Dec 2024

Dec 2024

It’s all about tariff nerves; the EFP explained

- The EFP is explained below

- Concerns – probably misplaced, but perception is everything – over possible tariff implementation give gold and silver a temporary boost

- The physical markets are quiet

- But the professional markets have been very lively

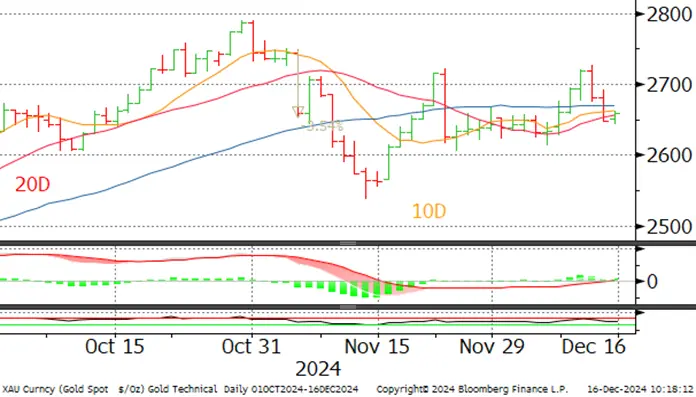

- Gold vaulted up towards $2,800 but the move was short-lived

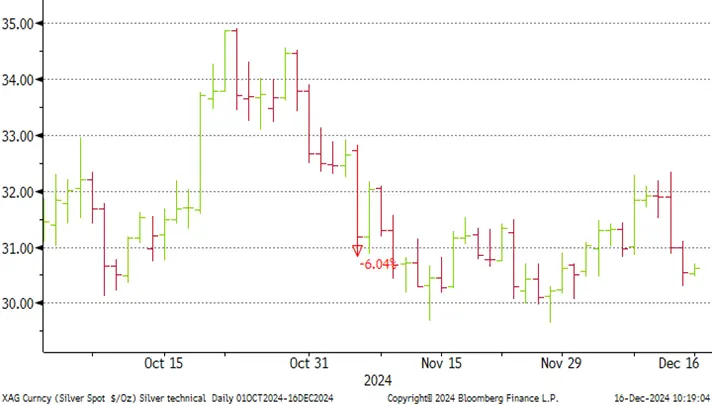

- Silver cleared $32 briefly, then recoiled before gold corrected

- Year-to-date gold is up 28% and silver, 29%

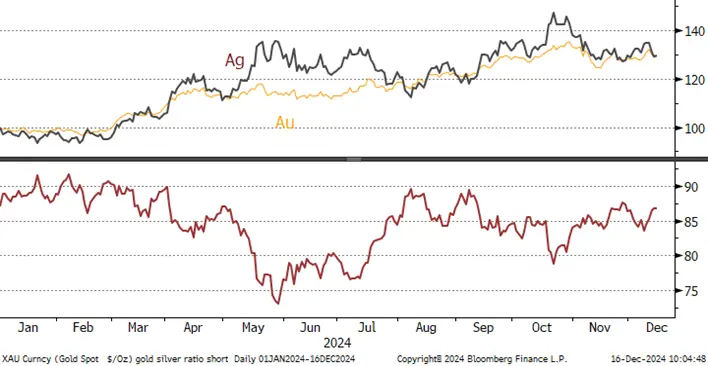

Outlook; the economic and political background is generally supportive for gold – but the Fed may cap prices if it points to an extended pause in rate cuts after December; while silver still has to face the persistent economic weakness in Europe and China and the ratio between the two metals is likely to widen towards 90.

Politics was the key driver last week and is likely to remain so for the foreseeable future. While underlying geopolitical strains are a continuing supportive force, last week the spotlight was on one specific element; the potential for US tariff imposition on gold and silver.

Talk about tariffs has been all the rage of late, most notably, as far as the precious metals markets are concerned, the threat by President-elect Trump to impose tariffs on imports from Mexico and Canada, which expanded into fears of tariffs on gold and silver more broadly. Most observers believe that these initial stances (regardless of the counterparty or the items in question) are simply negotiating positions – and indeed talks have already been taking place with Justin Trudeau.

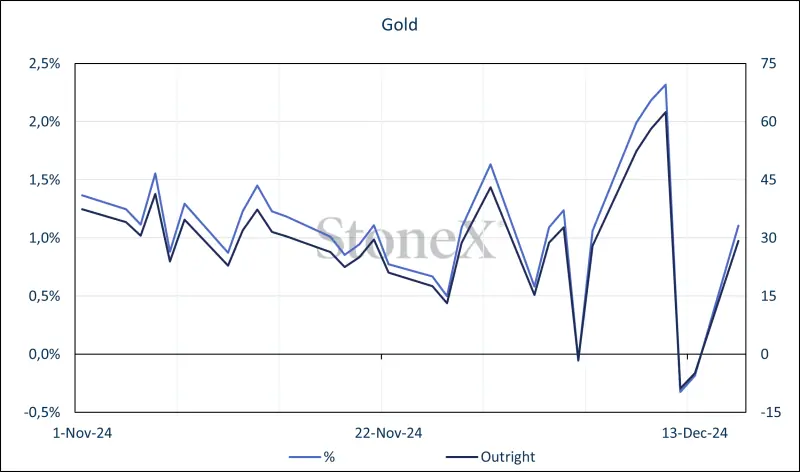

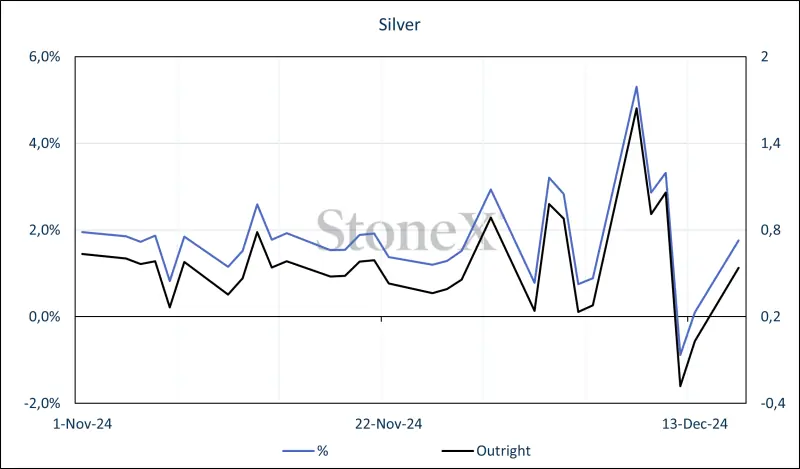

Even so, it doesn’t take much for fears or uncertainties to take hold and to rattle market sentiment and this is what happened last week in gold and silver (silver had also had a flurry of activity the previous week when the announcement came through about Mexico and Canada, as Mexico commands roughly 25% of US silver imports and Canada, 10%). The EFP held the spotlight, and the blow-out in EFP rates to over $60 in gold and $1 in silver cascaded through into the spot price and generated last week’s rallies.

Source: Bloomberg, StoneX

So what is the EFP and how does it work?

“EFP” is the acronym for Exchange of futures for physical. While the futures market forms part of the transaction, EFP trading is between two counterparties and is not centrally cleared. Last week the gold EFP shot out to more than $60 between spot and the active contract (February 2025 in this case); i.e. between 2% and 3%; that of silver reached a dollar, or just over 3%.

How does it work? Trading the EFP is a way of hedging market exposure. By buying the EFP, a holder of physical metal contracts with a counterparty to sell the physical position while simultaneously buying the futures. That way the exposure in the metal itself is unchanged; but the delivery date shifts. Some market stakeholders have been using the EFP in order to deliver metal into the United States ahead of 20th January in order to reduce the risk attached to long positions in case of tariff imposition. In our view tariffs on either metal, especially gold, are unlikely, but it is understandable that some traders – or their risk officers (as was the case during the pandemic) want to eliminate any possibility of being caught up in any fall-out.

Source: Bloomberg, StoneX

Gold, technical

Source: Bloomberg, StoneX

Gold in key local currencies

Source: Bloomberg, StoneX

Silver, short-term; failed at $32

Source: Bloomberg, StoneX

Gold:silver ratio, year-to-date

Source: Bloomberg, StoneX

In the background:

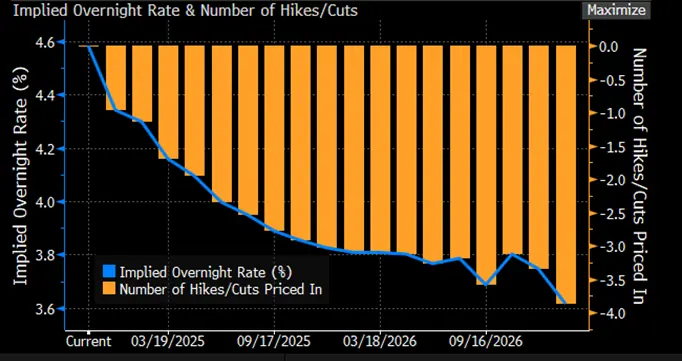

Source: Bloomberg

The next FOMC meeting is this week; the rate decision and the dot plot will be released on Wednesday and as always the key nuances will be in Chair Powell’s Press Conference. While the swaps markets are pricing in a 97% chance of a 25-point cut, to 4.5%, the Financial Times FT-Chicago Booth poll of academic economists is now more cautious than prior to the Presidential election, believing that the fed funds target rate will be around 3.5% at the end of next year, whereas previously they were expecting rates to be below that level.

Stagflation fears again?

Concerns over inflation lie behind the changed stance. One respondent is postulating that the Fed might go on hold for the whole of next year, while another has pointed out that while inflation has been managed downwards more effectively than expected, the last lap will be the hardest. Just over 80% of those polled expected that core inflation would not dip below 2% until at least January 2026, and the median estimate for core PCE over the next 12 months rose to 2.5%, against 2.2% in the September survey. There is also concern over growth rates under some of the policies that Mr Trump has been espousing.

Source: Financial Times

CFTC:; positive attitude to gold; silver mixed

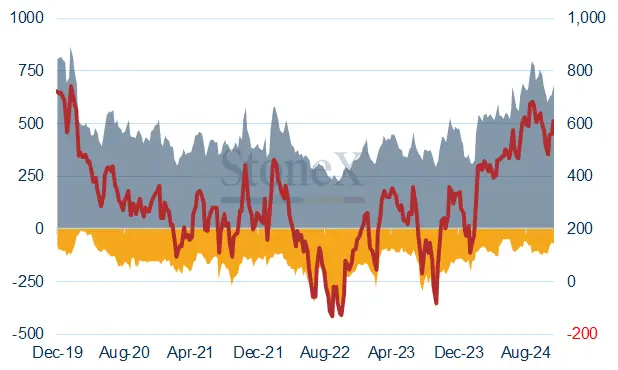

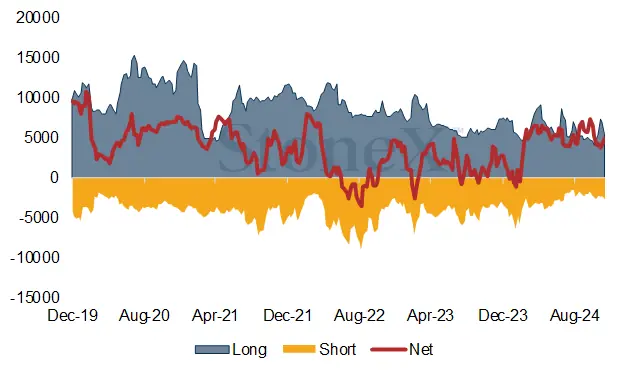

Gold longs continue to increase and shorts are still covering. Longs on 10th December, just as the action was starting in the EFP, were 680t, roughly where they stood at the start of November, while shorts, at 70t, are the lowest since mid-September. Silver, while also expanding on the long side, is finding extra shorts also. Longs stood at 7,538t on 10th December, with shorts at 2,732t, the highest since late July as the markets continue to fret over the economic outlook in Europe and China – and possibly there may be some concerns creeping in about the States in the medium term.

Gold COMEX positioning, Money Managers (t) – a week out of date due to Thanksgiving

Source: CFTC, StoneX

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

ETFs:

Gold As of 6th December, World Gold Council figures show a net loss year-to-date of 8.2t in ETF holdings, to a total of 3,207t. The States had lost 5.32t, the UK 0.4t, Germany 1.5t and mainland China, 0.7t.Bloomberg numbers for early December show a combined net loss of 5.5t. Switzerland was the only listed country in positive territory and that was only 0.1t. Bloomberg figures for the second week of December are mixed, with three days of net gains and one of net redemption, for a total drop of 0.1t.

Silver remains on the defensive with only six days of net gains from the past 20 days and five of the past six days have seen net redemptions. Year-to-date the ETPs have added 675t to a total of 22,446t. Global mine production is ~26,000t.

Source: Bloomberg, StoneX

Tailwinds for gold exceed the headwinds

For the longer term, the tailwinds substantially outweigh the headwinds and are summarised in this note that we published at the end of August: Precious Metals Talking points 083024: Gold: state of play and key influences going forward

Key points from this note are still relevant, and as follows

Current tailwinds include: -

- Geopolitical risk.

- Increasing trade tensions

- Stresses in the banking systems in the three major regions, notably in the small-to-medium sized sector, and especially exposure to property, and (in the US and to a lesser extent) Commercial Real Estate.

- Emergence of the Shadow Banking sector (i.e. unregulated transactions), reminiscent of the Sub-Prime issues in 2007 that led to the Global Financial Crisis in 2008

- Continued strong Official Sector purchases – not just because they are taking tonnage off the market but because of the signal that it sends to the markets because the Official Sector dislikes uncertainty

- Widespread investor interest, notably from High-Net-Worth individuals, Family offices and other professionals who are back in the market for the long haul.

Headwinds:

- Reduction in international political or trade tensions; Scott Bessant could well be instrumental here

- Any strong inflationary forces and / or associated expectation thereof could force a reversal in monetary policy

- Official sector going on the retreat (unlikely)

- Investors’ conclusion that risks have declined (likely to take a matter of years, compare GFC of 2008); it wasn’t until 2013 that professionals bailed out of gold (over 800t of ETF metal went straight into private hands in China).