Dec 2024

Dec 2024

Gold in neutral, as increased political risk in Europe gives support to the dollar

- Geopolitics and banking stresses remain supportive

- Shadow banking is gaining more headlines as politicians express some concern

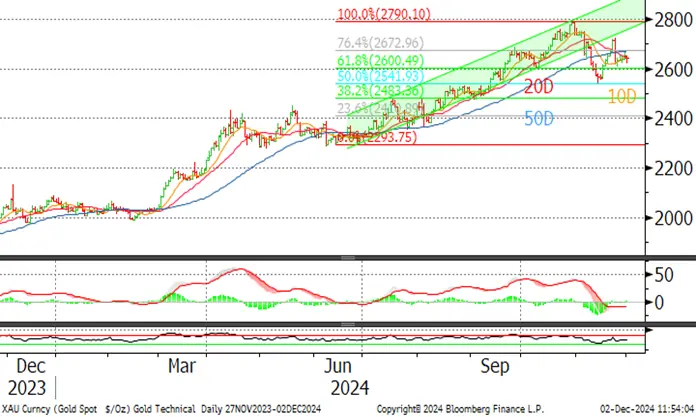

- But in the short term the technical picture has deteriorated with resistance from the 50-Day moving average tat $2,670, which is also a Fibonacci resistance level

- Economic numbers this week focus on US jobs (Friday) with the Nonfarm Payroll expected to rebound

- The Fed releases the Beige Book on Wednesday, which will give a further guide as to the FOMC decision on the 18th

- No CFTC numbers today due to Thanksgiving last Thursday

- Purchasing Managers’ Indices are due this week from Canada, France, Germany, Italy, the Eurozone overall, Japan the UK and the USA.

- France also has Industrial production numbers this week, amid a febrile political atmosphere

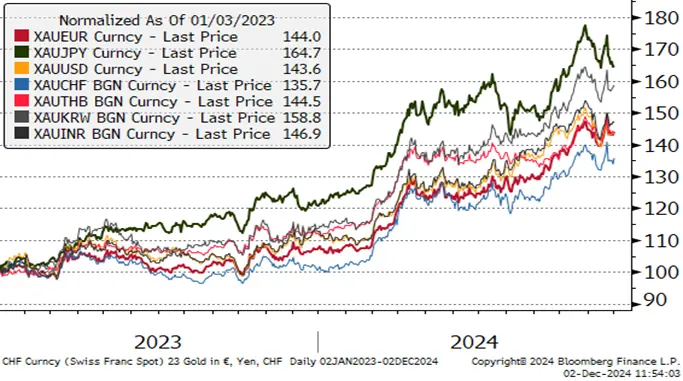

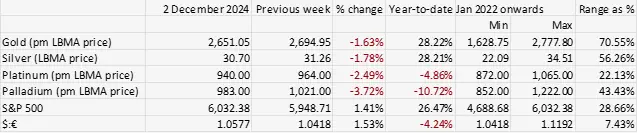

- Year-to-date gold is up 28% and silver, 27%

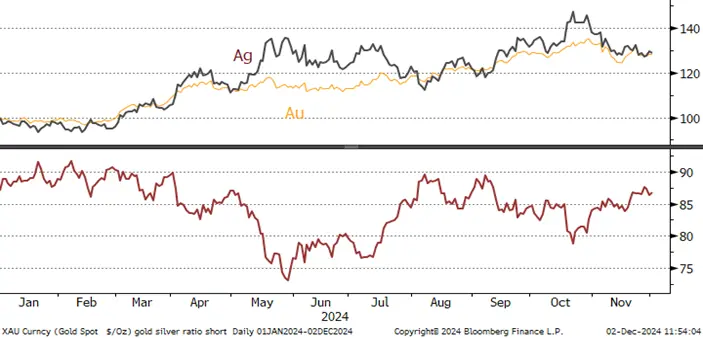

Outlook; similar to previously. The economic and political background is supportive for gold, while silver remains vulnerable in the short term to persistent economic weakness in Europe and China and the ratio between the two is likely to widen towards 90, although silver Is meeting some support at the $30 level. The longer-term outlook for “Trumponomics” is still clouded by uncertainty, but the markets are looking for the use of tariffs as a negotiating ploy with a view to weakening the dollar in the medium term.

In Europe there is a risk that the far-right party of Marine le Pen will vote with the Left-wing parties in the Assemblée Nationale this week with a view to toppling the Government of M. Barnier. The issue is the austerity budget. Since the snap elections in France (themselves brought about by unsettling European election results) the French Government has been hamstrung by a more or less even split between the three main political blocs and this has become increasingly untenable. The denouement is playing out as we write, with Mme. Le Pen challenging M. Barnier to negotiate on a range of social issues and there is a tangible risk of a no-confidence vote mid-week, which could be triggered if M. Barnier uses the “49.3” protocol to adopt the budget measures without a vote.. This is weakening the euro and favouring the dollar, which is helping to keep some pressure on gold – although the currency effect is more or less matched by the geopolitics of the situation.

Gold, one-year view; under some pressure

Source: Bloomberg, StoneX

Gold in key local currencies

Source: Bloomberg, StoneX

Silver, short-term; also under some pressure with resistance reaching up to $31.

Source: Bloomberg, StoneX

Gold:silver ratio, year-to-date

Source: Bloomberg, StoneX

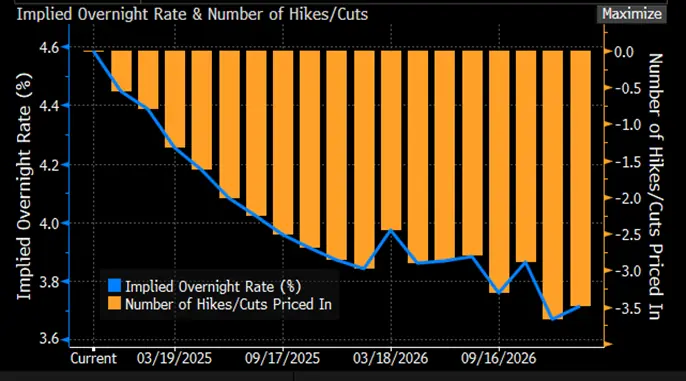

In the background:

Source: Bloomberg

The next FOMC meeting is 17-18 December; the swaps markets are now pricing in a 64% chance of a 25-point cut in the target rate at that meeting. The November Minutes were released last week, in which the Staffers noted that in “the Open Market Desk’s Survey of Primary Dealers and Survey of Market Participants, a large majority of respondents had a modal expectation of a 25 basis point cut at this meeting and another 25 basis point cut at the December meeting”, but that there was much more uncertainty for the longer term. This is understandable given the change in Administration, especially as at that time there was considerable uncertainty over the election result (the FOMC meeting itself was on the two days following the election).

On inflation and the labour market (the two prongs of the dual mandate) core PCE for September was 2.7%; last week saw the October release, which at 2.3% was as expected. The September labour market remained solid with unemployment edging down to 4.1%.

Policy interest rates came down between the September and November meetings, including Canada and the ECB, plus Colombia, Mexico, Korea, the Philippines and Thailand. In the States itself, “Market-based measures of inflation compensation moved up over the period from relatively low levels, while survey-based measures of longer-term inflation expectations were little changed. These measures continued to suggest an expectation that inflation would return over time to the Committee’s 2 percent objective”.

Interestingly, the Minutes show that banks in the October SLOOS (Senior Loan Office Opinion Survey on Bank Lending Practices) had maintained their lending standards and that, for the first survey since early 2022, standards on CRE loans for every category were not tightened, although by definition they are at the tight end of the range that has prevailed since 2005. Delinquency rates on loans to small businesses remained “modestly above” pre-pandemic levels.

Participants “noted that the slowing in these components of core inflation corroborated reports received from their business contacts that firms were more reluctant to increase prices, as consumers appeared to be more price sensitive and were increasingly seeking discounts. In this context, some noted that other factors such as waning business pricing power, the “still-restrictive” monetary policy, a broadly balanced (but mildly easing) labour market and productivity gains all militated against renewed inflationary pressures.

The sting in the tail; “In their discussion of financial stability, participants who commented noted vulnerabilities to the financial system that they assessed warranted monitoring. A couple of participants observed that the banking system was sound but that there continued to be potential risks associated with unrealized losses on bank assets”.

So on balance the meeting was constructive but not quite everything in the garden is rosy.

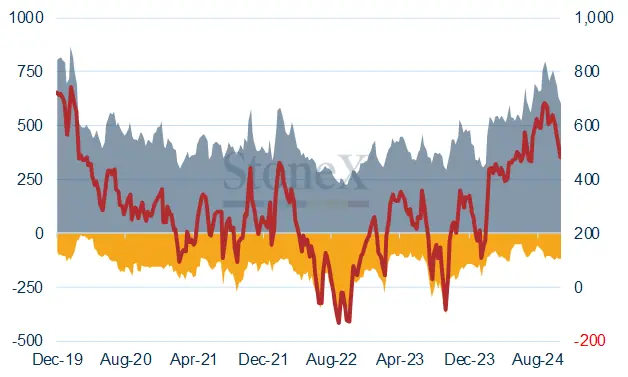

Gold COMEX positioning, Money Managers (t) – a week out of date due to Thanksgiving

Source: CFTC, StoneX

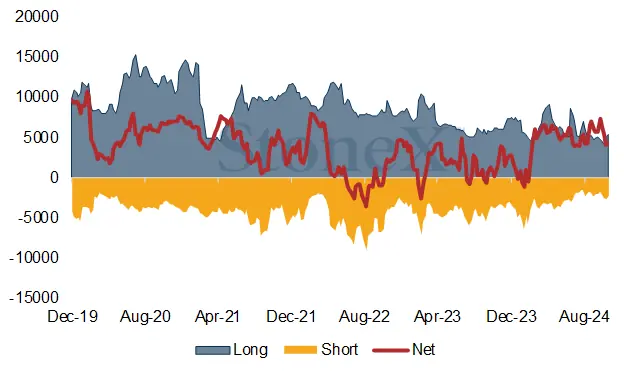

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

ETFs:

Gold ETFs on 22nd November, the most recent date from the World Gold Council, were 3,210.7t for net year-to-date gain of 3.4t, comprised as follows: North America, +10.8t, Europe, -7.1t Asi and other, both -0.1t. Some profit taking in China has taken that country into negative territory, with a 0.2t fall overall.

Bloomberg numbers from 23rd November onwards are mixed; with a net increase of 1.5t.

Silver ETFs came under steady selling pressure over November, losing 307t or 1.3%.to a total of 22,832t at month-end. Global mine production is ~26,000t.

Source: Bloomberg, StoneX

Tailwinds for gold exceed the headwinds

For the longer term, the tailwinds substantially outweigh the headwinds and are summarised in this note that we published at the end of August: Precious Metals Talking points 083024: Gold: state of play and key influences going forward

Key points from this note are still relevant, and as follows

Current tailwinds include: -

- Geopolitical risk.

- Increasing trade tensions

- Stresses in the banking systems in the three major regions, notably in the small-to-medium sized sector, and especially exposure to property, and (in the US) Commercial Real Estate.

- Emergence of the Shadow Banking sector (i.e. unregulated transactions), reminiscent of the Sub-Prime issues in 2007 that led to the Global Financial Crisis in 2008

- Continued strong Official Sector purchases – not just because they are taking tonnage off the market but because of the signal that it sends to the markets because the Official Sector dislikes uncertainty

- Widespread investor interest, notably from High-Net-Worth individuals, Family offices and other professionals who are back in the market for the long haul.

Headwinds:

- Reduction in international political or trade tensions; Scott Bessant could well be instrumental here

- Any strong inflationary forces and / or associated expectation thereof could force a reversal in monetary policy

- Official sector going on the retreat (unlikely)

- Investors’ conclusion that risks have declined (likely to take a matter of years, compare GFC of 2008); it wasn’t until 2013 that professionals bailed out of gold (over 800t of ETF metal went straight into private hands in China). In November to date the funds have list a net