Nov 2025

Nov 2025

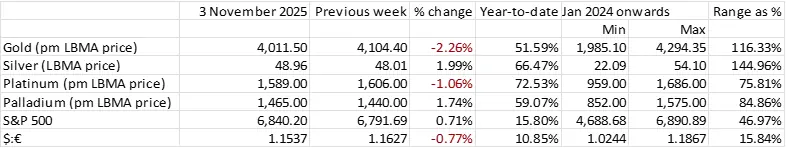

Gold, Silver Dip After Rally: Outlook Stable

Gold slides by 11% before steadying

Silver easing as metal finds its way across the Atlantic; inventories back to very close to tariff day levels

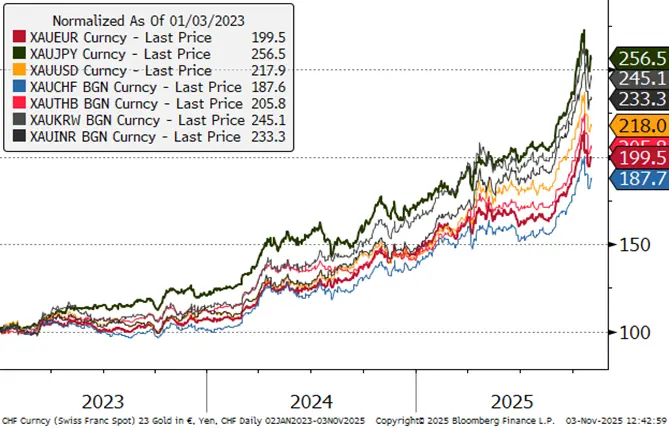

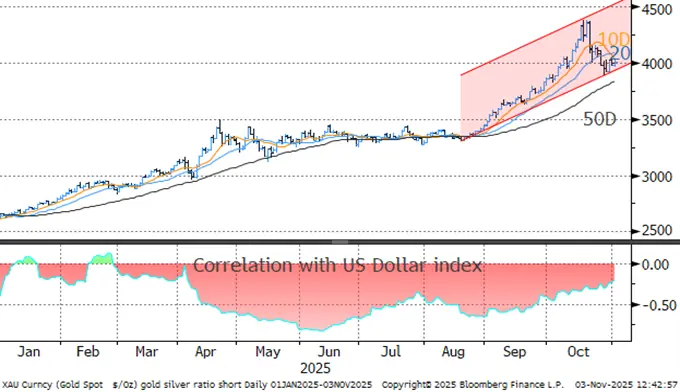

- Gold is now taking some of the froth off the top of its recent exponential price rise . The recent intraday peak was $4,382, a gain of 32% since this strong rally started in late August and of 67% since the start of this year.

- The recent correction saw a move to $3,386 in seven days in what some members of the Press called a rout; this 11% fall was triggered largely on technical considerations as the market was very heavily overbought and once the move faltered, some profits were taken and then technical stops were hit, bringing in CTAs and momentum traders.

- From a fundamental standpoint, the fall coincided with Diwali, the day in the Hindu calendar that is regarded as the most auspicious for the gifting of gold.

- The Monsoon season had been a good one, with a good harvest, and after months in which gold (and silver) demand had been under a cloud, the Indian market rocketed in October. The onset of Diwali took this element out of the market as most of the buying had been done beforehand.

- At the LBMA annual Conference last week, where there were more than 900 delegates, the overwhelming feeling was that we did indeed need this break in the bull run, but that with the width and depth of geopolitical uncertainty still swirling around the markets this looked looks more like a correction than a breakdown.

- The general body of opinion is that there is very good solid support between 3,700 and 3,800, a view to which we also adhere in the investment session. It was suggested that one of the areas that has been supporting gold has been the loss in industrial productivity globally over the past few years and that the advent of AI may be able to reverse this, at least in part. If so, then this theory points towards an easing in gold prices after maybe a year or so when the situation is clearer.

- We are looking for a period of consolidation in the near term. In our view a major key to the 2026 outlook revolves around the Supreme court’s ruling over the Lisa Cook Case. If found in favour of the President this could be good for a fresh $500 on the gold price on the back of reduced Fed independence vs political influence. This would be a bullish factor in itself, but there could be further ramifications from a weaker dollar. If the Court finds in favour of Cook then the reverse would be the case.

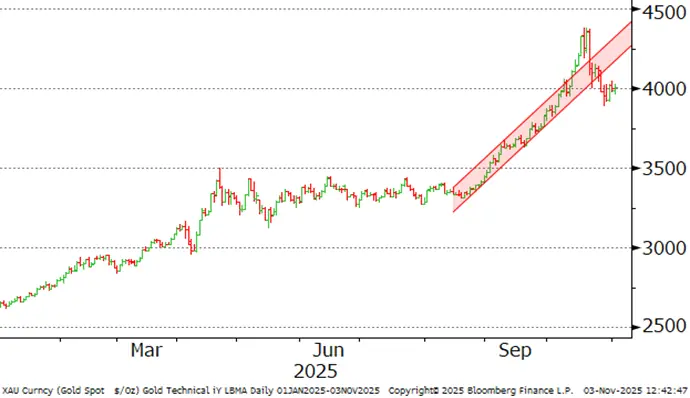

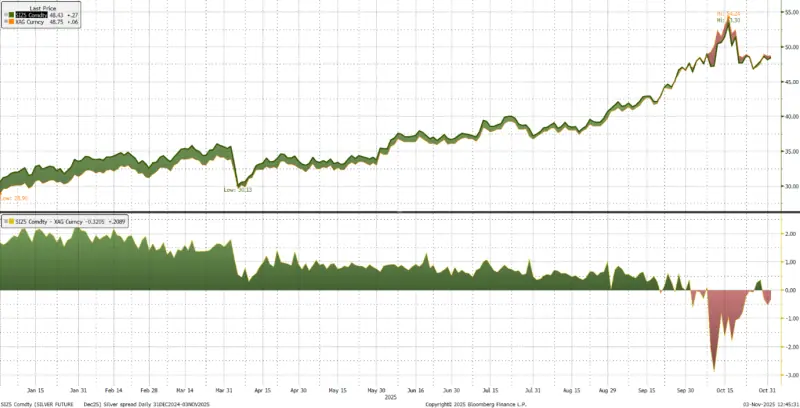

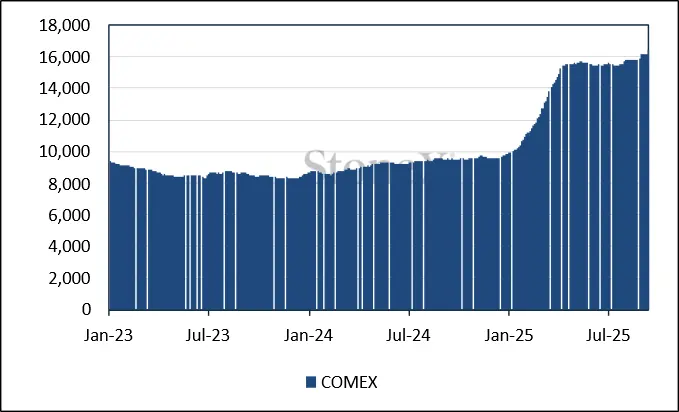

- Silver is also taking a much-needed breather and the dislocations in the market have been easing as metal has been coming across the Atlantic with houses reacting to the London- COMEX arbitrage. Inventories have dropped from 16,491t at end-September to 15,005t at end-October, a fall of 1,486t or 9% and taking them down to levels last seen two days after the tariff day. We won't have trade figures for a good while yet, but I got the impression from logistics companies last week that business has been active and material continues to be flown rather than shipped

- The onset of Diwali would also have helped ease conditions as buying was rampant in silver in October also. But we now have the wedding seasons ahead of us and this will also be supportive for both metals, with brides’ Shreedans (gold) and with wedding presents often in silver.

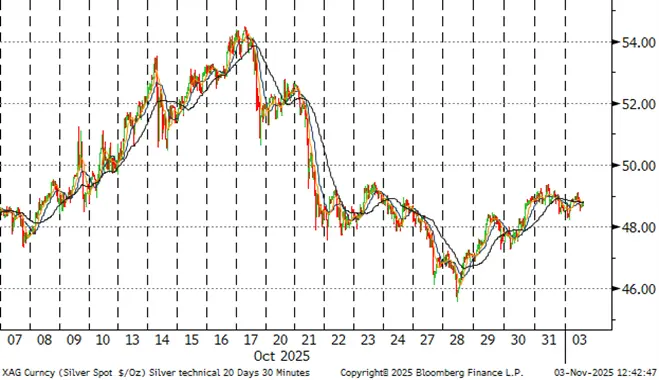

- We are not out of the woods yet, however. Although silver moved into a contango briefly in late October, it is now again in a small backwardation between spot and the COMEX active contract, and the India factor could be back in play here.

- LBMA vaulting numbers should be through next Monday and that will throw more light on the situation.

- The US Government remains in partial lockdown with the Republicans and Democrats at polar opposites on some issues, revolving in some part around medical health insurance. We therefore still haven't had any CFTC numbers since the 23rd September

- Outlook: Gold is also losing some froth, while still pricing in concerns over Fed independence and the possibility of stagflation as well as underlying geopolitical risk and international tensions. Some of the froth has been blown off in a much-needed correction. The Fed Beige Book is pointing to further slowdowns in the US and question marks persist over the state of the labour market.

- For the much longer term, silver has a robust fundamental outlook but for now, it is taking a much-needed break with metal coming eastwards across the Atlantic. The solar market remains oversupplied, but still has a constructive future, while AI and vehicle electrification will also help to keep the market in a pre-investment deficit.

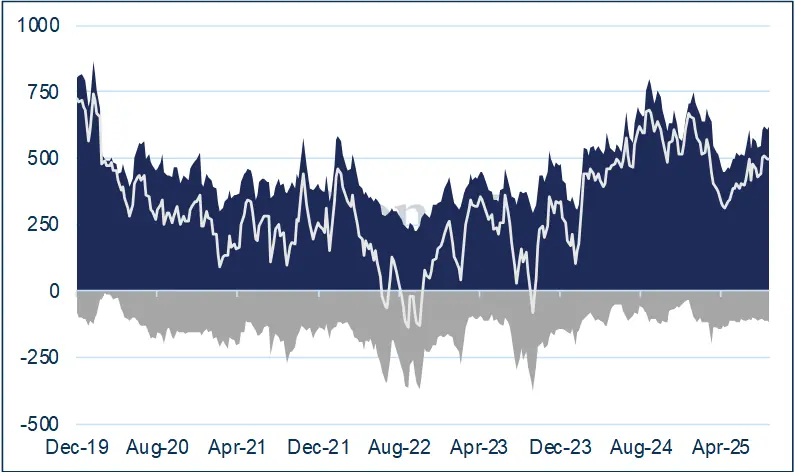

Gold, year-to-date; giving back gains but still underpinned

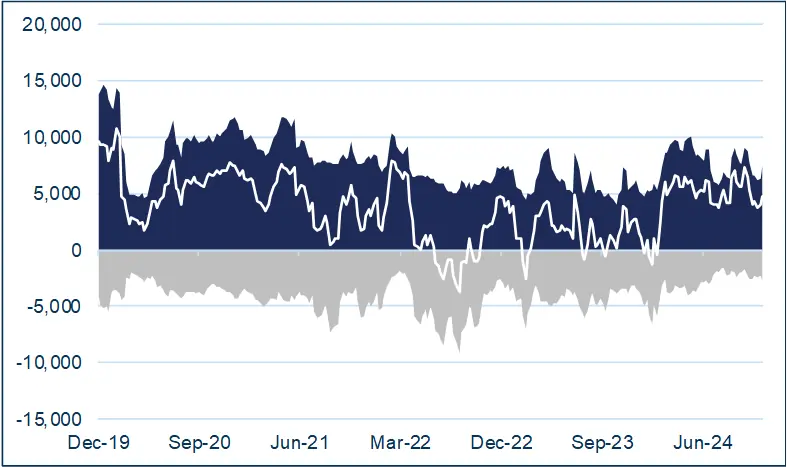

Silver; new records – but not in real terms. Taking a much-needed breather

Source: Bloomberg, StoneX

Silver easier in London- eased into contango briefly in late October; tighter again now

Source: Bloomberg

To recap: - Silver inventories on COMEX are divided into registered and eligible. “Eligible” inventories are inventories in a CME-approved warehouse, not necessarily delivered onto the Exchange itself; the owners of that metal may just be using the warehouse as a secured storage space. Eligible metals may belong to a range of different market participants. The CME does not have any direct control over these inventories.

When the holder of the metal delivers it onto the Exchange, then a warehouse receipt is issued and the inventories become “registered” and can then be used for delivery against futures contracts.

Since the 10th October combined registered and eligible silver inventories have declined by 1,525t.

The gold inventories have an additional sub-division, namely “pledged” warrants. These warrants are pledged to the Exchange as collateral, which gives CME a first priority security interest in the relevant warrants. When a clearing member initiates a pledge, the warrant status changes from “Registered” to “Pledged_PB_Pending”. When the transfer to CME is complete the status becomes “Pledged_PB”. The warrants remain registered with the Exchange. Currently 54% of COMEX inventories are registered.

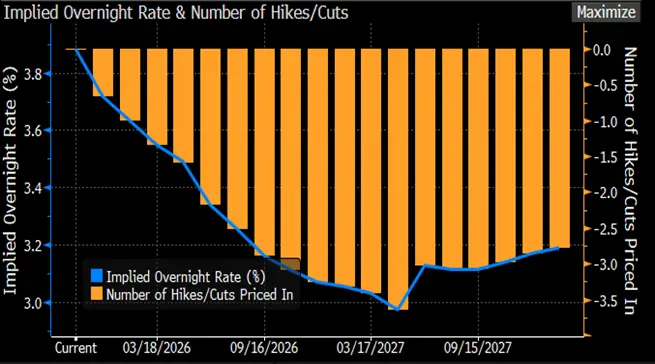

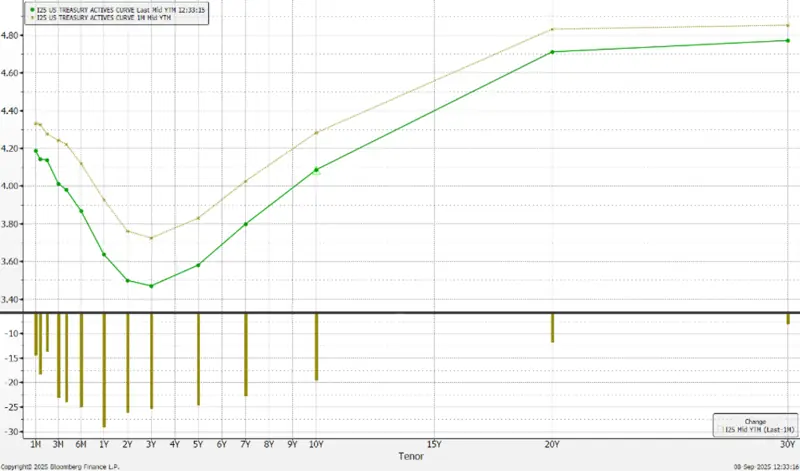

Meanwhile the US bond markets are pricing in a 66% chance of one more 25-point cut this year. The next FOMC meeting is scheduled for 9-10 December.

Source: Bloomberg

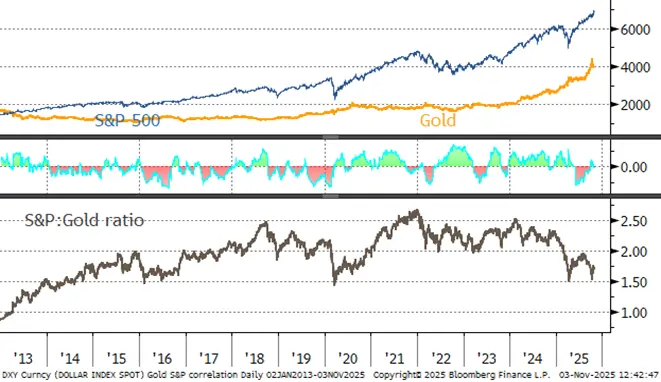

The S&P, gold and the dollar

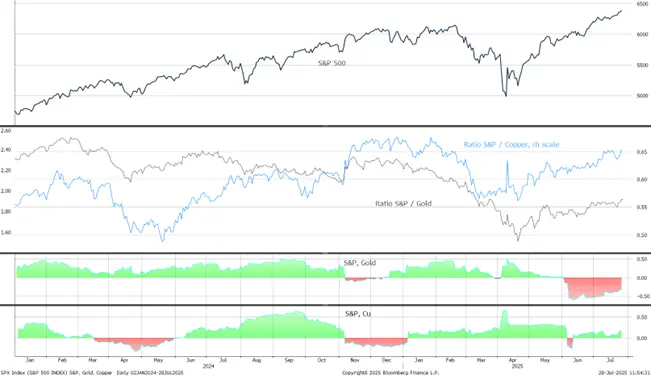

The S&P, gold and copper

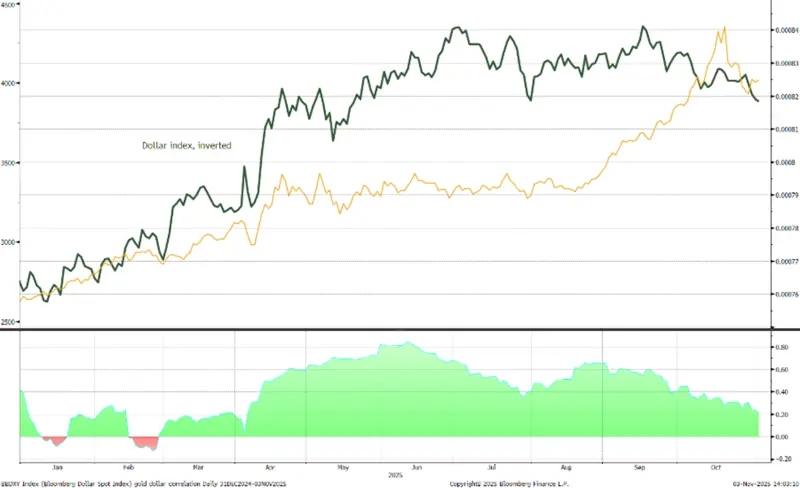

Gold:dollar correlation; easing again; now down to -0.21

Source: Bloomberg, StoneX

US yield curve: still steepening as the short end prices in rate cuts while the longer tenors are rising on fears of a longer-term inflationary impact; overall levels continue to drift lower, however

Source: Bloomberg, StoneX

COMEX silver inventories, tonnes

Source CME via Bloomberg, StoneX

Silver ETFs have oscillated over the same period, with reasonably chunky movements in both direction for a net gain (basis the Bloomberg figures) of 75t to 25,606t.

Gold COMEX inventories are also easing after touching a recent peak of 1,249t on 6th October, to stand last at 1,216t. Holdings in ETFs stood at 3,924.8t (World Gold Council figures) for a year-to-date gain of 705.9t. North American holdings are up 24.4% or 402.9t; Europe holdings are up 11.9% or 153.3t; Asia has expanded by 56.9% to 142.6t and “other” up 11.1% to 7.1t.

Gold in key local currencies

Source: Bloomberg, StoneX

Gold:silver ratio, year to-date

Source: Bloomberg, StoneX

The CFTC numbers run only as far as 23rd September due to the shutdown

Gold COMEX positioning, Money Managers (t) –

COMEX Managed Money Silver Positioning (t)

Source for both charts: CFTC, StoneX

CFTC: - As of 23rd September, the net gold long position among COMEX Money Managers was broadly unchanged over the previous four weeks – in a range of 509t to 499t, which is the most recent figure. At 618t, the outright longs were only 17t higher than the 12-month average and so there is no real overhang there. At 119t, the outright shorts were 13% higher than their 12-month average of 105t.

The silver position is different, with outright longs of 8,235t just 3% higher than the 12-monthaverage, while the outright shorts (2,197t) are 8% below the 12-month average.