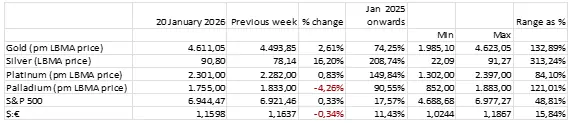

Jan 2026

Jan 2026

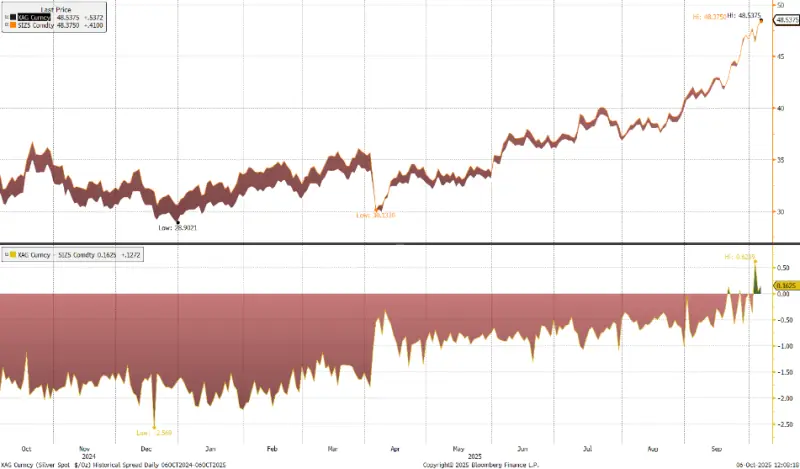

Silver massively overblown. The Log chart shows just how much

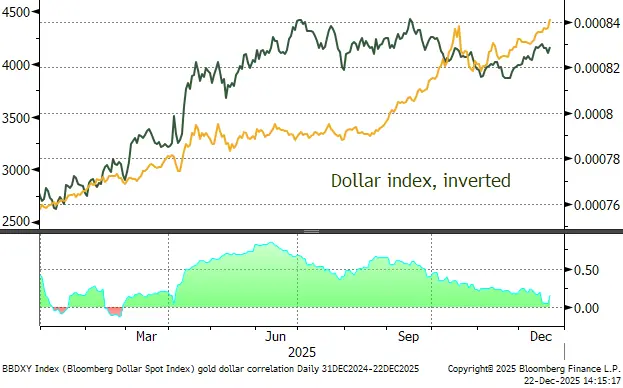

Geopolitical developments and renewed focus on the independence of the Federal Reserve, plus price-chasing at the professional and retail levels have driven gold and silver to more fresh highs. Silver is particularly febrile, with high volumes in both directions at the grass roots, which is a warning sign.

Quick year2025 round-up

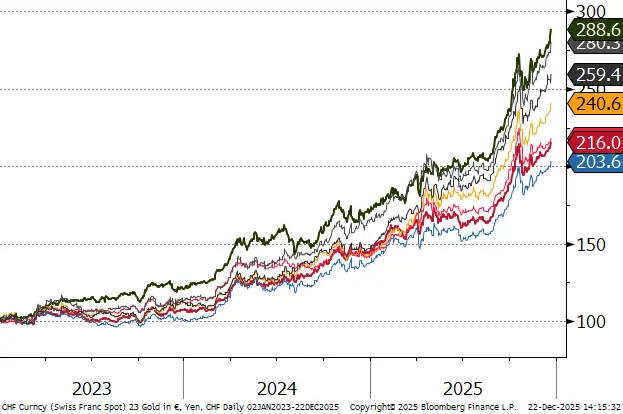

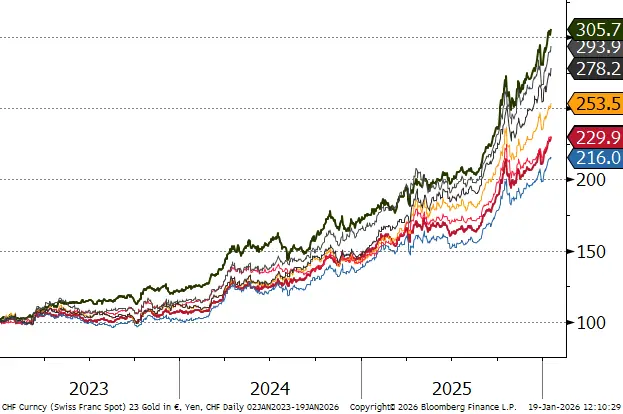

Price change year-on year (end-2024 to end-2025)

Exchange Traded Products:

Source: Gold; World Gold Council

Silver: Metals Focus 2021-2024; Bloomberg 2025 (may be understated).

Key headlines:

Department of Justice and Jay Powell, tariff threat on Europe over Greenland, silver not featuring in the latest Critical Minerals statement (but that doesn’t take the heat off).

Outlook

This massive recent gain in silver fills me with dread. In over 40 years covering this market I have seen many cataclysmic falls after aggressive bull runs. While this time it is a little different as the geopolitical background and industrial demand prognoses look to be supportive for the short-to-medium term and longer-term respectively, nonetheless there are some signs that we may be near the peak. Gold still has upside given the geopolitics that surround the market and this will help to keep silver supported for now.

So while there is, in our view, scope for further upside in both, and London silver remains relatively tight, once cracks in silver appear they could easily turn into chasms. Here is the link to last week’s piece – written before the announcement of the US DoJ probe into Fed Chair Powell, which is the StoneX submission of 2026 Precious Metals Price Forecasts for the LBMA Annual Survey

Recent price action

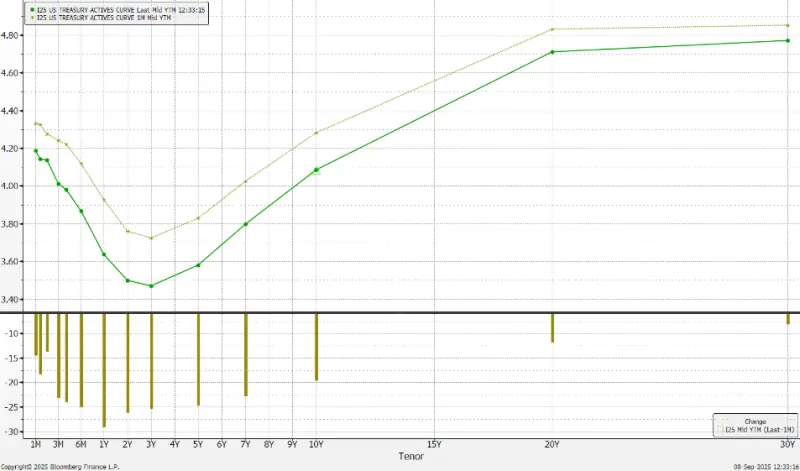

Gold’s high to date is $4,691, posted earlier today (Monday 19th ) on President Trump’s threats to impose tariffs on Europe over the Greenland disagreement (more below)

The announcement of the DoJ probe into Chair Powell on a “criminal” basis, reliant on cost-overruns in the Fed refurbishment, brought an unusual one-off Sunday video from Chair Powell, refuting the overt cause of the action and pointing to the President’s push for lower rates as the real reason

The DoJ announcement was Friday 9th January, Powell’s refutation on Sunday 11th. Gold ran from $4,452 to $4,630, a 4% gain

After the rally on these developments, gold paused for breath and looked as if it was heading for a period of consolidation. The tariff threat over this past weekend was good for a further jump to the highs, from a Friday close of $4,596 to the Monday high of $4,691, a gain of 3%. The tariff issue (pointing to eight EU members if they withstand any threats of US action over Greenland )remains only a threat, however.

Taken from the previous upward phase, this high of $4,691 equates almost exactly to a Fibonacci 38.2% target, and with the States closed today, activity in Aisa overnight will be informative.

Silver’s major move so far in January came between the 7th and the 14th, when it put on 27%, from $78.2 to $93.5. In the short period since then it has, in current context, at least, been treading water and the post-tariff rally has, as usual, been just more than twice that of gold when expressed in percentage terms (in this case 3,7%, to test $94.

The furore at these levels is seeing some FOMO buying action, but scrap coming back also. The US Mint has suspended coin sales. Tread with care.

Illustration of silver’s extreme price position.

It is instructive to look at silver on a log-chart rather than a linear scale (i.e. the y-axis is expressed in logarithmic terms so that each move is shown in proportion to other moves. Thus a $10 move off a base of $10 is 100%; $10 of a $100 base is 10%, etc). This latest move is very strong by any-one’s standards and should be flashing warnings. It does look as if silver still has the scope for further gains given the environment, but buckle up when a correction ensues, as it may well be a lot more than a correction.

Log-chart of silver’s longer term price action; not quite as big as the ’78-’80 move – but very close – and see what happened back then!

Hunt Brothers, 2nd oil shock, Iran, Soviet/Afghan

Continued post-Lehman fallout, financial sector bankruptcies- gold carries silver

Strong investment activity, not least on intra-Fed disagreements post QE2

Background physical moves: index rebalancing seems to have made little difference despite silver and gold being outperformers last year

The latest ETF numbers are as follows: The World Gold Council numbers run to last Friday 16th January and show a healthy gain of 40.2t in just two weeks’ trading, with a 1.1% gain of 23.3t in North America to 2,118t; of 2.0% in Asia (8.5t) to 4455t; and a 0.6% gain in Europe (8.1t) to 1,428t. Total; 4,065t.

Silver figures from Bloomberg for the year-to-date show a less convincing performance, with just three days of net creations from a total of 11 trading days. Clearly there has been some profit-taking and it’s possible that some of the commodity rebalancing, which takes place at the start of each year, may have had an effect (although it would appear that there were eager buyers, especially in gold, ready to snap up anything that was coming free as a result of any rebalancing sales).

So fat this year over 500t have come out of those silver ETFs that are covered by Bloomberg. After losses of 528t they stood at 26,334t at the end of last week.

Gold COMEX positioning, Money Managers (t) –

OMEX Managed Money Silver Positioning (t)

Source for both charts: CFTC, StoneX

Among the Money Managers on COMEX, gold solid, silver under profit takngi

The latest CFTC figures, to 13th January, show a reasonably good increase in outright longs. Ending the year at 462t there was a dip to 456 followed by a gain to 494t. This is still only 85% of the 12-month average, so the market is not carrying an overhang in this sphere. Shorts are steady, between 70t and 75t.

Silver has been subject to profit taking here, too; in mid-December silver outright longs were as high as 6,398t; they stood last Tuesday at 3,665t, just 51% of the 12-month average. Sports have also contracted over the period, but by just 780t.

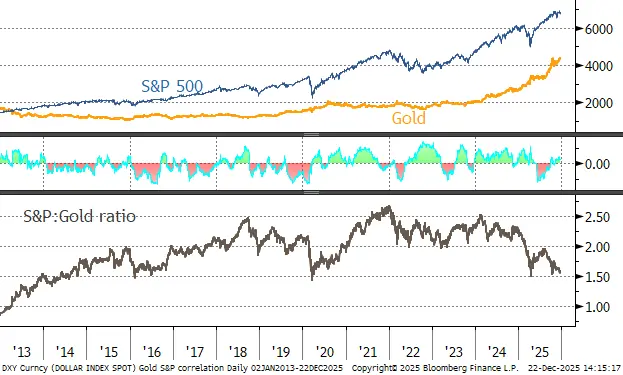

The S&P, gold and the dollar; gold:S&P marginally positive at 0.04

Source; Bloomberg, StoneX

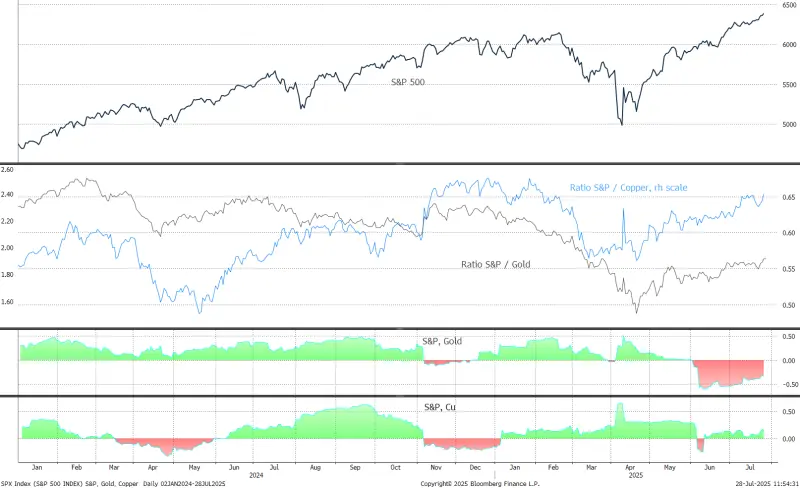

The S&P, gold and copper; S&P-gold 0.25; S&P Cu, 0.37

Gold, one-year view; still within its uptrend, although still overbought

Source; Bloomberg, StoneX

Silver March 2026-spot spread; flat. London still relatively tight

Source; Bloomberg, StoneX

Gold in key local currencies.

Source: Bloomberg, StoneX

Gold:silver ratio, long-term; now at 14-year lows

Source: Bloomberg, StoneX