Jan 2025

Jan 2025

Trump’s Executive Orders & Fed Meeting Impact Markets

- Last week was all about President Trump and his flurry of Executive Orders

- Silver demand growth may be reduced following the President’s EV-related Executive Order, but only at the margin

- This week sees the first FOMC meeting of the year and indeed of Mr. Trump’s Presidency; the Fed is expected to keep rates on hold

- Be prepared for some degree of antagonism from the President as the Fed takes an independent stance

- Heavy falls in tech stocks today are giving gold a boost as a safe haven

Outlook; the overall outlook for gold is effectively unchanged. We continue to expect further gains in gold in the first part of this year as geopolitics remains dominant, although the emergence of a degree of pragmatism over tariffs in favour of negotiation – while not coming as a surprise – perhaps takes some of the heat of out of the geopolitical environment. A lot of this is priced-in and we would not be at all surprised to see gold prices peak this year. Silver will be focusing on how the EV tactic from the White House plays out. If gold does go onto the retreat silver is likely to go with it, but any dips may well be shallower than those of gold. This would be a fundamental shift in the long-standing relationship between the two as we see the start of some decoupling.

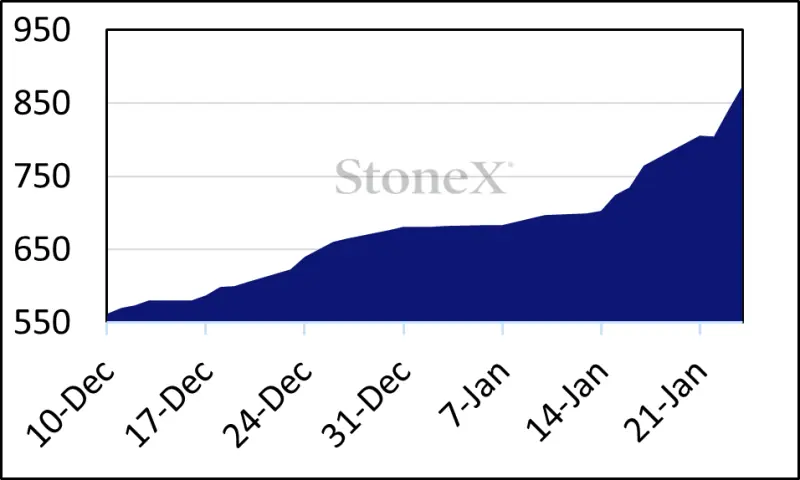

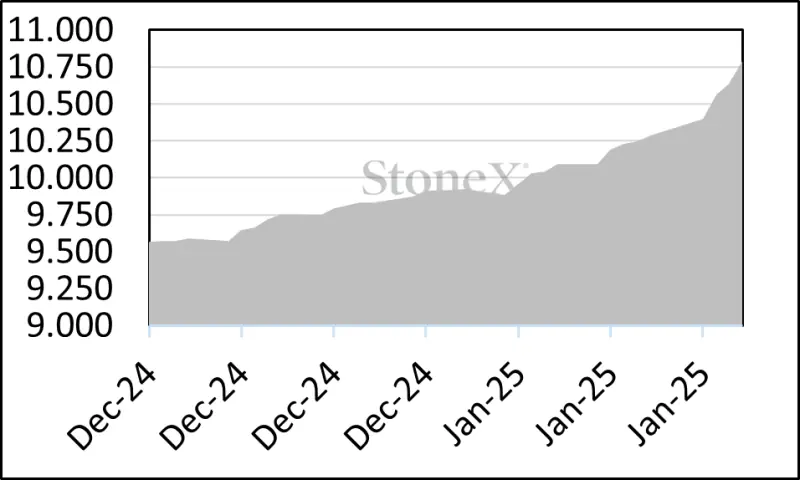

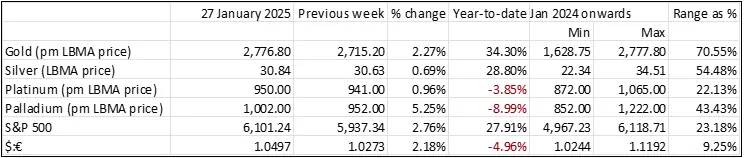

Last week was characterised by the continued flight of gold, and to a lesser extent silver (plus a lot of platinum) into CME warehouses and elsewhere in the United States. Although it is still pretty unlikely that there will be tariffs on gold imports, risk managers are understandably not taking any chances. Since 10thDecember the changes have been as follows (tonnes): -

10th Dec | yesterday | change | % | % of OI | |

Gold | 562 | 873 | 311 | 55.3% | 45 |

Silver | 9,568 | 10,787 | 1,219 | 12.7% | 42 |

Platinum | 4.27 | 10.92 | 6.65 | 155.7% | 8 |

Palladium | 385.30 | 385.30 | 0.00 | 0.0% | 2 |

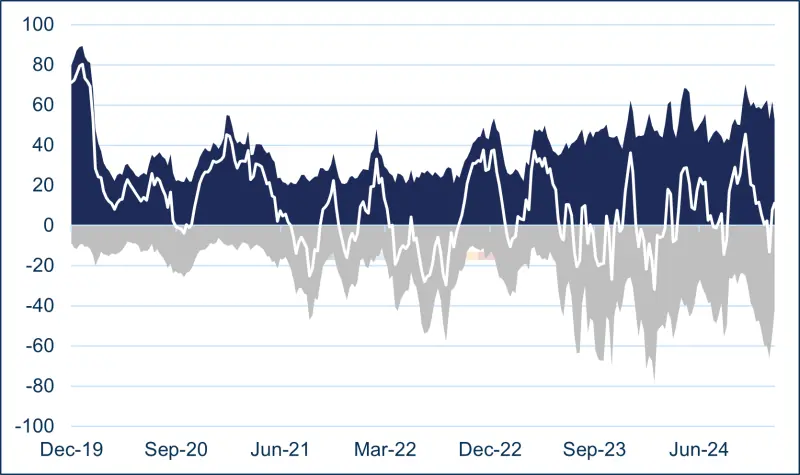

Gold and silver inventories in COMEX warehouses

Gold

Silver

The most tangible element in the gold and silver markets are the inventory changes on the CME since early December. And bear in mind also that these numbers only reflect what has gone into CME warehouses. Other entities will have been receiving metal also.

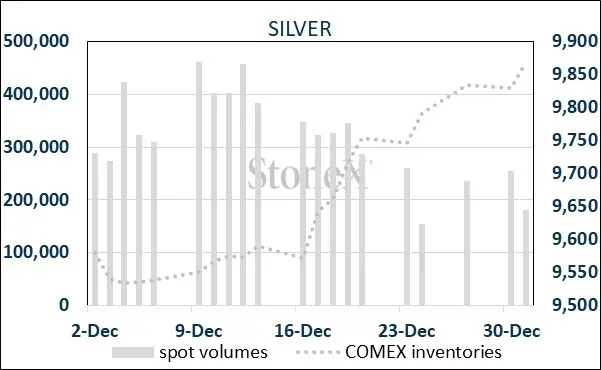

These next charts, which we also ran last week, show how volumes in the LBMA loco London spot markets started to jump in December as increasing numbers of participants employed the EFP (we have discussed this before – examination is at the end of this note). Typically it takes ten days to deliver metal out of London and into COMEX warehouses and the relationship is shown nicely here, especially in gold:

CME gold and silver inventories against spot volumes

Source: Bloomberg, StoneX

Meanwhile silver is a key element in the electrification of the vehicle fleet. While the absolute numbers have not been broken out in our original sources, the jump in silver demand in electrical and electronic components in the States since the start of this decade must have been informed at least in good part by the growth in BEV vehicles – which carry much more silver than ICE vehicles (although silver usage in that sector is continuing to rise as levels of sophistication continue to rise). That jump was nine million ounces (280t). That equates to just 1.3% of global industrial demand and even this is likely to be an over-statement as we can’t guarantee that all of that increase relates to the electric fleet.

So even if the development of the electric fleet is dismantled in the United States it will continue to march onwards in the rest of the world. Mr Trump has commanded the elimination of electric “mandates” – there are in fact no such mandates in place and reverse regulations over vehicle emissions and fuel economy. The Financial Times reports that the Massachusetts Institute of Technology estimates that incentives have created an 8% increase in new BEV registrations for each $1,000 of incentive offered. That said, repealing the $7,500 per vehicle incentive would need to go through Congress and it is by no means certain that it would do so.

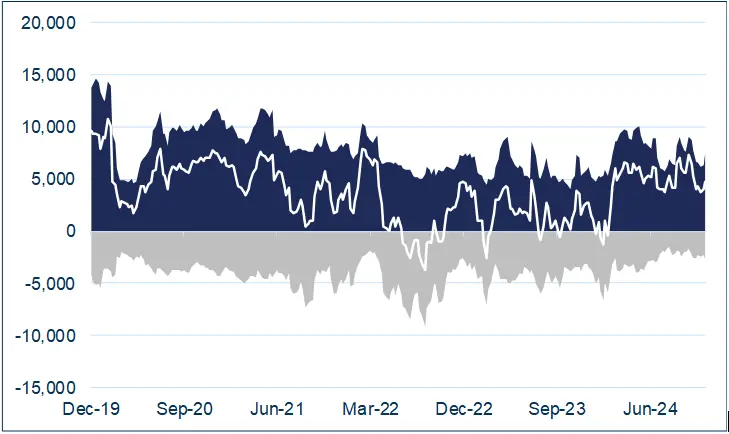

And the arrival of AI is also beneficial for silver as the super-chips that go into the equipment have a lot heavier silver loadings than standard electronic equipment. The news this morning (27thJanuary) revolves around DeepSeek, a Chinese AI start-up project that is just over a year old and which is undercutting the costs of more established companies in the sector, and which saw over a trillion dollars wiped off their market capitalisation, with Nvidia, for example, dropping by 13% in early trading. The company has reportedly delivered AI models that compete in terms of other chatbot companies, but at substantially lower cost.

This has the potential to raise temperatures in the States and it will be interesting to see whether this has an impact on potential Sino-US trade talks.

S&P, the tech sub-sector, gold

Source: Bloomberg, StoneX

In the markets, gold briefly regained earlier losses, (which had been prompted by dollar strength on the back of the migrant / no tariff deal with Colombia moving towards $2,770), but eased again as the dust settled.

Gold, technical

Source: Bloomberg, StoneX

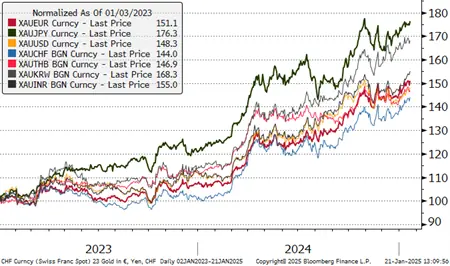

Gold in key local currencies

Source: Bloomberg, StoneX

Silver, short-term; failed at $32

Silver technical

Source: Bloomberg, StoneX

Gold:silver ratio, 2020-to-date

Source: Bloomberg, StoneX

In the background:

CFTC: positive attitude to gold; silver mixed

Gold longs-up again last week and have added 139t or 25% since the start of the year to reach 706t, while shorts contracted by 15t or 31% to 35t, the smallest since early May 2020. This is not only favourable sentiment towards gold, it is still much more a function of concern over the possibility of US tariffs, even though the fact that gold is a reserve asset would militate against tariffs on that metal.

Silver is a different issue. International trade figures from the United Nations show that Mexico was in fact responsible for 42% of US silver imports in 2023, and Canada, 15%; the prospect of tariffs has not gone away although it does look as if negotiations will take place. CFTC shows longs expanding by 1,610t or 26% so fart his year, to 7,755t; shorts are down by 308t or 9% to 2,958t.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

ETFs:

World Gold Council figures record a small loss 2024, at just 6.8t, although dollar flows were positive at $3.4Bn, taking assets under management to $271Bn. North America added eight tonnes, Europe dropped 98t, while Asia added 78t, a gain of 57%. As we have noted before, at just 115t, Chinese holdings are minimal by comparison with the 1,582t in the States and 1,288t in Europe, there is considerable upside scope.

January has remained mixed, with 10 days of net creations from a total of 17 trading days so far for a net gain of almost nine tonnes, to a total of 3,227t. Global Mine production ins ~3,600tpa.

Silver – added a net 506t over 2024, to reach 22,276t; in early January there have been a couple of days of noticeable redemptions, for a net decline of 92t, against global silver mine production of ~26,000t. In January to date silver has also been mixed, with nine days of net creations for a net loss of 177t after some sizeable redemptions in recent days.

So what is the EFP and how does it work?

“EFP”is the acronym for Exchange of futures for physical. While the futures market forms part of the transaction, EFP trading is between two counterparties and is not centrally cleared. Last week the gold EFP shot out to more than $60 between spot and the active contract (February 2025 in this case); i.e. between 2% and 3%; that of silver reached a dollar, or just over 3%.

How does it work? Trading the EFP is a way of hedging market exposure. By buying the EFP, a holder of physical metal contracts with a counterparty to sell the physical position while simultaneously buying the futures. That way the exposure in the metal itself is unchanged; but the delivery date shifts. Some market stakeholders have been using the EFP in order to deliver metal into the United States ahead of 20th January in order to reduce the risk attached to long positions in case of tariff imposition. In our view tariffs on either metal, especially gold, are unlikely, but it is understandable that some traders – or their risk officers (as was the case during the pandemic) want to eliminate any possibility of being caught up in any fall-out.

Tailwinds for gold exceed the headwinds

For the longer term, the tailwinds substantially outweigh the headwinds and are summarised in this note

Current tailwinds include: -

- Geopolitical risk.

- Increasing trade tensions

- Stresses in the banking systems in the three major regions, notably in the small-to-medium sized sector, and especially exposure to property, and (in the US and to a lesser extent) Commercial Real Estate.

- Emergence of the Shadow Banking sector (i.e. unregulated transactions), reminiscent of the Sub-Prime issues in 2007 that led to the Global Financial Crisis in 2008

- Continued strong Official Sector purchases – not just because they are taking tonnage off the market but because of the signal that it sends to the markets because the Official Sector dislikes uncertainty

- Widespread investor interest, notably from High-Net-Worth individuals, Family offices and other professionals who are back in the market for the long haul.

Headwinds:

- Reduction in international political or trade tensions; Scott Bessant could well be instrumental here

- Any strong inflationary forces and / or associated expectation thereof could force a reversal in monetary policy

- Official sector going on the retreat (unlikely)

- Investors’ conclusion that risks have declined (likely to take a matter of years, compare GFC of 2008); it wasn’t until 2013 that professionals bailed out of gold (over 800t of ETF metal went straight into private hands in China).