Apr 2024

Apr 2024

Weekly roundup for StoneX Bullion

By Rhona O'Connell, Head of Market Analysis

- Profit taking following a roller-coaster week

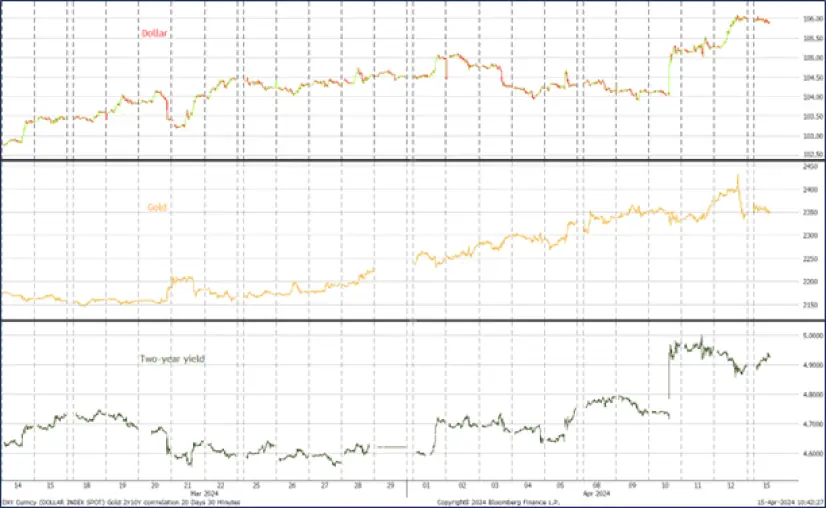

- The dollar, yields and gold all higher in classic risk-aversion moves

- Gold made successive record highs and now needs to settle down amid a new paradigm

- The Iranian airstrike has not moved the markets, for several reasons

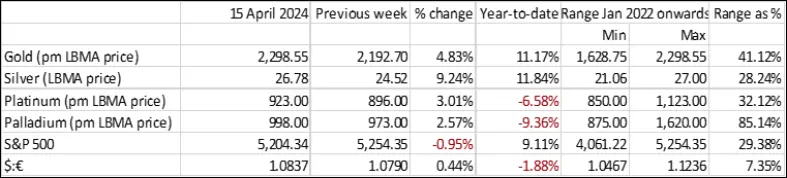

- Since the start of the bull run gold is up 15% and silver, 25%

Outlook; gold demand at the retail level in the physical market is still non-existent with some coins trading at a discount to spot. There has been some much-needed consolidation under profit taking but this market is all about risk mitigation and silver is along for the ride amid commodity-wide strength

The dollar, two-year yield and gold

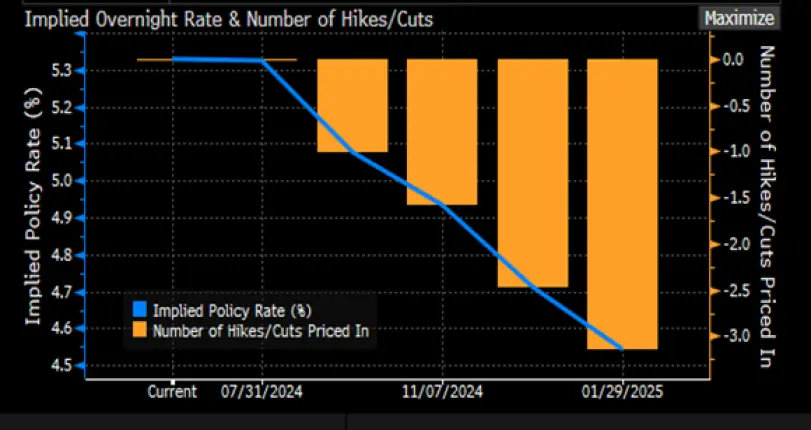

Gold posted successive records last week, peaking at $2,431 on Friday during a day in which it traded a range of almost $100. As one dealer put it on Friday “no trader wants to go home short”. We did, however, see a lot of profit taking in the United States, which is entirely understandable at the end of a very busy week in all regions; with dropping to $2,334 on Friday before closing at $2,344. The escalating tension in the Middle East is a clear driver, but the developments over the weekend, with the Iranian air strike on Israel, had only a limited effect on the precious metals markets. This is in part because the metals were already well overbought, partly because geopolitics have been driving the move anyway, and partly because the intense diplomatic manoeuvring is giving rise to hope that the situation can be contained.

Gold, silver and the ratio, January 2022=100

Source: Bloomberg, StoneX

We start this week with gold edging gradually lower in London after a fresh rally in the Far East, which almost certainly was related to the week-end developments. The Shanghai market has been trading at a premium of over $47, but this is more closely related to restricted import licences rather than physical demand, which has slowed almost to a stop. The local premium plus fabrication charges mean that jewellery is unrealistically priced at the moment compared to the international spot market. Silver challenged $30 on Friday, but failed to clear it and came off in line with gold to close the week at $27.9 and is hovering around $28 at the start of this week.

Silver technical; also correcting and now sitting on support from the ten-day moving average at $27.6

Source: Bloomberg, StoneX

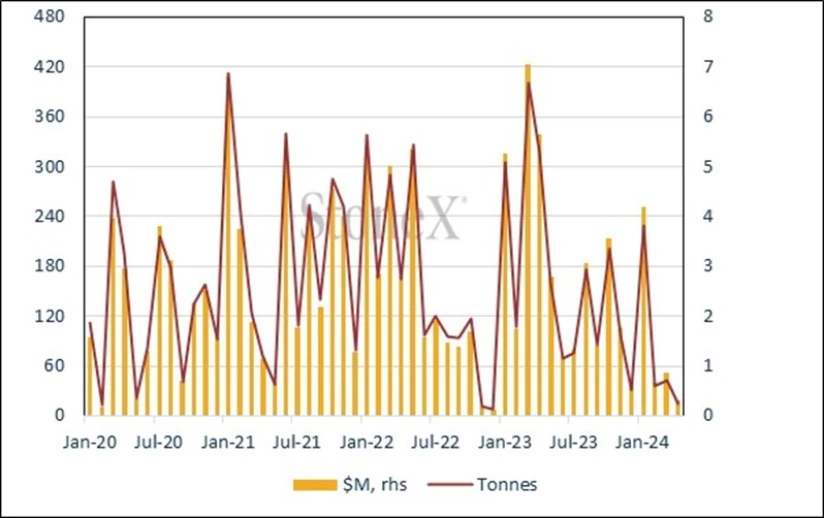

Meanwhile the latest figures from the United States Mint show how coin sales were relatively steady in March, but the daily average rate for the first half of April was below 60% that of March in tonnage terms and roughly 70% in dollar value of the contained gold.

US Mint gold coin sales, tonnage and notional contained value

Source: US Mint, StoneX

Silver’s move is still slightly smaller than the traditional beta with gold of between 2.0 and 2.5 although the ratio has now come down to 82.8, the lowest since early December, and close to the average of 84.3 for the period between the start of 2023 and the end of last week. Silver is also taking support from copper, which has been in a bull market since early February but has been particularly strong in the first half of April, and is trading at just over $9,570/t basis three months. This is the highest since early Novemnber 2022, on renewed optimism over the resilience of the economy in the United States and coupled with comapratiely constrained supply at present plus the long term outlook for demand. These are currently more influential than the problems in the Chinese property market.

In the background the gold and silver exchange traded funds have both encountered redemptions in the past week, which is likely to be profit taking as the volumes of gold sales have been higher than usual, amounting to roughly 14t so far this month; silver redemptions have also been quite chunky, but the net change so far in April is still positive, at 213t. Year to date, gold has lost 127t while silver has added 577t.

Gold, silver and copper; silver correlation with gold, 0.69; with copper, 0.52

Source: Bloomberg, StoneX

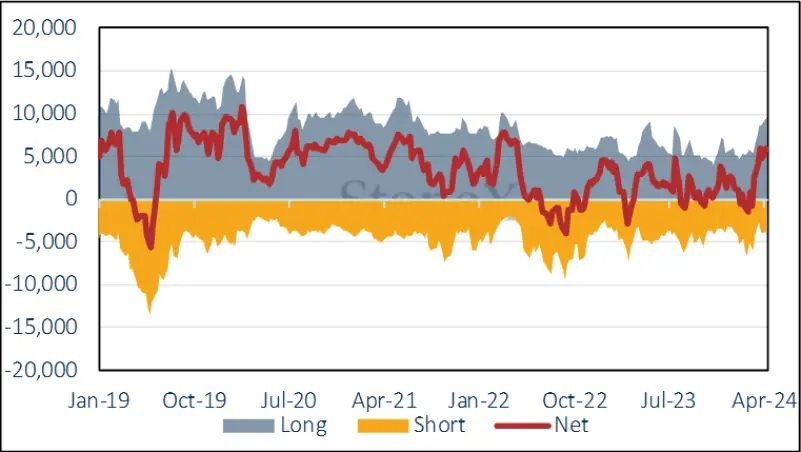

The Commitments of Traders report for 9th April shows an easing in the appetite for gold on the back of the jump in prices (gold closed last Tuesday at $2,353, a gain of $125 or 6% over the week); longs added just five tonnes (0.9%) while shorts expanded byt 21t or 26.5%. This took the outright long to 543t but it is likely that this will have come down a fair amount during the selling on Friday. This takes the net long to 247t. Silver was more bullish, in that longs increased by 3.0% or 280t to 9,582t while shorts contracted by 6.5% or 255t to 3,693t, while the price gained 7.5% from $26.19 to $28.15. Silver thus still carries a heavy speculative overhang with the outright longs at 3,389t over the twelve-month average.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

Source: Bloomberg, StoneX