Nov 2023

Nov 2023

StoneX Bullion round-up Monday 6th November 2023

By StoneX Bullion

Gold has insufficient support to clear $2,000 for now at least

- “Gold was overbought at $2,000 and has enjoyed a much-needed period of consolidation

- The current range is clearly the comfort zone

- While other asset classes were volatile towards the end of last week, gold was resoundingly stable – which is one of its primary characteristics

- While gold’s range was 2.9% (as a percentage of the low) over the week, silver’s was 5.2%, which is also typical given the relationship between the two

- The Fed is not even thinking about cutting rates

Outlook; the latest numbers from the US economy, coupled with the FOMC outcome (rates on hold) and Jay Powell’s comments last week, are supportive for gold, but marginally less so for silver. The near-term upside for gold still looks capped at $2,000 and $23.50 respectively. Our view on consolidation for more time remains unchanged, therefore.

Gold; technical considerations; now out of the uptrend, and rightly so

Source: Bloomberg, StoneX

US economic numbers argue against any further rate hikes

The cautious tone adopted by Fed Chair Jay Powell after the FOMC meeting last week was underscored with the latest round of US economic numbers. The Institute of Supply Managers’ (ISM) employment survey, released on 1st November, showed a drop in manufacturing, with a sharp fall in the employment index and slippage to 45.5 from 49.2 in the New Orders Index (a reading of 50 is neutral). Later in the week, jobless numbers rose, but only slightly, and durable goods orders softened marginally. The increase in Nonfarm Payrolls was slower than expected and the unemployment rate inched higher, to 3.9% from 3.8% in September.

Finally the ISM Services numbers were all lower than expected. The Services sector recovered later than manufacturing as the COVID impact was gradually shaken off so these numbers do come as something of a setback. The Services index and Prices Paid index were both down, but they were at least above the neutral 50 level; while the employment index dropped from 53.4 to 46.8 and Services New Orders fell from 51.8 to 45.5.

Average hourly earnings are also slowing.

Gold in key currencies; correcting in Asia – which was necessary

Source: Bloomberg, StoneX

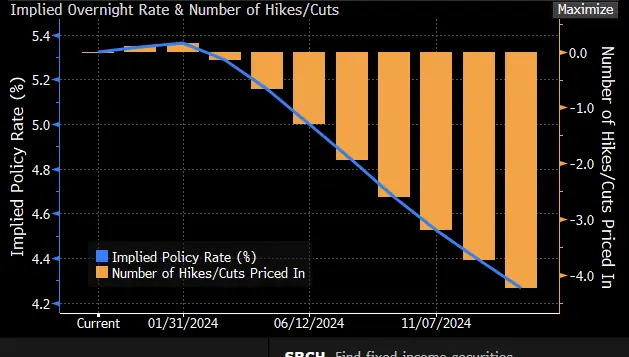

So while these numbers are by no means catastrophic, they do point to an easing in the recovery and certainly suggest that the Fed need not tighten any further. The US bond markets are pricing in a rate cut in June, but in his Press Conference after the FOMC meeting las week, in response to more than one question from the floor about the potential for rate cuts next year, he said that the Fed is neither talking nor thinking about cutting rates. The Fed will remain data-dependent, however, so we should continue to expect a flexible approach.

Source: Bloomberg

Meanwhile on the other side of the Atlantic, the Eurozone industrial confidence reading is still below zero while the core CPI came in at 4.2% year-on-year, highlighting that the European Central Bank still has problems on its hands, while in China the Purchasing Managers’ Indices are closely grouped around the 50 level and the currency remains under pressure, which is keeping the People’s Bank of China’s attention focused on maintaining a steady exchange rate; this is starting to prompt analysts to ponder the possibility of a fresh fall if and when the PBoC eases its support programme. Were this to happen the knock-on effect into the rest of the region would in theory be supportive for gold, but in the short term would probably put it under pressure in the face of any distress selling. We must underline here that we are not suggesting that this is on the horizon, but it is worth noting that analyst thoughts on the subject are making their way into the news.

Gold, silver and the ratio; five-year view

Source: Bloomberg, StoneX

Futures positioning;

Increased length in both gold and silver, but with different patterns.

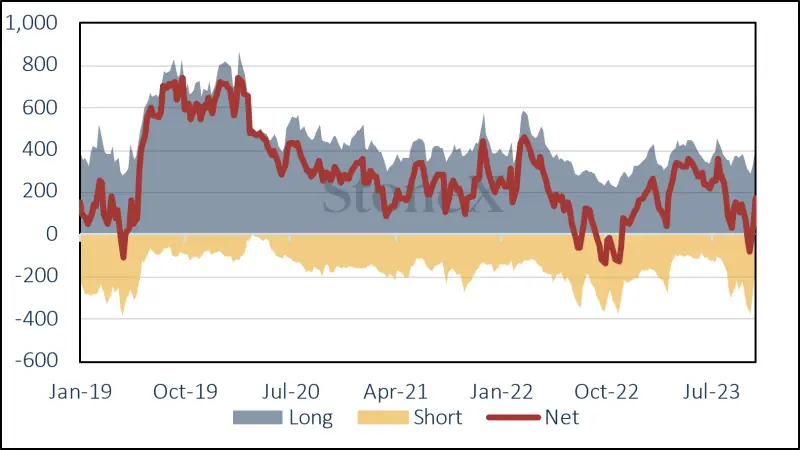

Gold: From a net short of 96t on 3rd October, Managed Money is now at a net long of 126t, a swing of 223t.

Over the week:

Outright longs up 55t or 17% to 381t, the highest since 8th August and compared with a 12-Month average of 359t. Outright shorts down 71t or 26% from 279t to 207t.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

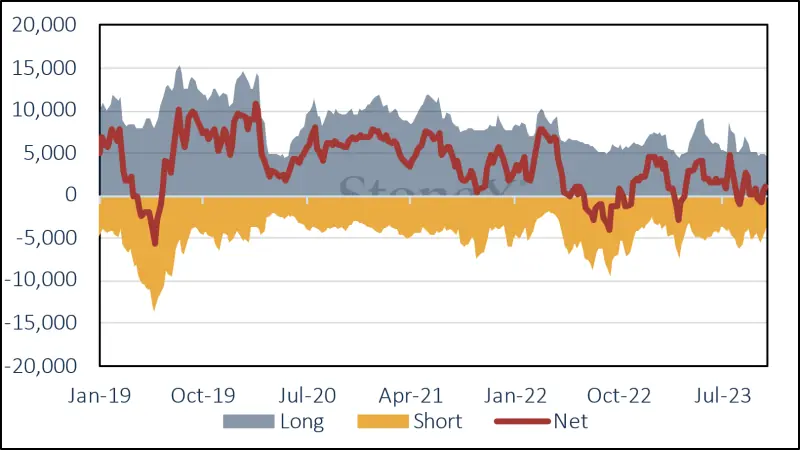

Silver: Contractions on both sides but a lot more short covering than long liquidation.

Longs down 5% or 227t to 4,761t; shorts down 856t or 19% to 3,597t compared with a 12-Month average of 4,587t. Shorts are down by 2,004t in a fortnight, and the net long is up from 535t to 1,164t.

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

Exchange Traded Products

In the ETP sector, we have seen a couple of chunky days’ gold buying (14t on 20th October and 21t on 30th October). The first tranche was clearly bargain hunting at the lows of the recent range and will have helped to generate the move that day from $1,960 to $1,977, while the second took place in a day when prices were correcting after a smart move during the previous US afternoon with gold reaching up to $2,010 as tensions escalated in the Middle East; also attention turned again to the US deficit and the cooling labour market in the United States. Holdings are currently 3,237t for a year-to-date loss of 235t; global mine production is roughly 3,700tpa.

Silver has seen some scattered buying, but sentiment remains cautious and the silver ETPs encountered six consecutive days of redemptions over much of last week and the week before, although there was some purchasing last Friday. Since the start of October the silver ETPs have posted a net loss of 69t, but this is minimal by comparison with the underlying holdings, which currently stand at just over 22,100t, with a net reduction of 1,154t for the year to date. Global mine production is approximately 27,000tpa.

Conclusion

Gold is still likely to hold in its current range and silver is expected to continue to underperform, especially with so many COMEX silver shorts now closed out.

Source: Bloomberg, StoneX