Mar 2025

Mar 2025

Gold Nears $3,000 While Silver Faces Resistance

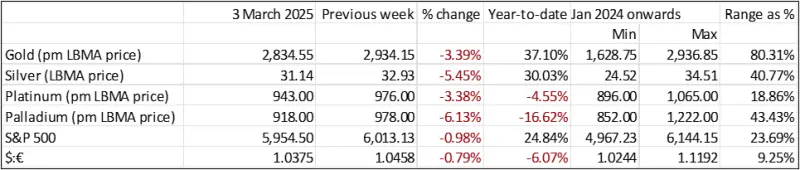

- Since mid-February gold has approached, but not tested, $3,000

- Gold’s range was 11.3% to an intraday high of $2,956, peaking on 24th February and correcting towards $2,830 thereafter

- Silver tested $33.5 earlier in the month but backed off quickly and latter undulations took it down to support at the 50-day moving average ($30.9) and as we write it is looking to post fresh gains towards $32.0

- Prevailing sentiment continues to look towards uncertainty, with international tensions boiling up again and the threat of US tariffs on a range of goods draws ever closer

- This is tying some policymakers’ hands, with one Fed President last week saying that it was hard to make significant policy changes amid such uncertainty

- The short term squeeze arising from this dislocation in the gold market with heavy shipments out of London and into the States, has eased somewhat although Comex inventories continue to rise.

Shorter term outlook; circumstances remain supportive for gold although $3,000 will be important resistance psychologically, even if not technically, and bouts of profit taking are appearing. Next Fibonacci resistance level is $2,870. Silver’s outlook is less constructive than gold’s for the time being, reflecting economic uncertainties and the continued lack of physical purchases from retail investors in particular sums up the caution in this market The moving averages are moving into a negative pattern, also.

International economics

The key elements to watch over the next few days are numerous. Consumer confidence fell in the States in February to just 98.3 as the prospect of tariffs is still stoking fears of inflation. This may not be well-founded but in market activity perception and sentiment remain important and this is one element that is supportive for gold but much less so for silver. In the coming days we have a rash of US economic indicators, but the Manufacturing Purchasing Managers’ Index (PMI) was released on the day of writing and this was better than expected at 52.7. Thereafter we have the China PMI, and the current weakness of the yuan will be a matter for attention as it is helping to foster investment in gold coins and bars (to some extent at the expense of gold jewellery due to weak consumer sentiment in the country). Meanwhile the EU inflation numbers, released at the start of this week, were fractionally higher than expected at 2.4% Y/Y and core at 2.6% Y/Y – leaving the European Central Bank with another headache.

Finally probably the most important parameter this week will be Friday’s US release of the NonFarm Payroll numbers, which are currently called at +160k after 143k last month. We will also need to keep a close eye on any revisions as NonFarm can be noisy with different-size companies reporting at different times and it is certainly possible that there will be downward revisions – which could raise expectations of another cut from the Fed. Meanwhile the Fed is now conducting its five-yearly Longer-Term Strategy Review, which handles Longer-Run Goals and Monetary Policy Strategy and will include the importance of keeping longer-term inflation expectations well anchored. The longer-term target of 2% inflation reins unchanged.

Geopolitics

On the issue of tariffs, President Trump is still arguing that the tariffs threats on Canada and Mexico are designed to reduce immigration as well as the fentanyl imports issue. He originally imposed 25% tariffs on both countries (but 10% on Canadian energy) plus doubling the China tariff to 20%; these were then suspended but are due to come back into effect on Tuesday 4th March. It is reported that these tariffs would affect roughly $1.5Tn on an annualised basis. Other tariffs are expected in April once the mandatory periods of investigation have been completed.

Elsewhere the stresses over the Ukraine continue to rumble on with Europe now looking to stand shoulder-to-shoulder after the unfortunate developments in the meeting between President Trump and Zelensky.

All in all, a supportive matrix for gold, but the recent profit taking may yet prove that much of this is all priced in.

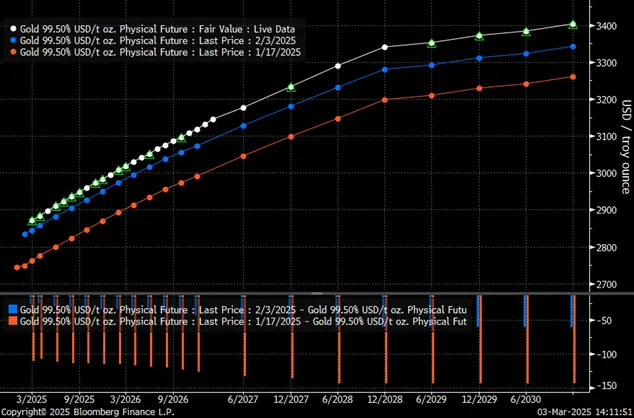

The gold forward curve; now, one month and six weeks ago

Source: Bloomberg

Background price action

Gold, one-year view; broke out from the uptrend the upper channel of which seems to be providing some support

Source: Bloomberg, StoneX

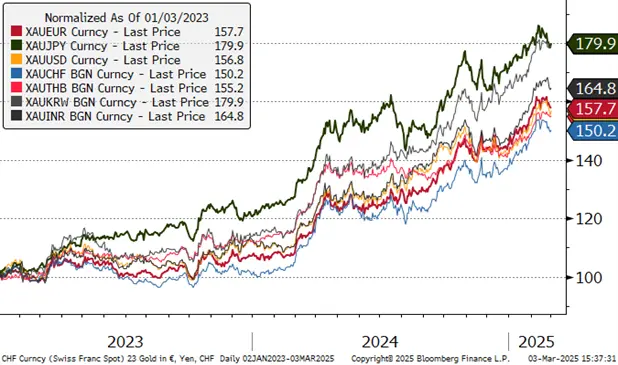

Gold in key local currencies;

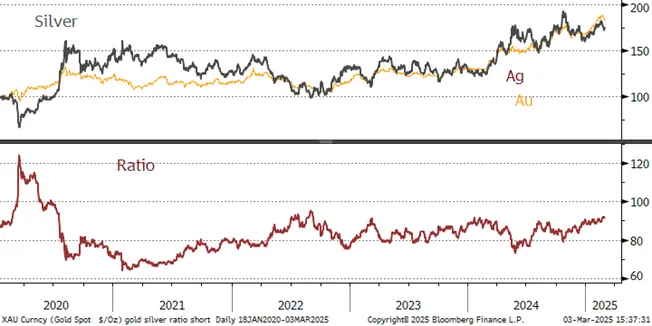

Silver, one year view; failed at $33.5 and now caught below the 10 and 20-Day moving averages

Source: Bloomberg, StoneX

Gold:silver ratio, January 2024 to-date; Europe, China weighing on silver

Source: Bloomberg, StoneX

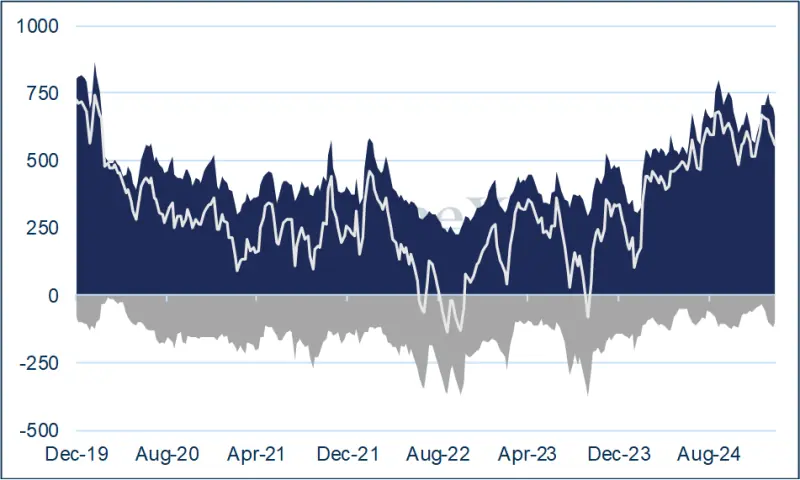

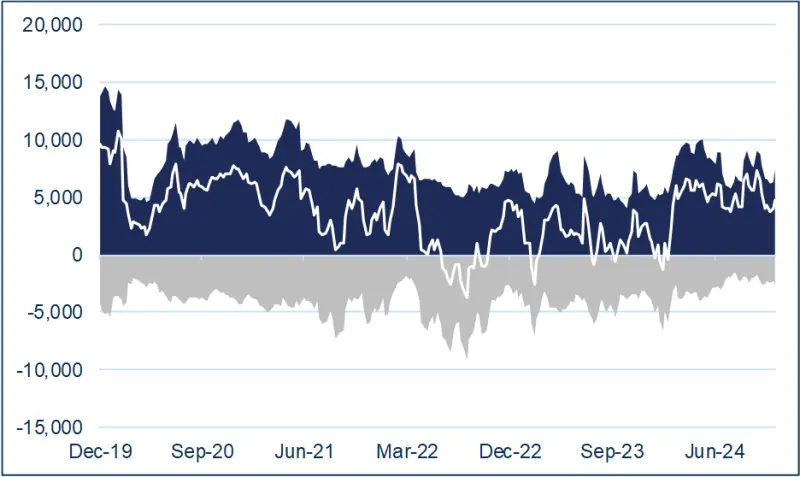

CFTC; changed attitudes to gold; silver mixed

Gold longs have declined over February, falling from 748t to 662t; shorts expanded to 116t in the first half, but eased back slightly to stand at 102t, up from 54t in late January. Silver positions have fluctuated but longs dropped overall from 9,067t to 8,253t; shorts also contracted, from 3,223t to 2,861t.

Gold COMEX positioning, Money Managers (t) –

COMEX Managed Money Silver Positioning (t)

Source for both charts: CFTC, StoneX

Silver took a different course from gold with longs and shorts both increasing, but only fractionally (longs up to 6,136t from 5,875t; shorts up from 3,071t to 3,266t). During December silver longs declined, as they did in gold, but shorts continued to expand as the markets fretted over global growth levels.

So what is the EFP and how does it work?

How does it work? Trading the EFP is a way of hedging market exposure. By buying the EFP, a holder of physical metal contracts with a counterparty to sell the physical position while simultaneously buying the futures. That way the exposure in the metal itself is unchanged; but the delivery date shifts. Some market stakeholders have been using the EFP in order to deliver metal into the United States ahead of 20th January in order to reduce the risk attached to long positions in case of tariff imposition. In our view tariffs on either metal, especially gold, are unlikely, but it is understandable that some traders – or their risk officers (as was the case during the pandemic) want to eliminate any possibility of being caught up in any fall-out.

ETFs:

Global ETF gold holdings

Gold ETFs were revitalised during February, with 16 days of net creations from a total of 20 trading days, rising from 3,254t to 3,326t by month-end.

Silver, in keeping with CFTC numbers and its price action, was more mixed, with eleven days of net creations for a small net increase of 85t, or less than one half of one percent, to finish at 22,047t.

Global mine production is ~26,000t.

Source: Bloomberg, StoneX