Mar 2025

Mar 2025

Gold Hits Record $3,124 Amid Trade Tensions

By Rhona O'Connell, Head of Market Analysis

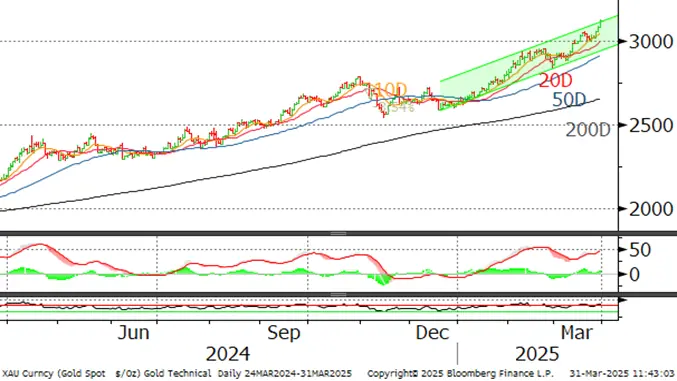

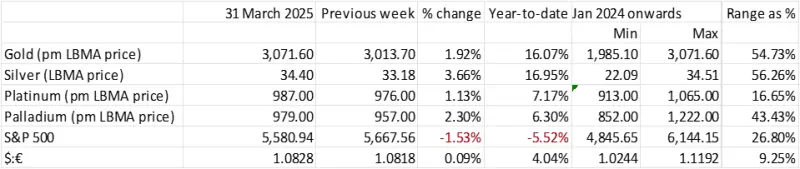

- Gold continues to defy gravity, clearing the nominal intraday record of $3,057 (20th March) to post $3,124 on 31st March, as at time of writing.

- In real terms, though, we are still 11% below the intraday high (in today’s dollar terms) of $3,486. This was a nominal $850 on 21st January 1980 amidst the second oil crisis, the Afghanistan and Iranian crises and the failed attempt of the Hunt Brothers to corner silver.

- Gold’s driving forces are still geopolitics and the growing economic and trade war uncertainty (all of which, of course, are intertwined), with markets and investors focusing on the so-called “Liberation Day” on Wednesday 2nd April.

- Gold is still overbought and is testing the upper end of its new steeper channel, but for now it has a life of its own as the markets are firmly in risk-off mode.

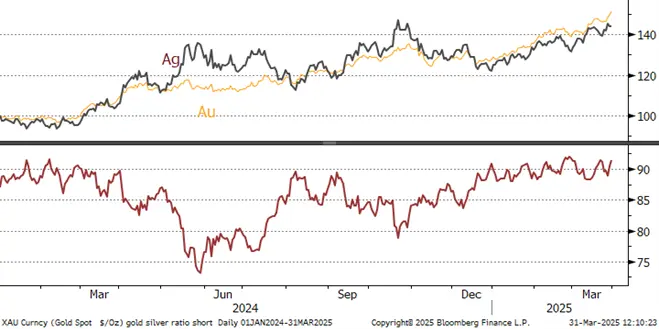

- Silver cleared $34 at the start of this week but was also overbought and subsequently dropped through all the major moving averages to $33.5.

- The gold:silver ratio continues to widen as the economic problems that are helping to boost gold are working against silver.

- It all hinges around tariff day, what is aid, what it the underlying intention, and how viable would be the implementation of any proposals.

- One of the President’s Aides is arguing for stiff negotiation, and then “doing a deal”

- While another senior aide wants any implantation to be within well-structured legal frameworks, which would add several months of lead time.

- The USMCA (United States Mexico and Canada Agreement) had thousands of products that were exempt and just unravelling that would, in our view, be a logistical nightmare.

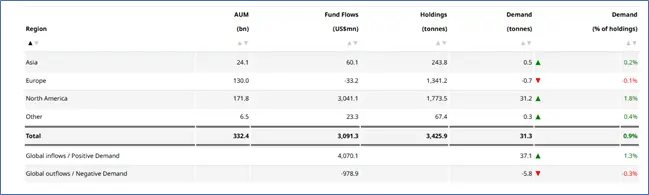

- Asian gold demand has tailed off, North American coin and bara re still sclerotic, but European interest is solid.

Shorter term outlook: gold due for a correction, silver remains vulnerable to any pullback Expect a knee-jerk reaction to whatever is announced on Wednesday. For the longer-term gold still has strong tailwinds, but whether there is much more upside is questionable. Silver’s long-term fundamentals remain constructive but the President’s aversion to green energy is a stumbling block of a sort.

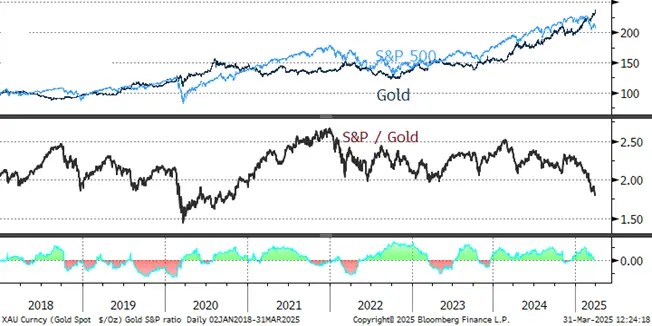

The S&P/Gold ratio is at a near five-year low, reflecting uncertainty and concern, investment hiatus

Source: Bloomberg

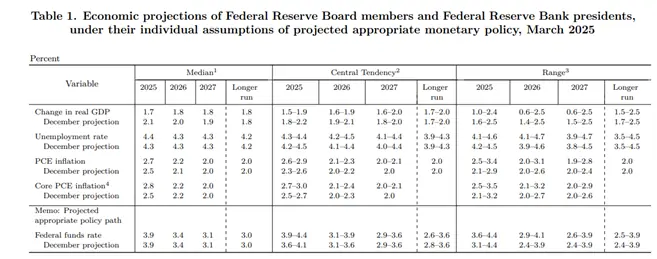

Source: Federal Reserve

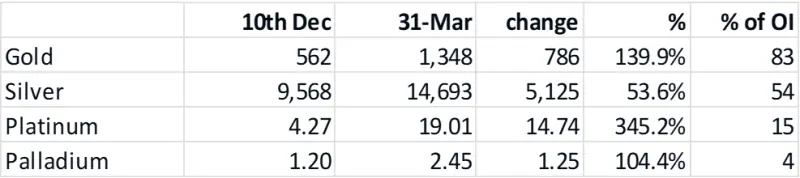

Meanwhile metal continues to flow into CME warehouses although the rate of change has dropped off and the gold inventory to Open Interest cover is now stabilising at between 80 and 83%.the latest summary of movements (10th December is when material started coming into New York as risk managers had started worrying about the tariff threat). The EFP has again been volatile, although this is arguably less closely related to fundamental concerns about getting metal into place as it is about reducing positions ahead of the weekend when it would be difficult to deal with any adverse exogenous developments.

Gold, one-year view; now in a steeper channel

Source: Bloomberg, StoneX

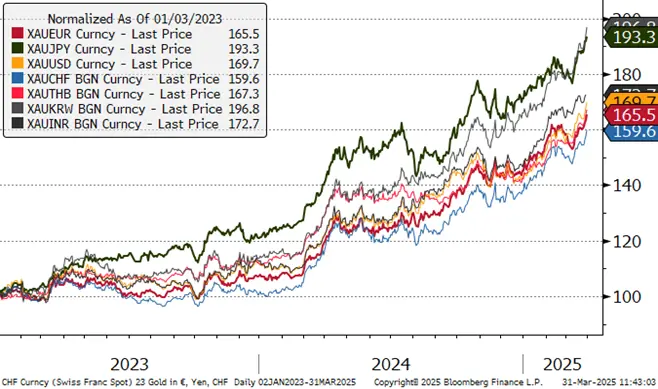

Gold in key local currencies

Source: Bloomberg, StoneX

Silver, January 2024 to date; challenging the upper band of the channel at 34.4

Source: Bloomberg, StoneX

Gold:silver ratio, January 2024 to-date; Europe, China weighing on silver

Source: Bloomberg, StoneX

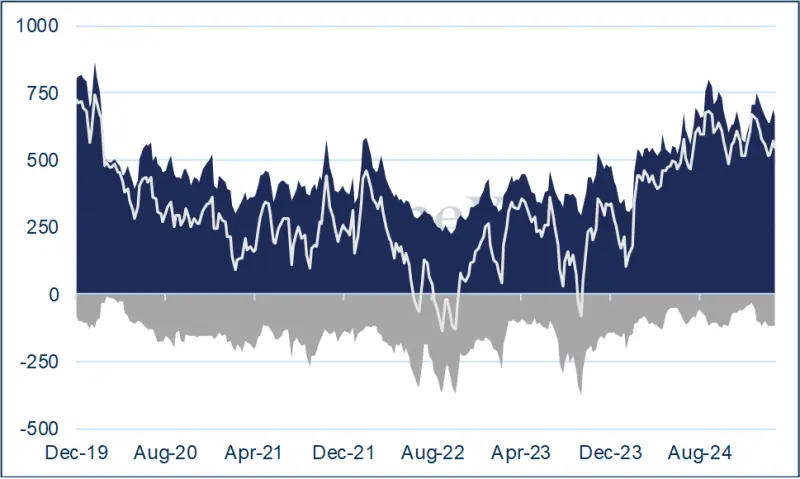

CFTC: gold’s gentle correction in mid-March was alongside light profit-taking in the longs and a small increase in shorts (23t off the longs, five tonnes into the shorts); during the period gold had risen from $3,001 to $3,057 and then declined to $3,022. The final standings on 25th March were 664t of longs (18% over the 12-month average) and 121t of shorts.

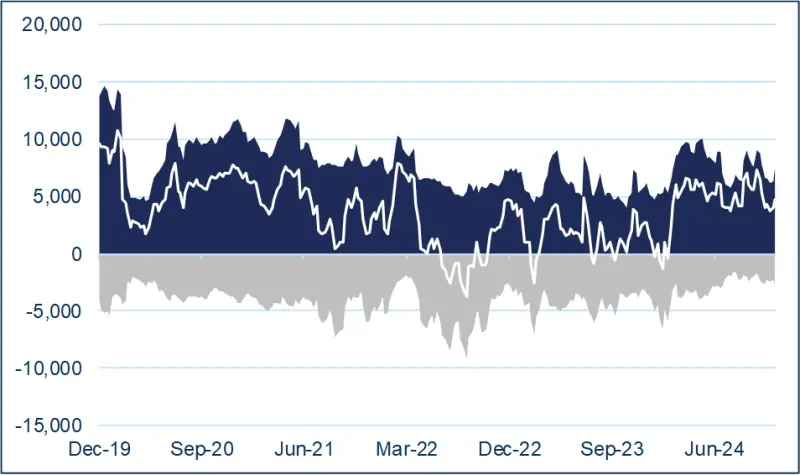

Over the same period silver slid from $34.1 to $32.7 before recovering to $33.6. the change in positioning saw outright longs drop by 5% or 466t while shorts gained 9% or 186t to 2,247t.

Gold COMEX positioning, Money Managers (t) –

COMEX Managed Money Silver Positioning (t)

Source for both charts: CFTC, StoneX

So what is the EFP and how does it work?

How does it work? Trading the EFP is a way of hedging market exposure. By buying the EFP, a holder of physical metal contracts with a counterparty to sell the physical position while simultaneously buying the futures. That way the exposure in the metal itself is unchanged, but the delivery date shifts. Some market stakeholders have been using the EFP to deliver metal into the United States ahead of 20th January to reduce the risk attached to long positions in case of tariff imposition. In our view tariffs on either metal, especially gold, are unlikely, but it is understandable that some traders – or their risk officers (as was the case during the pandemic) want to eliminate any possibility of being caught up in any fall-out.

ETFs:

Global ETF gold holdings

Gold ETFs were revitalised during February, with North America turning from net selling in December and January to a net purchase of 72t in February for a net investment of $6.8Bn. The global flows have continued into the first three weeks of March with 72t of net purchases – including 23.7 in one day.

In the year to 21st March, the flows were as follows:

Source: World Gold Council

As we noted last week, the flows in Asia just keep on coming. The scope for large increases in the region is potentially huge.

Silver is still seeing sporadic light sales but also some chunky net positive days. In March to date, Bloomberg records a net increase of 163t; year-to-date, till in the red, with a small reduction of 65t to 22,211t.

Global mine production is ~26,000t.

Source: Bloomberg, StoneX