Nov 2025

Nov 2025

Gold & Silver Outlook 2026: Court Ruling Impact

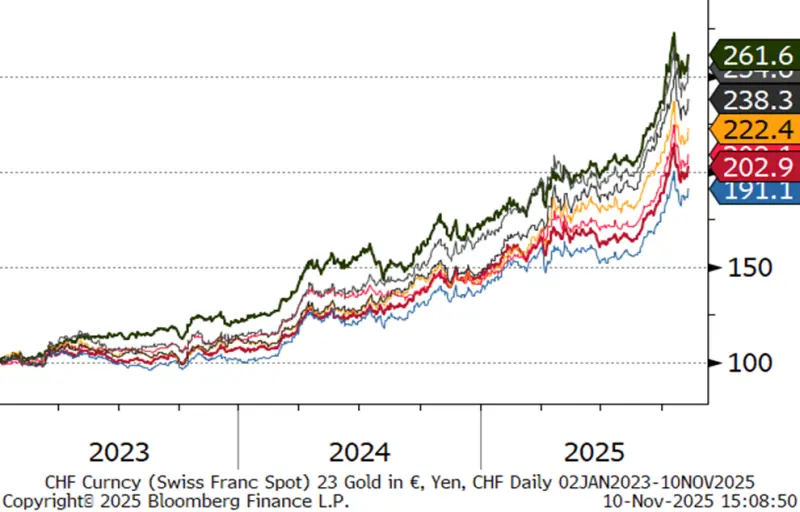

Gold slides by 11% before steadying

Silver easing as metal finds its way across the Atlantic; inventories back to to tariff day levels

- With the fundamental shifts in the gold and to a lesser extent silver post-Diwali, and with a lot of silver crossing the Atlantic of which more below professional market detention has turned once again to the geopolitical difficulties surrounding the markets, notably in the United States.

- Most recently has been the development over this weekend, with some Democrats breaking ranks with their party in order to come to an agreement on the deal to reinstate government activity. So far, this has only been approved in the Senate and still needs to get through the House, but it is quite interesting to note that some Democrat party members have gone public with strong criticism of those colleagues

- Elsewhere, last week saw the start of the Supreme Court hearing over the validity or otherwise of the imposition of tariffs under the International Emergency Economic Powers Act

- The testimony of the Treasury Secretary received close scrutiny, while in the eyes of the press the attitude of the judges on the Supreme Court was an equal if not more interesting focus of attention. The press has been making much of the fact that the Court breaks down 6-3 in favour of those judges with Republican leanings as opposed to Democrat, but - as should indeed be the case - the Importance of the law over politics, 's taking pride of place

- In this instance, of course, if the Court does rule against the use of this legislation to impose tariffs, there are other methods by which they could be reintroduced or sustained. So this is a question of the Separation of Powers

- This is clearly one of two strands that talk to the independence of the Judiciary, and by extension, when we come to the Lisa Cook hearings for which start in January, of the independence of The Fed

- While a robust stance from the judiciary could be expected to generate a fall in gold prices, but gold strengthened since the weekend and as we write it as testing $4,100, preferring to focus rather on the political infighting in Washington.

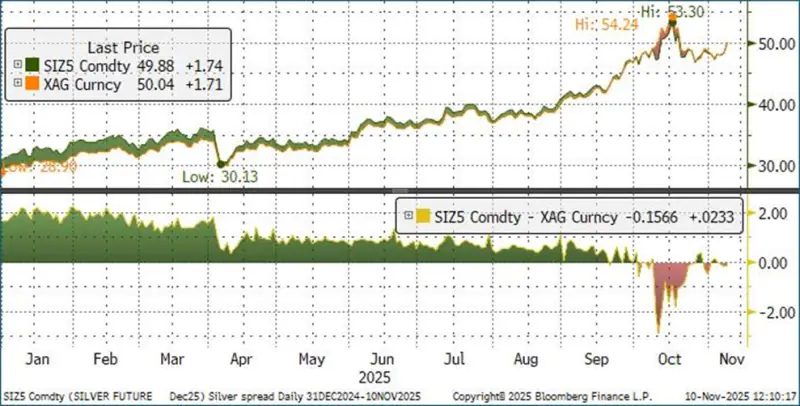

- Meanwhile the London silver market has found increased liquidity over the past couple of weeks, as metal has been pouring into London, but it still remains tight with spot and the active COMEX contract still in a backwardation, albeit a small one

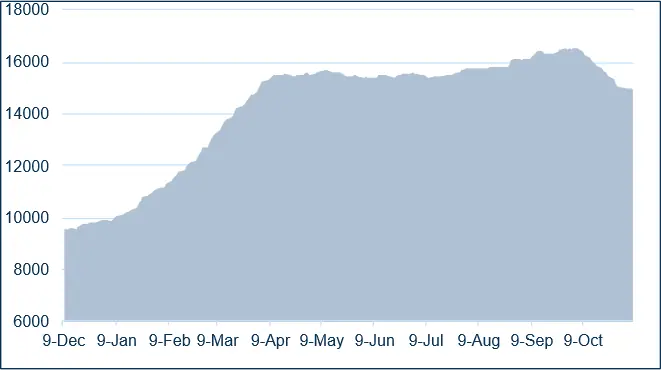

- Below is a brief summary in note form of the latest activity with respect to shipments out of COMEX and an important point to note here is that the increased tonnage into LBMA vaults during the month of October vastly outweighs the reported increase in ETF holdings during that month, although this should be read with caution because the Bloomberg numbers for gold substantially understate the actual position and it is possible that they may be missing something in silver also

- Either way a 270t increase in the ETFs against an increase of over 2000t into LBMA certainly suggests that the arbitrage has worked by pulling metal across the Pond, thus reflecting the efficiency of markets and price discovery

- Looking further ahead with the onset of the Indian wedding seasons , evident , which is always a strong tool for silver demand, it is perfectly possible that this market will remain tight for the time being

- Outlook: 2026 outlook revolves around the Supreme Court’s ruling over the Lisa Cook Case. If found in favour of the President this could be good for a fresh $500 on the gold price on the back of reduced Fed independence vs political influence. This would be a bullish factor in itself, but there could be further ramifications from a weaker dollar. If the Court finds in favour of Cook, then the reverse would be the case.

- For the much longer term, silver has a robust fundamental outlook but for now, it is taking a much-needed break with metal coming into London. The solar market remains oversupplied, but still has a constructive future, while AI and vehicle electrification will also help to keep the market in a pre-investment deficit.

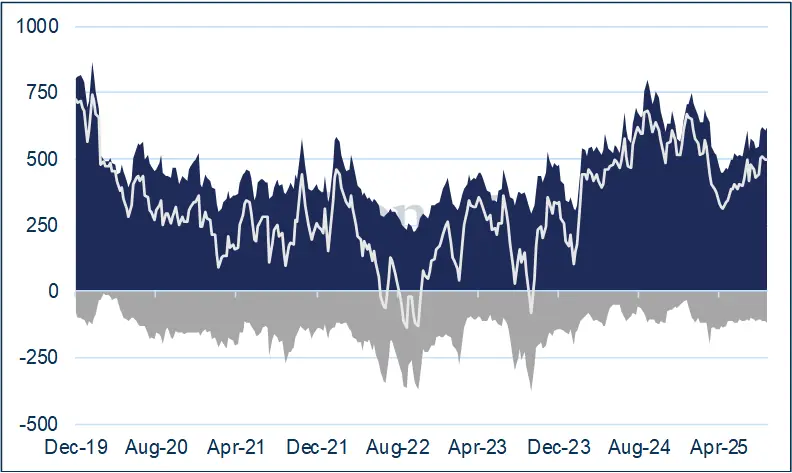

Gold, year-to-date; giving back gains but still underpinned.

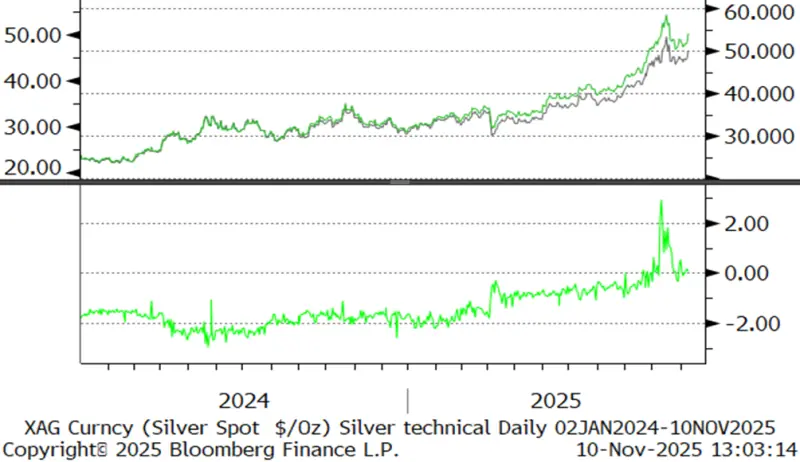

Silver; off the highs and consolidating. Taking a much-needed breather

Source: Bloomberg, StoneX

Silver’s recent physical shifts

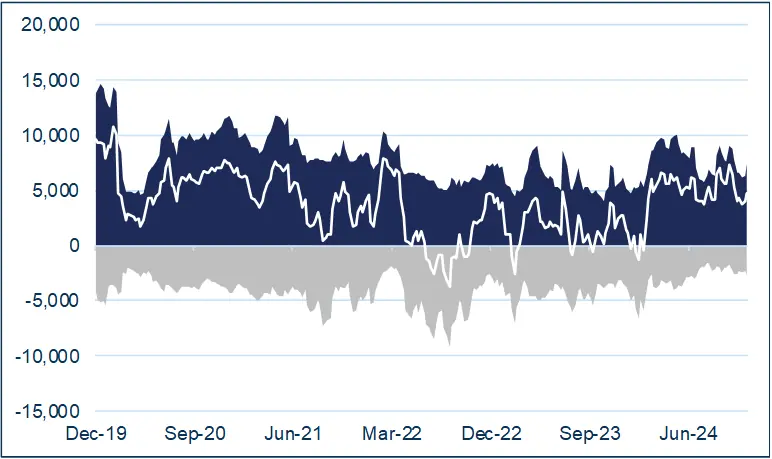

COMEX silver inventory movements

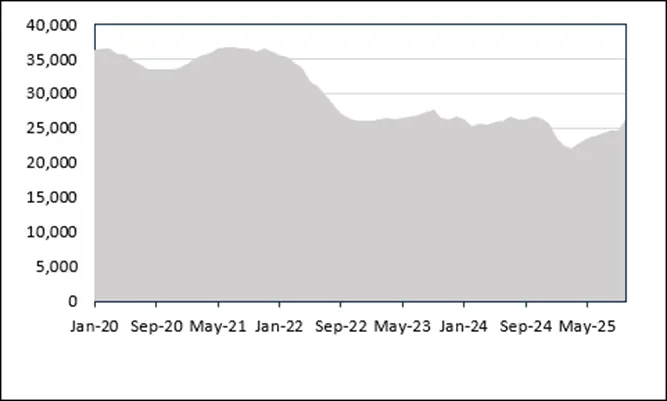

Opening level 29 Sept, 16,531t of which 5,954 were registered.

Closing level 7th October 14,933t for a drop of 1,599t or 9.7%.

Now at lowest level since 1st April (Tariff day was of course the 2nd).

Asahi down 520t, CNT 267t, Brinks 224t, JPM 173t, HSBC 152

LBMA vaults: have been rising since March (ETF activity), adding 2,519t between end-March and end-August.

Lost 65t in September then added 1,673t in October to 26,255t, highest since end-November, before the panic started.

If we assume that all the silver in London vaults is backing ETFs (unlikely but it won’t be far off) then the increase of just 270t in ETFs from end-August to end-October (BBG numbers, may well be incomplete – the gold numbers are way lower than they should be) is dwarfed by the overall LBMA increase so liquidity should be a lot better now (subject to India’s wedding seasons – but we are still in a small backwardation.

COMEX silver inventories, t

Source: LBMA, StoneX

Spot vs active contract

Source: Bloomberg

To recap: - Silver inventories on COMEX are divided into registered and eligible. “Eligible” inventories are inventories in a CME-approved warehouse, not necessarily delivered onto the Exchange itself; the owners of that metal may just be using the warehouse as a secured storage space. Eligible metals may belong to a range of different market participants. The CME does not have any direct control over these inventories.

When the holder of the metal delivers it onto the Exchange, then a warehouse receipt is issued and the inventories become “registered” and can then be used for delivery against futures contracts.

Since the 10th October combined registered and eligible silver inventories have declined by 1,525t.

The gold inventories have an additional sub-division, namely “pledged” warrants. These warrants are pledged to the Exchange as collateral, which gives CME a first priority security interest in the relevant warrants. When a clearing member initiates a pledge, the warrant status changes from “Registered” to “Pledged_PB_Pending”. When the transfer to CME is complete the status becomes “Pledged_PB”. The warrants remain registered with the Exchange. Currently 54% of COMEX inventories are registered.

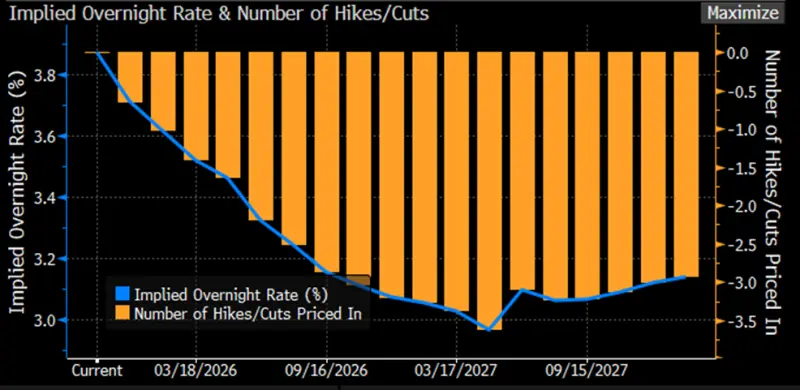

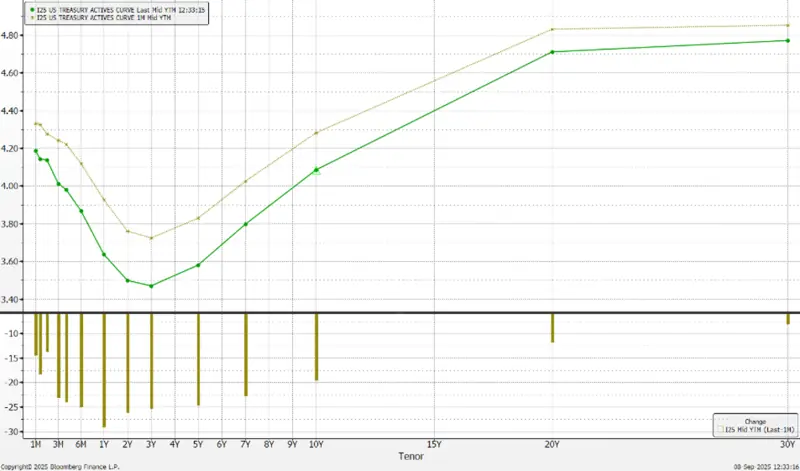

Meanwhile the US bond markets are still pricing in a 66% chance of one more 25-point cut this year. The next FOMC meeting is scheduled for 9-10 December.

Source: Bloomberg

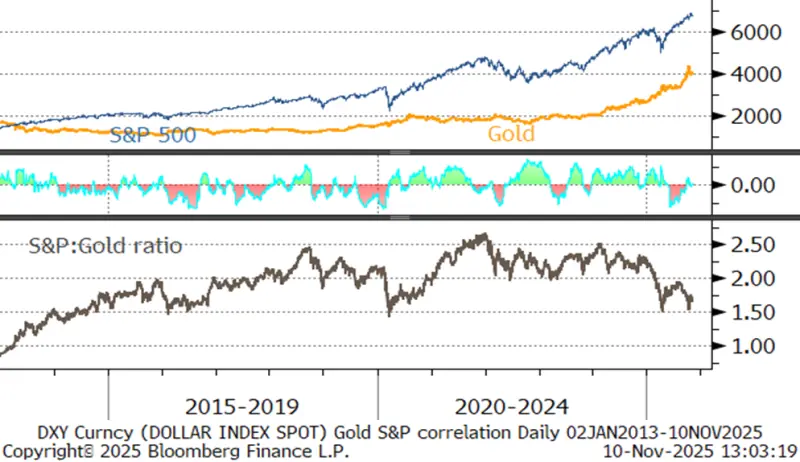

The S&P, gold and the dollar

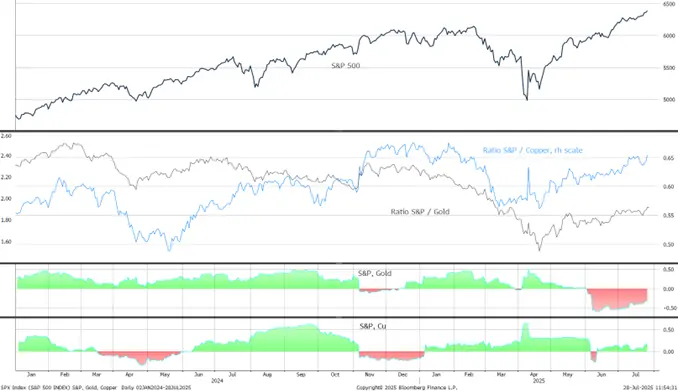

The S&P, gold and copper

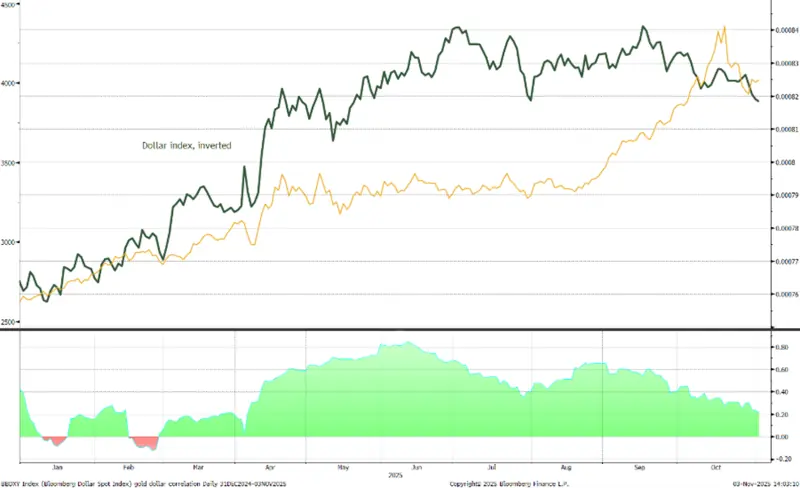

Gold:dollar correlation; easing again; now down to -0.21

Source: Bloomberg, StoneX

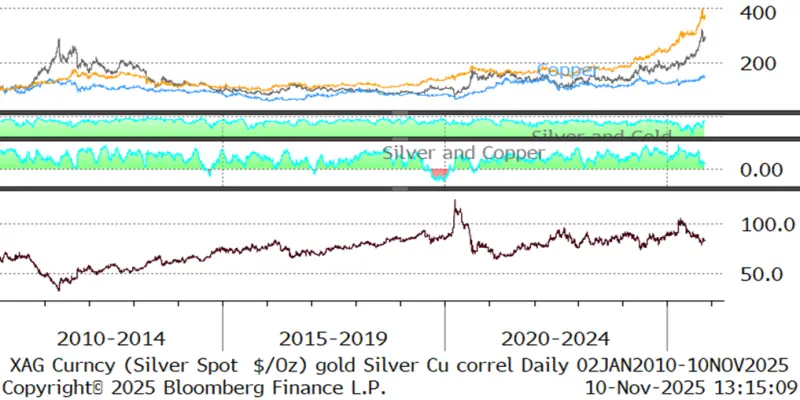

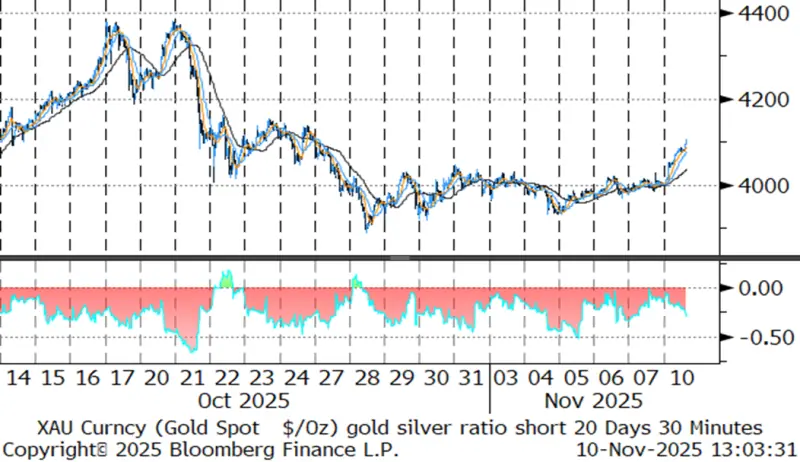

Gold, silver, copper correlations: silver and gold up sharply to 0.83; silver and copper, dropping hard to 0.16

US yield curve: overall levels continue to drift lower, while medium term curve steepens again on inflationary fears

Source: Bloomberg, StoneX

COMEX silver inventories, tonnes

Source CME via Bloomberg, StoneX

Silver ETFs have been on the back foot since late October; since 22nd October there have been only two days of net creations from 13 trading days, for a net fall of 702t to a recorded total of 25,286t 9world mine production is just under 25,500tpa.

Gold ETFs:

World Gold Council figures to last Friday 7th November showed a ytd gain of 677t to a total of 3,896t. In dollar terms this is a net inflow of $72.4Bn. Regionally, North America has taken in 392t (24%), Europe, 113t (9%) and Asia, 165t (76%). In the week to last Friday the moves were all small with North America a small seller while Europe and Asia added small amounts.

COMEX inventories are still easing after touching a recent peak of 1,249t on 6th October, to stand last at 1,174t, a fall of 76t since that peak.

Gold in key local currencies

Source: Bloomberg, StoneX

Gold:silver ratio, year to-date

Source: Bloomberg, StoneX

The CFTC numbers run only as far as 23rd September due to the shutdown

Gold COMEX positioning, Money Managers (t) –

COMEX Managed Money Silver Positioning (t)

Source for both charts: CFTC, StoneX

CFTC: - As of 23rd September, the net gold long position among COMEX Money Managers was broadly unchanged over the previous four weeks – in a range of 509t to 499t, which is the most recent figure. At 618t, the outright longs were only 17t higher than the 12-month average and so there is no real overhang there. At 119t, the outright shorts were 13% higher than their 12-month average of 105t.

The silver position is different, with outright longs of 8,235t just 3% higher than the 12-monthaverage, while the outright shorts (2,197t) are 8% below the 12-month average.

Hopefully we will be able to update these in the near future.