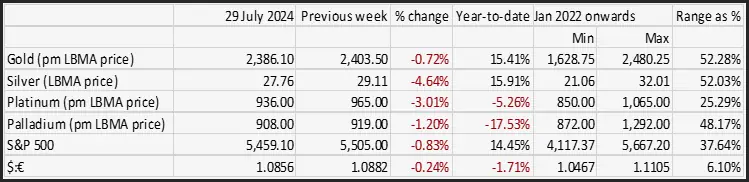

Jul 2024

Jul 2024

Gold and Silver Market Highlights: A Week of Fluctuations and Trends

By Rhona O'Connell, Head of Market Analysis

- Roller-coaster week for gold, ending unchanged

- Silver still struggling, influenced by the base sector; drops 5%

- Although silver ETFs took on a lot of metal last week

- India cuts gold and silver import tariffs; initially hits, then encourages, gold demand

- China physical gold demand is reappearing

- Gold:silver ratio back up to 85, near three-month highs

- U S politics still supportive although momentum is likely to fade a little

- Gold ETFs added 16t last week

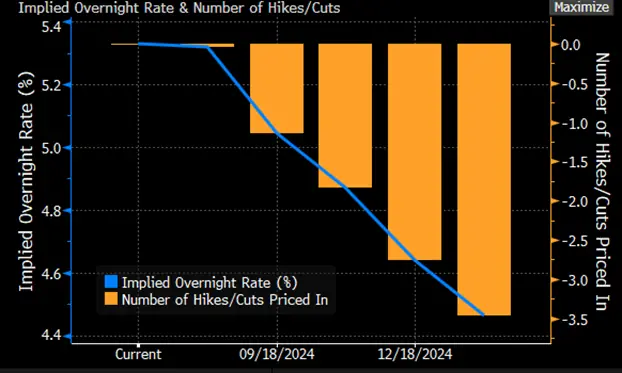

- Swaps markets now pricing in three rate cuts this year

Outlook; the overall outlook for gold remains positive on the back of geopolitics and economic uncertainty, and the evolution of the US political scene will remain supportive as a bull case can be made for both likely Presidential election outcomes. Rising Middle Eastern tensions are also supportive, but it is arguable that much of this is now priced in and we could still be marking time.

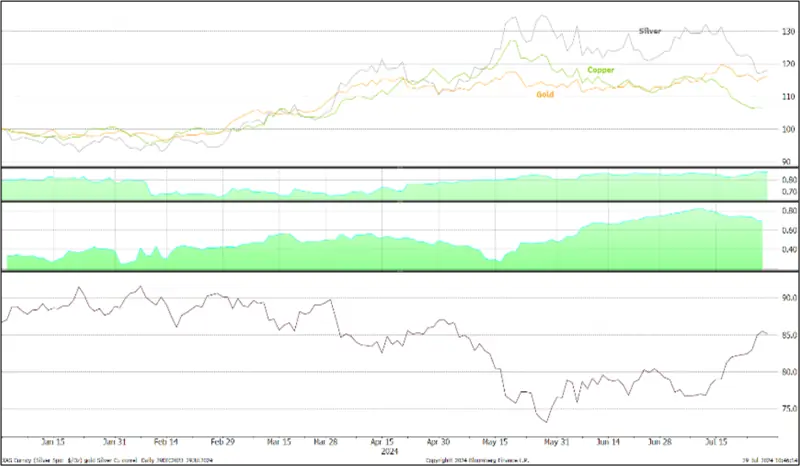

Gold, silver and the ratio, year-to-date; bullish ratio technicals

Source: Bloomberg, StoneX

After starting a fresh bull run on 26th June at $2,294 to scale new highs at $2,484 on 17th July, gold has unwound exactly half of those gains to trade at just below $2,390 as we write. There were a series of changing influences last week, all of which remain relevant. The week ended with a flourish on the back of a benign Core PCE in the United States, posting 2.6% Y/Y and 0.2% M/M, further raising expectations of a September rate cut.

On the geopolitical front, the swift gathering of Democrat support for Kamala Harris has tightened the Presidential race, although the general view is that Donald Trump will regain the White House. Congress may well be divided, which could make policy implementation difficult for either party. The revival in Democrat interest has been reflected in the fact that in just one week Kamala Harris’ campaign has raised $200M with a lot more to come, by the look of it.

For interest, here is a run-down of the most likely running mates (the first four in the list have apparently been invited to meetings this week with business leaders who are members of the “Leadership Now Project”): -

- Andy Beshear, Governor of Kentucky. 46. Strongly pro-choice and pro-union. Has felt Vance’s collar after the latter called people of Eastern Kentucky “lazy”. Kentucky is not a swing state, however, which goes against him.

- Josh Shapiro, Governor of Pennsylvania. 51. Swing State. According to Polymarket polls he is currently the favourite. Former Pennsylvania AG and made his name battling Trump over the latter’s policies and fending off Trump’s efforts to overturn the 2020 Pennsylvania election result as well as standing up to him on the issue of banning US entry from Muslim majority countries.

- Mark Kelly, Senator for Arizona. 60. Swing State. Military background, former NASA astronaut and Navy combat pilot. Could be useful on border issues. Polls better than Biden vs. Trump and has good record of winning against Trumpian opponents.

- Roy Cooper, Governor of North Carolina. 67. Republican-leaning swing state. Has successfully expanded Medicaid, pushed back against anti LGBTQ+ laws, vetoed a bill that would have banned abortion after 12 weeks. Second-favourite

- Wes Moore, Governor of Maryland. 45. Maryland’s first black Governor – which works against him given that Harris is African American. Afghan veteran, good track record in office. State expected to remain Republican.

- JB Pritzker, Governor of Illinois. 59. Democrat state, not swing. Wealthy and this could be a political drawback

- Pete Buttigieg, Secretary of Transportation. 42. Openly gay, which could affect some voters. Good press profile, effective communicator. Is from Indiana, which is a Red state and likely to stay that way.

In gold’s physical markets there are clear signs of a revival in physical interest. Firstly, the Indian Government reduced import tariffs on gold and silver from 15% to 6% in mid-week last week. Initially this saw some selling develop as holders adjusted to the new lower landed price (platinum and palladium tariffs were also reduced, from 15.5% to 6.4%). The selling did not last long, however, and after periods when domestic prices have been at a discount to international prices a premium was rapidly established.

Gold, year-to-date; technical indicators

Source: Bloomberg, StoneX

Part of the reason for this is to try and stamp out smuggling, which has long been a feature of the Indian gold market (Metals Focus believes roughly 150t found its way into India in 2023). The Reserve Bank is also standing prepared to supply gold into the domestic market if there is heavy demand as the Government is concerned about its international balance of payments. Gold is India’s second-largest import behind oil, and this is by no means the first time that the Government has been concerned about gold imports as heavy inflows undermine the rupee.

It also wipes out the recent trade in gold-platinum alloys of up to 90% gold and ~5% platinum. These were attracting a lower tariff of 5% under the Comprehensive Economic Partnership Act with the Emirates (the UAE-CEPA). Then, once imported, they were melted and cast into gold bars that were then sold with the 15% tariff equivalent illegally applied.

Further east there are signs of a revival in gold demand in China. Shanghai is now back to a premium over loco London but the market has some way to go to reverse the heavy falls in jewellery sales in the first half of this year, which according to the China Gold Council were down by 524t overall. Buying had been relatively strong in the first quarter, and this therefore implies an implosion in Q2. That said, sales of bars and coins are reportedly higher.

Silver is continuing to suffer from the overflow of weakness in the base metals markets, which are in turn reacting to China’s economic weakness and slow European economic activity, although there are some signs that Europe may be starting to bottom out. Silver is failing to rally with gold and the constant talk of overcapacity in China’s solar market, which has added substantially to silver physical demand – estimates for 2023 show solar demand of 6,017t last year, 20% of global fabrication (excluding investment) demand, could well be an influence here.

Meanwhile gold ETFs absorbed a net 16t in four days last week, taking net creations in July to 47t, reducing the year-to-date losses to 76t for holdings of 3,150t. Global mine production is ~3,750t. Silver ETFs look to have found bargain hunting as last week saw four days of net creations, for a net gain of 684t over the week, of 702t for the month to date and a year-to-date gain of 393t. Global mine production is ~25,800tpa. Technicals don’t look good either, with the moving averages in a negative formation and the MACD flashing negative since 18th July.

US Core PCE, CPI

Source: Bloomberg, StoneX

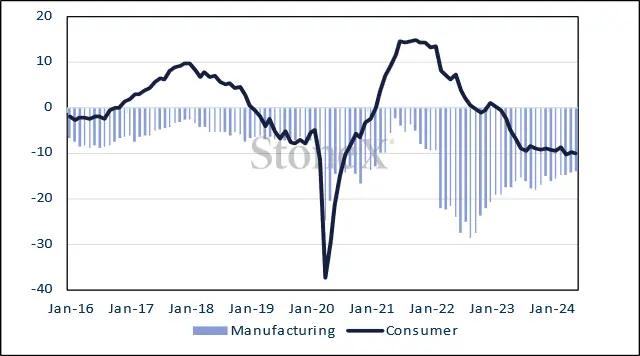

EU Confidence Measures

Source: Bloomberg, StoneX

In addition, we mentioned in the past two weeks that the gold:silver ratio’s technical indicators were becoming bullish; the 10-day moving average has now moved even further above the 20-day, which may continue to bode ill for silver.

Silver, year-to-date; technical indicators

Source: Bloomberg, StoneX

Gold, silver and copper: silver correlation with gold, 0.87; with copper, 0.69

– looser with copper this time and tighter with gold

Source: Bloomberg, StoneX

Bond markets’ expectations for the rate cycle; now looking at a 110% chance of a September cut, 65% for November and 93% of one in December to clos ethe year at 4.46%

Source: Bloomberg

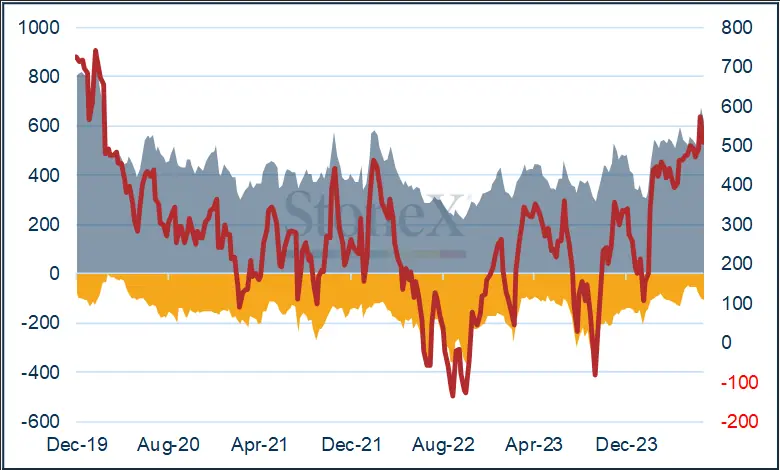

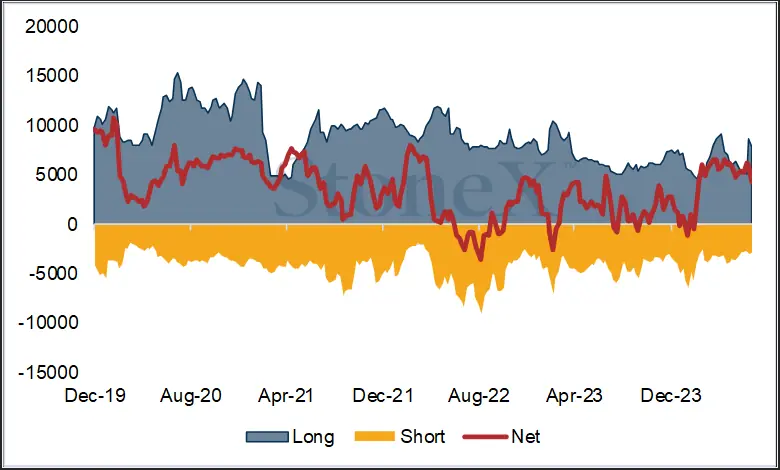

COMEX

Both gold and silver were under pressure in the week to 23rdJuly with gold falling by 2.7% to $2,401 and silver dropping 7% to finish at $29.10. Gold outright longs dropped by 9% or 58t to 615t; outright shorts expanded by 9% to 109t. Net long down from 574t to 507t. Silver outright longs fell by 21% to 1,926t and shorts contracted marginally, by 3%or 103t to 2,881t. Net long down 30% to 4,173t.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

Source: Bloomberg, StoneX