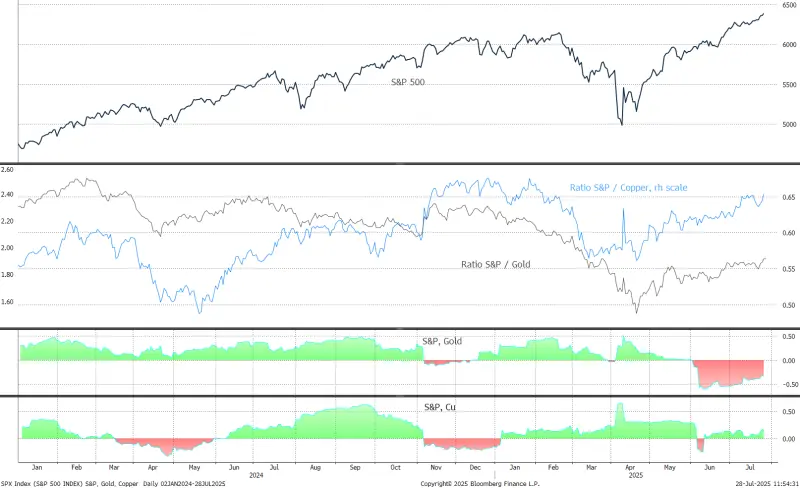

Gold, silver and copper; silver-gold 0.82; silver-copper, 0.56

Gold, one-year view; 50% retracement complete

Source; Bloomberg, StoneX

Silver March 2026-spot spread; flat

Source; Bloomberg, StoneX

Gold in key local currencies.

Source: Bloomberg, StoneX

Gold:silver ratio, long-term; bottomed at 46, heading back towards 60

Source: Bloomberg, StoneX