Sep 2024

Sep 2024

Gold vs Shares - FTSE 100. Should I buy physical gold over FTSE 100 shares?

By StoneX Bullion

Should you invest in gold or shares, like the FTSE 100? If you’re not sure where to put your money for the best returns, this article is for you. Below, we explore the benefits of investing in the FTSE 100 vs the benefits of investing in gold, and compare how these two investments have performed over the last two decades.

What is the FTSE 100?

The FTSE 100, or Financial Times Stock Exchange 100 Index, is a share index representing the 100 largest companies listed on the London Stock Exchange (LSE). These companies span various industries, including finance, energy, consumer goods, and healthcare, and include some of the biggest names in the UK, like HSBC, BP, and Tesco.

Also known as the ‘Footsie’, the FTSE 100 serves as a key indicator of the UK stock market and broader economy’s performance. Unlike the FTSE 250, which has a domestic focus, the FTSE 100 is more internationally focused. It has been operating since 1984 and is owned by the London Stock Exchange.

Why invest in the FTSE 100?

Investing in the FTSE 100 can offer many benefits, including diverse portfolio exposure, dividend income, and liquidity. Let’s take a look at the benefits of investing in shares via the FTSE 100:

- Diverse portfolio exposure: The FTSE 100 includes companies from a diverse range of industries, providing exposure to sectors like finance, healthcare, and energy. This diversification can help investors spread risk, as one sector’s positive performance can offset downturns in another.

- Dividend income: One of the main benefits of investing in shares is that many companies provide dividends. This allows investors to generate passive income while also benefiting from appreciating stock prices.

- Stability & credibility: The FTSE 100 is made up of well-established, global companies with significant market capitalisations. For investors, this means more stability compared to smaller or mid-cap stocks.

- Liquidity: FTSE 100 shares are highly liquid and can easily be bought and sold when needed.

Average FTSE 100 dividend yield

One of the main reasons why shares are so popular amongst investors is the potential for dividends – small returns based on stock performance and the number of shares an investor owns. Whether paid out annually, biannually, or quarterly, dividends offer a passive income stream on top of potential capital gains.

Dividend yields for FTSE 100 companies are calculated by dividing the most recent full-year dividend by the company’s current share price. This percentage shows investors the return they receive based on the number of shares they own.

Over the last decade, the average dividend yield for the FTSE 100 has consistently hovered around 3.80%. This number can be used as a reliable benchmark but keep in mind that dividends can vary with market conditions. In 2021, for example, many companies slashed their payouts due to the economic uncertainty during the COVID-19 pandemic. In contrast, 2019 saw a surge in average dividend payouts, reaching an impressive 4.5%.

What is gold investing?

Gold investing involves purchasing gold – either physical bullion or through financial products like ETFs or mining stocks – with the goal of preserving or growing your wealth. There are many different ways to invest in gold:

- Physical gold: This involves buying investment-grade gold in the form of bullion bars and coins or wearable bullion jewellery. Buying physical gold allows investors to have direct ownership over the metal and reduces counterparty risk, although it may come with additional storage and insurance costs.

- Gold exchange-traded funds (ETFs): Gold ETFs are investment funds that are traded on exchanges, like stocks. They provide exposure to gold's price movements without having to physically store the metal, but come with additional risks, including not owning a tangible asset.

- Gold mining stocks: This involves purchasing stocks in companies that mine or produce gold. These gold investments can be more volatile.

Read: Everything You Need to Know About Gold ETFs

Why invest in gold?

Gold is a tangible asset with intrinsic value that makes it a smart investment with unique benefits, including diversification, hedge against inflation, liquidity, and tangibility. Let’s take a look at the benefits of investing in physical gold, specifically:

- Diversification: Gold has a low correlation with traditional assets like stocks and bonds, making it an excellent portfolio diversifier that helps reduce overall risk.

- Hedge against inflation: Gold has a history of maintaining or increasing its value during inflation, helping investors retain purchasing power in times when paper currencies decrease in value.

- Liquidity: Gold is a highly liquid, universally-recognised asset that can easily and quickly be converted into cash when needed.

- Tangibility: Unlike stocks or bonds, owning physical gold gives you a real, tangible asset that you can hold. It does not rely on digital technology and provides a more concrete investment compared to shares.

- Safe haven: Gold tends to perform well during periods of political instability, financial crisis, or stock market volatility. Many investors turn to gold when other markets are turbulent, giving it the nickname of ‘crisis commodity’.

- No counterparty risk: Unlike other investments, physical gold doesn't rely on the performance of external parties or entities. Its value is self-contained and it will never collapse, go broke, or bankrupt.

See More: Why Buy Gold? Reasons to Invest in Physical Gold Bullion

Investing in gold vs shares (FTSE 100)

Before you decide whether to invest in gold or shares, it’s important to understand the different roles they play in an investment portfolio. Let’s take a closer look at how gold and FTSE 100 shares compare:

GOLD | FTSE 100 SHARES | |

ASSET TYPE | Physical, tangible asset you own directly. | Intangible ownership of part of a company. |

INCOME STREAM | No regular income stream, value comes from price appreciation. | Depends on the shares, but many provide a regular income stream paid out through dividends, although amounts can change. |

RISK | Lower-risk, tends to increase in value during market uncertainty. | Can be more volatile, with potential for gains or losses based on company performance and market conditions. |

ROLE IN PORTFOLIO | Hedge against risk, inflation, and economic instability. Gold is a safe-haven asset and increases in value when other markets are volatile. | High growth potential in times of market stability, but vulnerable to market corrections and economic downturns. |

VOLATILITY | Less volatile but prices can fluctuate. | More volatile, reacting to business decisions and political or economic changes. |

LIQUIDITY | Highly liquid, can be bought and sold globally with ease. | Highly liquid, although value can depend on market conditions at time of sale. |

LONG-TERM GROWTH | Historically maintains or appreciates in value over time. | Long-term growth potential, but dependent on the performance of individual companies and the broader market. |

COUNTERPARTY RISK | No counterparty risk, you own the physical asset directly. | Dependent on companies, markets, and banks. |

Gold vs FTSE 100 performance

When it comes to investing, performance matters above all else. To help you decide between gold vs shares, we compare the performance of gold with the FTSE 100 over the last two decades.

Note the index shows average performance – individual companies may have performed much better, but some would have also performed worse.

FTSE 100 vs gold: Performance in the last decade (2013 - 2023)

The FTSE 100 index started in October 2013 at 6,731.43 points and reached 7,617.97 by September 2023. This was a gain of 13.17%. Even at its peak in February 2023, the FTSE 100 saw a gain of 17.01%, hitting 7,876.28 points. However, these gains were interrupted by downturns, especially during the 2020 pandemic, when the index dipped significantly.

Gold started the same period in 2013 at £796.12 per ounce and has since risen by 92.54%, reaching £1,532.84 in September 2023. Earlier in 2023, gold even doubled its value to £1,601.51 per ounce. Unlike the FTSE 100, which has seen ups and downs, gold’s performance remained steady and has consistently outperformed the stock index since 2016.

Keep Reading: Is There a Correlation Between the US Dollar and Gold Prices?

FTSE 100 vs gold: Long-term performance comparison (2000 - 2024)

Over the past 24 years, the FTSE 100 has only seen a 17% increase from 6,364 points in 2000 to 7,461 points in 2024. The highest it climbed was 23%, but at its worst, it lost 43%.

On the other hand, gold’s performance has been absolutely incredible. Gold prices have risen 850% in the same period, starting at £170 per ounce and reaching more than £1,600 per ounce by 2024.

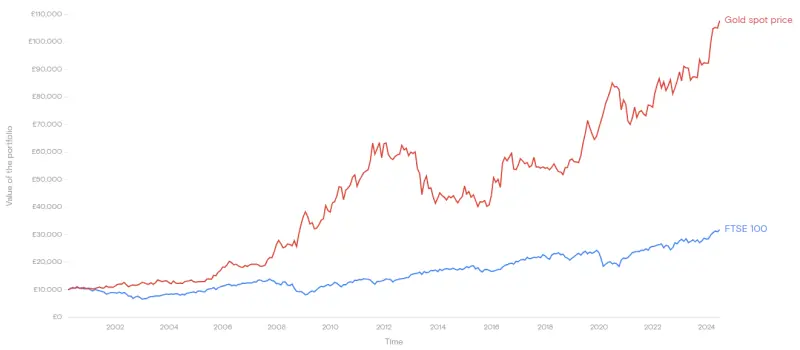

FTSE 100 vs gold: Hypothetical investment

Let’s put these figures into perspective with a hypothetical investment:

- A £10,000 investment in gold in the year 2000 would be worth over £90,000 by 2024.

- A £10,000 investment in the FTSE 100 would have barely reached £15,000, with potential losses depending on the time of cashing out.

INVESTMENT | VALUE IN 2000 | VALUE IN 2024 | GROWTH |

Gold | £10,000 | £90,000 | +850% |

FTSE 100 | £10,000 | £15,000 | +17% |

FTSE 100 vs Gold spot price: Historical performance chart

Looking at the standout performance of gold vs shares over the last two decades, it’s super clear to see the growth potential of this precious metal. Gold’s value tends to rise when stock markets struggle, providing a buffer against financial crisis. This was especially clear during the 2008/09 financial crisis and more recently during the pandemic, when gold prices soared as stocks faltered.

On the other hand, the FTSE 100’s slower growth has been impacted by market fluctuations, global events, and company-specific risks. While some individual stocks within the FTSE 100 may have outperformed the index, the broader market performance has been weaker compared to gold.

Continue Reading: Is Gold Jewelry a Good Investment?

Summary: Should I invest in gold or FTSE 100?

Choosing between investing in gold or the FTSE 100 comes down to your investment goals and risk tolerance. To recap:

Investing in gold:

- Provides stability and value appreciation over time

- Protects against inflation, currency devaluation, and market crashes

- Balances overall portfolio risk

- Provides a safe haven

- No counterparty risk

- Provides a tangible asset

- Simpler than investing in shares and monitoring the market

- Growth has been enormous in the last two decades.

Investing in shares:

- Offers potential for both capital gains and dividends

- Is more volatile compared to gold

- Depends on market conditions, company performance, and broader economy

- Growth has been modest and slow in recent decades.

If you’re looking for a safe, long-term store of value with less active management and incredible growth potential, gold is likely to be the better option for you. If you’re willing to take on more risk for the potential of regular income and capital growth, investing in FTSE 100 shares may be a good choice.

Ready to start benefiting from gold’s incredible investment potential? You’re in the right place. Browse our collection of investment-grade gold bullion bars and gold coins and start growing your wealth today.