Oct 2023

Oct 2023

Weekly Precious Metal Roundup

By Rhona O'Connell

Welcome to our newly re-branded entity,”StoneX Bullion”, which replaced the previous “CoinInvest” brand and went live in July. This ties in with our very successful US franchise and thus gives a seamless global product brand within the precious metals markets.

Gold is overbought above $1,900 and due a correction, but the change in range is sustainable

Our headline a fortnight ago was “Recovery on the cards, but it will be hard work”. Albeit for unhappy reasons, the turnaround was much less hard work than we expected. The boiling up of tension in the Middle East has been the clear driver here as markets have gone firmly into “risk-off” mode, giving gold (and, by association, silver) a boost.

The immediate outlook on Gold;

- gold overbought at $2,000 and needs to correct, but the medium-term range should remain unchanged with support at $1,900

- while the upside is probably favoured in the medium-term

- political tension affects gold directly and indirectly in these circumstances as a potential knock-on from its impact on monetary policy

- silver’s comparative underperformance underlines the political and economic risks adhering to the flare-up

Gold and the2-year and 10-year US Bond Rates

Source: Bloomberg, StoneX

As tensions flared initially, US Treasuries also saw some initial interest as a safe haven, but the bond markets still appear to be more concerned with central bank policy and while policy rates may not rise much further, if at all, in the current environment, quantitative tightening is still with us and this is helping to keep rates supported, with the result that gold and US rates are all rising.

Central Banks gold-supportive by default

Now it is axiomatic that the major central banks will have their eyes firmly on geopolitical tensions, both due to elevated risk and its potential impact on economic activity; there is therefore a “second-order” impact of the geopolitical developments on monetary policy. In this instance, while it is unlikely to mean rate cuts as that would be way too soon and risk undoing the work that has been done thus far, it certainly does suggest that major central banks will be even more cautious than usual. So this is another element that supports gold, based on geopolitical risk but via a circuitous route.

Gold and the VIX index; see how the correlation has been positive since mid-October

Source: Bloomberg, StoneX

Where there has been a sea-change, though, is that now the markets (not just the bond markets) do appear to have adjusted to “higher-for-longer”, and this has, to some degree, opened the path for gold to renew its role as a safe haven. As we write, gold has tested the psychologically important $2,000 and has been found wanting, but this is not a surprise given the speed of its rise since early October. From the $1,811 low on 6th October, the day that the market turned up, gold gained 10.3% to the high of $1,997 on 20th October before starting a mid-correction at the start of this week. If we go back to the $2,063 high of 4th May, this recent run-up almost completed a Fibonacci 76.4% retracement.

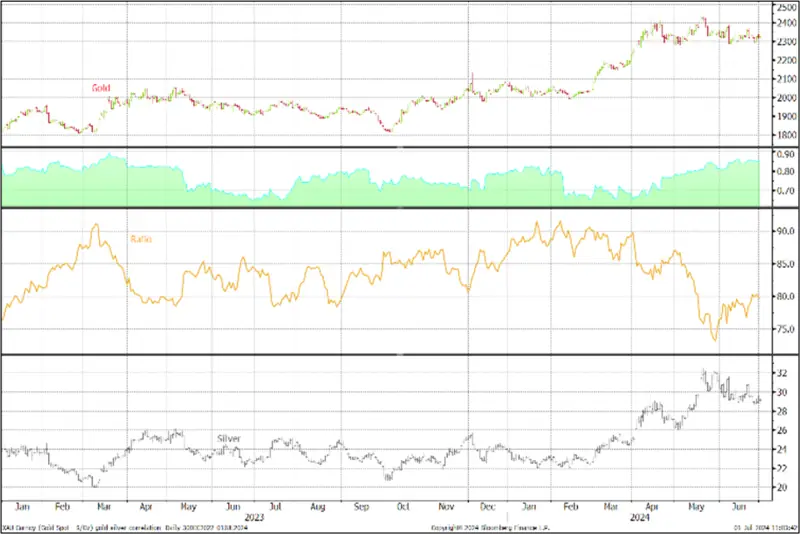

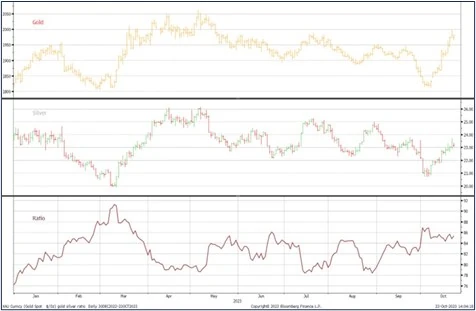

Gold, silver and the ratio

Source: Bloomberg, StoneX

Silver, meanwhile, managed only a 50% retracement in its own rally when compared with the 6th May high of $16.14, running up recently to $23.70 last Friday, 10th October. The recent rally itself, from $20.69, was of 14.5%, a much lower beta than usual. Usually, when moves are fundamentally driven, a 10% move in gold would be expected to generate at least a 20% move in silver. It did not reflect the highly political element in this recent move.

Futures positioning

On COMEX, both metals have seen fresh longs and reduced shorts among the Money Managers; over the past week, gold longs expanded by 34t or 12% while silver shorts contracted by 97t or 2%. The net positions swung from a short of 83t to a net long of 47t. The outright longs in this sector, at 326t, are 9% lower than the twelve-month average.

Silver longs added 182t (4%) while shorts contracted by 1,146t or 21%, so the net position swung from a short of 795t to a long of 535t. The outright longs, at 4,988t, are 20% below the twelve-month average.

So, neither of these can be described as having, on COMEX at least, a speculative overhang.

Exchange Traded Products

In the ETP sector, gold has remained friendless despite the political turmoil, with only three days of net creations since the first attack; in fact, the story that the daily numbers tell is of selling into strength with some of the highest net redemption days coming when the price was running hard. Since the start of October the gold ETPs have lost a net 51t for a dollar outflow of $3.1Bn. Year to date the net fall is 251t or $14.4Bn.

Silver is similar, with only two days of net creations over the same period. The net change since the start of October is a drop of 42t as there had been some buying at the start of the month. The drop since the first reported attack was 325t or just 1% of the underlying, to 22,168t (world mine production is ~26,500tpa.

Conclusion

Both metals should now consolidate and unwind overbought positions; the relative moves between the two metals highlight the geopolitical and attendant economic risk of the current circumstances. For now, though, conditions need to settle down.