Oct 2025

Oct 2025

Heading for $4,000? Political tensions firmly in the forefront

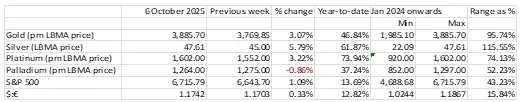

- Gold is now trading above $3,900 with new cohorts of investors looking for hedges against uncertainty and political difficulties

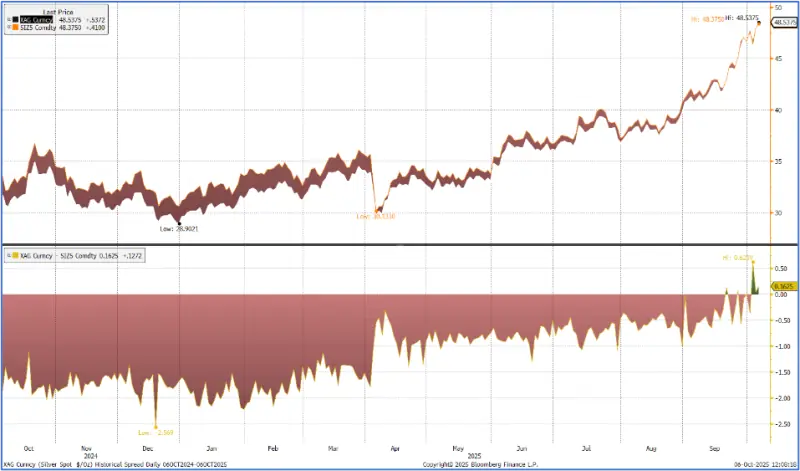

- Silver is outperforming, as is its wont when gold is moving with conviction; the gold:silver ratio is now down to 82, an eleven-month low

- The polarisation in Washington over the Appropriations Bill has resulted in government shutdown, with almost a million federal workers on furlough; lack of economic data is hampering the Treasury markets

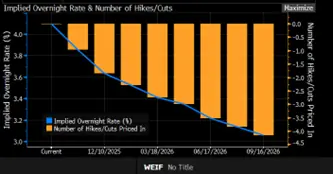

- Fed September Minutes are released this Wednesday; likely to show tension in the Committee

- Investors are looking beyond the shutdown and focusing rather on resilient growth and the belief that prevailing high multiples are justified

- Silver is still tight in London and the EFP blew right out again last week; registered inventories (see definition below) are only 36% of the total (see the chart of the spot-December spread, below)

- Global identifiable silver inventories stood at 38,432t at the start of the year, according to Metals Focus. On the basis of our estimate for the 2025 market balance they should now be roughly 35,000t, of which almost half is on COMEX

- Silver Eagle sales (including sales to distributors) in the year to end-August amounted to 274t, half the level of the first eight months of 2024. Coin resale has been lively with some coins trading at a discount to spot and thus finding their way back to refineries, so this number is almost certainly over-stated. September figures are not yet available

- World Gold Council numbers show that gold ETFs added 112t in September; to a total of 3,807t. Bloomberg numbers (less comprehensive than WGC) suggest a further addition of 20t thereafter

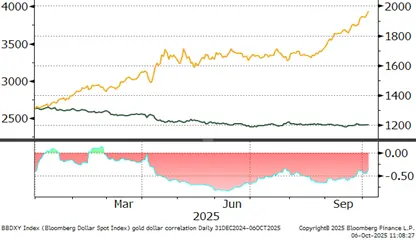

- The dollar is stabilising while the yield curve is still steepening, but more gradually

- The Supreme Court is fast-tracking its hearing over whether the tariffs imposed under the International Emergency Economic Powers Act are legal. The hearing is set down for the first week in November

- The Lisa Cook process: the Supreme Court has now set down January for hearing argument

- Outlook: For the much longer term, silver has a robust fundamental outlook but for now, it is still overbought above $47 and needs to correct and consolidate. That said, the metal is being carried higher on its own momentum. Gold is still set fair for further gains, but here, too, conditions need to calm down a little. The solar market remains oversupplied but still has a constructive future, while AI and vehicle electrification will also help to keep the market in a pre-investment deficit. Gold is still pricing in concerns over Fed independence and the possibility of stagflation as well as underlying geopolitical risk and international tensions.

With no jobs data released last week due to the shutdown the markets are working blind, to an extent. The lastest assessment of Treasury perfomrance gives a 90% chance of a 25-point cut at the 29th October meeting

Source: Bloomberg

Note also that silver and the PGM are on the zero-tariff list.

Silver still tight in London- and has been since the markets started worrying about tariffs

Source: Bloomberg

Silver inventories on COMEX are divided into registered and eligible. “Eligible” inventories are inventories in a CME-approved warehouse, not necessarily delivered onto the Exchange itself; the owners of that metal may just be using the warehouse as a secured storage space. Eligible metals may belong to a range of different market participants. The CME does not have any direct control over these inventories.

When the holder of the metal delivers it onto the Exchange, then a warehouse receipt is issued and the inventories become “registered” and can then be used for delivery against futures contracts.

The gold inventories have an additional sub-division, namely “pledged” warrants. These warrants are pledged to the Exchange as collateral, which gives CME a first priority security interest in the relevant warrants. When a clearing member initiates a pledge, the warrant status changes from “Registered” to “Pledged_PB_Pending”. When the transfer to CME is complete the status becomes “Pledged_PB”. The warrants remain registered with the Exchange. Currently 54% of COMEX inventories are registered.

The S&P, gold and the dollar

The S&P, gold and copper

Gold, one-year view; new records in real and nominal terms

Gold:dollar correlation; easing again; now at-0.54

Source: Bloomberg, StoneX

Silver, one-year view; still overbought

Source: Bloomberg, StoneX

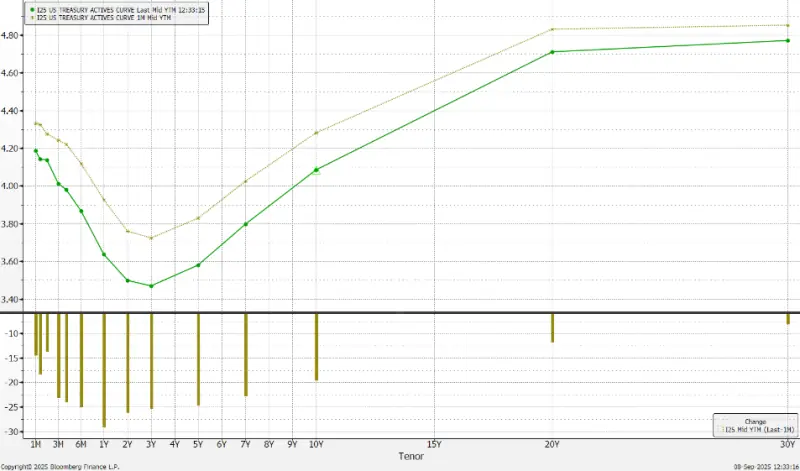

US yield curve: still steepening as the short end prices in rate cuts while the longer tenors are rising on fears of a longer-term inflationary impact; overall levels are lower, however

Source: Bloomberg, StoneX

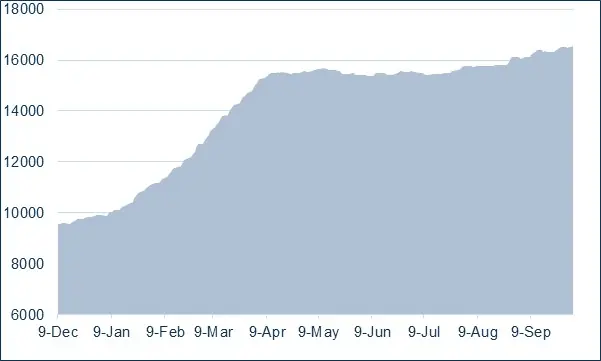

COMEX and ETF silver inventories, tonnes

Source CME via Bloomberg, StoneX

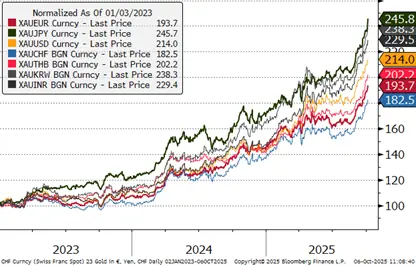

Gold in key local currencies.

Source: Bloomberg, StoneX

Gold:silver ratio, year to-date

Source: Bloomberg, StoneX

The CFTC numbers run only as far as 23rd September due to the shutdown

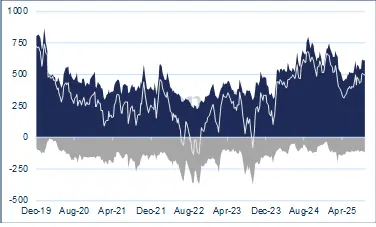

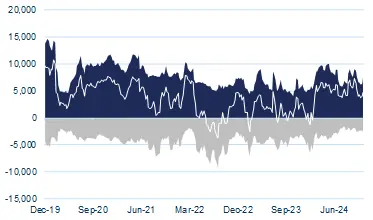

Gold COMEX positioning, Money Managers (t) –

COMEX Managed Money Silver Positioning (t)

Source for both charts: CFTC, StoneX

CFTC: - As of 23rd September, the net gold long position among COMEX Money Managers was broadly unchanged over the previous four weeks – in a range of 509t to 499t, which is the most recent figure. At 618t, the outright longs were only 17t higher than the 12-month average and so there is no real overhang there. At 119t, the outright shorts were 13% higher than their 12-month average of 105t.

The silver position is different, with outright longs of 8,235t just 3% higher than the 12-monthaverage, while the outright shorts (2,197t) are 8% below the 12-month average.

ETF – more still gaining last week; year-to-date net gain now exceeds 1,000t. Some profit taking in evidence

Gold: the latest figures from the World Gold Council, up to Friday 26th September, show yet another gain, this time of 27.2t in the week. Again, the majority of the increase was in North America, with a 17.4t, a 5.0t gain in Europe and one of 4.6t in Asia. Year-to-date, the regional changes were as follows: North America, 332.5t; Europe, 142.6t; Asia, 106.1t; that is 20%, 11% and 49% respectively.

Silver: Some selling coming in on the approach to $50. The Bloomberg figures suggest that the net ETF creations in the first nine months of the year were 3,350t, of which 2,021t were in the June-August period. In September some selling started appearing but the net gain over the month was still 557t. There has been further liquidation in the first days of October for a net loss of just 61t for a year-to-date gain of 3,289t to 25,565t. World mine production is just less than 26,000t.