Feb 2024

Feb 2024

Gold trying to move higher, but still very sensitive to US numbers

By StoneX Bullion

Please note this will be the last weekly note until Monday 4thMarch.

- A sharp gold rally towards $2,060 after Jay Powell

- And an equally sharp reversal after strong payroll numbers

- Chinese premia are gradually easing

- While silver is still underperforming on economic uncertainty

Gold remains keenly attuned to nuances over the US economy and the rate outlook, while the physical market remains reasonably solid

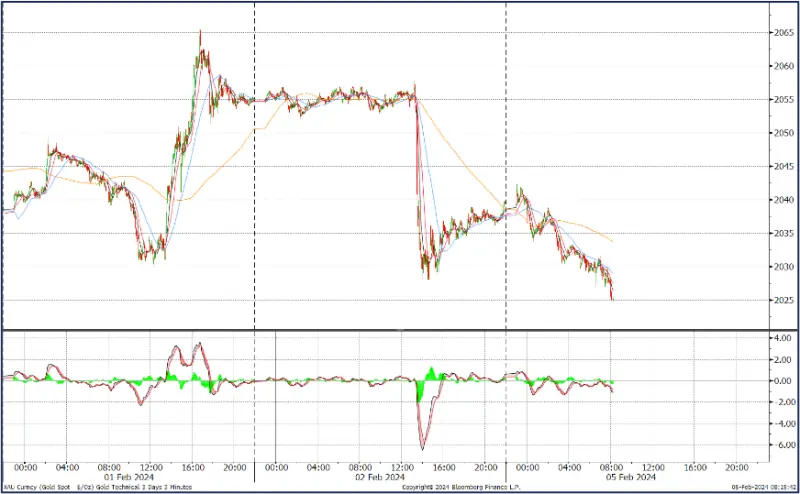

Gold; short term moves late last week

Source: Bloomberg, StoneX

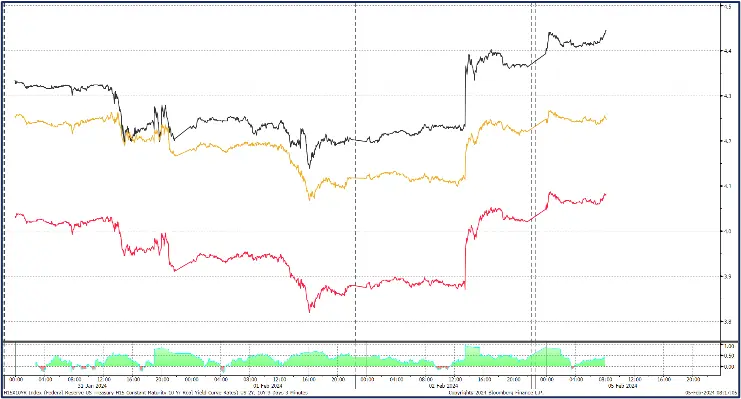

Bond yields over the same period

Source: Bloomberg, StoneX

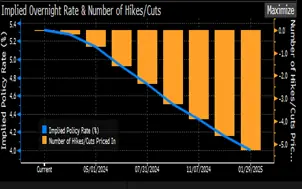

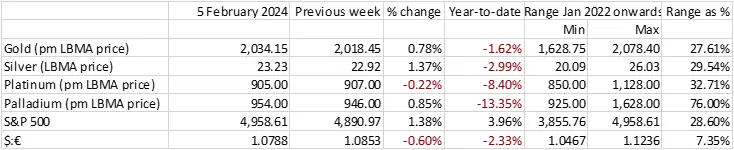

Source: Bloomberg

Yet again gold has tried to break higher but failed to find the necessary follow-through. Last week we saw an attack on $2,060 in the wake of Jay Powell’s press conference following the Federal Open Market Committee’s meeting on Tuesday and Wednesday. The Fed’s Statement after the meeting carried no surprises, but the Press Conference threw a slightly different light on matters.

In the Q&A session he was asked whether a slide in employment would likely lead to cutting rates sooner; he was emphatic in his response. Strong body language and the use of the word “Absolutely”. Less than 24 hours later, the US employment figures were weaker than expected with continuing claims up to 1.90M from 1.83, and initial jobless claims were 224k after 214k; the rise in labour costs was way below expectations at 0.5% against a call of 1.2%, as productivity increased.

The combination of his comments and these numbers was enough to propel a 2.7% ($35) rally in gold to test $2,065 before correction to $2,055.

Twenty-four hours later the very strong nonfarm payroll figures came out and threw everything into reverse. Nonfarm payrolls rose by 353k, well ahead of expectations; the market consensus had been for a rise of 216k. Inside the numbers there was a month-on month increase in hourly earnings although this came after a decline the previous month, while the unemployment rate, steady at 3.7%, was better than expected.

This pushed Treasury yields higher and took the wind out of gold’s sails so that on a weekly basis, prices are yet again unchanged at around $2,020.

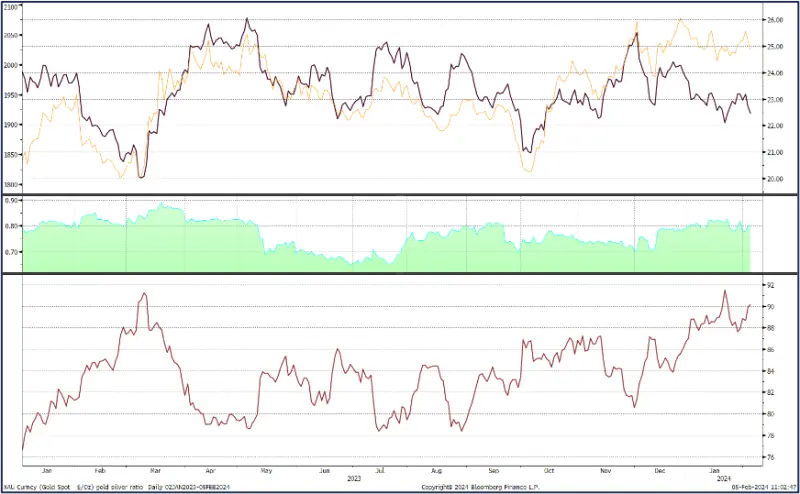

Silver has been underperforming again and came down with gold at the end of the week to drop into support at between $22.0 and $22.5.

Gold and the two-year and ten-year yields, January 2021 to date

Source: Bloomberg, StoneX

Gold silver and the ratio; silver’s correlation with gold and with copper

Source: Bloomberg, StoneX

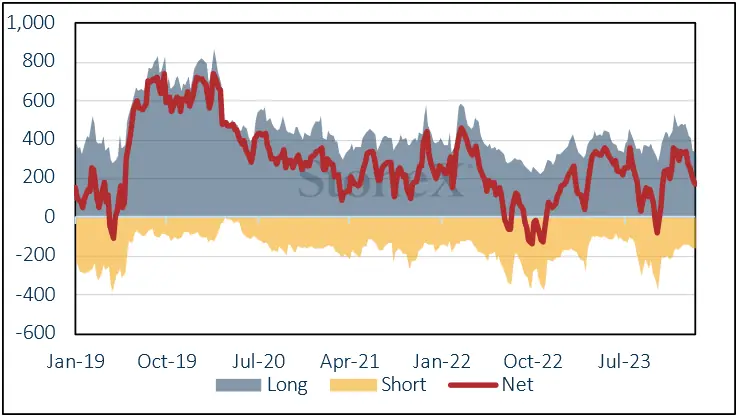

In the background the change in Commitments of Traders in the week to 30th January, during which time gold had dropped initially towards $2,010 then rallied to reach $2,040, outright longs actually dropped by 10t or 3% to 336t, while shorts expanded by almost 4% to 162t. This took the net position to 174t, well below the twelve-month average of 221t long.

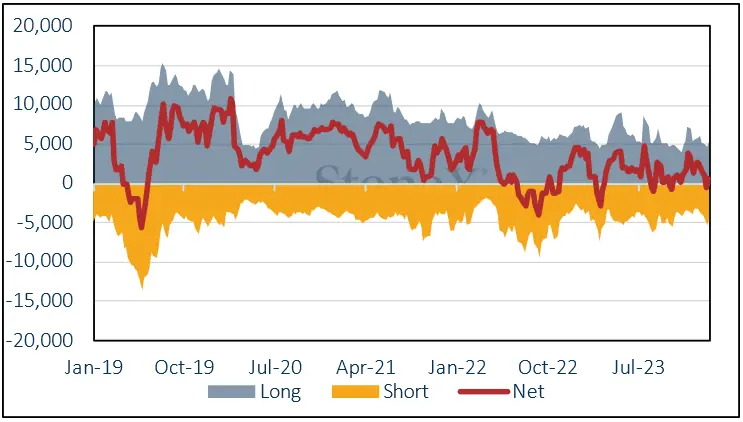

Silver meanwhile had rallied from $22.1 to $23.1 over the period with outright longs rising by 548t or 12% to 5,279t and shorts contracted by 11% or 575t to 4,583t, generating a net long of 696t after a net short on 23rd January. The failure to follow through may well mean that these positions were reversed over the following week.

Amongst the Exchange Traded Products, the latest figures from the World Gold Council (to 16th January) showed a 5.5t fall over the week; Bloomberg figures, which are not as comprehensive as those from the Council, but nonetheless give a good gauge of sentiment, suggest a further reduction on 8.4t, to an estimated total of 2,010t.

Silver ETPs have also been under pressure with continued selling since 25th January. The large injection of funds on 23rdand 24th January, which amounted to 533t, have been partially reversed with net sales of 351t since then, to a total of 21,780t (world mine production is approximately 26,500t).

Silver technical; spot is below all the key moving averages and the longer-term averages are all above those in the shorter term

Source: Bloomberg, StoneX

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

Source: Bloomberg, StoneX