Jan 2026

Jan 2026

LBMA 2026 PM forecast survey

12 January 2016. This was submitted before the news of the DoJ probe into the Fed

Rhona O’Connell

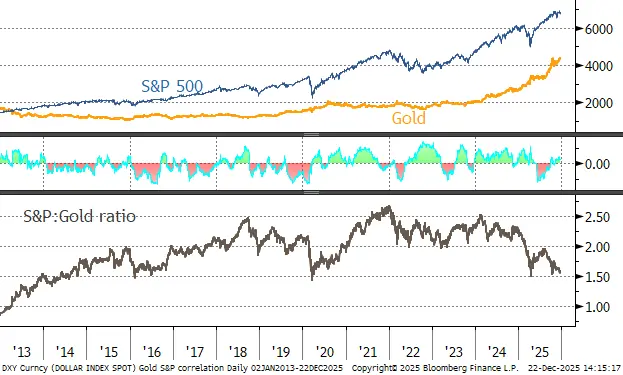

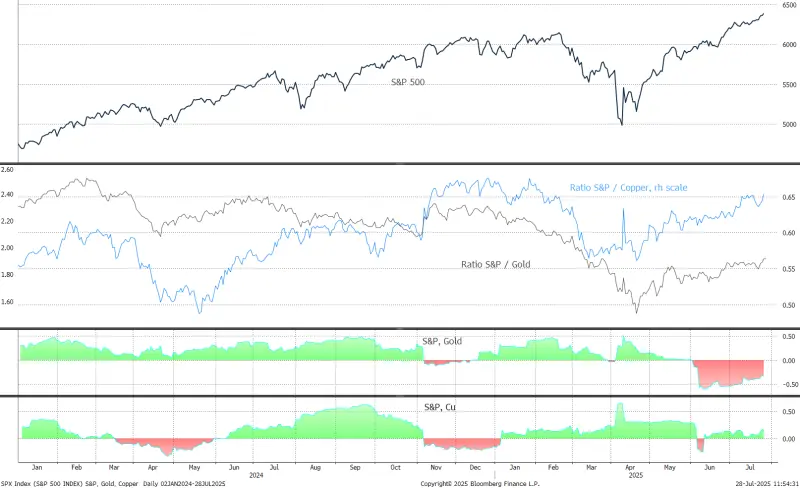

GOLD:

Hi 4950

Lo 3650

Ave 4380

Geopolitics are supportive in the first part of the year, with the markets tense and watching any changes in the President Trump’s political or economic stance.

US Constitutional issues will also be supportive in the short term but a lot will hinge on the Supreme Court’s decision in the Lisa Cook case. If the Court finds in favour of the President that undermines the Constitutional Separation of Powers (Legislative, Executive, Judiciary) and would boost gold further. Finding in Cook’s favour (more likely) should readily unwind some of the risk premium in the market. Real yields likely to drift lower in the earlier part of the year.

Latterly inflation remains in the 2.5-.3.5% range while fiscal deficits and Treasury issuance pressures longer term rates higher with the yield curve steepening.

US Mid-term elections should mean that the President introduces stability during mid-year as the GOP defends its seats. This would be a turning point for gold and should bring prices down, very possibly to below $4,000.

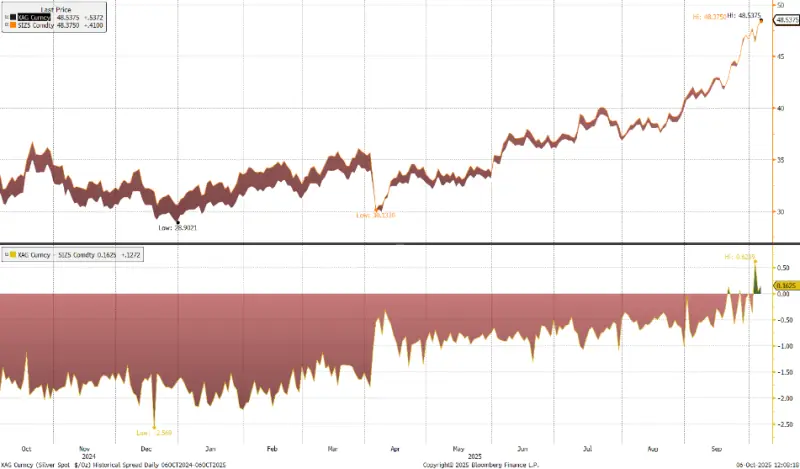

SILVER

H 95.19

L 53.68

Av 70.65

Notorious for volatility in both directions silver starts 2026 nearing bubble territory and through the underlying fundamentals are strong, supply is price inelastic and largely a function of the base metals activity, although these high prices should evoke some scrap return / investment profit taking at the physical retail level.. Very high prices are likely to erode price-elastic demand in jewellery and silverware and accelerate industrial thrifting; once prices start to top out we can expect a violent fall, as has happened so many times before, with speculators bailing out and some being stopped out in the recoil.

PLATINUM

H 2600

L 1650

A 2050

The outlook this year is less ominous than twelve months ago, with net zero deadlines, at least as far as the auto sector is concerned, rolling back. Most market observers had not given these deadlines much credence but now, especially with the US Administration’s stance, these expectations are being crystallised and the auto companies are actively changing their plans; and in a number of cases, taking a huge financial hit. The prosect for ICE vehicles has therefore improved, but it is nonetheless a declining profile. On the bright side the Chinese Government is embracing the hydrogen economy, which should underpin imports. Meanwhile it is possible that some of the migration from gold jeweller to platinum will slow given the recent rally. The supply side is likely to recover and in this environment part of the recent gains are likely to be unwound while Guangzhou adds fresh interest.

PALLADIUM

H 1900

L 1350

A 1582

The auto sector arguments apply even more strongly to palladium and so there is respite for this market but this is only a stay of execution and so the dark days of sub-$1,000 are probably over. The market remains under a long-term cloud, however and it is hard to see a repeat in 2026 of the 2025 expansion in the ETFs. Palladium supply is also largely price-inelastic and the improvement in the South African platinum mines’ performance this year over last will boist palladium supply. After the 2025 rally, which was partly contagion form platinum, we should expect a retreat.

Source for charts: Bloomberg, Stonex