Sep 2025

Sep 2025

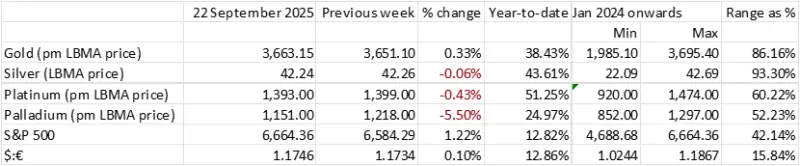

Gold Hits $3,724, Silver Soars Above $43.8

By Rhona O'Connell, Head of Market Analysis

- Gold posted another intraday record last week, touching $3,708 and then being overtaken this morning (22nd) to $3,724 as we write

- Last Friday saw a net inflow of 26.8t into the ETFs covered by Bloomberg, the largest one-day increase since 21st January 2022 and taking September flows to 79t

- WGC latest ETF figures are for 12th September, at 3,744t. The Bloomberg recorded changes since then amount to a gain of 38t, to an approximate total of 3,782t

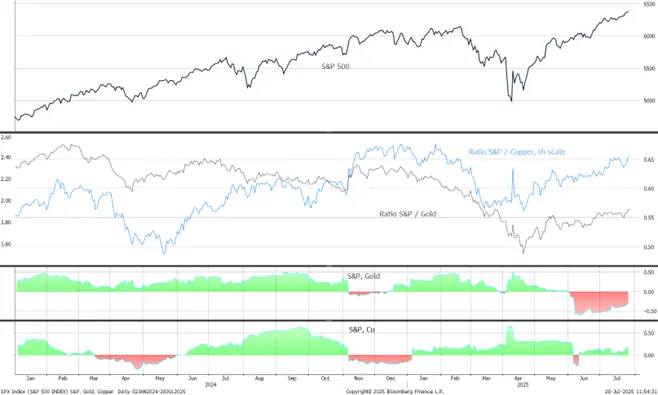

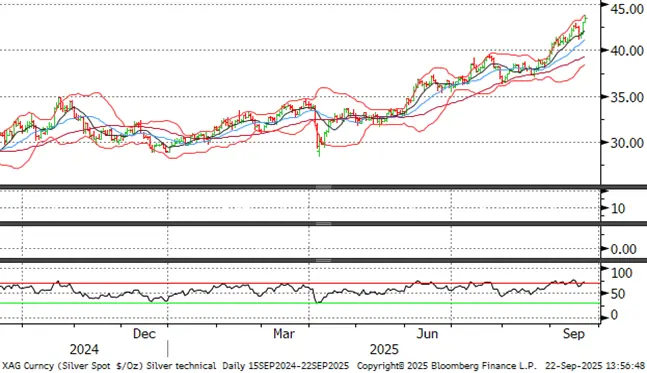

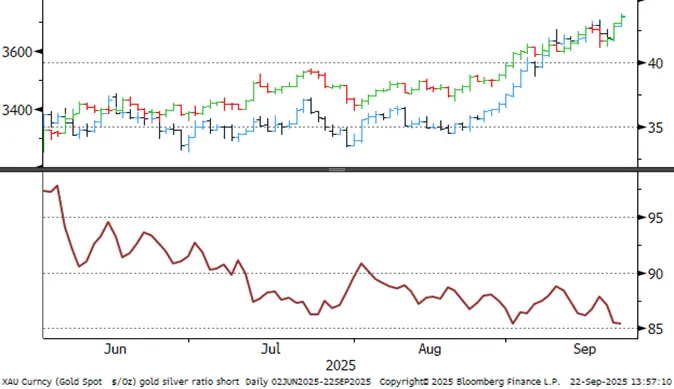

- Silver has continued to outstrip gold, putting on 6% in just three days to $43.8 on this Monday morning

- Gold and silver demand is starting to pick up in India, despite these high prices, ahead of the imminent festival of Diwali (20th October) and subsequent wedding seasons

- European investor activity in the gold market is also thriving, but silver is slower

- The picture is different in south-east Asia, however, with gold scrap flows coming at a tidy pace, and coins are still being sold back in North America. Silver Eagle sales (including sales to distributors) in the year to end-August amounted to 274t, half the level of the first eight months of 2024

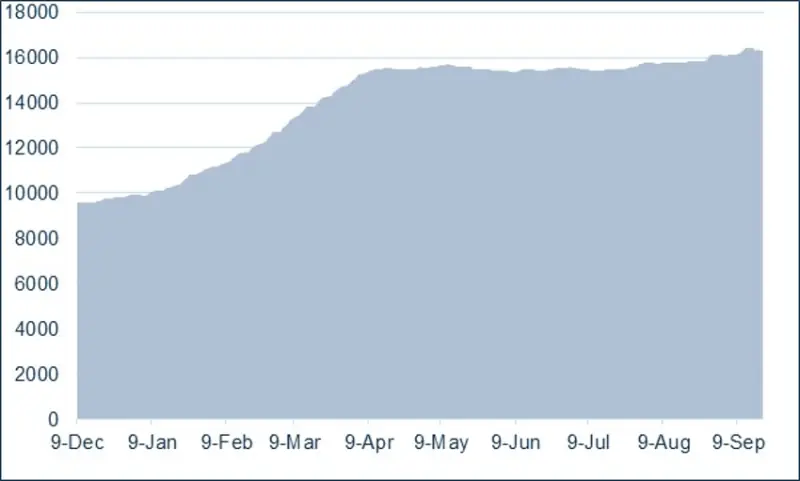

- Silver is still tight in London although COMEX inventories eased by 105t last week to stand at 16,300t, equivalent to 64% of open interest

- Global identifiable silver inventories stood at 38,432t at the start of this year, according to Metals Focus. On the basis of our estimate for the 2025 market balance they should now be roughly 35,000t

- Since the start of this year combined inventories on COMEX, ETFs and LBMA vaults have risen by 7,829t although there is a risk of double counting here as LBMA vaults will be holding some ETF material. LBMA vault holdings have dropped by 1,093t this year, reflecting imports into the States on fears of tariff

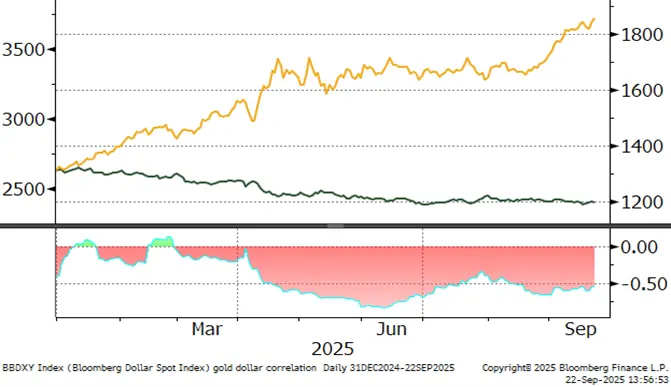

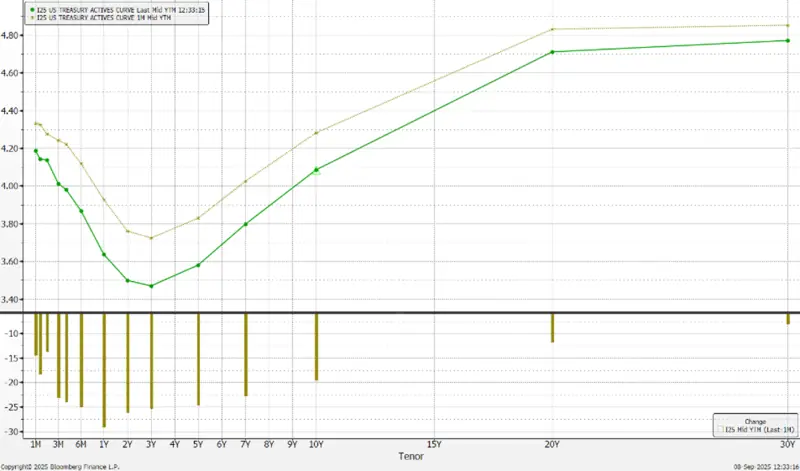

- The dollar is still under pressure and investors are continuing to exit from long bonds

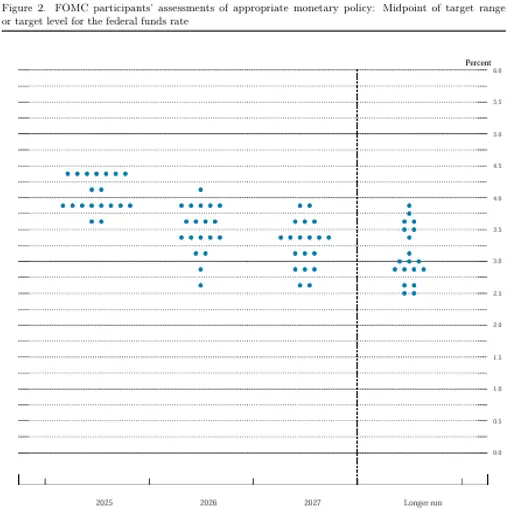

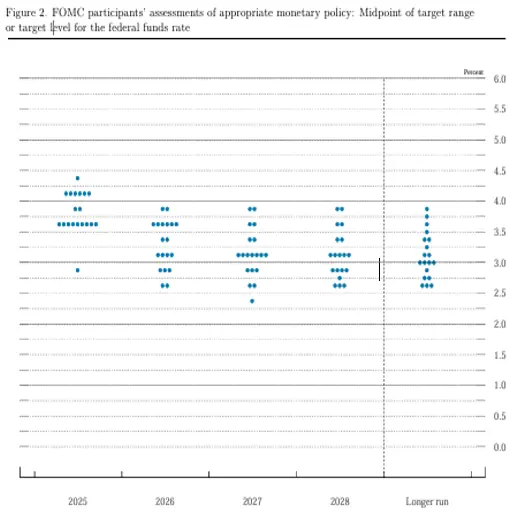

- The FOMC cut the fed funds target rate by 25 points last week, as expected, but the tone of the Statement and some of Fed Chair Powell’s comments in the Q&A were restrained, while the dot plot (below) points to one more cut this year and two in 2026

- The new temporary FOMC member Stephen Miran is taking an unpaid leave of absence from his role on the President’s Council of Economic Advisors. He told the press last week that intends retaining his own independent economic analysis when it comes to his decisions and recommendations

- Outlook: For the much longer term, silver has a robust fundamental outlook but for now, it is still overbought above $42; it needs to correct and consolidate but seems reluctant to do so. The solar market remains oversupplied but still has a constructive future – although at these prices manufacturers are looking to accelerate thrifting and substitution, while AI and vehicle electrification will also help to keep the market in a pre-investment deficit. Gold is still pricing in concerns over Fed independence and the possibility of stagflation as well as underlying geopolitical risk and international tensions, so any weakness in price is catching enthusiastic bids.

As reported last week: The latest Executive Order with partial respect to the metals markets, was signed on 5th September and clarifies the tariff numbers that are in the relevant Annex. These now include all the relevant tariff numbers that cover gold in unwrought and semi-manufactured form. We need to treat this with care because the wording in the Executive Order itself uses terms such as “I may be willing” to apply a zero rate, although we can be pretty sure that gold will be fine. Another element of uncertainty is that the Order refers to those countries with which the States already has reciprocal agreements in place.

This is not currently the case with Switzerland and the Swiss authorities are in fresh negotiations with the US Administration. The current tariff rate is 39% and while the Government has offered to buy more US energy (including enriched uranium and LNG) and weapons, plus additional investment. One spokesman is reported by the Financial Times to say that the has been some good progress, but he is not expecting a swift resolution.

Note also that silver and the PGM are on the zero-tariff list for those nations with whom there is a reciprocal agreement

The Fed Dot Plots; June and September

Source: Federal Reserve Board

Silver, gold and copper

Source: Bloomberg, StoneX

Gold, year-to-date; new records in real and nominal terms

Source: Bloomberg, StoneX

Gold:dollar correlation; easing again; now at-0.54

Source: Bloomberg, StoneX

Silver, two-year view; now overbought

Source: Bloomberg, StoneX

US yield curve: steepening as the short end prices in rate cuts while the longer tenors are rising on fears of a longer-term inflationary impact; overall levels continue to drop, however

Source: Bloomberg, StoneX

COMEX silver inventories, tonnes

Source CME via Bloomberg, StoneX

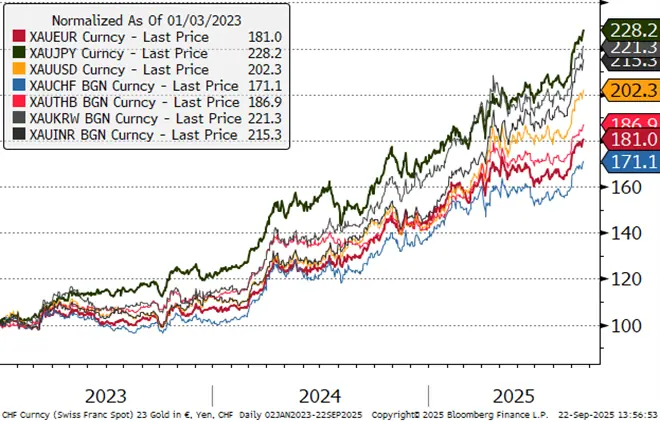

Gold in key local currencies

Source: Bloomberg, StoneX

Gold:silver ratio, year to-date

Source: Bloomberg, StoneX

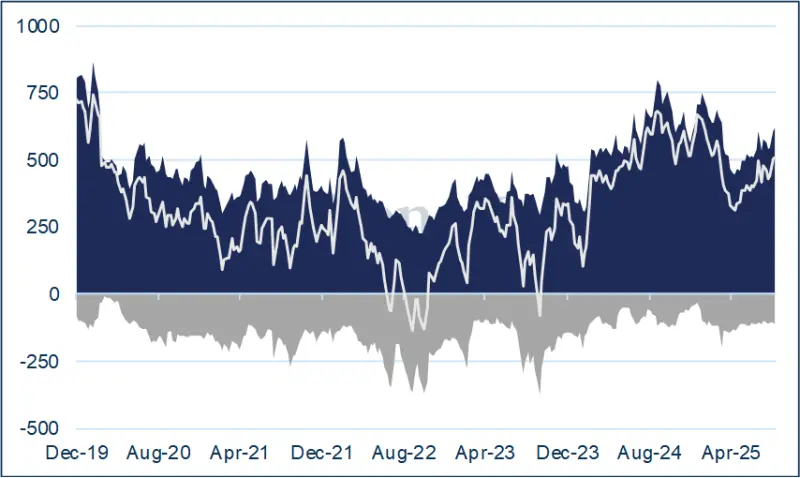

Gold COMEX positioning, Money Managers (t) –

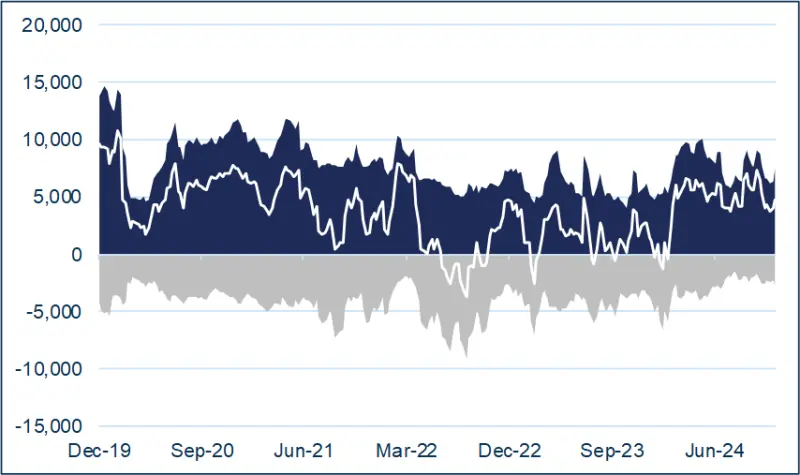

COMEX Managed Money Silver Positioning (t)

Source for both charts: CFTC, StoneX

CFTC: - gold Managed Money seeing some profit taking, but not much. Outright longs slipped from 619t to 608t, while shorts added just three tonnes to 113t.

Silver; expansion in both segments, net virtually unchanged. Longs added 300t (4%) to 8,240t; shorts added 298t (14%) to 2,403t.

ETF – gold: last week’s big jump on Friday takes year-to-date increase to ~563t. Latest World Gold Council figures are for 12th September, at 3,744t.

Silver: The Bloomberg figures suggest that the net ETF creations in H1 2025 were 1,761t, of which 989t were in June. There were net additions of 541t in July and a further 524t in August to a total of 25,070t, according to Bloomberg, while September to date has been a lot slower, for a net increase of 136t.