Sep 2024

Sep 2024

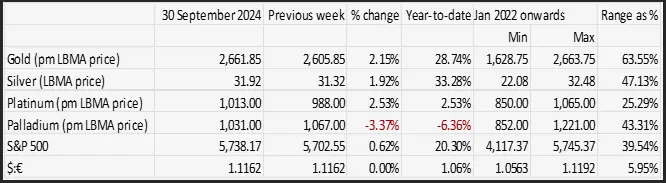

Gold and Silver Markets: New Highs, Corrections, and Key Insights for Investors

By Rhona O'Connell, Head of Market Analysis

- More new highs for gold, but now starting a much-needed correction

- Support offered between $2,505 and $2,620 from the key moving averages

- COMEX outright longs at a 4.5-year high last Tuesday. Too high!

- Shorts up 60% in the week but only to four-month highs.

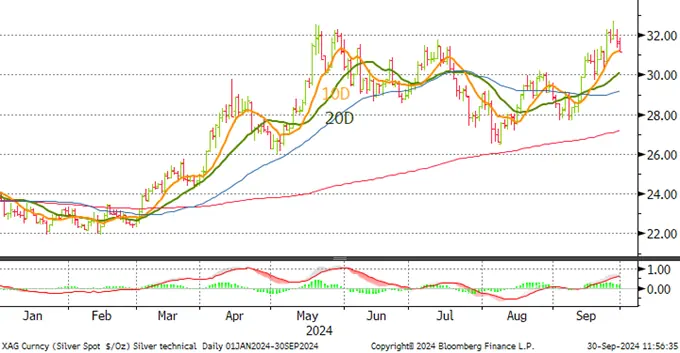

- Silver has run out of steam, not least due to some lively hedging activity

- From bottom to top in September silver gained 18% from $27.7, peaking at 32.7

- The correction has taken it down to $31.0, unwinding 34% of the move

- The ratio bottomed out at 82.8 on 24th September and is working towards 85.0

- China starts its week-long National Holiday on 1st October after a strong run in the CSI 300 has unwound all of the year’s losses in just one week. Is this good for gold purchases, which have been flat while consumer confidence has remained low?

- Gold State of Play: a Cheat Sheet

Outlook; with geopolitical tensions worsening and amid continuing uncertainty over the Fed’s likely chosen path, the tailwinds for gold continue to exceed the headwinds and there is still plenty of upside scope. Still the long-side speculators keep coming and this must make an overbought market subject to a short-term correction as the CFTC numbers (below) demonstrate. Silver is similar, despite the price retreat, in terms of very heavy outright longs – but with shorts also on the rise.

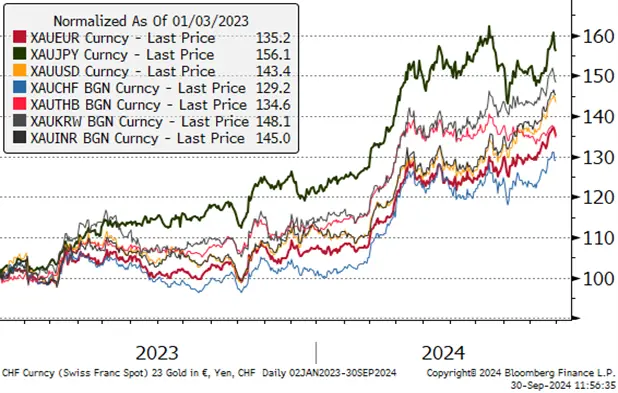

Gold in key local currencies

Source: Bloomberg, StoneX

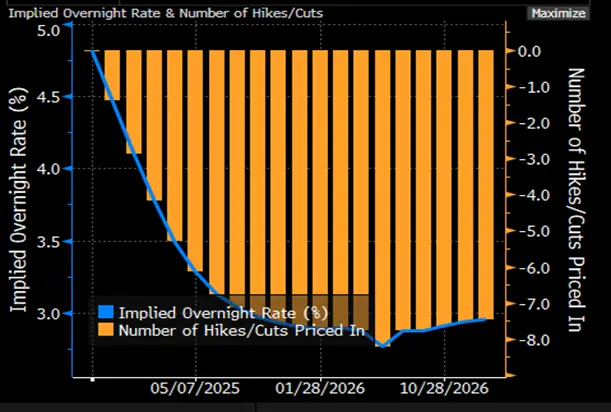

Now that the Fed’s September meeting has come and gone, one might have hoped, after all the preliminary hype, that the dust would, for once, settle. Not a bit of it. Uncertianty is rife about whether the Fed will cut rates in November and by how much; the added frisson of the election just around the corner – and ahead of the Fed meeting by just 24 hours. The swaps market is pricing in a 50-point cut in both the November and December meetings. Even though the bond markets are almost always more benign than the Fed’s indications and indeed its actions, even this seems to be somewhat aggressive and so, like the Fed, we need to turn to the economic numbers to try and gauge the likeliest profile.

Last week saw a raft of US economic numbers; consumer confidence (Conference Board) came in below 100 (100 is neutral) with expectations weakening to 81.8.

On the upside, durable goods orders were better than expected and ahead of the previous month, housing appeared to be stable and while the labour market continued to cool it does not look like a deterioration; and the University of Michigan Survey was relatively robust with expectations at 74.4, with the one-year and five-year inflation expectations at 2.7% and 3.1%. Contrasting with these encouraging numbers were personal consumption at 2.8%, personal income was, at 0.2%, was half the expectation level and down from 0.3%. The Personal Consumption Expenditure index (PCE), one of the key parameters monitored by the Fed, was 2.9% year-on-year, although the core index, to which the Fed pays even more attention, was much better contained, at 2.3%. A key element that boosted the headline PCE was the Services Sector, notably housing, both overall and in the imputed rental levels of owner-occupied housing.

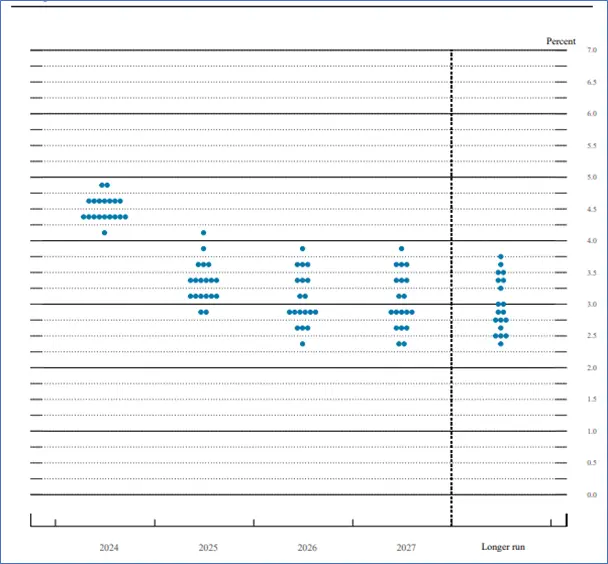

Dot Plot September

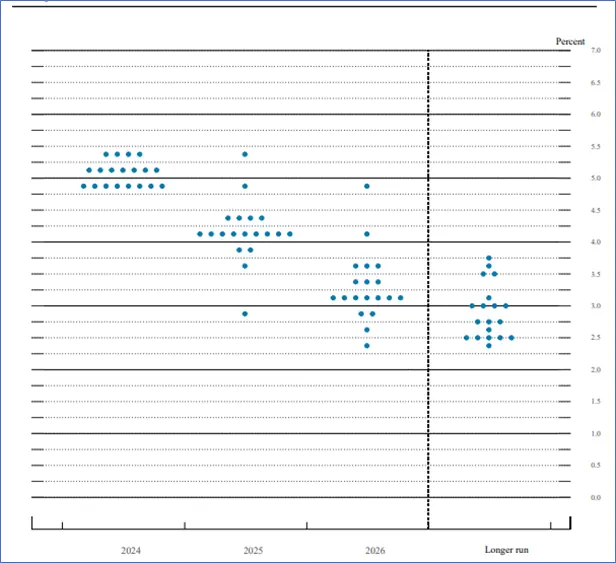

Dot plot June

This week will shed further light on the situation, with NonFarm Payrolls due on Friday. The headline number is forecast at +145k, following 142k in August, which was below market expectations. The July number had also been revised downwards to +89k and a few weeks prior to that there was a huge downward revision of 818,000 in the year to March 2024.

On that basis, therefore, while the market will watch PCE closely the reaction is likely to be cautious and any revision will be keenly regarded also.

Meanwhile on the other side of the world the Chinese equity markets, ahead of their week-long holiday that starts on Tuesday 1st October, have been really buoyant following the heavy stimulus programmes announced by the Government last week. As our chief China analyst notes, statistics show that it took four months for a substantive improvement in Chinese consumer confidence after the Government announced its stimulus programme in the wake of the Global Financial Crisis of 2007/2008. For the past few weeks Chinese retail demand for gold jewellery has been flat on its back although there has been some interest in coins and bars from an investment perspective. It remains to be seen how quickly consumer confidence starts to seep back into the market and next week’s holiday is likely to be far too soon, but if there is a resurgence in interest, that can be taken as a positive grass roots sign.

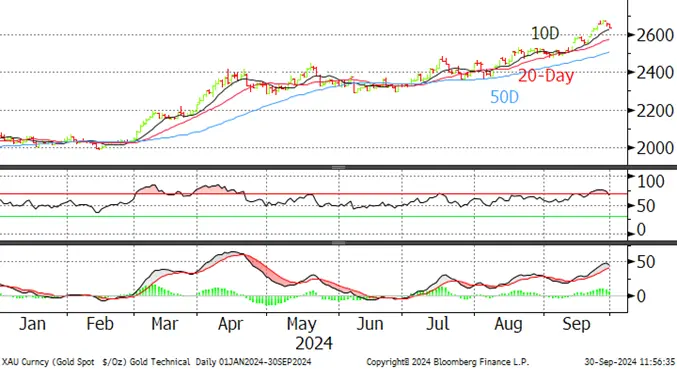

Gold, year-to-date; technical indicators supportive

Source: Bloomberg, StoneX

Silver, year-to-date; technical indicators positive; the 10D average currently providing support

Source: Bloomberg, StoneX

Gold:silver ratio, year-to-date

Source: Bloomberg, StoneX

The swaps market is pricing in two more 50-point cuts – one in November and one in December. As usual, more benign than the Fed

Source: Bloomberg

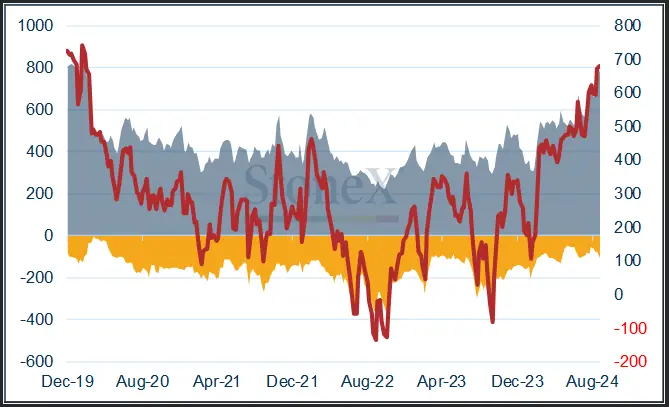

COMEX

Gold; too optimistic? Longs continued their onward march, rising 45t or 7%, shorts up 12% (7t) in the week to 24thSeptember, to 798t, which is 72% higher than the twelve-month average and the highest since 3rd March 2020. The bears are joining swords with the bulls, with outright shorts up by 60% to 116t, the largest since late May 2024. Net long;681t, the highest, unsurprisingly, also since 3rd March 2020.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

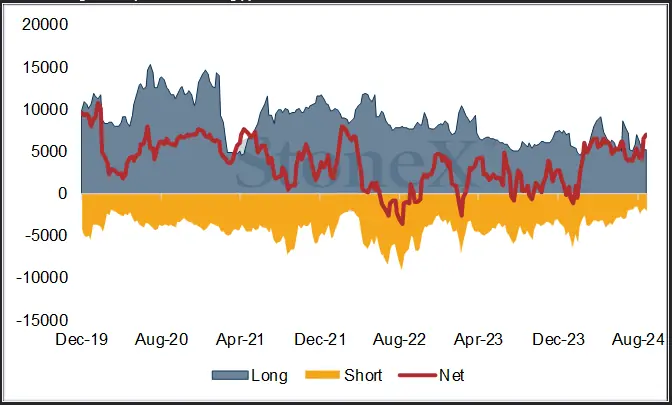

Silver; also still over-exuberant through to last Tuesday, but the reversal is likely to have seen some of that taken away since then. Longs gained 13% in the week to 24th, adding 823t to 9,034t. This, too, is way above the twelve-month average, at 32% over the top. Shorts gained 11% (24t) to 2,025t, which is below the levels of early September and only 57% of the twelve-month average. Net long 7,009t and twice the average of 3,391t.

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

ETFs:

Gold ETFs have been mixed over September, with twelve days of net creations for a total of 20 trading days through to the 29th. Net gain; 20.5t for a year-to-date total loss of just 23t or 0.7%. Silver ETFs saw ten days of new additions for a gain of 313t (1.4%) to 22,421t. This gives a year to-date gain of 651t or 3.0t. Global mine production is ~26,000tpa.

Source: Bloomberg, StoneX

Tailwinds for gold exceed the headwinds

For the longer term, the tailwinds substantially outweigh the headwinds and are summarised in this note that we published at the end of August: Precious Metals Talking points 083024: Gold: state of play and key influences going forward

Key points from this note are still relevant, and as follows

Current tailwinds include: -

- Geopolitical risk – not just the overt international tensions (Ukraine, Middle East, potential Taiwan issues, etc) but the number of elections around the world this year, which has been generating uncertainty.

- Increasing trade tensions

- Stresses in the banking systems in the three major regions, notably in the small-to-medium sized sector, and especially exposure to property, and (in the US) Commercial Real Estate.

- Emergence of the Shadow Banking sector i.e. unregulated transactions), reminiscent of the Sub-Prime issues in 2007 that led to the Global Financial Crisis in 2008

- The equities rout of early August (now more than recovered) may be a signal not to be too complacent about equities valuations

- Continued strong Official sector purchases – not just because they are taking tonnage off the market but because of the signal that it sends to the markets because the Official Sector dislikes uncertainty

- Retail investors in Asia are chasing the market higher in the expectation of yet higher prices

- And so are some High-Net-Worth individuals, Family offices and other professionals who are back in the market for the long haul.

Headwinds:

- Reduction in international political or trade tensions; Harris more of a bearish influence than Trump on this score

- Any strong inflationary forces and / or associated expectation thereof could force a reversal in monetary policy

- Official sector going on the retreat (unlikely)

- Investors’ conclusion that risks have declined (likely to take a matter of years, compare GFC of 2008); it wasn’t until 2013 that professionals bailed out of gold (over 300t of ETF metal went straight into private hands in China)