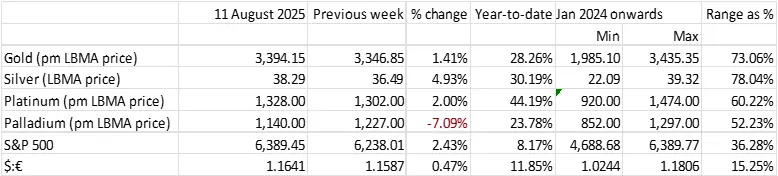

Aug 2025

Aug 2025

Gold Market Steady Amid Global Uncertainty

A Customs ruling late last week caused some anxiety in gold, but it looks as if the situation will be rectified soon

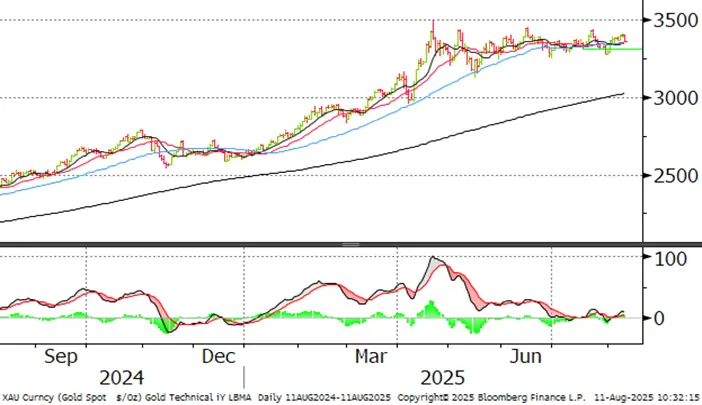

- Spot gold prices have remained confined to narrow ranges but the futures market had a fright at the end of last week on the back of a Customs ruling – which the White House has said that it will clarify.

- Spot, after dipping below $3,300 at the start of August, worked its way gradually higher last week, reaching $3,406 at the start of Asian hours on Friday, but we are now back at $3,360 as the markets take stock. Details in the body of the text.

- The three key moving averages have remained tightly clustered accordingly, between $3,349 and $3,356 and are in a positive construction.

- The physical markets are quiet virtually everywhere as a result of economic uncertainty and the time of year. Discounts in Dubai have helped to prompt some interest in India and there is a scattering of demand in parts of the Middle East, but conditions remain seasonally slow.

- Activity in the Far East is mixed, with scrap return from some areas countered by increased interest in others.

- We noted a good monsoon season last week; conditions remain normal and bode well for the harvest. Since 60% of the population in India is reliant to one extent or another on the harvest, and farmers favour gold as a primary investment; this currently points to an uplift post-harvest (September) and just ahead of the Festival Season.

- India typically accounts for ~25% of the combined jewellery and coin & bar markets worldwide.

Jewellery and coin&bar markets combined; market share Q2 2024

Source: World Gold Council, StoneX

- Gold and silver coins remain moribund, at a discount to spot in both metals and recent silver price rises have dampened appetites even further.

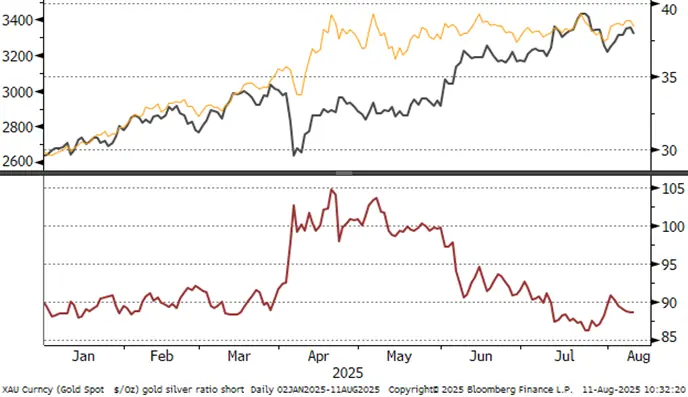

- While gold has been confined to a 5.0% range between $3,270 and $3,439 since 23rd July, silver has, as usual, been more volatile in a range of 8.4%. The whole range took place between 23rd and 31st July and prices have recovered since, reaching almost $38.50 last week before retreating at the start of this week.

- Investment products continuing to be re-sold…

- … but gold and silver ETFs both saw some chunky interest at the end of last week, which may have helped push silver through $38, albeit briefly, while the gold activity would have been supportive rather than driving prices higher.

- COMEX Managed Money saw gold sentiment swing to bullish, while silver was the reverse.

Outlook: unchanged. For the much longer-term, silver has a robust fundamental outlook but for now it is stabilising above $36 while resistance at $38 and above is still proving effective. The speed with which gold futures unwound the premium that was established last week underpins our view that there is not much upside potential from there, barring a black swan or major geopolitical development.

Comment – press unwittingly overstating the gold action last Friday

All the volatility in the COMEX futures contracts (notably December, the active month) last week came about because of the following: -

A Swiss refiner asked the United States Customs and Border Protection for clarification about the tariff position with respect to 100-ounce bars and kilobars. The authority ruled that these bars should not be under the 7108.12.10 tariff (unwrought non-monetary bullion or doré) and classified into 7108.13.5500, which includes semimanufactured or powder forms and thus incurs tariffs.

At this point the futures prices on COMEX jumped, but, while the spread between spot and December expanded to just over $100 at one point, and thus hit the headlines with words like “record”, it wasn’t actually that dramatic. The average premium between spot and the active contract has averaged 5.4% since the start of 2024 and 3.1% since the start of this year. Last Friday the percentage premium was just 2.8% before sliding back to 1.7% this morning (Monday) which is where is it was last Thursday.

The White House has said that it will be issuing an executive order in the near future, clarifying the position.

Once again this raises the debate about the COMEX contract and London Good Delivery. COMEX good delviery is 100-ounces or kilobars; London Good Delivery (LGD) bars are 400-ounces. In lockdown, with so few planes flying, there was an adjustment and increased flexibility allowing for partial delivery in LGD. This was temporary however and there is an argument that the two centres should be fungible. There is also a rule in place that COMEX gold must be vaulted within 150 miles of New York City; a case could be made for easing this restriction.

Meanwhile some politicians in Switzerland are making political capital out of all this, given that it was the swelling in shipment of COMEX-deliverable metal ahead of the tariff deadline in April that bloated the trade balance between the US and Switzerland. One has even suggested that the refiners foot the bill.

The Trade Policy Uncertainty Index, easier than a week ago

Source: Bloomberg

The majority of US trade counterparties are now subject to 15% tariffs but there are some outliers. In China’s case it looks as if there will be a further extension of the negotiation period, possibly of 90 days.

Some of the rates that have hit the headlines include 30% on South Africa, 35% on Canada (Trump has implicitly tied this into Canda’s recognition of Palestine as a State); 39% on Switzerland (see above), which has raised some hackles, 40% on Libya, 35% on Iraq and 40% on Laos.

The S&P, gold and the dollar

The S&P/Gold and S&P/Cu ratios

Gold, one-year view; still in a worryingly narrow band

Gold:dollar correlation; tightening again; now at-0.48

Source: Bloomberg, StoneX

Silver, one-year view; resistance at $38

Source: Bloomberg, StoneX

COMEX gold inventories, tonnes

Source CME via Bloomberg, StoneX

Source: Bloomberg, StoneX

Gold:silver ratio, January 2024 to-date

Source: Bloomberg, StoneX

Background

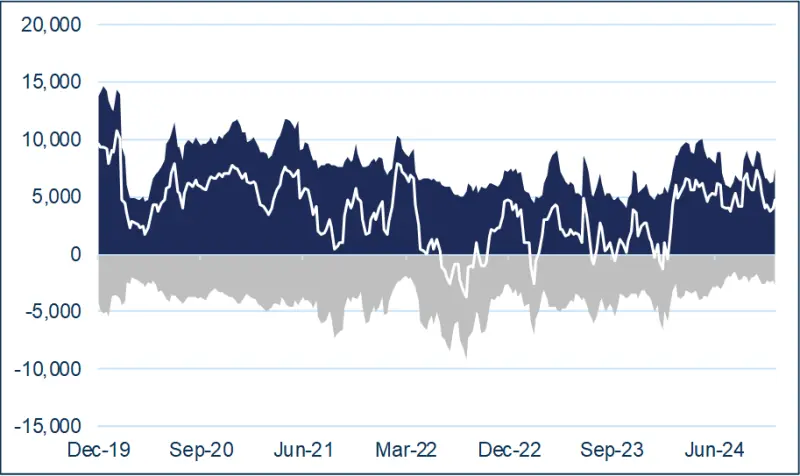

The latest CFTC report is that for 5th August. Gold’s rally from 30th July to 5th August ($3,268 to $3,390) was accompanied by bargain hunting and short covering in the Managed Money sector on COMEX Silver: over the same period silver prices dropped then rallied, ending marginally lower just below the $38 resistance.

Gold COMEX positioning, Money Managers (t) –

COMEX Managed Money Silver Positioning (t)

Source for both charts: CFTC, StoneX

ETF

Silver: The Bloomberg figures suggest that the net ETF creations in H1 2025 were 1,761t, of which 989t were in June. In other words, 56% of the net gains to that point were in June. Looked at another way, on an unweighted annualised basis, June uptake would be equivalent to 11,864t, or the equivalent of five months’ silver mine production. Activity has been mixed since, but the balance has been favourable with net additions of 597t to 24,602t according to Bloomberg. World mine production is just less than 26,000t.

Gold: the latest figures from the World Gold Council, up to 31st July, show a slowdown in net creations. This is more a function of reduced buying rather than any heavy sales. For the month as a whole, North America added just 12.5t to 1869.7t; Europe +10.9t to 1,377.4t; and Asia, +0.8t to 321.5t. Bloomberg figures (not as extensive) imply a gain of 13t in August to date, but this is only approximate. World gold mine production is 3,661t (Metals Focus figures).

Source: Bloomberg, StoneX