May 2025

May 2025

Gold Market Outlook May 2025: Key Trends

Risk premium still unwinding in gold, as the focus turns to the EU

- Continued uncertainty over US policy has been supportive over the past fortnight

- Although the rapid change in proposed 50% tariffs on the EU has generated a fall over the past weekend

- The latest trade statistics from Hong Kong reinforce the anecdotal evidence of a resurgence in Chinese demand

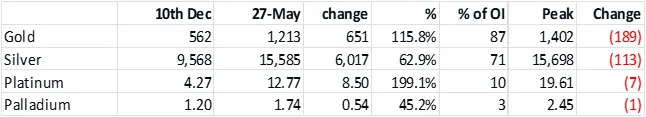

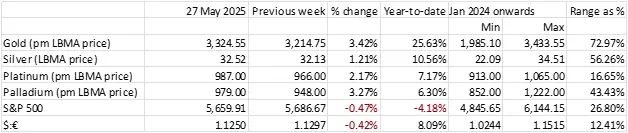

- Gold inventories on COMEX peaked at 1,402t on April 4th. They have dropped since to 1,206t.

- The Inventory/Open Interest cover is down to 85%, still substantially higher than the more normal 40%+

- The bond markets continue to discount two rate cuts this year, although Fed rhetoric is generally more hawkish

- Gold coin business is very sluggish in North America in response to high prices

- ETFs still seeing liquidation in the first half of May.

- Silver ETFs, by contrast, are continuing to expand

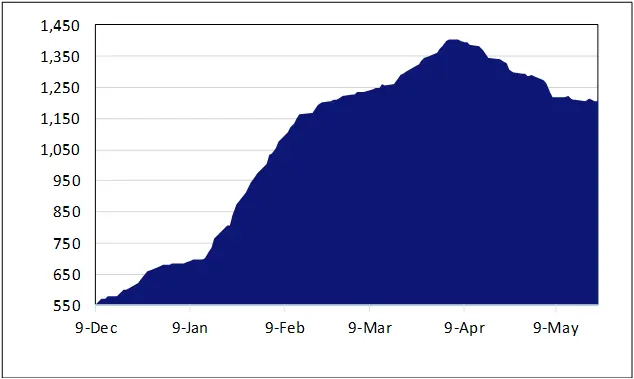

- Shorter term outlook is unchanged: gold is still consolidating. We expect prices to remain supported while the markets contend with continued uncertainty, but we continue to believe that the high is in. The gold:silver ratio, still just over 100, should start to decline as and when the economic clouds start to clear, but this may not be much before year-end

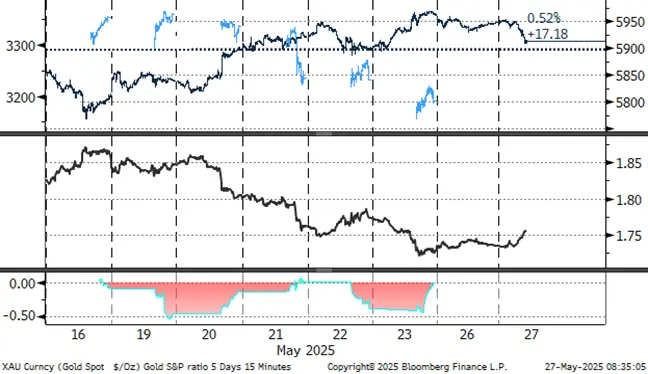

The S&P/Gold ratio is easing on the back of continued policy uncertainty

Source: Bloomberg

Comment: -

The changes in US tariff policies continue to be a key influence as the markets swing between risk-on and risk-off, but with the emphasis on the latter. The suggestion in late May that the US would impose 50% tariffs on EU imports (and the likely retaliation from the EU) gave gold a fresh boost towards $3,370, but the reversal of the position over the weekend, in order to allow further negotiation, put gold under pressure to trade just below $3,300.

In the background the latest trade statistics from Hong Kong show that, after net exports to mainland China of just over seven tonnes in the whole of the first quarter of this year, trade surged in April to a net import of 43.5t as demand strengthened dramatically. Market stakeholders withdrew a net 152 tonnes from the Shanghai Gold Exchange in April; the Exchange records 135t of withdrawals and just one tonne of delivery. Meanwhile Chinese ETFs added 65t in April although it looks so far as if those inflows have slowed in May. For context, global mine production is approximately 3,600t.

On the other side of the world, coin offtake is very sluggish with the US Mint reporting just 5,000 ounces of gold Eagles sold in April and also thus far in May, against 20,000 in March and 10,000 in February; this is well down on previous years’ volumes.

COMEX gold inventories, tonnes

Source CME via Bloomberg, StoneX,

Gold, one-year view; back towards neutral territory

Source: Bloomberg, StoneX

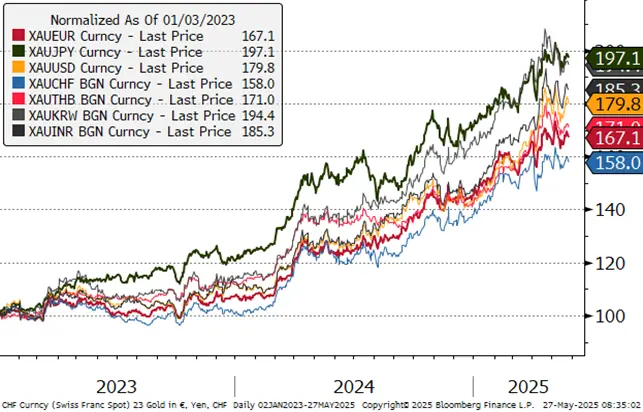

Gold in key local currencies

Silver, January 2024 to date; technical picture supportive

Source: Bloomberg, StoneX

Gold:silver ratio, January 2024 to-date; steadying

Source: Bloomberg, StoneX

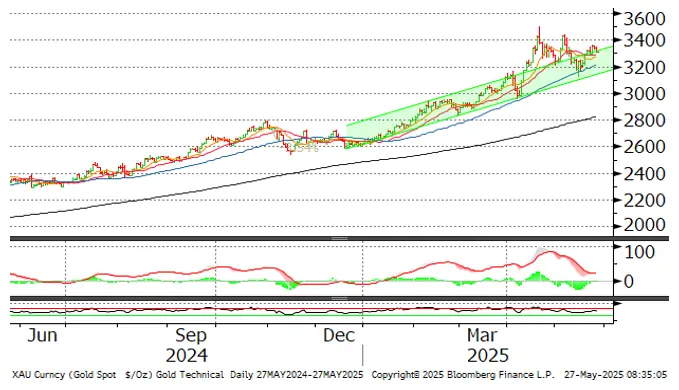

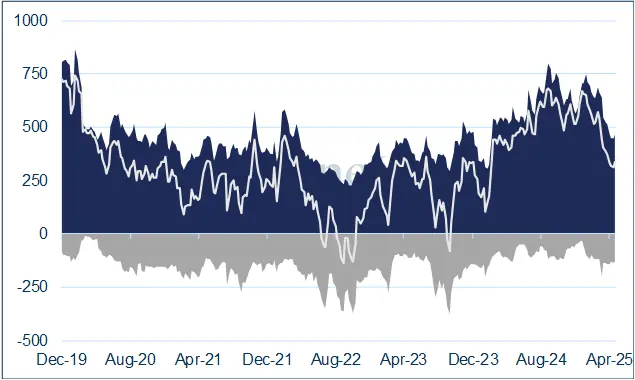

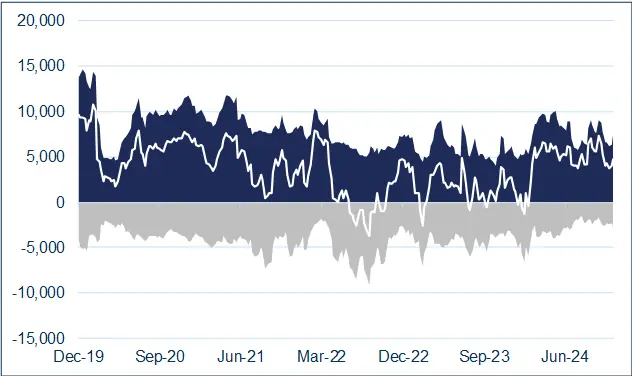

CFTC: the week to 20th May, in which gold prices initially dipped from $3,250 towards $3,100 and then rallied to close at $3,300, was accompanied by a small (15t, 3.3%) gain in longs and a five tonne (3.9%) fall in shorts. Silver, meanwhile, more or less mirrored gold but was less bullish, by dropping from $33.2 to $31.7 and then pushing up to close at $33.1. Given that this was accompanied by a 5.0% increase in outright longs and a 0.4% increase in shorts, was again testament to the fact that the physical market is still concerned by the lack of economic improvements in Europe and sluggish behaviour in China.

To that end, the latest economic numbers from Germany are something of a mixed blessing. Germany is the economic powerhouse of the EU and the latest GDP numbers, for Q1 2025, show a 0.4% quarterly rise after a contraction of 0.2% in the previous quarter, stemming from strong manufacturing figures. Consumption was up by 0.5%, as savings fell. Whether this has been sustained into the second quarter, amid the swirling tariff developments, is open to question.

Gold COMEX positioning, Money Managers (t) –

COMEX Managed Money Silver Positioning (t)

Source for both charts: CFTC, StoneX

Source: Bloomberg, StoneX