Jun 2025

Jun 2025

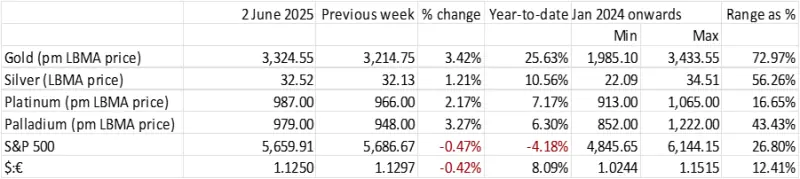

Gold Nears Breakout Amid Consolidation Triangle

Markets moving into risk-off, with equities under pressure

- More tariff turmoil supports gold but with a lesser impact than previously

- Gold contained in a narrow range, continues to consolidate –

- - but is close to completing a tringle formation, which implies a reasonably imminent breakout

- Politics will determine in which direction

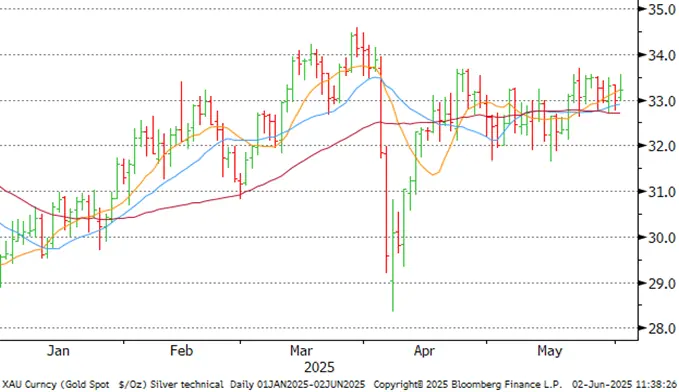

- Silver has shown fresh signs of life, but still in a sideways channel

- The dollar is under pressure; gold higher but sluggish

- Sino-US relations sour once more

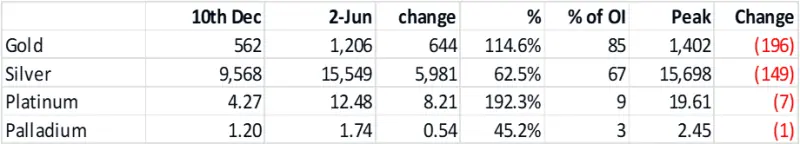

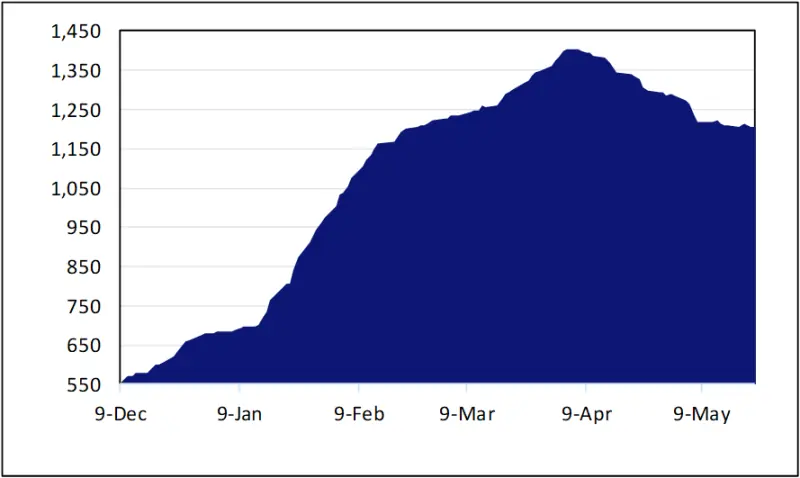

- Gold inventories on COMEX peaked at 1,402t on April 4th. They too are stabilising at 1,206t; silver still coming off.

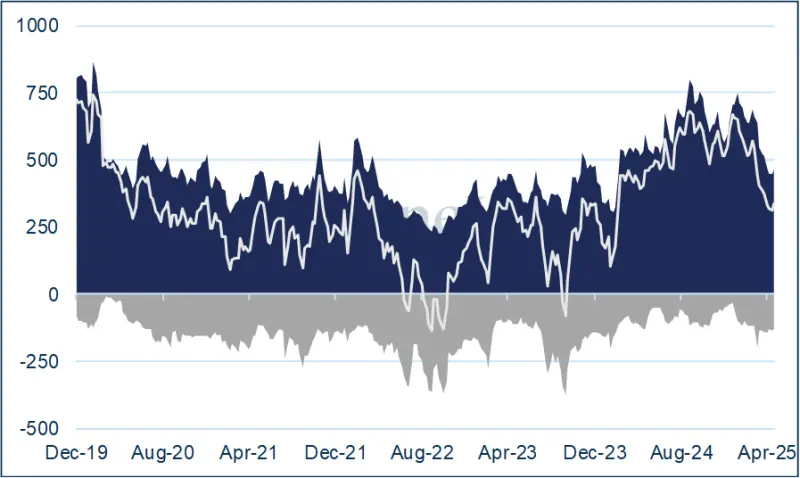

- Gold COMEX open interest has dropped sharply over the past week

- Price action suggests a reduction in positioning on both sides

- The bond markets continue to discount two rate cuts this year, although Fed rhetoric remains hawkish amid “wait-and-see” stance

- Euro looking relatively robust even ahead of a likely ECB rate cut this week

- ETFs some buying interest below $3,300

- Silver ETFs continue to see lively buying

- Shorter term outlook is unchanged: gold is still consolidating but the tone is hinting at fresh gains, and Asia was bullish at the start of the week following the Chinese Dragon Boat Festival.

- The gold:silver ratio, still just over 100, should start to decline as and when the economic clouds start to clear, but this may not be much before year-end

Gold, one-year view; break-out in the offing?

Source: Bloomberg, StoneX

Comment: -

Last week saw President Trump announce that as of 4th June he would double the Section 232 (steel, aluminium) tariffs from 25% to 50% (Canada is arguing that this could be catastrophic for the domestic aluminium industry), while the temperature is rising again between the US and China. On 12th May in Geneva the two countries agreed to a pause that would see tariffs reduced while negotiations continued. The tone has soured, though with Mr Trump saying last week that China has veered away from the agreement, but did not say in which respect – although the US Trade representative Jamieson Greer has said that the critical minerals exports have not resumed in the way that the States had been expecting. The Financial Times is reporting that China did “hasten the issuance of licences” for some US-bound rare earth shipments and there are suggestions that the delays may have been bureaucratic rather than deliberate. The Chinese Commerce Ministry has said that it will safeguard its legitimate rights by taking “strong and resolute measures”.

There are conciliatory noises coming through, though, with Scott Bessent saying that he believes that the next phone call between the President and Mr. Xi should be able to work through the issues – although there is no news of any such call being scheduled as yet.

Meanwhile the more widespread uncertainty persists following a US Appeals Court ruling last week that the US-imposed global tariffs are illegal. Independent analysts are suggesting that this will delay tariffs but not prevent them, while the president of Goldman Sachs has said that he envisages a 10% baseline tariff with some higher exceptions.

All of this remains supportive for gold (although the impact is lessening over time) and continues to throw a shadow over silver. The ratio has nudged above 100 once more, standing most recently at 100.7.

On the other side of the world, coin offtake is still very sluggish with the US Mint reporting just 5,000 ounces of gold Eagles sold in April and only 500 ounces thus far in May, against 20,000 in March and 10,000 in February; this is well down on previous years’ volumes.

COMEX gold inventories, tonnes

Source CME via Bloomberg, StoneX,

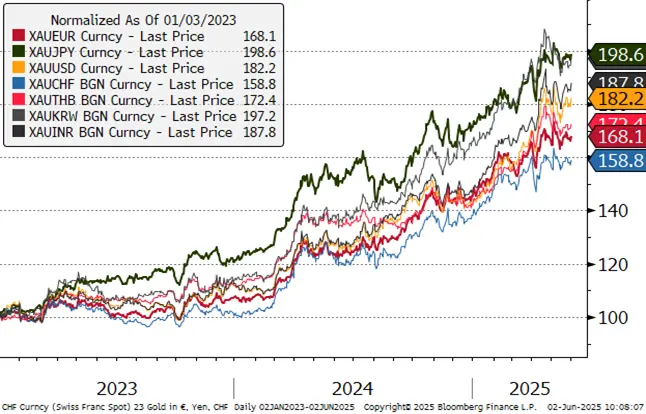

Gold in key local currencies.

Source: Bloomberg, StoneX

Silver, year to date; technical picture supportive

Source: Bloomberg, StoneX

Gold:silver ratio, January 2024 to-date; steadying

Source: Bloomberg, StoneX

In the background the economic numbers from the States last week were solid with the core PCE down a fraction to 3.4% but a small increase in continuing unemployment claims; the market is still looking for two rate cuts this year, but the Fed is standing firm in the fact of tariff-driven uncertainties. The University of Michigan Survey revealed a moderation in one-year inflation expectations, to 6.6% and 4.2% for the five-year horizon. Economic confidence figures in Europe were marginally improved month on month, but still fragile, at 94.8 for Economic Confidence and minus 10.3 for industrial confidence. Industrial profits in China were up 3.0% year-on-year, which is encouraging.

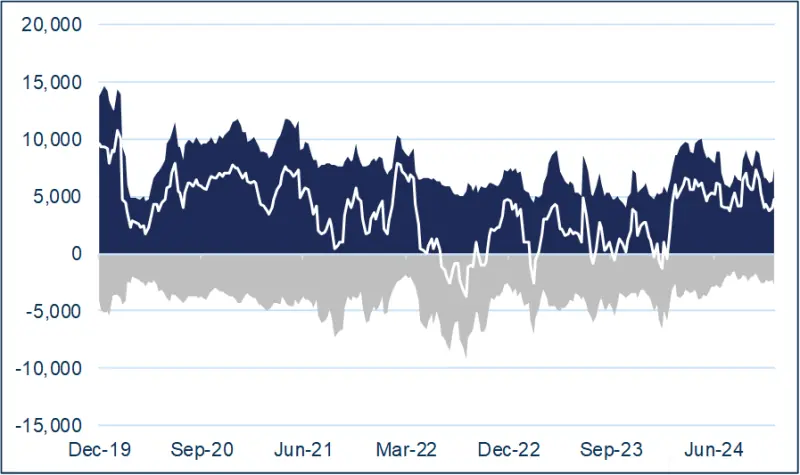

CFTC: the week to 27th May, in which gold prices initially rallied from $3,205 (coinciding with support from the 200D moving average towards $3,370 and then eased to close at $3,305, was accompanied by a very small (5.1t) loss in longs (profit taking) and 15t (11.6%) of short covering. Silver, meanwhile, rallied from $32.1 to $33.7 in two days then consolidated to close at $33.3. Longs and shorts both expanded again, with the emphasis on the longs, which increased by 6.5% to 7,820t; shorts nudged higher by 1.2% to 2,400.

Gold COMEX positioning, Money Managers (t) –

COMEX Managed Money Silver Positioning (t)

Source for both charts: CFTC, StoneX

ETFs: some buying interest returning to gold, but cautiously; silver still mixed, but with the bias towards the buy-side.

Source: Bloomberg, StoneX