Dec 2025

Dec 2025

Weekly roundup for StoneX BullionLooking forward into 2026

By Rhona O'Connell

22 December 2025

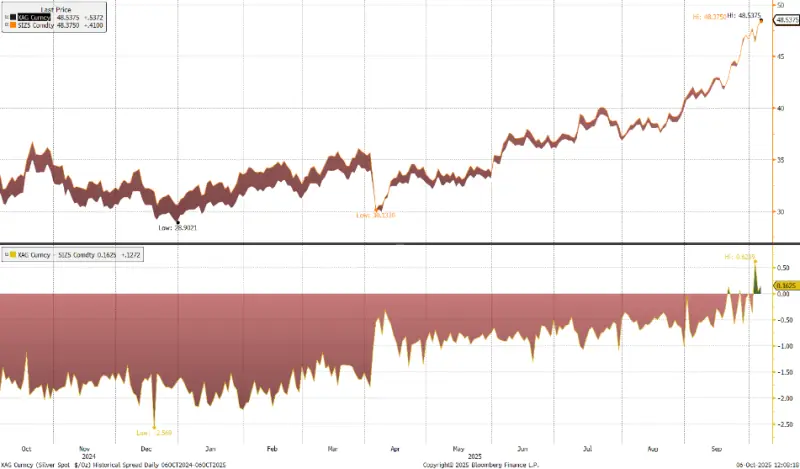

In order to look forward into 2026 we need to look back at the latter part of 2025, with gold posting new records in both nominal and real terms and the London silver market almost breaking down in October. Silver’s tensions have abated somewhat but not dissolved and the prospects for 2026 suggest continued tightness in London, at least to start with.

To set the scene; -

October was particularly dramatic with some notable shifts in underlying patterns in silver in particular, and both metals saw rejuvenated physical demand. The Indian monsoon and harvest were successful and were followed by the Festival Season.

Diwali (the festival of Lights) is important in the Hindu calendar, with Diwali day itself seen as the most auspicious day for gift giving (especially gold), and was aided by the good harvest season this year, plus the fact that gold and silver demand in India in particular had been very quiet for the previous few months by virtue of high rupee prices. The buying was particularly frenetic and helped to contribute to the tightness in the silver market (see below).

Gold made more record highs in both real and nominal terms and silver continued to crest new peaks in nominal terms. In real terms, the $50 silver price posted on 21st January 1980 works out at $214 in 2025 dollars. This is not to suggest that we are expecting silver to go to that level; far from it, but reflects the fact that it is a hybrid metal with 70% of its global fabrication going into the industrial sector.

Gold remains underpinned by geopolitical tensions in late 2025, not just with respect to international trade relations although these have eased a little following the meeting between President Trump and President Xi, although to what extent this can be sustained, and for how long, remains a key variable that will continue to give gold pent-up buoyancy.

Elsewhere Middle East issues are not looking any closer to resolution and the protracted negotiations over Ukraine continue to flounder, while the tension between the US and Venezuela is adding further fuel to the fire.

Meanwhile the “debasement” trade continues to grip the markets and plenty of investors want to ditch the dollar. A leading investment banker told the LBMA Seminar in December that a number of its High Net Worth individuals and Family Offices are asking for anything but the dollar, and preferably something “inanimate”.

This is where gold becomes pivotal.

Also running through this sentiment, of course, is the ongoing concern about the independence of the Federal Reserve, the world’s largest central bank.

The Supreme Court does not start hearing the Lisa Cook case until January and it is not clear when a decision will be handed down. Essentially the President wanted to fire. Lisa Cook for cause on the back of the allegation of irregular mortgage activity on her part. Given that this is simply an allegation, she filed suit and in our view the outcome of this case will be one of the pivotal drivers affecting gold in 2026. If the court finds in favour of the President, this could easily put another $300 on to the gold price. If it finds for Cook then it could just as easily take $300 off. This is not because of the likely makeup of the Federal Reserve Board thereafter because if and when Steven Miran steps down from his temporary role as a Governor that will remove one of the most open proponents of dramatic lowering of interest rates. Therefore, any dovish Trump appointee thereafter is unlikely to shift the current balance. Rather, the point is that the US Constitution enshrines strict separation of the three arms, namely the Judiciary, the Executive and the Legislature. Any blurring of that distinction undermines the independence of the Central Bank and would reduce confidence in the United States, not least because it raises the possibility of swings in policy every four years as opposed to a steady monetary policy, and would also likely undermine the dollar.

Meanwhile investment in gold ETFs last year was approaching a record, with gains of over 740t through to early December, to stand at over 3,950t. This has been driven particularly by funds in North America, which have added over 400t , while .Asia shows increasing interest (from a low base), adding over 180t. Given the transparency of these numbers, ETFs can often be a price maker as well as a price taker, and this was the case in late 2025.

Equally the net purchases from the Official Sector in the first three quarters of the year were 602t, (so ETF and the Official Sector have absorbed more than 1340t this year). It is important to remember that investment and speculative activity, quite apart from commercial business , means that global OTC gold trades, over a 12-month period, are typically at least 90 times mine production levels and so while this investment / diversification activity from these two sectors is important in terms of tonnage, the message that the official sector, in particular, is sending to the market is important. In other words they are hedging against risk in all forms and that sentiment is on its own, a tailwind for gold.

As the year draws to a close gold is trading above $4,400. A number of observers are calling a $5,000 target. Given that this is only another 16% it is not out of the question, but it is arguable that, barring a Black Swan (Venezuela tension is a case in point) gold is starting to look top heavy. We expect the upward momentum of 2025 to abate in 2026, but for solid support above $3,500.

Meanwhile silver remains tense and as we write spot prices are attacking $65/ounce, a gain of 125% since the start of the year. This move has become self-fulfilling and given silver’s capricious nature we are concerned that when the move starts to crumble the fall could be violent – it usually is. The tightness in London in October, during which it came to cost as much as 2.25% annualised to borrow metal overnight, has not fully abated, as silver’s classification as a Critical Mineral still renders it vulnerable to tariffs and / or quotas. While there are over 27,000t of metal in LBMA vaults, much of this is secured against ETFs and the free float is thin. India’s appetite for jewellery and silverware, after months of resistance to high rupee prices, has been reinvigorated and will persist into the first quarter of 2026, fuelled by the local wedding seasons.

This resurgence coincided with China’s Golden Week holiday (so no silver exports) and continued concerns over the implications of S.232 (the tariff section), which meant that US-based risk managers were not prepared to let metal out of the country, just in case. Ultimately with the London / COMEX arbitrage blowing out to more than $1.50/ounce, metal was flown (as opposed to shipped) across the Atlantic, with COMEX inventories dropping from 16531t in late September to 14,116t in mid-December. This is still historically high, however; more normal levels are 9,000-10,000t. ETF investment, meanwhile, stands at 26,508t at time of writing, a gain of over 4,300t in the year. For context, mine production is roughly 26,000tpa.

Expect volatility, tension, swings in forward and lease rates, and a risk of a sharp drop when the investment momentum fades.

Silver galloping on under its own momentum

Source: Bloomberg

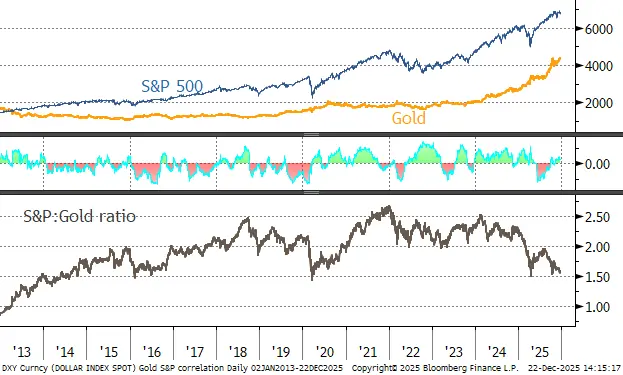

The S&P, gold and the dollar

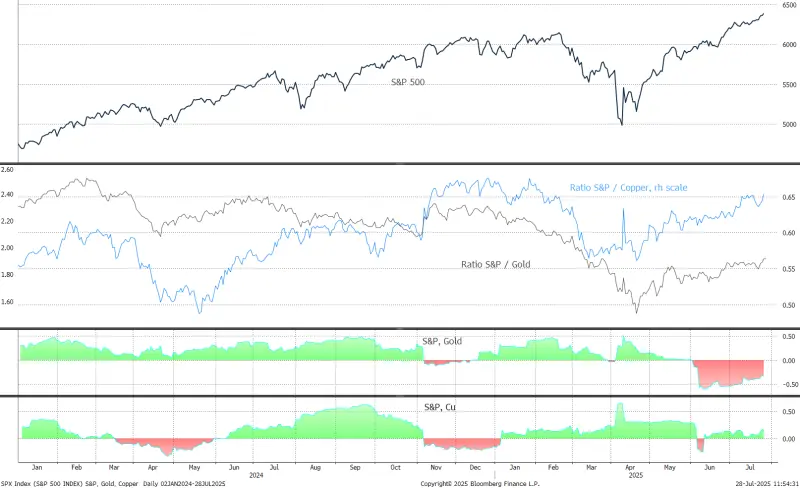

The S&P, gold and copper

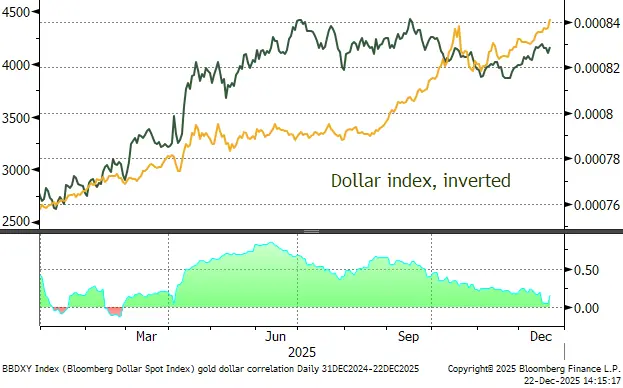

Gold, year-to-date; making new highs

Gold:dollar correlation; easing sharply; now at-0.16

Source: Bloomberg, StoneX

Silver, attacking $70

Source: Bloomberg, StoneX

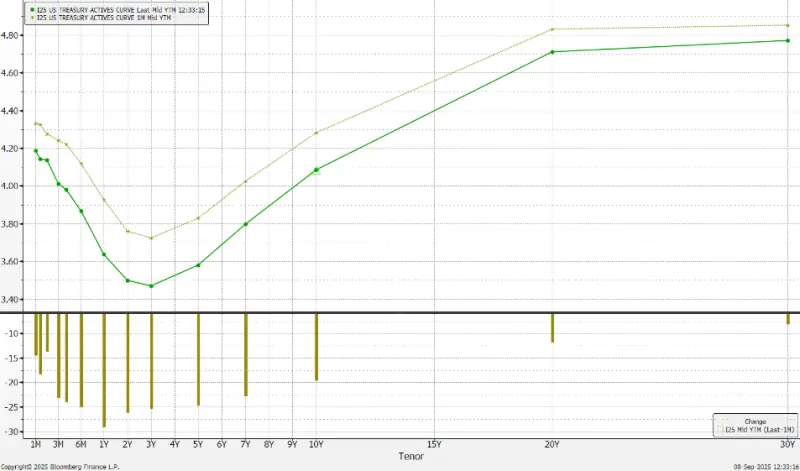

US yield curve: still steepening as the short end prices in rate cuts while the longer tenors are rising on fears of a longer-term inflationary impact; overall levels are lower, however

Source: Bloomberg, StoneX

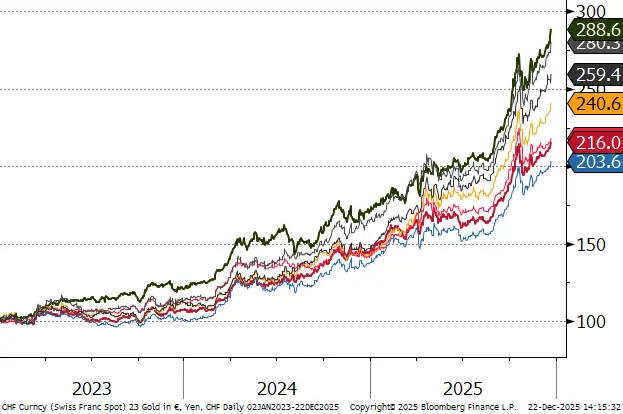

Gold in key local currencies.

Source: Bloomberg, StoneX

Gold:silver ratio, at the lowest since mid-May 2020

Source: Bloomberg, StoneX

CFTC: -

The numbers are starting to filter through now but are still out of date. In the week to 9th December gold sentiment was neutral, as was silver.

Gold: MM Longs, 446t; shorts, 62t.

Silver: MM Longs rising 6398t; shorts covering, 2,181t

ETF –still making gains

Gold: the latest figures from the World Gold Council, up to Friday 19th December, show gains, although the pace is slowing. Holdings were 3,968t, a year-to-date gain of 749t,. compared with global mine production of just shy of 3,700t., Year-to-date, the regional changes were as follows: North America, 429t (26%); Europe, 123t (10%); Asia, 189t (87%).

Silver: Still making gains, with 487t added in November and 736 in December to date.. The Bloomberg figures suggest that the net year to date gain ins a chunky 4,332t since end-2024, to a total of 26,538t – but this may be understating the position. World mine production is just less than 26,000t.