Sep 2024

Sep 2024

Gold and Silver Markets: A Two-Week Consolidation Overview

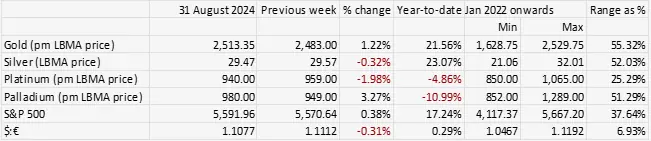

- Gold spends the fortnight consolidating just above $2,500

- This was needed after the run to new highs and overbought territory

- Silver, meanwhile, after its sharper rally, has retreated from $30 towards $28

- Central Bank policy has been the chief area of interest, in all the major regions

- Gold ETFs are rising, while silver is mixed

- Gold State of Play: a Cheat Sheet

Outlook; gold’s tailwinds remain stronger than the headwinds for professional investors. The price-elastic markets in Asia are mixed; there has been some light resale but in other areas there is some fresh interest in expectation of higher prices yet. Silver is still wary of economic activity and, as we cautioned a fortnight ago, gold’s loss of momentum has led to silver underperforming in the short term; fresh strength will need a renewed bull run in gold. So now we await the US labour market numbers, and the FOMC and the European Central Bank.

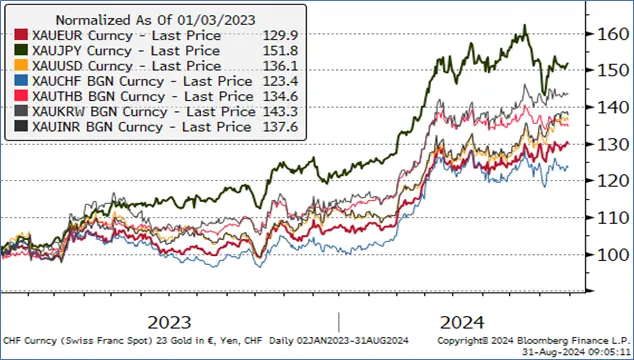

Gold in key local currencies

Source: Bloomberg, StoneX

It's all about monetary policy, at the professional level. At Jackson Hole, Fed Chair Powell made several key points, of which the two most important were

“The time has come for policy to adjust”

And

“We do not seek or welcome further cooling in labor market conditions.”

Since then the latest US inflation figures were just below expectations, with the Personal Consumption Expenditure (one of the key elements that guide Fed policy) at 2.5% Y/Y with the core index at 2.6% Y/Y. While at first glance these figures are clearly still well above the 2% target, the so-far benign evolution of the inflationary forces in the States mean that the Fed is now shifting its emphasis to the labour market. The Fed, of course, looks at the economy as a whole in order to fulfil the dual mandate (inflation, employment).

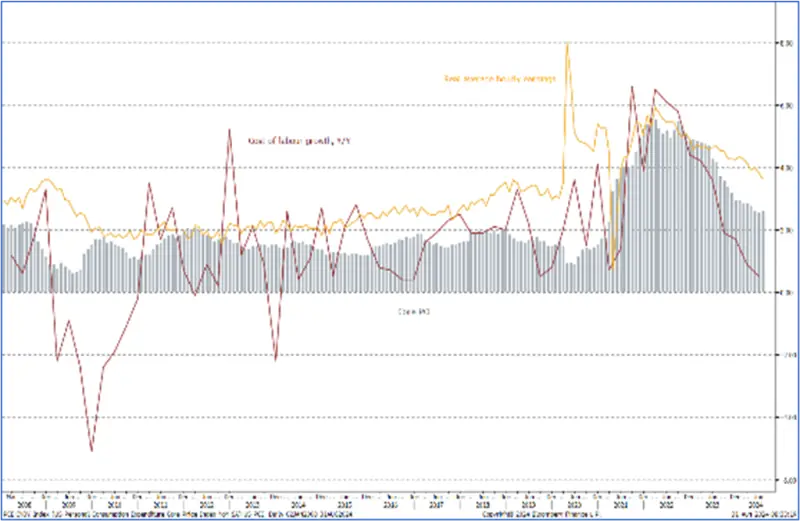

US PCE

Source: Bloomberg, StoneX

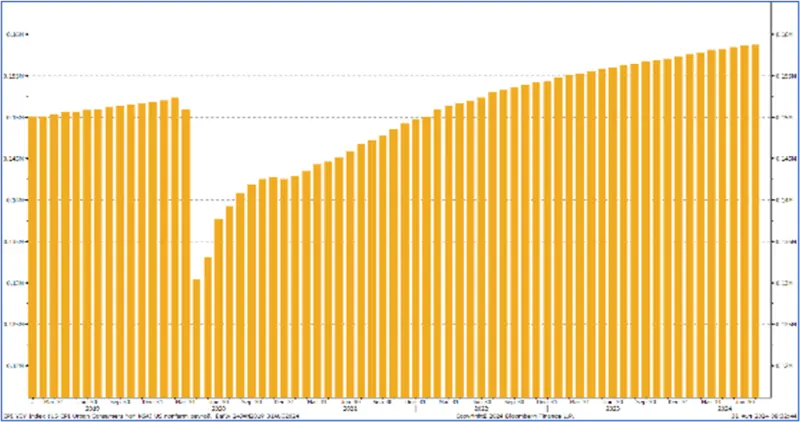

US NonFarm Payroll

Source: Bloomberg, StoneX;

This means that next Friday’s NonFarm Payroll figures will be key ahead of the Fed’s important meeting on 17/18th. Here too it should be emphasised that one set of data points taken in isolation is not how the Fed operates, but this time the numbers will be important as they will give a guide as to whether the recent slowing in the labour market has been a gradual easing or a more serious deterioration. One point to bear in mind is that the unemployment rate, last at 4.3%, is not so much a function of falling outright employment, but by increasing numbers of people seeking work as the post-pandemic household savings run-off, certainly among the less well-off, has now unwound, and this is augmented by immigration.

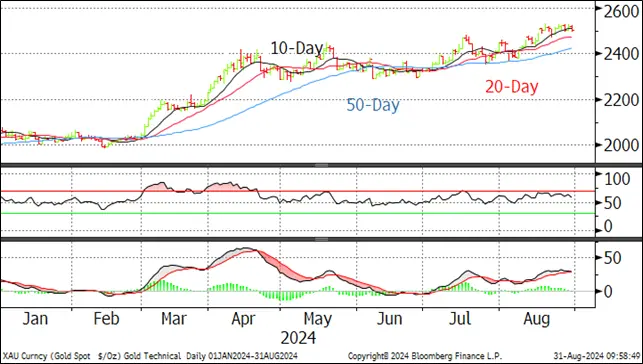

Gold, year-to-date; technical indicators neutral

Source: Bloomberg, StoneX

Silver, year-to-date; technical indicators

Source: Bloomberg, StoneX

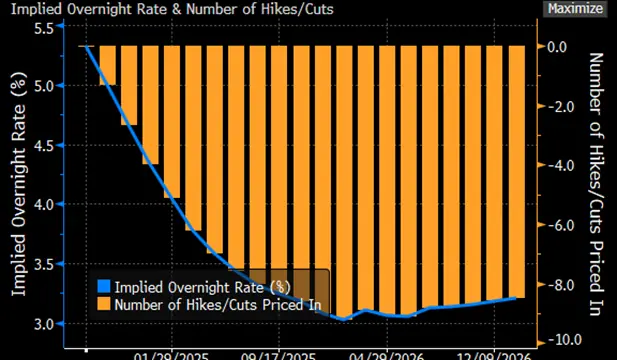

The swaps market is evenly balance between expecting a 25-point or a 50-point cut at the September meeting.

Source: Bloomberg

A 25-point cut would likely be supportive for gold in the short term while a 50-point hike would potentially put some near-term pressure on the market.

Meanwhile the substantial undershooting in inflation in the EU as a whole, notably in Germany, Spain and France, may also suggest a second cut from the European Central Bank at its 12th September meeting. Arguing against this, though, is the caution expressed at Jackson Hole by the ECB’s Chief Economist Philip Lane, and also by the fact tat a major component in the reduced inflation rates was lower energy prices. As energy can be particularly volatile, especially given the tensions in the Middle East, this may stay the ECB’s hand.

Tailwinds for gold exceed the headwinds

For the longer term, the tailwinds substantially outweigh the headwinds and are summarised in this note that we published at the end of last week: Precious Metals Talking points 083024: Gold: state of play and key influences going forward

Key points from this note are as follows

Current tailwinds include: -

- Geopolitical risk – not just the overt international tensions (Ukraine, Middle East, potential Taiwan issues, etc) but the number of elections around the world this year, which has been generating uncertainty.

- Increasing trade tensions

- Stresses in the banking systems in the three major regions, notably in the small-to-medium sized sector, and especially exposure to property, and (in the US) Commercial Real Estate.

- Emergence of the Shadow Banking sector i.e. unregulated transactions), reminiscent of the Sub-Prime issues in 2007 that led to the Global Financial Crisis in 2008

- The equities rout of early August (now more than recovered) may be a signal not to be too complacent about equities valuations

- Continued strong Official sector purchases – not just because they are taking tonnage off the market but because of the signal that it sends to the markets because the Official Sector dislikes uncertainty

- Retail investors in Asia are chasing the market higher in the expectation of yet higher prices

- And so are some High-Net-Worth individuals, Family offices and other professionals who are back in the market for the long haul.

Headwinds:

- Reduction in international political or trade tensions; Harris more of a bearish influence than Trump on this score

- Any strong inflationary forces and / or associated expectation thereof could force a reversal in monetary policy

- Official sector going on the retreat (unlikely)

- Investors’ conclusion that risks have declined (likely to take a matter of years, compare GFC of 2008); it wasn’t until 2013 that professionals bailed out of gold (over 300t of ETF metal went straight into private hands in China)

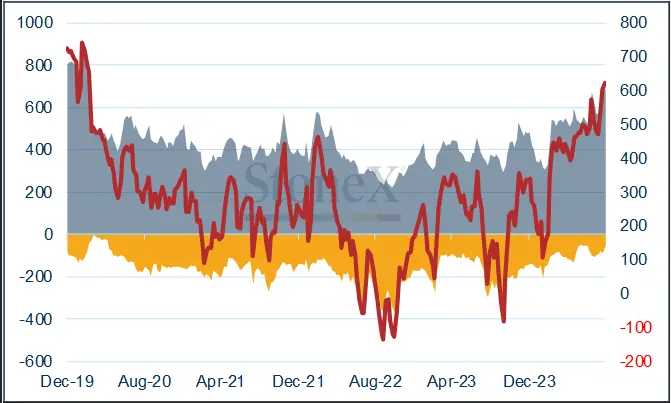

COMEX

Gold reached a new high on 20th August at $2,523 (intraday) and the market has traced out a very narrow range since, between $2,470 and $2,520. In the first week of the fortnight the outright longs ran up from 634t to 691t, then there was a small retreat to 678t. Outright shorts also increased (from 81t to 90t) and then came off quite sharply, to 545t.

This leaves the net position at +623t, with the outright longs standing at 51% above the 12-month average, which is a bit top-heavy.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

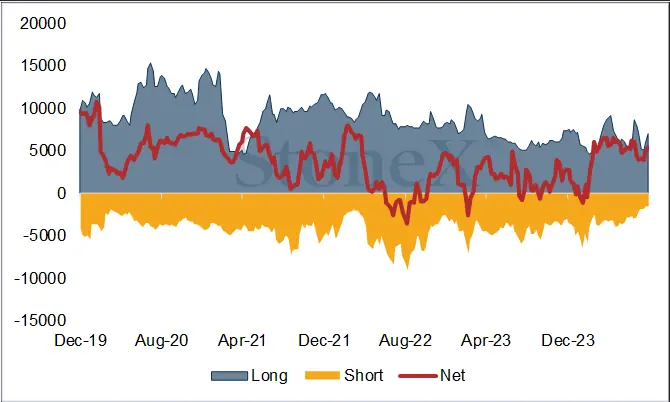

Silver’s recent high (not the outright 2024 peak) of $30.2 was posted a few days after that of gold, but the subsequent retreat has taken it to $28.67 at time of writing, just above key support from the 20-day moving average, but below the 10-day and 50-day.

On COMEX silver took a different course from gold, with outright longs increasing in both weeks to add 1,143t or 20%, to 6,899t; the rally in the first week was supported by hefty short-covering from 1,939t to 1,505t and there was a very small 4t increase in the second week. At 6,899t the outright long is just 2% over the twelve-month average which may seem to be neutral, but against a small short position there is still cause for caution here.

COMEX Managed Money Silver Positioning (t)

In the ten trading days since our last note, gold ETFs have seen eight days of net creation to add 18 tonnes. The mrket tone remains supportive, by comparison with the first half of the year; in late May the year-to-date losses had been 141t; now that reduction is down to 55t including an increase of 57t since the start of July.

Silver has had more mixed fortunes of late. The past ten days have been evenly split between net creation and net redemption for a 79 tonne loss, to stand at 22,252t, a year-to-date gain of 482t. Global mine production is roughly 26,000tpa.

Source: CFTC, StoneX

Source: Bloomberg, StoneX