Oct 2024

Oct 2024

Gold Markets in Flux: Middle East Tensions, US Labor Strength, and Silver Volatility

By Rhona O'Connell, Head of Market Analysis

- Gold caught between Middle East escalation and a healthy-looking US labour market

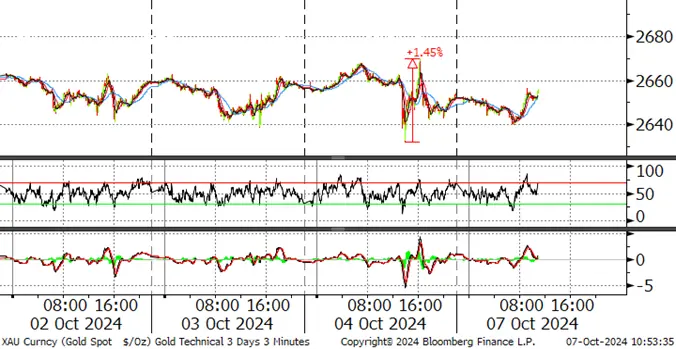

- The 10-day moving average is now just above spot; 20D is at $2,620

- COMEX outright longs off in the week to last Tuesday – but are still too high!

- Shorts up 32% in the week to the highest since late February

- These elements could point to incipient volatility

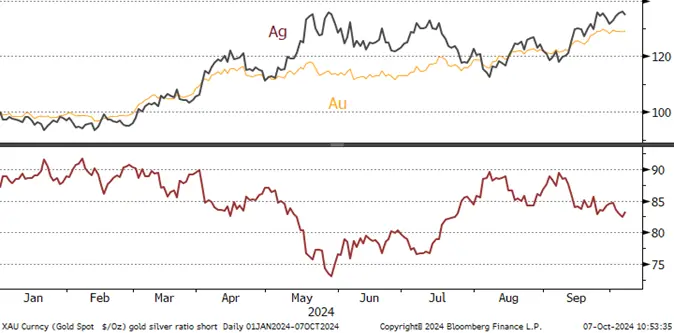

- Silver challenged $33 towards the end of last week and is now sitting on support from the 10D moving average at $31.8

- Gold’s knee-jerk reaction to nonfarm numbers last Friday saw a drop then sharp rally, but only over a 1.5% range…

- …while silver was all over the place, carving out a range of 4.6% before falling as sharply as it rose (which is par for the course)

- The ratio continues to ease, and the Golden Week holidays in China last week will have contributed to this

- Meanwhile Diwali is on the horizon and gold trade into India is surging after the tax cut; local price at a record

- The escalation in the Middle East conflict cannot be ignored

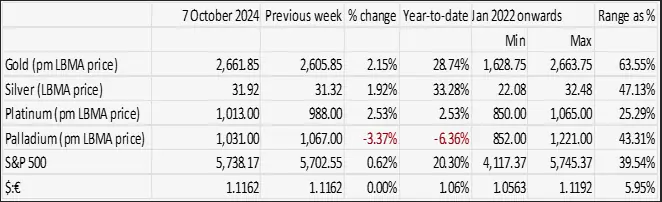

- Gold State of Play: a Cheat Sheet

Outlook; after stronger than expected Nonfarm payroll numbers, some of the speculative froth has been taken off gold in the short term, but for the medium term the tailwinds continue to exceed the headwinds; we are now seeing sone stabilisation in the dollar price – and we needed it. The market retains a buy-on-dip bias. Silver has also seen some profit taking, and the speed of that move on Friday may well have been driven by short covering. This metal, too, needs some time to draw breath and at these levels it is possible that it will underperform gold for a while.

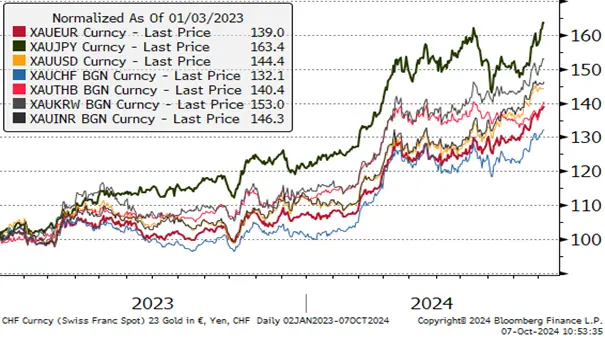

Gold in key local currencies

Source: Bloomberg, StoneX

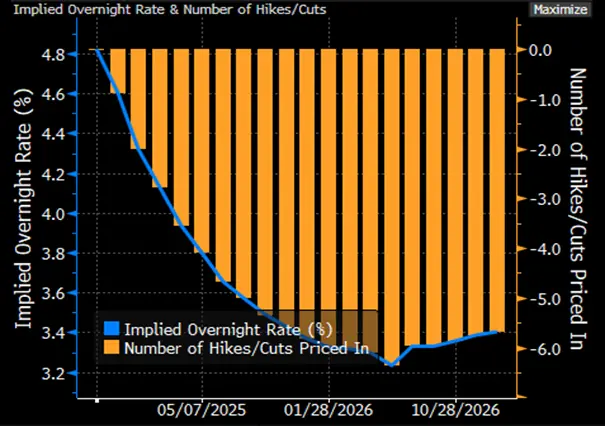

The NonFarm Payroll numbers were the centre of attention last week and came in much stronger than expected, at +254k after a consensus expectation of +145. Our strategist has pointed out that part of the large increase in government numbers would have been driven by teachers returning to post, but the team also makes the point that NonFarm can (not unlike JOLTS, the Job Opening survey) be volatile, especially with revisions. The next Fed meeting is on the 6th and 7th November, which will make for an interesting meeting as the US election is on the 5th. The Fed stands by its insulation from political influence, but no doubt there will be headline noise that week.

Diwali, the most auspicious period in the Hindu calendar for gold purchases and gifting (also celebrated by Jains, Sikhs and some Buddhists), starts with Dhanteras on 29th November, with Diwali itself celebrated on 31stOctober. The overall Festival runs through to 3rd November. Jewellers have been active gold purchasers and local prices hit an all-time high of Rp 78,450 per 10g last Friday, equivalent to $2,906/ounce. When we factor in the 6% import tax (reduced from 15% in July), the landed price would be ~$2,820 equivalent, which suggests a small domestic premium of 3%. Prospects for gold offtake are bright for the next few months, following a good monsoon season (important for crops and farmers’ gold purchases, which are an important part of the market) and what is looking like a lively wedding season in December / January.

The World Gold Council has reported that imports in August reached roughly 140t, not only reflecting jewellery fabrication, but a continued increase in ETF gold investment with Indian ETFs adding 9.5t so far this year, to a total of 51.8t.

Central Bank purchases and sales, tonnes

Source: World Gold Council

The Council also reports that official sector net purchases in August were just eight tonnes, concentrated in Emerging Markets with the National Bank of Poland the leading buyer, followed by Turkey and India, while Kazakhstan shed a net five tonnes.

Meanwhile China returns from the Golden Week holiday and the markets have had time to absorb the likely impact of the stimulus packages of the previous few days. More stimulus measures are expected on Tuesday 8th October, and the equities market re-open on that day also. The massive rally after the stimulus package in late September saw the Shanghai Composite index reach one-year highs, while Hang Seng recovered to 2-1/2 year highs. Investment Bank Goldman Sachs is suggesting that even at these levels the Chinese equities are undervalued, but with the obvious caveat that evidence of a recovery will be necessary.

For the past few weeks Chinese retail demand for gold jewellery has been flat on its back although there has been some interest in coins and bars from an investment perspective; if confidence does start to return then we could well see the unleashing of pent-up demand.

Gold, short-term; technical indicators still supportive

Source: Bloomberg, StoneX

Silver, year-to-date; technical indicators positive; the 10D average still providing close support

Source: Bloomberg, StoneX

Gold:silver ratio, year-to-date

Source: Bloomberg, StoneX

The swaps market has beaten a retreat and is now only looking for 25 point cut in November and another in December

Source: Bloomberg

COMEX

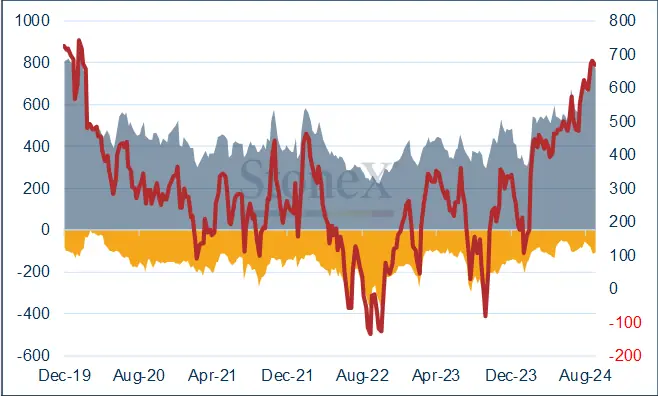

Gold; some heat has gone, but still looking toppy.

Managed Money positions decreased on both sides of the market, with longs losing 45t (6%) and shorts, 37t or 32%. While lower, the outright longs at 771t are still 65% higher than the 12-month average. Net long; down fractionally to 667t.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

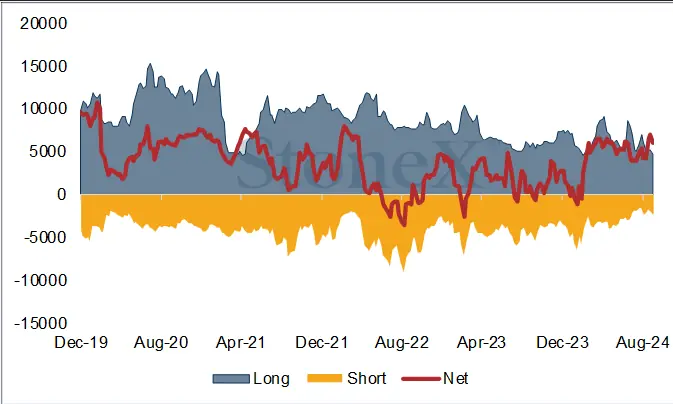

Silver; a good deal of froth has been blown off, but it may still be vulnerable.

Longs shed 577t (6%) dropping to 8,457t. This is still a good way above the twelve-month average, at 22% over the top. Shorts increased again, gaining 17% (350t) to 2,375t, which is back to the levels of late July, and at only 67% of the twelve-month average. Net long down 13% to 6,082t and76% above the average of 3,460t.

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

ETFs:

Gold ETFs; the tide has been turning, with days of net creations exceeding net redemption days by 15 to 10 since the start of September. Since then the net gain is 9.7t for a year-to-date total loss of just 24t or 0.7%. Silver ETFs saw 12 days of new additions and 13 days of losses over the period, for a gain of 215t (1.0%) to 22,467t. This gives a year to-date gain of 698t or 3.2t. Global mine production is ~26,000tpa.

Source: Bloomberg, StoneX

Tailwinds for gold exceed the headwinds

For the longer term, the tailwinds substantially outweigh the headwinds and are summarised in this note that we published at the end of August: Precious Metals Talking points 083024: Gold: state of play and key influences going forward

Key points from this note are still relevant, and as follows

Current tailwinds include:

- Geopolitical risk – not just the overt international tensions (Ukraine, Middle East, potential Taiwan issues, etc) but the number of elections around the world this year, which has been generating uncertainty.

- Increasing trade tensions

- Stresses in the banking systems in the three major regions, notably in the small-to-medium sized sector, and especially exposure to property, and (in the US) Commercial Real Estate.

- Emergence of the Shadow Banking sector (i.e. unregulated transactions), reminiscent of the Sub-Prime issues in 2007 that led to the Global Financial Crisis in 2008

- Continued strong Official sector purchases – not just because they are taking tonnage off the market but because of the signal that it sends to the markets because the Official Sector dislikes uncertainty

- Retail investors in Asia are chasing the market higher in the expectation of yet higher prices

- And so are some High-Net-Worth individuals, Family offices and other professionals who are back in the market for the long haul.

Headwinds:

- Reduction in international political or trade tensions; Harris more of a bearish influence than Trump on this score

- Any strong inflationary forces and / or associated expectation thereof could force a reversal in monetary policy

- Official sector going on the retreat (unlikely)

- Investors’ conclusion that risks have declined (likely to take a matter of years, compare GFC of 2008); it wasn’t until 2013 that professionals bailed out of gold (over 300t of ETF metal went straight into private hands in China)