Nov 2024

Nov 2024

Gold Rises on Geopolitical Tensions and U.S. Election Focus

- Geopolitics continue to boost gold; now marking time

- Spot still failing at $2,800

- While gold is posting fresh nominal highs, it is still 30% off the spot high of 21st January 1980 when expressed in today’s money

- China ETF gold demand accelerating

- Gold re-focusing on the Presidential election as well as the Middle East

- NonFarm Payroll –poor, devil in the detail

- Silver ETFs mixed, some profit taking

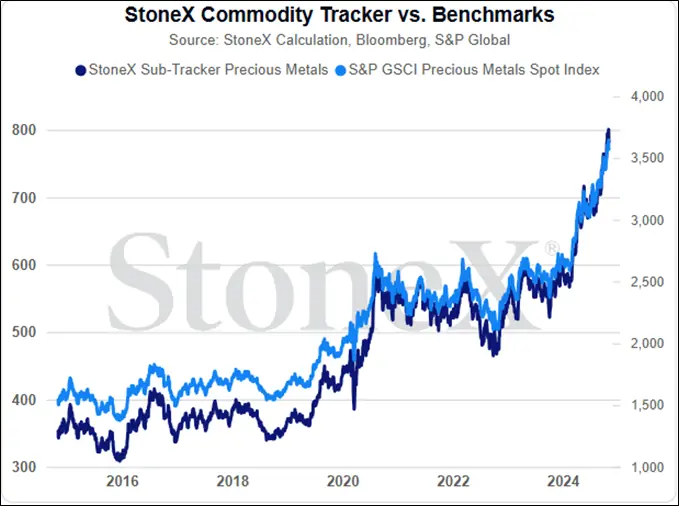

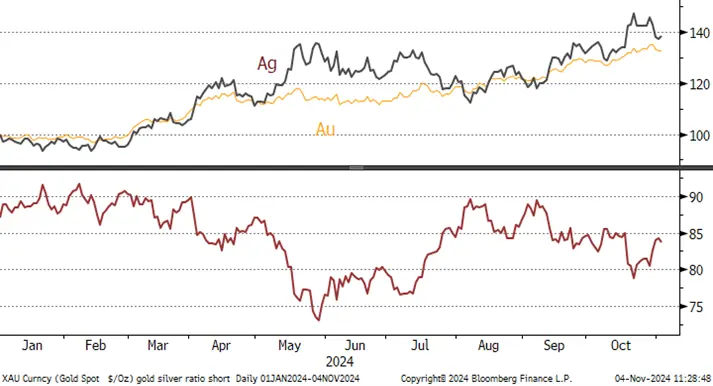

- Year-to-date gold is up 32% and silver, 38%

- COMEX gold and silver both saw profit taking last week, but fresh interest into the dips

Outlook; gold is still in buy-on-dips mode as geopolitical tension is not abating and this week, of course, is key. A tightly-fought Presidential race may well result in a contested victory, which will keep all the markets on edge. A clear victory would likely see a dip, but we would expect that to be bought – again. As we noted last week, one of the key elements of geopolitical risk this year has been the plethora of elections, but the uncertainty will not dissipate once the elections are over. Meanwhile this week sees 20 central bank meetings with interest rate decisions, many of .which are expected to involve rate cuts. We expect any outcome of the Presidential election to be inflationary; the question is, by how much?

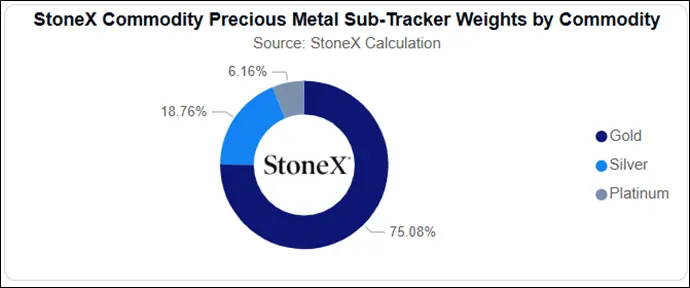

Source: StoneX

Source: StoneX

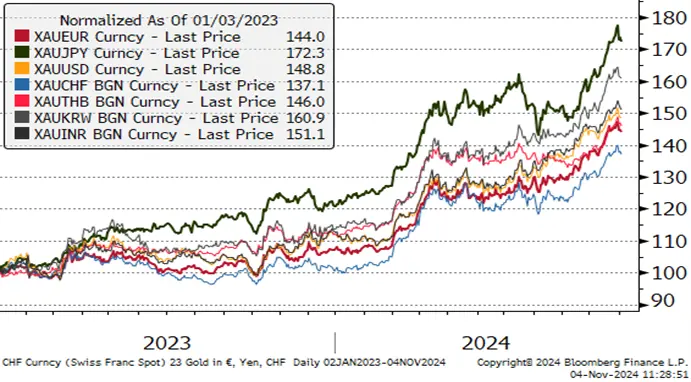

Gold in key local currencies

Source: Bloomberg, StoneX

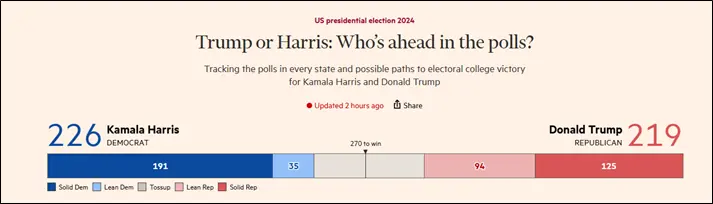

Gold (and by association silver) is currently pricing in a very narrow winning margin in the US Presidential election. If there is a clear victor then it is likely that some of the heat would come out of gold in the short term, as a key element of uncertainty would have been removed.

Potential outcomes:

- Contested victory; President may not be known for days, at least; uncertainty extends, gold likely to challenge $2,800 again and probably succeed.

- Clear victory; gold likely to dip and that would likely then be well bid.

- Republican Sweep of the White House and Congress; gold higher in the medium term due to potential inflationary policies (corporation tax cuts, tariffs), heightened geopolitical tension

- Democrats Sweep; also gold likely higher on fears of inflationary forces (tax and spend), but probably more pragmatism on foreign policy

- Either incumbent, divided Congress (this is probably the most likely outcome), status quo likely to be maintained – would Congress pass a repeal of the Inflation Reduction Act, for example?

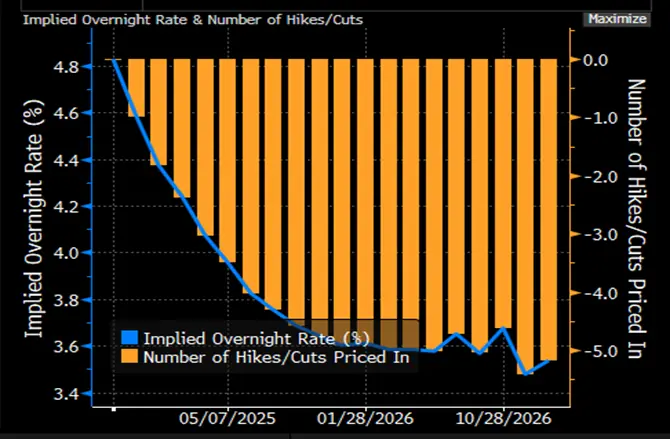

- Important question; would inflation become enough of a factor for the Fed to perform a U-Turn? Given the weakening in the US labour market, probably not, but don’t rule it out.

Source: Financial Times

Gold, short-term; technical indicators still supportive

Source: Bloomberg, StoneX

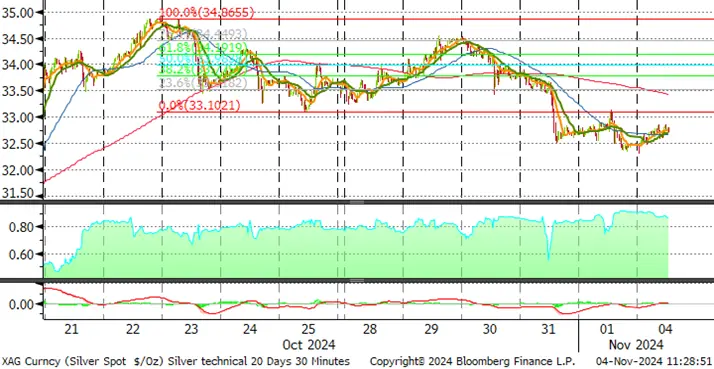

Silver, year-to-date; technical indicators positive; the 10D average still providing close support

Source: Bloomberg, StoneX

Gold:silver ratio, year-to-date

Source: Bloomberg, StoneX

In the background:

Although the NonFarm October numbers in the States were distorted due to hurricanes Helene and Milton, plus strikes, the downward revision to earlier numbers enhances the prospect of a rate cut this week. The headline NonFarm payroll figure was poor, at just +12,000 but behind that lies the downward revisions for previous months. August was revised down by 81,000 and September by 31,000 giving a combined reduction of 112,000. Helen made landfall on 26th September and Milton on 9th October; the Bureau of Labor Statistics reports that employment estimates may have been affected, but that “it is not possible to quantify the net effect on the over-the-month change in national employment, hours, or earnings estimates because the establishment survey is not designed to isolate effects from extreme weather events”.

The downward revision, given that employment is now the primary focus for the Fed, bakes in a 25-point cut this week. On a brighter note, however, Robert Armstrong of the Financial Times points out that unemployment, at 4.1%, is low and that “Going back just 50 years [unemployment has only been below 4.1%] 13 per cent of the time, and all of those instances are from a brief period in 1999-2000 and 2017-2024 (whether the recent low levels represent two distinct economic periods, or one long period interrupted by the pandemic, is an interesting question)”.

Elsewhere, interest rate cuts are expected this week from the Bank of England, Bank of Sweden, of the Czech Republic. Pakistan is likely to cut again (from 17.5%). Inflation numbers are due from a number of countries in Asia including Japan, while China is due to report on Saturday.

Source: Bloomberg

But for now, it’s all eyes on the States.

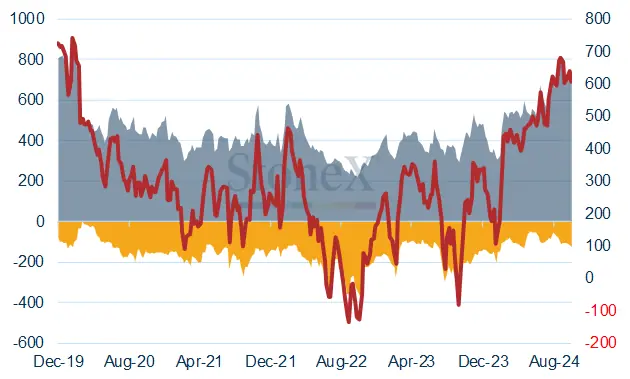

COMEX

Gold; some profit taking and fresh shorts help to unwind overbought conditions

Gold reached new records late last Tuesday and early Wednesday morning at $2,790; CFTC numbers submitted at close of business on 29th. Managed Money positions saw longs shed 24t (3%) and shorts made a small gain of 7% or 8t. The outright longs at 731t are 51% higher than the 12-month average. Net long; down fractionally again to 607t.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

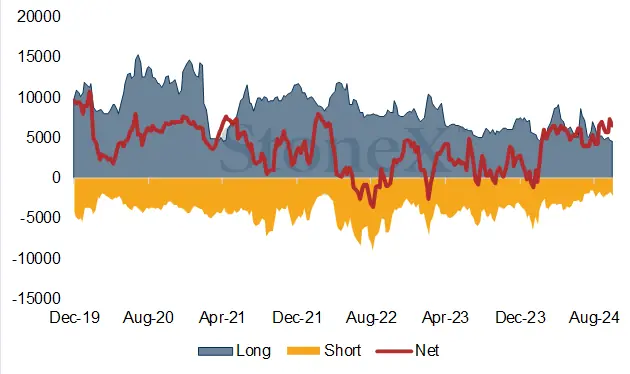

Silver; moderation in sentiment; similar pattern to gold as the rally prompts some profit taking

Silver peaked at close of business on Tuesday 29thOctober, coinciding with the CFTC numbers; longs contracted by 3% or 337t in the week to 8,710t to stand at 21% over the 12-month average. Shorts expanded by a sizeable 29% (589t) to2,244t. Net long down 926t to 6,466t.

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

ETFs:

Gold ETFs; some profit taking appeared on gold’s second failure at $2,800, but volumes were relatively well contained to give an October gain of 24t. After light selling at the start of November the year to date gain of is 3,223t. In the year to 25th October, World Gold Council numbers show a ytd gain of 111t in the States but a 70t drop in Europe. China has added 44t, or 72%, to 105t. Silver has added 680t (3%) over October-to-date, to 23,102t. This gives a year to-date gain of 1,333t or 6%. Global mine production is ~26,000tpa.

Source: Bloomberg, StoneX

Tailwinds for gold exceed the headwinds

For the longer term, the tailwinds substantially outweigh the headwinds and are summarised in this note that we published at the end of August: Precious Metals Talking points 083024: Gold: state of play and key influences going forward

Key points from this note are still relevant, and as follows

Current tailwinds include: -

- Geopolitical risk.

- Increasing trade tensions

- Stresses in the banking systems in the three major regions, notably in the small-to-medium sized sector, and especially exposure to property, and (in the US) Commercial Real Estate.

- Emergence of the Shadow Banking sector (i.e. unregulated transactions), reminiscent of the Sub-Prime issues in 2007 that led to the Global Financial Crisis in 2008

- Continued strong Official Sector purchases – not just because they are taking tonnage off the market but because of the signal that it sends to the markets because the Official Sector dislikes uncertainty

- Widespread investor interest, notably from High-Net-Worth individuals, Family offices and other professionals who are back in the market for the long haul.

Headwinds:

- Reduction in international political or trade tensions; Harris more of a bearish influence than Trump on this score

- Any strong inflationary forces and / or associated expectation thereof could force a reversal in monetary policy

- Official sector going on the retreat (unlikely)

- Investors’ conclusion that risks have declined (likely to take a matter of years, compare GFC of 2008); it wasn’t until 2013 that professionals bailed out of gold (over 800t of ETF metal went straight into private hands in China)