Oct 2023

Oct 2023

StoneX Bullion round-up Monday 30th October 2023

By Rhona O'Connell

Conditions are tempting for gold, and especially for by-product silver producers, to lock in forward prices

Last week this was our immediate outlook;

- “Gold overbought at $2,000 and needs to correct, but the medium-term range should remain unchanged with support at $1,900

- while the upside is probably favoured in the medium-term

- political tension affects gold directly and indirectly in these circumstances as a potential knock-on from its impact on monetary policy

- silver’s comparative underperformance underlines the political and economic risks adhering to the flare-up”

This week the view is more or less unchanged, with the additional comment that some producer selling has been seen and silver would be very tempting also at these levels.

In summary,

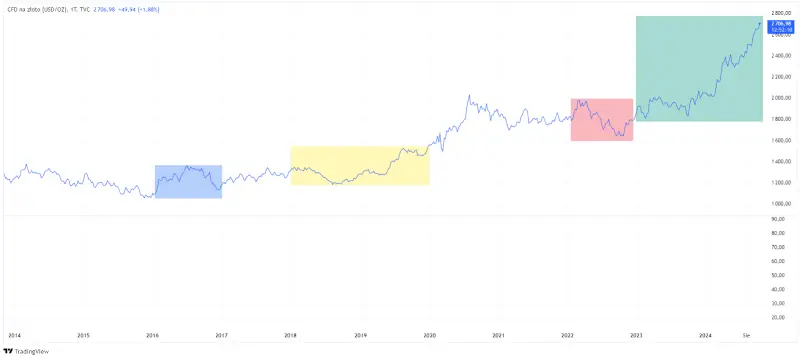

Gold in key currencies

Source: Bloomberg, StoneX

We still think it's consolidating and building a base for further gains, subject to geopolitics. The hue and cry a couple of weeks ago when gold bounced up as of 7th October was in my view a bit overdone - all it was doing was moving back into its comfort zone of $1,950-1,990 after a bout of weakness. A change of “big figure” is always of psychological interest so the challenge of $2,000 was bound to attract attention, but it is of no technical significance. From a technical standpoint, gold is overbought in US dollar terms on the RSI (Relative Strength index) and getting that way on the Bollinger basis. Definitely overbought in Swiss franc, yen and euro terms. And very much so in Thai baht and Korean won so I would expect physical metal to be coming back from those areas.

On a supportive basis, the 20-Day moving average is crossing above the 50D as we write, which is a bullish signal.

So the technicals are short-term over-extended, but for the slightly longer term they are constructive as the key moving averages are all below the spot price and trending higher.

Time for a breather.

Gold; technical considerations

Source: Bloomberg, StoneX

Silver has continued to underperform gold, following the similar influences that we outlined last week – moving higher on gold’s coattails, but also reflecting the fact that the majority of demand is industrial and growth remains under a degree of threat. Since the markets’ recent lows of 6th October, gold has rallied by 9.6% and silver by “just” 10.2%. Given that silver

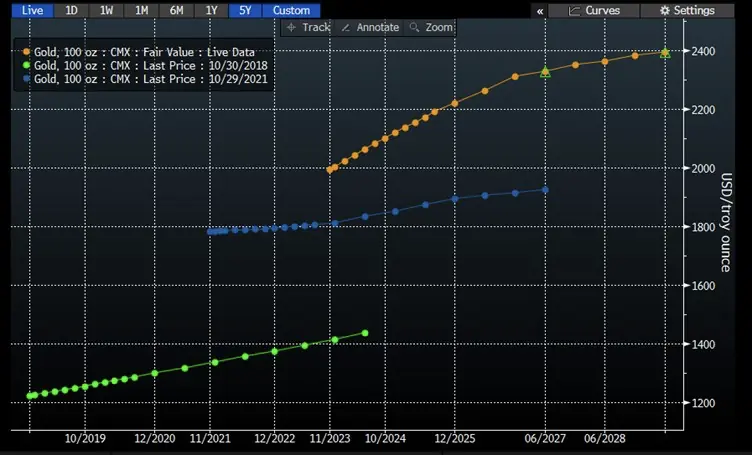

Gold, silver and the ratio; five-year view

Source: Bloomberg, StoneX

typically moves twice as far as gold, if not more, on this specific basis this is a notable underperformance. While the industrial element goes a long way towards explaining this, silver’s reluctance to move underscores the fact that while investors are hedging against risk, the momentum to take gold into a new higher range is still not there, or silver would be more aggressively bullish.

In the background there have been reports of some producer selling, which is not surprising given the price action. Interest rates are also a key here. As the chart below shows, two years ago the five year yield was 1.16%. Now, it is 4.8% and with the Fed most likely to be putting its rate cycle on pause, the gold contango on top of high spot prices must make it very tempting to lock in some forward prices. As of this morning 30th October, five-year forward gold is $2,385.

Gold forward curve; live, two- years and five years ago

Source: Bloomberg, StoneX

It is possible that something similar is happening in silver, although the forward curve profiles are different from gold in that two years ago the shorter tenors were higher than they are now. Bear in mind that only 27% of silver mine production is from primary silver mines and the rest is a base metal by-product. With copper lead and zinc all still struggling (especially zinc) the prospect of locking in good silver by-product credits must also be very enticing.

Silver forward curve; live, two- years and five years ago

Source: Bloomberg, StoneX

Futures positioning;

On COMEX, there was more long-side positioning in gold and some chunky short-covering, with longs adding 55t or 14% and shorts contracting by 71t or 34%. This takes the net long to 173t, the highest since mid-August while the outright longs, at 381t are the highest since early August and 6% above the twelve-month average.

Silber was a different story, with its underperformance both prompting, and reflected in, further long liquidation (227t or 5%) but some heavy short-covering (always a wise move, as silver short-covering rallies can be very vicious), taking 856t or 24% out of the position to 3,597t, down 67% since the recent peak of 5,601t – which was only a fortnight previously. The net long thus rose from 535t to 1,164t over the week.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

Exchange Traded Products

In the ETP sector, there has been a little scattered buying in gold, taking the days of net creations in October so far to six form a total of 20 trading days. This included over 14t going in on the day that gold first challenged $2,000 (20th October), but generally there has been continued light selling for a net reduction of 38t in the month and 231t year-to-date, to stand at 3,242t. Global mine production is roughly 3,700tpa.

Silver has been similar, with some scattered buying leading to a very small net gain in the month to date of 30t and a loss year-to-date of 1,055t to stand at 22,240t. Global mine production is approximately 27,000tpa.

Conclusion

Gold is still likely to hold in its current range and silver is expected to continue to underperform, especially with so many COMEX silver shorts now closed out.

Source: Bloomberg, StoneX