Oct 2024

Oct 2024

Gold Faces Shallow Correction as Silver Hits Highs

- A much-needed midweek correction for gold , but still only a shallow one

- Spot approached $2,800 but failed at $2,760

- Mid-week last week nearby gold was in a backwardation in the face of demand

- Gold ETF year-to-date now positive

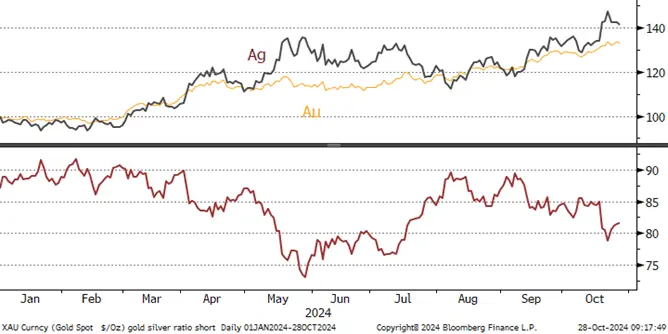

- Net silver long at 2-1/2-year highs

- Gold seems to have election-fatigue and is more concerned with the Middle East

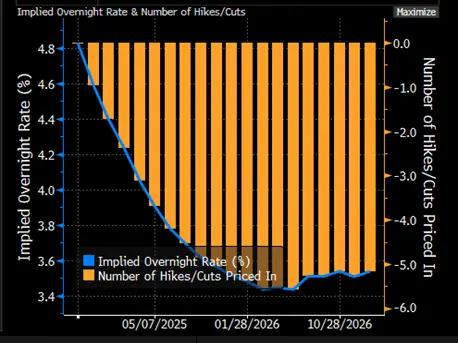

- Although the NonFarm Payroll figures (Friday) will be in focus; markets pricing in small cuts in rates

- Silver was, in the words of one of our dealers, “stupid” last week and volumes appeared to be relatively thin in the face of volatility-

- - which, of course, exacerbated that volatility

- Silver tested $35 then retreated with gold

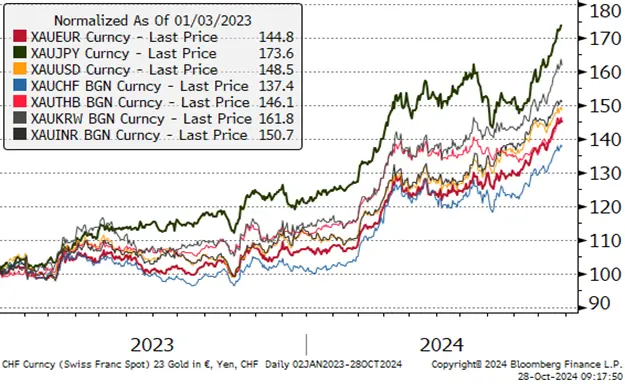

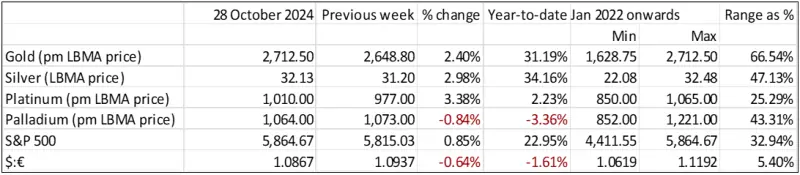

- Year-to-date gold is up 32% and silver, 41%

- US economy remains relatively robust, Europe still under a cloud

- China Gold Association reports a drying-up of local demand in the face of high prices in Q3

- COMEX gold outright longs up again in the week to last Tuesday as gold approached the peak

- COMEX silver; big jump in outright longs plus short covering fan the rally towards $35

- Diwali is this week; gold trade in India is solid but silver is dead

Outlook; gold is still in a buy-on-dips mode and while some would-be investors have been looking for dips in excess of $200, they are not appearing as others are piling into corrections. While one of the key elements of geopolitical risk this year has been the plethora of elections with over half the world’s electorate having the opportunity to vote, the uncertainty will not dissipate just because the elections are over. Policies need to be worked out and assessed. The latest development here is that the ruling LDP-Komeito coalition in Japan has just lost its Lower House majority for the first time since 2009, adding to uncertainties.

Gold in key local currencies

Source: Bloomberg, StoneX

While we noted last week that gold thrives on uncertainty and that the Presidential race was providing exactly that, it is starting to feel as if the market has election-fatigue. The next step will be to assess the outcome of next week’s election and what that will mean, both in terms of any short-term disruption and for longer-term geopolitical developments.

Meanwhile the consensus about the NonFarm Payroll numbers is that they are expected to be down month-on-month for the first time in three months, while some observers are suggesting that they will actually be negative, for the first time since December 2020. The Fed’s Beige Book, released late last week, reported declining manufacturing activity in most Districts, while reports on consumer spending were mixed.

In Europe, economic activity has yet to pick up. In Germany, for example, August industrial production was down 2.7% year-on-year. Factory orders were down 3.9% year-on-year and by 5.8% month-on-month, while Bloomberg economists are forecasting a negative GDP for Q3 for the Eurozone as a whole. This may well mean that, although the Governing Council is not keen on continued back-to-back interest rate cuts, they may find that their hand will be forced.

Meanwhile, as we have previously noted, in the physical market Diwali, the most auspicious period in the Hindu calendar for gold purchases and gifting (also celebrated by Jains, Sikhs and some Buddhists), starts with Dhanteras on 29th October, with Diwali itself celebrated on 31st October. The overall Festival runs through to 3rd November. Prospects for gold offtake are bright for the next few months, following a good monsoon season (important for crops and farmers’ gold purchases, which are an important part of the market) and what is looking like a lively wedding season in December / January. Demand has picked up and although there was some return into the rally.

In Turkey, the September CPI was 49.4% year-on-year and retail demand for gold remains very strong, with the local market commanding a very high premium. The Far East is mixed, with some buyers chasing price strength, and others selling into that strength.

Turkey; CPI, year-on-year change

Source: Bloomberg, StoneX

Gold, short-term; technical indicators still supportive

Source: Bloomberg, StoneX

Silver, year-to-date; technical indicators positive; the 10D average still providing close support

Source: Bloomberg, StoneX

Gold:silver ratio, year-to-date

Source: Bloomberg, StoneX

The swaps market has beaten a retreat and is now giving a 25 point cut in November a 97% probability and 76% of another in December

Source: Bloomberg

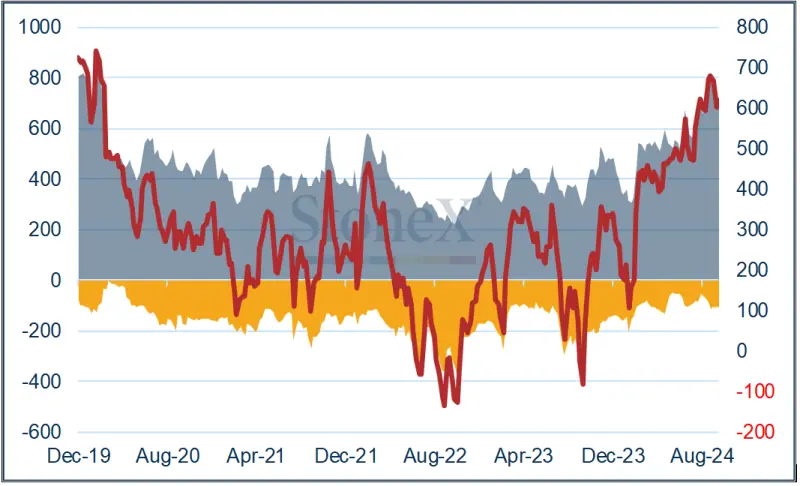

COMEX

Gold; longs still rising and still looking toppy.

Managed Money positions saw longs add 26.6t (3%) and shorts, 8.8t (8%). The outright longs at 754t are 57% higher than the 12-month average. Net long; up fractionally again to 638t.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

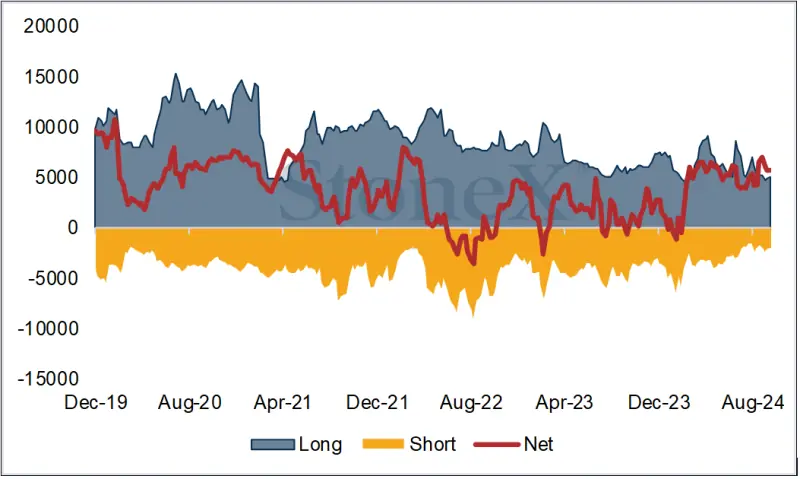

Silver; big bullish shift.

Longs added 1,370t (18%) to 9,047t to stand at 27% over the 12-month average, and at the highest level since the start of June. Shorts contracted by 1,656t (also 18%) to 7,392t. Net long up 1,745t to 7,392t, the highest since March 2022.

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

ETFs:

Gold ETFs; buyers outstripping sellers for much of October, with a month-to-date increase of 27t to 3,227t for a year-to-date gain of 2t. In the year to 18th October, World Gold Council numbers show a ytd gain of 3.1t in the States, small falls in much of Europe. China has added 32t, or 52%, to just 93t. Silver has added 680t (3%) over October-to-date, to 23,102t. This gives a year to-date gain of 1,333t or 6%. Global mine production is ~26,000tpa.

Source: Bloomberg, StoneX

Tailwinds for gold exceed the headwinds

For the longer term, the tailwinds substantially outweigh the headwinds and are summarised in this note that we published at the end of August: Precious Metals Talking points 083024: Gold: state of play and key influences going forward

Key points from this note are still relevant, and as follows

Current tailwinds include:

- Geopolitical risk.

- Increasing trade tensions

- Stresses in the banking systems in the three major regions, notably in the small-to-medium sized sector, and especially exposure to property, and (in the US) Commercial Real Estate.

- Emergence of the Shadow Banking sector (i.e. unregulated transactions), reminiscent of the Sub-Prime issues in 2007 that led to the Global Financial Crisis in 2008

- Continued strong Official Sector purchases – not just because they are taking tonnage off the market but because of the signal that it sends to the markets because the Official Sector dislikes uncertainty

- Widespread investor interest, notably from High-Net-Worth individuals, Family offices and other professionals who are back in the market for the long haul.

- Headwinds:

- Reduction in international political or trade tensions; Harris more of a bearish influence than Trump on this score

- Any strong inflationary forces and / or associated expectation thereof could force a reversal in monetary policy

- Official sector going on the retreat (unlikely)

- Investors’ conclusion that risks have declined (likely to take a matter of years, compare GFC of 2008); it wasn’t until 2013 that professionals bailed out of gold (over 800t of ETF metal went straight into private hands in China)