Jun 2024

Jun 2024

Gold and Silver Trends Amid Economic Uncertainty and Central Bank Sentiment

By Rhona O'Connell, Head of Market Analysis

- Gold has now been trading around a horizontal axis in a range roughly $85 either side of $2,360 with solid support between $2,280 and $2,340; spot was most recently at $2,325

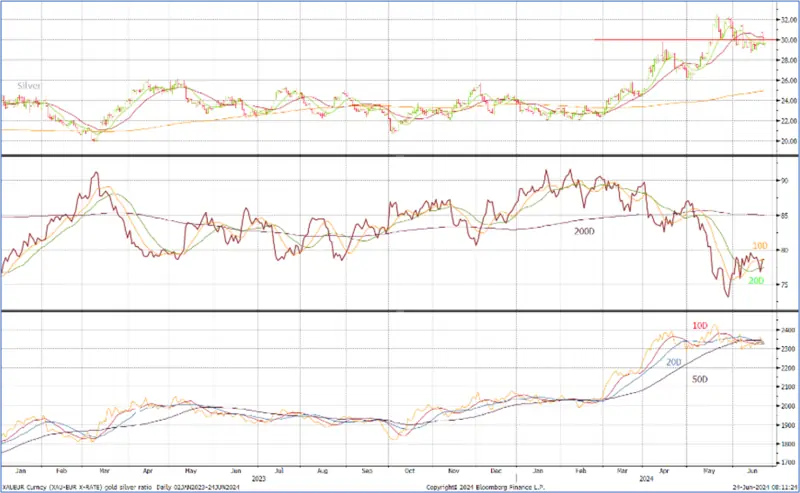

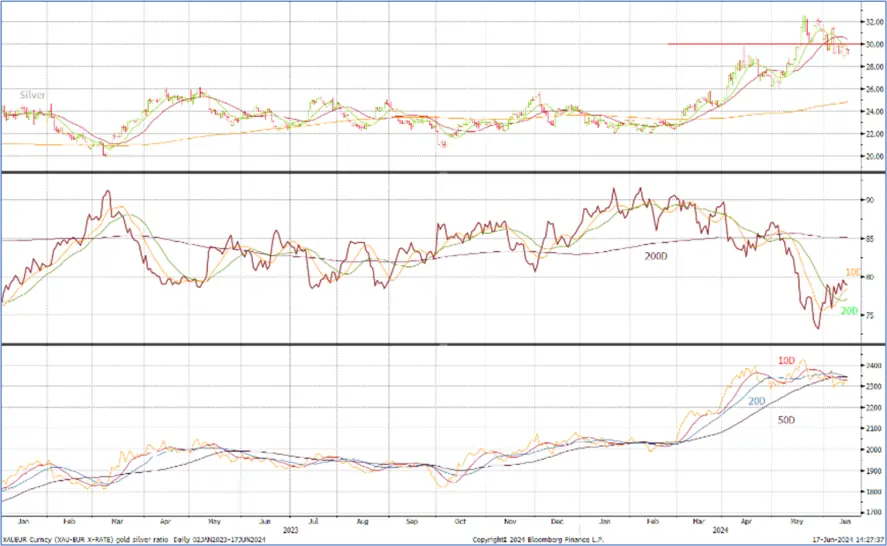

- Silver, having (as usual) outperformed to the upside, has been tracing a gradual downward course from its mid-May high of $32.52, standing last at $29.67

- Support at $29 is still proving resilient

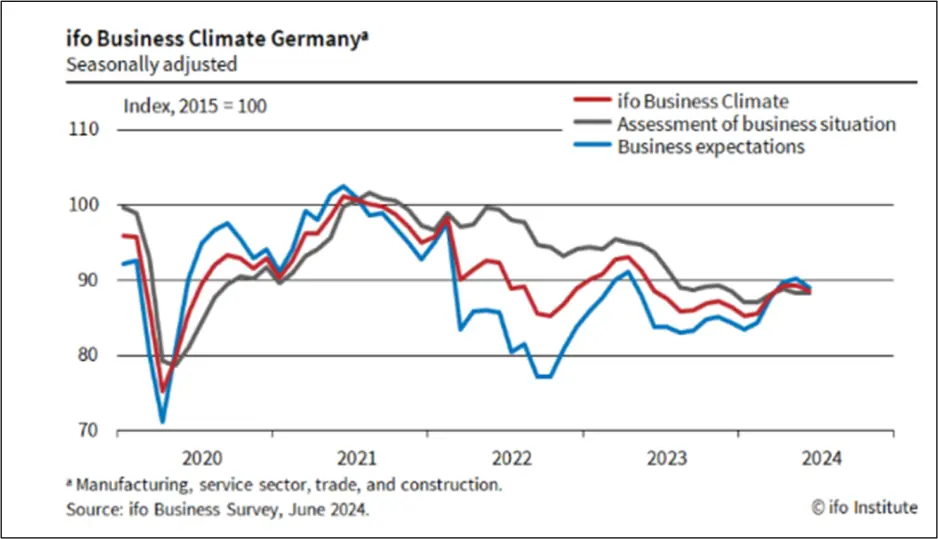

- The gold:silver ratio has been broadly steady after recovering from its dip as prices came off the top in late May, and is currently at 78, with a year-to-date average of 85

- After more unsettling economic numbers from Europe last week, this week sees a number of significant economic releases

- And several speeches from members of the Federal Open Market Committee

- World Gold Council Annual Central Bank survey shows 29% of the cohort expecting to raise reserves over the next twelve months.

- Indian Monsoon is late

Outlook; geopolitical risk continues to support gold prices, although silver has suffered a little from the easing in the base metals prices last week amid continued uncertainty over the European and Chinese economies. With the quarter-end approaching there may be some position-squaring, which could put prices under light pressure, but the fundamentals remain positive for both gold and silver overall.

Gold, silver and the ratio, January 2023-to-date

Source: Bloomberg, StoneX

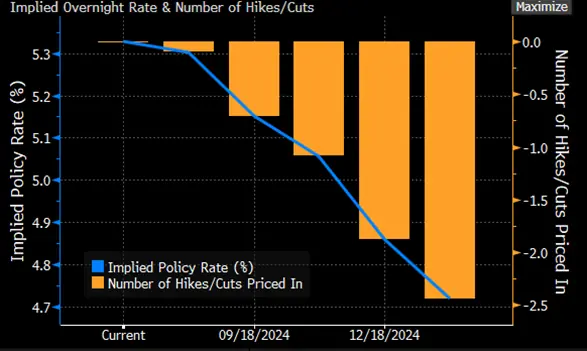

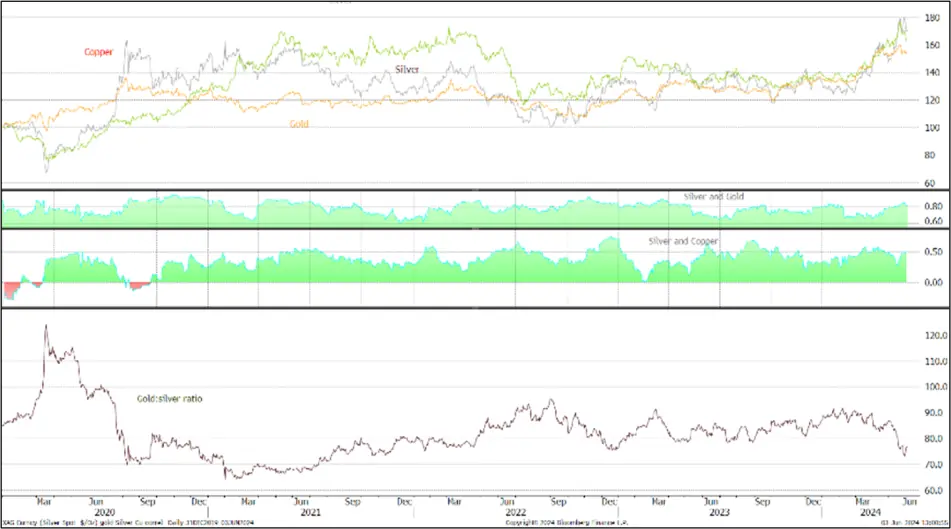

Not to put too fine a point on it, gold and silver trading patterns have been, in the words of one of our dealers last week, “boring”. The Fed ‘s attitude towards data-dependence with respect to rates policy means that we shouldn’t expect anything from them in the near future, and the fed funds markets are now ascribing a 61% probability of a rate hike in September and an 89% chance of a further cut in December; leading to an implied rate of 4.86% in December (currently 5.50%). A number of observers think that there will be only one cut this year, however, which is almost certainly contributing to the stagnation in the market.

Bond markets’ expectations for the rate cycle; now looking at a 61% chance of a September cut

Source: Bloomberg

Backing this up is the fact that the recorded daily averages for the active COMEX gold contract were 18% lower than the daily average in the first half of the month.

At the fundamental level, the Indian south-west monsoon season is late this year with precipitation reportedly down by 20% in the first half of June by comparison with the norm. This can be significant for the gold market in particular (silver to a lesser extent) as over 40% of the Indian population works in the agricultural sector and roughly 60% of the Indian population overall is dependent on it. A large number of Indian farmers have a degree of mistrust of the banking system and gold tends to be one of their first purchases after the harvest (it is no coincidence that Akshaya Tritiya and Diwali follow closely on the two harvest seasons in India) and a reduced harvest may well affect purchases. The Minimum Support Price (MSP - the minimum prices that the Government will pay farmers for their different crops) was set last week for Kharif crops for the marketing season 2024-2025 and, depending on the crop, is anything from 50% to 77% over the farmers’ costs. For the majority it is a margin of 50%.

Source: Indian Meteorological Bureau

Looking retrospectively the latest trade figures from the Swiss Federal Customs Office show a rise in net imports of gold to 61.8t, which reflects some (but not much) price-elastic selling as the price scaled new record highs. Germany and the United States were also net sellers; while this is not unusual for the States, Germany has been a net seller for the 13 of the past 15 months, for a total of 47.5t (monthly average of 3.7t). This compares with a monthly average net import into Germany of 4.9tpm from January 2021 to December 2022. China continued to take in metal with a net import of 36t, right in line with the monthly average since January 2021, while Indian net imports slowed.

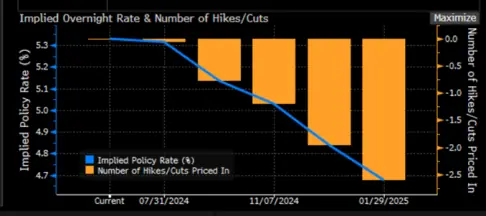

Looking to the economic and political elements surrounding the market, the Purchasing Managers’ Indices (PMI) for leading EU countries were released at the end of last week and in the main they were disappointing. For the euro area as a whole, the S&P Global PMI fell to 50.8, although at above 50, this is still in positive territory. Eurozone manufacturing, however, at 45.6 (down from 47.3) and the Manufacturing PMI Output Index, at 46.0 (from 40.3), were both at six-month lows, partly reflecting nervousness over the outcome of the French election following the European Parliament elections that saw a move to the right (but not as far as had been expected) in Germany, France and Italy. This has prompted renewed expectations for another rate cut from the ECB and the European bond markets have already priced in one further 25-point cut this year.

This week sees, inter alia, US Consumer Confidence (Tuesday), Japan retail sales, China industrial profits, Eurozone economic confidence, US durable goods, GDP (all Thursday), and France, Italy Spain CPI, US PCE Inflation (Friday).

Four US Fed Presidents are due to speak during the week.

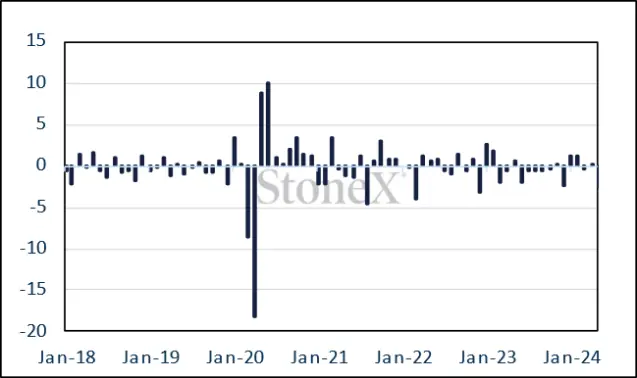

EU Consumer Confidence

China Consumer Confidence

Source: Bloomberg, StoneX

In the background the gold Exchange Traded Products went into reverse. In the first half of June (after a net gain of 8.2t in May) the gold ETFs added 4.7t, but subsequently shed 12.7t in just five days, before a sizeable increase of 7.2t last Friday 21stJune. That gives a year-to—date fall of 136.1t to 3,089.6t (world mine production is roughly 3,700tpa).

COMEX

The past week’s COMEX numbers are not yet available as last Monday was a public holiday in the States.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

Source: Bloomberg, StoneX