Nov 2024

Nov 2024

Gold and Silver Post-Election Trends: Market Movers and Volatility

By Rhona O'Connell, Head of Market Analysis

- Gold watching politics; silver has another wary eye on short term economics.

- Gold’s overall fall in the wake of the US Election result was a drop of 9%

- With HNW and Family Offices, among others, waiting for such a drop, it became well-bid, with a 7% rally to $2,720

- Until today (Monday 25th) on reports of a potential deal between Israel and Hezbollah; taking $90 off

- After a week of to and fro there is a belief that the selection of Scott Bessent as US Treasury Secretary is a positive move (and may also be feeding into gold’s retreat)

- Options expiry today; heavy open interest in calls below prevailing prices

- But not so far below as to expect much profit taking

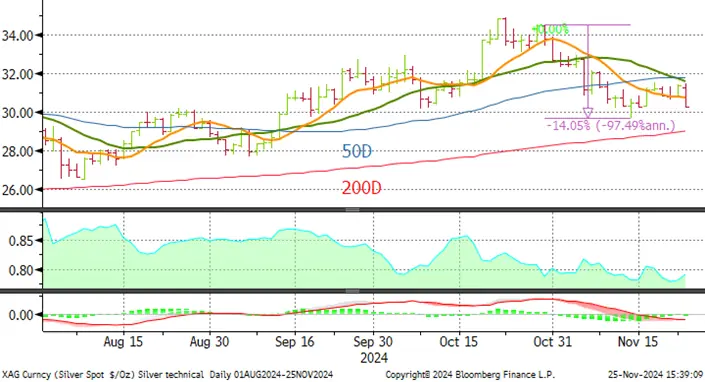

- Silver’s post-election fall was 14% ($34.5 to $29.7); subsequent rally was only 7% as European and Chinese economic malaise has remained on the silver radar

- Silver ETFs mixed, some profit taking

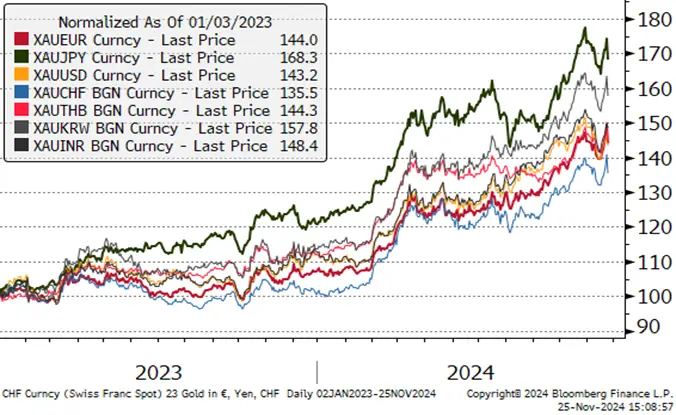

- Year-to-date gold is up 28% and silver, 27%

Outlook; gold dips are generally well-bid. The Middle East will be a key over the coming week (as will the Cabinet of the President-elect – as has been the case for the past week); gold tailwinds are still stronger than headwinds and we would expect buying into this correction. New highs certainly in the crosshairs – but not yet. Silver is slightly more cautious given the disappointment in the Chinese stimulus packages along with the problems in Europe. For the longer term, this writer is currently expecting gold to peak next year as the world hopefully becomes a nicer place….

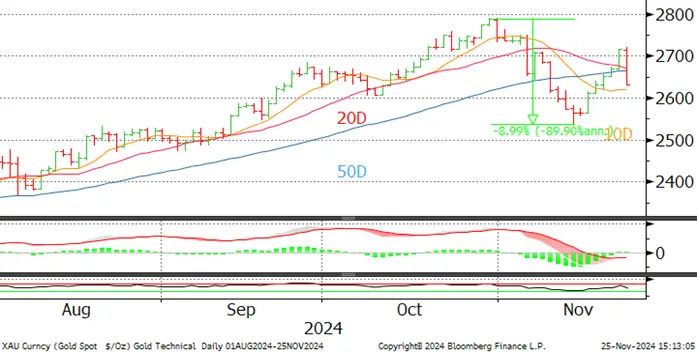

Gold, short-term; 50:20 Death cross in sight

Source: Bloomberg, StoneX

Profit taking in the gold ETFs has seen 33t come out of the funds since the start of October, although the latest figures suggest that after a 36t loss in the first twelve days of November there has been some nibbling since the 19th, responding to the start of the rally towards $2,700. In the background the markets have obviously been watching the escalation of conflict in Europe as well as the Middle East, although as already noted, the possibility of a ceasefire appears to be improving. This comes from a statement, reported in the Press, from the Israeli Ambassador to the United States, saying “we are close to a deal”. It would seem that the intensified diplomacy in the region may be bearing fruit as there are also reports of a possible ceasefire with Lebanon. The Israeli Security Cabinet is apparently due to vote on the former on Tuesday 26th.

Gold ETF holdings by region, year-to-date – buyers starting to nibble

Source: World Gold Council

Meanwhile in Washington there has been some shuttling back and forth over some of the President-Elect’s section for his Cabinet, even with some in-fighting developing last week. As we write there is an air of cautious optimism as Mr. Trump has selected Scott Bessent for Treasury Secretary. This is going down well with experts in the field with the Financial Times reporting (from the writer’s first-hand experience) that Mr Bessent has certainly got the experience and the expertise; for example he was running Gorge Soros’ office during the sterling crisis of 1992, and has extensive other experience including a keen understanding of how the intermingling of the American and Chinese economies meant that a tacit agreement was necessary in 2015 in order to avert a financial crash in China.

The FT’s reading of the current position is that tariffs would be a negotiating tool, ideally leading to accord that would involve a “co-ordinated and gradual depreciation of the dollar in exchange for a reduction in American tariffs”, which could ultimately result in a better balance in the world economy.

So it would appear that this role is to be taken by a man of experience and firm views, but not without a degree of pragmatism.

Ther are many variables here, of course, but this appointment would potentially be one of the elements that could see gold peak in 2025 before easing on the back of improved financial and geopolitical issues.

Gold in key local currencies

Source: Bloomberg, StoneX

Silver, short-term;50:20 Death Cross has already happened and currently battling with the 10D

Source: Bloomberg, StoneX

Gold:silver ratio, year-to-date

Source: Bloomberg, StoneX

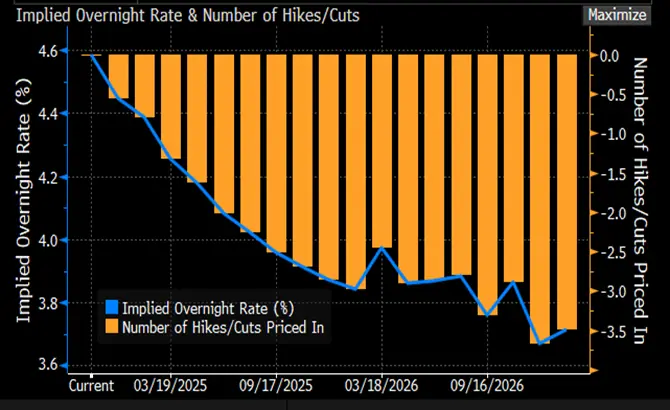

In the background:

Source: Bloomberg

The next FOMC meeting is 17-18 December; the latest swaps markets are pricing in a 60% chance of a 25-point cut in the target rate at that meeting. The November Minutes are released this week, a is the core PCE, one of the Fed’s key parameters and which is currently called at +2.2% Q/Q and 2.8% Y/Y. Meanwhile there is still disagreement between different members of the FOMC as to where the US’ neutral interest rate lies, with Chicago President Fed President Goolsbee and Governor Bowman at odds; the former thinks it is a long way below current levels, while the latter suggests that it may be closer than they think. The December FOMC meeting will produce the “Dot Plot”, in which each Committee member marks where they think the target rate will be at the end of next year and thereafter.

COMEX

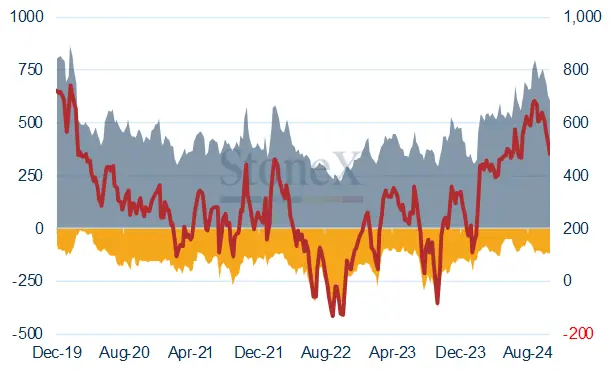

Gold; sizeable long liquidation post-election

Managed Money positions saw longs shed 82t (12%) in the fortnight to 19th November while shorts were up by 5t (4%). The outright longs at 601t are now only 21% higher than the 12-month average and at fifteen-week lows. Net long; 483t, 16-week lows.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

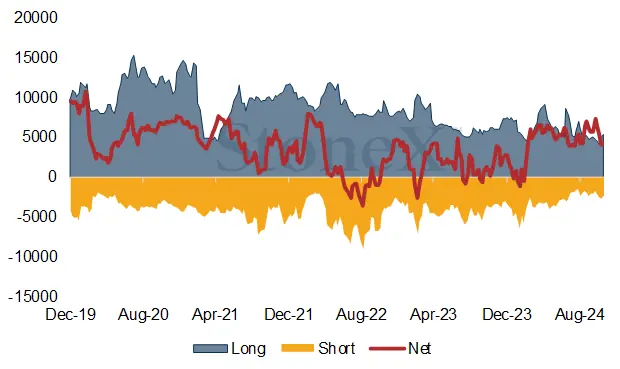

Silver; bail-out from the longs

Even stronger contraction in silver longs post-election, with a 16% drop from 7,804t to 6,544t; shorts, by contrast, also contracted, down 9% from 2,527t to 2,297t. Outright longs are now below the 12-month average (7,369t), and at their lowest since early September.

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

ETFs:

Gold ETFs; discussed above

Silver while gold has started seeing some cautious interest in the past few days, silver has seen some net redemptions of 268t (but this is only 1.2%), with only sporadic buying appearing. Latest holdings as recorded by Bloomberg are 22,870t, against global silver mine production of ~26,000t.

Source: Bloomberg, StoneX

Tailwinds for gold exceed the headwinds

For the longer term, the tailwinds substantially outweigh the headwinds and are summarised in this note that we published at the end of August: Precious Metals Talking points 083024: Gold: state of play and key influences going forward

Key points from this note are still relevant, and as follows

Current tailwinds include: -

- Geopolitical risk.

- Increasing trade tensions

- Stresses in the banking systems in the three major regions, notably in the small-to-medium sized sector, and especially exposure to property, and (in the US) Commercial Real Estate.

- Emergence of the Shadow Banking sector (i.e. unregulated transactions), reminiscent of the Sub-Prime issues in 2007 that led to the Global Financial Crisis in 2008

- Continued strong Official Sector purchases – not just because they are taking tonnage off the market but because of the signal that it sends to the markets because the Official Sector dislikes uncertainty

- Widespread investor interest, notably from High-Net-Worth individuals, Family offices and other professionals who are back in the market for the long haul.

Headwinds:

- Reduction in international political or trade tensions; Scott Bessant could well be instrumental here

- Any strong inflationary forces and / or associated expectation thereof could force a reversal in monetary policy

- Official sector going on the retreat (unlikely)

- Investors’ conclusion that risks have declined (likely to take a matter of years, compare GFC of 2008); it wasn’t until 2013 that professionals bailed out of gold (over 800t of ETF metal went straight into private hands in China). In November to date the funds have list a net