Apr 2024

Apr 2024

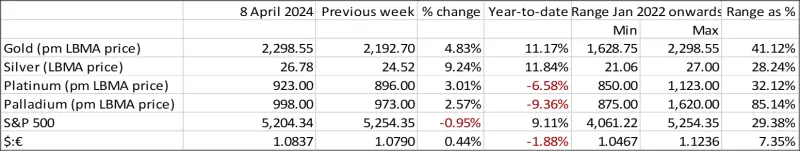

Weekly roundup for StoneX Bullion

By Rhona O'Connell, Head of Market Analysis

- Strong US numbers last week did not deter gold’s bullish mood

- Although inside the detail the numbers are not as aggressive as they might seem, with manufacturing employment flat and machinery manufacturing employment falling

- Jay Powell soothed the markets while Fed officials still vary over the rate outlook

- Silver open interest on COMEX at its highest since June 2014 and the price at its highest since November 2020.

- Since 29th February gold has gained 16% and silver, 26%

Outlook; gold is still in need of consolidation and silver is still overbought. Gold demand at the retail level in the physical market has largely evaporated with some coins trading at a discount to spot, although there has been an upsurge in interest in gold ETFs in China. Professional momentum is still positive

Gold, silver and the ratio

Source: Bloomberg, StoneX

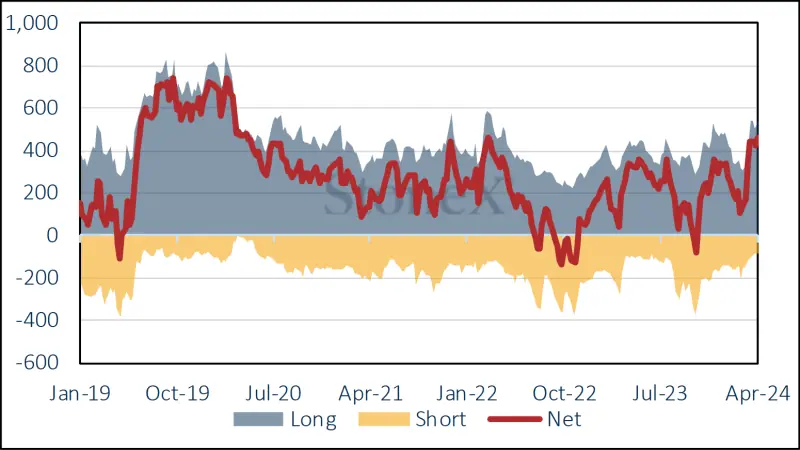

Gold started its latest bull run on the back of weaker US economic numbers on 29th February and has developed independent momentum of its own. As we write, spot is trading at $2,335, thus posting a 16% gain over the period. From the 8th to the 20th March prices essentially moved sideways as some speculative froth was blown off and overbought conditions were to some extent unwound, but on the 20th Jay Powell’s comments that the Fed would start easing “at some point this year”, while not especially new, were enough to nudge gold over $2,200. This new record, and the psychological importance of crossing another $100 level, stirred up yet more emotion and it is widely accepted that there are now players in the market. This should ring something of an alarm bell, because once the price starts to lose momentum, we should expect to see profit taking and some stale bull liquidation. This may well be on the horizon now, as open interest has contracted slightly on COMEX over the past week or so, although there was some short covering on COMEX in the week to 2nd April.

Silver technical; 10-day moving average now offering support at $26.0, while the 50D has now crossed the 200D to the upside in a Golden Cross

Source: Bloomberg, StoneX

The change of attitude in the market can be summed up by the fact that when the nonfarm payroll numbers came in way higher than expectation last Friday, gold barely took any notice, whereas in recent months this would have been a sell signal. In fact, when the earthquake hit the East Coast of the States later in the day gold shot up another $20 in a short space of time. Gold has since remained resilient while Treasury yields have been rising in response to the continued robust performance from the US economy, with the 10-year bonds getting towards 4.5%, which also is a key psychological level.

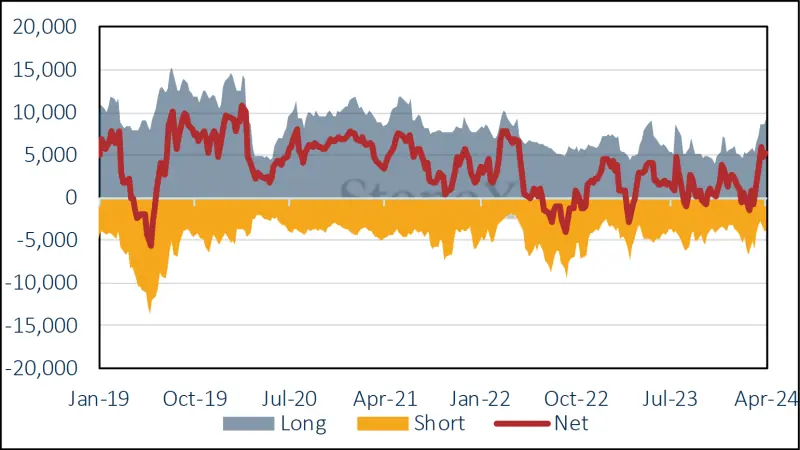

Silver, meanwhile, has posted a hefty gain of 25.9% since end-February and is benefiting not just from professional investment, but there are reports that industrial interest is also picking up. Erven so this is a very strong move and silver is way overbought. This is the highest level since June 2021 and while silver took its time to follow gold’s move, it has also been getting support from copper, which has been in a positive mode of late. Open interest on COMEX has expanded substantially and is standing at its highest level since March 2014. Commitments of Traders show that on 2ndApril, when silver had risen 17% to close at $26.08, there was another big increase in longs, adding 642t or 7.4%, and a small increase in outright shorts, of 2.6% or 101t. The outright long, at 9,302t, is the largest since late March 2022 and is 52% higher than the twelve-month average.

So there is a possibility of sizeable liquidation once the tide turns. Silver is renowned for its ability to drop hard and fast and should be viewed with caution.

All eyes now turn to the US CPI number, which is due for release this Wednesday and is called at 0.3% month-on-month, after 0.4% in March. Year-on-year it is forecast at 3.4% headline and 3.7% core. The following day sees the PPI, which is called at 0.3% month-on-month for final demand and 2.2% year-on-year, and 2.3% Y/Y for the core number.

The markets are now pricing in just two rate cuts this year, although the Committee is by no means unanimous. The President of the Federal Reserve Bank of Dallas said last Friday that the strength of the US economy in the face of higher interest rates makes it premature to consider cutting yet and that uncertainty levels are still too high; Michelle Bowman, one of the Fed Governors, chined in that it is still too soon to look at reducing rates, and that she continues to see upside risks to inflation; Atlanta’s Raphael Bostic is still arguing for just one cut this year. Bowman also said that it is ”quite possible” that the appropriate fed funds rate to underpin low and stable inflation may be higher than the pre-pandemic rates. That is not that dramatic a statement, given that fed funds in late 2019 were 1.50-1.75%. That said, in early 2019 they were above 2.0% but below 3%, which still gives the Fed plenty of scope for rate reductions in future months.

March dot plot; ’24 median 4.6%; ’25, 3.9%

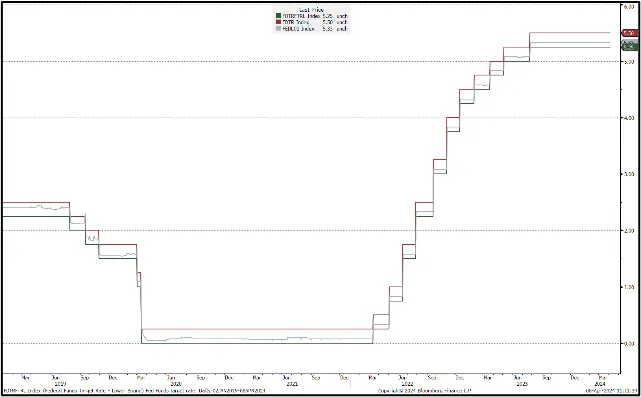

Fed funds target bands

Source: Federal Reserve Board

Gold, silver and copper; silver correlation with gold, 0-.67; with copper, 0.51

Source: Bloomberg, StoneX

Amongst the Exchange Traded Products, the latest figures from the World Gold Council (to 22nd March) showed a drop of 111t year-to-date to 3,115t. The largest drop, in both tonnage terms, is of 61t in North America a fall of 3.7%, while European Products were down by more in percentage terms with a 3.9% fall of 54t. shed 3.3% or 46.1t. Asia has posted small gains of 3.9% or 5t. Subsequent figures from Bloomberg, which are not as comprehensive as those from the Council, nonetheless identify trends, suggest that since 22nd March the gold ETPs were mixed, but posted small losses overall to a total of 3,106t.3,134t, which would be a net drop of 95t.

Gold (inverted) and the two-year and ten-year yields, January 2023 to date

Source: Bloomberg, StoneX

Silver ETPs have continued to see fresh buying, with the first week of April adding 510t to a total of 22,643t, a year-to-date gain of a year-to-date gain of 874t after months on the back foot. World mine production is approximately 26,500t.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

Source: Bloomberg, StoneX