Nov 2023

Nov 2023

StoneX Bullion round-up Monday 27th November 2023

By StoneX Bullion

Some ETP buying is appearing in China. Small, but with interesting scope

- Gold looking ahead with respect to the rate cycle; perhaps a little premature

- Technical considerations remain mixed, supportive on balance

- Gold up 2.7% since the start of last week; silver by 6.6%

- Both are overbought in the short term

- Talk of seasonal December strength has historic validity but do the fundamentals back it up this time?

Gold’s push past $2,000 late last week is, as usual, attracting attention because of the psychological significance of the change in big figure. Can it be sustained this time? A number of analysts are pointing to the fact that gold typically enjoys price strength in December and suggesting that this year will be the same. We don’t disagree, but are slightly more cautious. What are the key factors?

BULL | THE COUNTER ARGUMENT |

Expectation of rate cuts in the US | Premature despite an easing US labour market and weakening sentiment |

Continued geopolitical risk | Priced in, markets watching the hostage release position |

Improved technical moving average configuration | Short-term yes, but the 50D is still below the 200D |

Working into the resistance between $2,020 and $2,050; MACD has turned positive | Overbought on Bollinger and RSI and up by 12% already from the early November lows |

ETPs last week were neutral or positive apart from the US, Germany and Switzerland | Still very patchy |

Interest building in Chinese ETPS | Yes positive, but only 7.4t so far this year. |

But think of the potential! | |

Downward tendency for US yields next year? | The jury is out on that element as quantitative tightening supports yields |

Conclusion: - the bullish arguments outweigh the counterarguments, suggesting that there is scope for further gains in December. But the market does need to slow, or correct, if this move is to prove sustainable and for the 2023 high ($2,063 intraday) to be taken out.

On a fundamental basis there has been some sporadic price-related selling in south-east Asia, while India has clearly gone quiet following the festival season. The latest trade figures from Hong Kong suggest reduced net exports into China in October, but this does not necessarily mean that the Chinese market has contracted. It does look as if not all import quotas have been released, but by the same token the domestic premium over the international market has come down from $40 recently to trade currently at $32 or just 1.6%.

Gold; monthly moves over the past seven years; does this bode well for December and January?

Source: Bloomberg

Gold’s gain so far in November is just 1.4%, although this comes on top of a 7.3% October rise; on an intraday basis the rise for this quarter has been 8.9% (gold’s period of weakness came to an end in the first week of October at $1,180 sop the increase since then has been over $200 or 12%

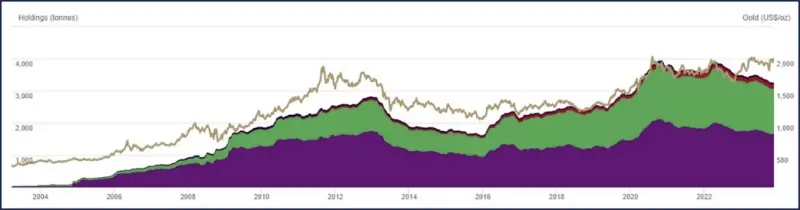

Meanwhile it will be interesting to keep an eye on the Chinese ETPs. The increase in holdings so far this year have only been of 7.4t but this is a 14% increase and potentially lays the foundation for expanding activity in the future.

Gold; scope for more upside, but a correction would add stability

Source: Bloomberg, StoneX

The fact that silver has moved by the times as much as gold in the past week gives further credibility to the move but here, too, the market is overbought and needs to correct. The physical market has also slowed, with premia coming right down in India, and continued regular supply from the base metals producers around the world, notably China and with BHP closing a deal with the miners’ union at its massive Escondida mine in Chile it looks as if output disruption in that country may now be on the retreat, but there is still strike action in Peru, at Southern Copper.

Gold, silver, the correlation and the ratio; year-to-date

Source: Bloomberg, StoneX

Exchange Traded Products

In the ETP sector, last week saw regional increases in holdings everywhere except North America, Germany and Switzerland, reflecting a growing, if very tentative, increase in investor interest notably in the UK and, interestingly, in China even though the latter was 58.8t or 1.4%. The World Gold Council tracks over 100 such funds and pegs current holdings at 3,242.5t as of 24th November, meaning a year-to-date drop of 230.0t or 6.6%.

ETF gold holdings by region

Source: World Gold Council

Silver has remained patchy, with eight days of net creations from a total of 18 trading days in November, although two of those were last week. The net change in November is a loss of 88t, and 1,249t year-to-date, or 5% to stand at 22,047t; this compares with annual global mine production of approximately 26,000t.

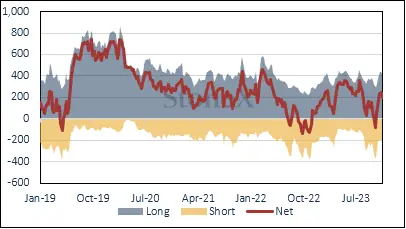

Futures positioning;

The numbers for the week to 21st November are not yet published due to the Thanksgiving Holiday in the United States last Thursday, for completeness we have kept the numbers from the previous week.

[Gold: dropped from $2,007 on 30th Oct to a low of $1932 on the 13th; rally started on 13th and spot closed at $1,964

Negative sentiment returning for the most part with longs down by 24t (5.5%) and shorts up 19.4t or 10%. Net long down 18% to 200t from 243t and vs a 12M average of 194t.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

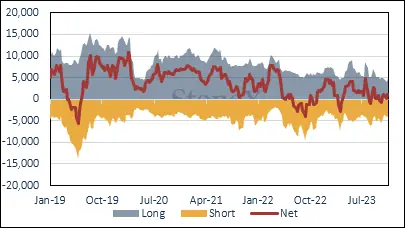

Silver: price dropped from $23.30 on 3rd November, bottomed at $21.88 on the 13th, closed $23.07 on the 14th.

The reverse of gold with a 20% (819t) increase in longs and a 5.1% (207t) contraction in shorts; net long bounds up from 56t to 1,078 against a 12M average of 1,761t.

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

Source: Bloomberg, StoneX