Dec 2023

Dec 2023

Gold settling after its brief burst of life; silver has a speculative overhang

By StoneX Bullion

- Gold consolidating, but took the Fed positively

- Technicals look mixed but that reflects the hefty drop of a fortnight ago

- Any change in Big Figure is bound to attract attention but support stands between $1,975 and $2,002

- Fed rate projections are much more closely grouped than in September

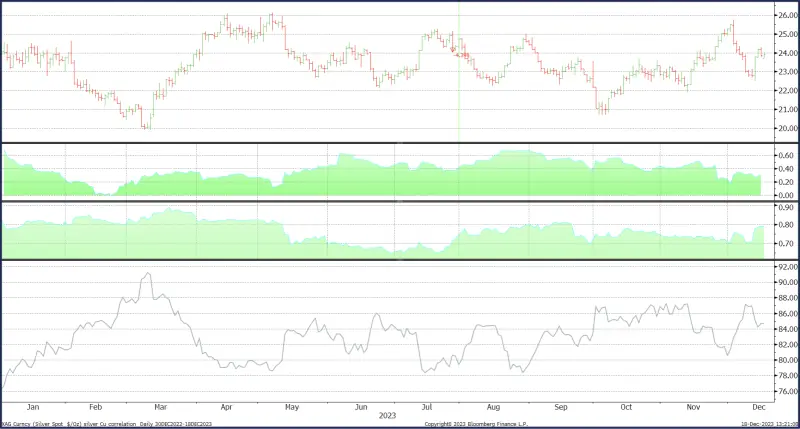

- Silver more interested in gold than copper, and looks to the longer term

- Silver’s speculative overhang has been reduced

Gold; ten moving average is below the twenty-day but this stems from the big price fall on 4th December

Source: Bloomberg, StoneX

FOMC fed funds rate projections

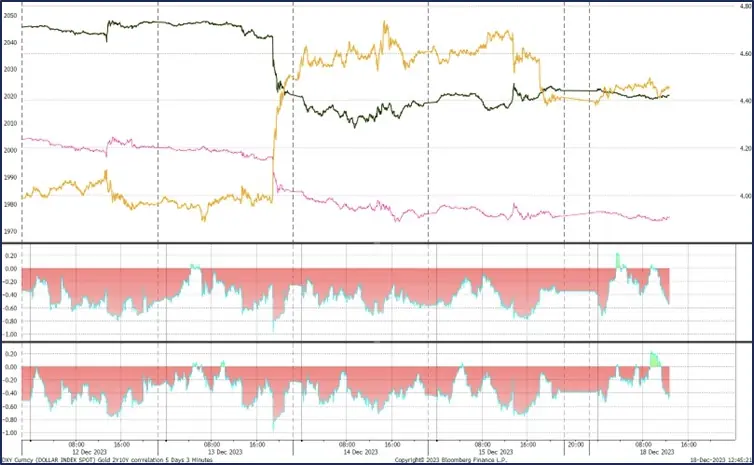

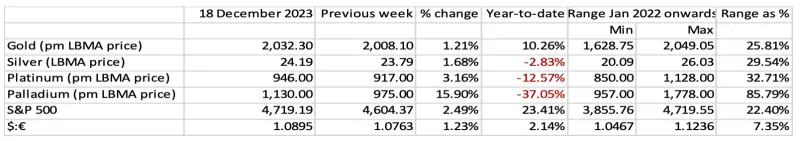

The markets took the outcome of the Federal Open Market Committee’s final meeting of 2023 as (again) postulating an easier rate prognosis than is likely to be the case. Once the Statement came out and Chair Powell’s Press Conference got underway yields dropped sharply and gold ran up from $1,982 to close the session in the United States at $2,025 then tested $2,050 the following day for a 3.4% gain. Silver rose by just over 7.6%, in keeping with the relationship between the two metals, from $22.50 towards $24.50, has since given back roughly a quarter of that gain and is trading just below $24 as we speak, below which there is a reasonable body of price support. Silver’s recent activity certainly suggests that for now, at least, it is preferring to concentrate on gold rather than responding to the slowing in the US economy, the struggles in Europe and the comparatively anaemic recovery in China (bearing in mind that ~60% of silver’s fabrication demand is driven by industrial uses). It is also important to remember here that the outlook for the solar industry in particular is very strong and benefits silver, as does the electrification of the vehicle fleet, underpinning silver’s fundamentals for the longer-term.

Meanwhile back in Washington…

After the September meeting the dot plot showed a really wide variation in the views of the different members of the FOMC as far as the end-2024 fed funds target rate was likely to be. This time the grouping was much tighter and the weighted average rate, at 4.36%, was 34 basis points lower than that of September and 0.97% below the current rate of 5.33%.

So on that basis it could be arguable that the FOMC itself is pricing in four rate cuts next year, but if we look at the distribution of the dots the majority of the members are looking at either two or three. In the Q&A following the meeting, Chair Powell said that the insertion of the word “any” before “additional firming” is an acknowledgment that they are “at or near” the peak rate for this cycle. The “next question” is when it would be appropriate to start “dialling back”; easing job growth and moderating inflation are all in the right direction but “we still have a ways to go”. Then on Friday, the President of the Atlanta Fed and that of New York contrasted with the Chicago President, demonstrating the difference of opinion within the Committee, with the Atlanta President saying that he sees just two cuts next year, starting in Q3; the New York President saying that it is “premature” to talk of a March cut but Chicago arguing that the risks are becoming more balanced and implying that the Fed might need to shift its focus towards the “full employment” element of the dual mandate.

Over the rest of the week the gold price spent most of the time swinging between $2,030 and $2,040 before some profit taking took the heat out of the market and prompted a small fall towards $2,020, where it continues to trade as we write. The bond markets are mixed; following the sharp falls in the immediate wake of the FOMC meeting, the two-year bond yield has rallied slightly and is holding above 4.4%, but the ten-year yield continues to drift marginally lower. Gold is showing a fractionally closer relationship with the ten-year at minus 0.52 against minus 0.46.

In the background the US’ economic numbers continue to suggest a slowing in the strength of the economic recovery. On Friday, industrial production for October was revised downwards to minus 0.9% month-on-month against minus 0.6% previously estimated, while the November number was +0.24%, missing the markets’ call of +0.30%.

Gold silver and the ratio; silver’s correlation with gold and with copper

Source: Bloomberg, StoneX

On balance, gold is showing resilience, but it is arguable that it is discounting the shift in the Fed’s stance and further upside may need additional external impetus. The physical markets are quiet as the different price-elastic regions in the Middle East, south and south-east Asia absorb the impact of higher prices. The Chinese New Year starts on 10th February 2024 and while there is obviously a good while before it comes round, it will be the Year of the Dragon, which is traditionally associated with growth, progress and abundance. The Chinese economy is still comparatively sluggish (by their standards) but from the point of view of the potential for gold purchases the approach of this particular year may see a substantial uptick in local buying.

Gold and the two-year and ten-year yields

Source: Bloomberg, StoneX

Exchange Traded Products

In the ETP sector, the first two weeks of December have actually seen more days of net buying rather than selling although it was marginal, at six out of eleven. The net changes thus far are still in the negative column, at minus four tonnes. The World Gold Council tracks over 100 such funds and pegs current holdings at 3,232t as of 18th December, meaning a year-to-date drop of 239t or 7%.

Silver ETPs have seen just three days of net creations in the month to date, but one of those was a big day (+239t), meaning that month-to-date there has been a gain of 84t to 21,914t (world mine production is approximately 26,500t).

Gold spot price vs ETF holdings

Source: Bloomberg, StoneX

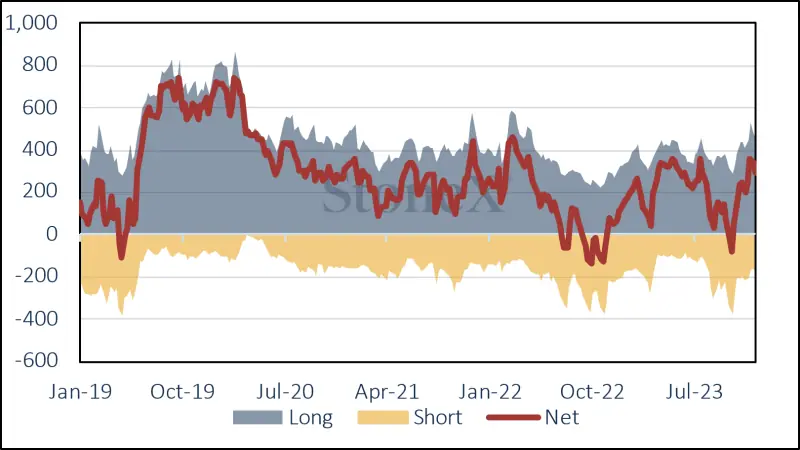

Futures positioning;

In the week to 12th December the managed money positions in gold saw profit taking and some fresh shorts, with longs shedding 6% or 32t to 465t; shorts gained 7% or 11t to 168t, leaving the net position at 297t.

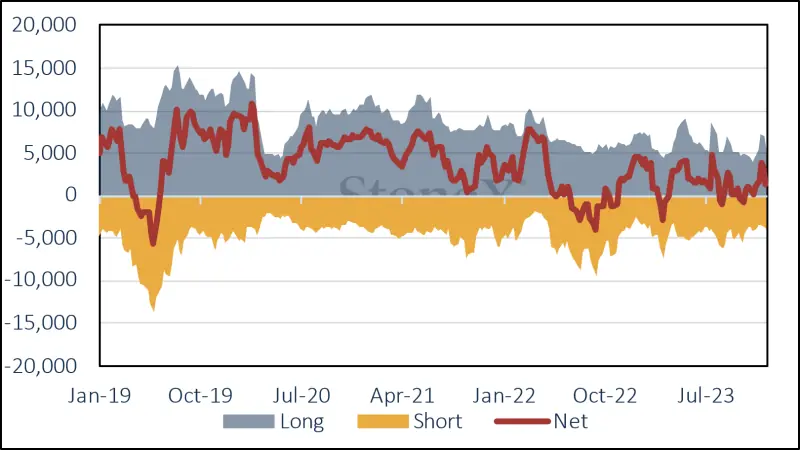

We referred last week to a speculative overhang in the COMEX silver Managed Money positions; this was partially worked off in the week to 12th December, with longs coming down by 24% from 7,049t to 5,381t and compared with a twelve-month average of 6,175t. Short expanded by 11% from 3,588t to 3,987t meaning that the net change was small, dropping from a short of 4,383t to 4,377t.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

Source: Bloomberg, StoneX