Buy Precious Metals Online – Gold, Silver, Platinum & Palladium

StoneX Bullion is your trusted platform to buy, sell, and invest in precious metals online.

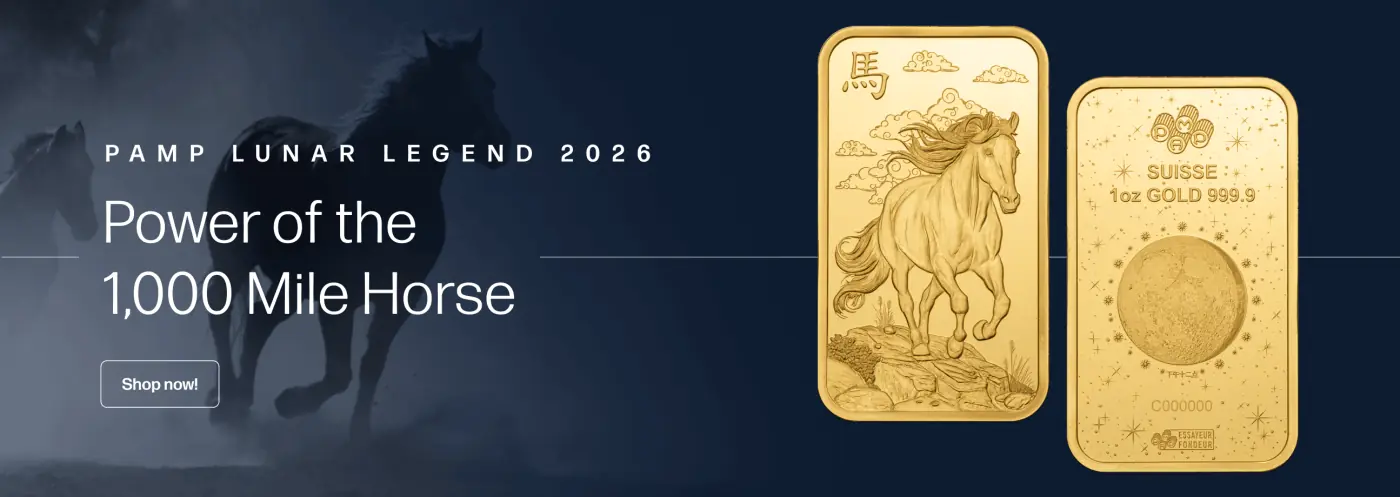

Since 2006, we have been serving investors, collectors and traders across Europe with a wide range of products, including gold bars, gold coins, silver, platinum, and palladium at competitive prices.

Whether you are a first-time buyer or a seasoned investor, our platform makes it easy to access the global bullion market: live pricing updated every 60 seconds, competitive spreads, and a wide choice of bars and coins from the world’s leading mints.

With a strong track record, secure processes, and thousands of satisfied clients, StoneX Bullion stands for reliability, transparency, and trust in precious metals trading.