Jun 2025

Jun 2025

Gold & Silver ETF Inflows Amid Bullion Tariffs Wait

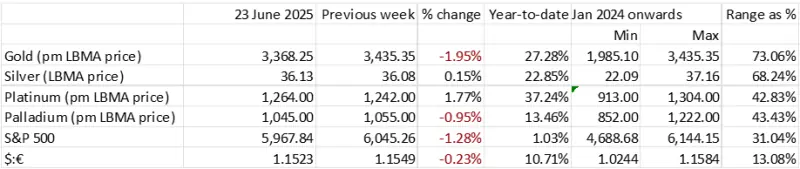

Silver (and the other white metals) plays catch-up with gold, eyeing the doubling of S.232 tariffs. This points to limited further upside in silver for now.

- Gold has been keeping to a tight range; turned a blind eye to the US attack on Iranian sites

- And this again underpins our view that the market is crowded and that the high is in

- Silver ‘s short-covering rally has lost momentum and the overbought position is unwinding

- “Bullion” is exempt from tariffs, but the markets remain jumpy; all eyes on 9th July with the markets also wating to see whether the PGM qualify as bullion for these purposes

- Gold and silver ETFs are both still enjoying fresh inflows, in good volumes in the past few days

- Caution: retail investment non-existent, solar cells currently oversupplied

- And now 49% of this year’s net ETF silver gain have come in June (1,517t ytd)

- The outcome of the Federal Reserve meeting was as expected, with rates kept on hold although there is evidence of some polarisation of views in the Committee…

- … especially after a 0.9% month-on-month drop in retail sales; vehicles particularly weak

- The G7 meeting is widely regarded as having been a non-event, especially with the early departure of president Trumpp.

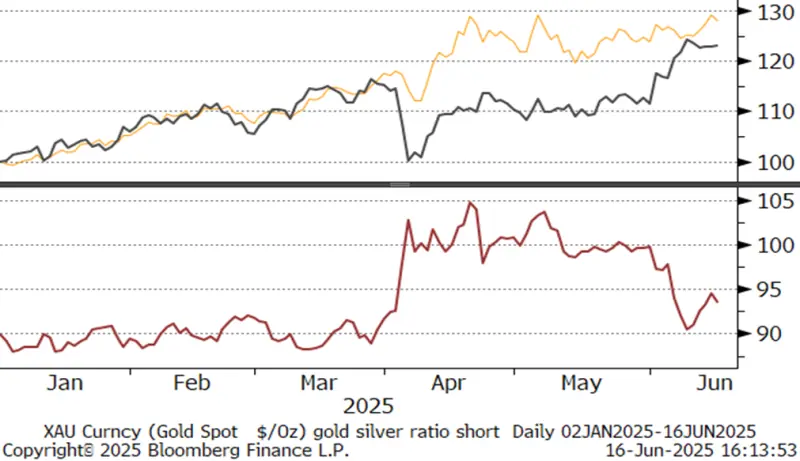

- Outlook:unchanged. The gold:silver ratio is stabilising between 91 and 95, the heightened political tensions favour gold and work against silver if they do throw up more economic headwinds. For the much longer term silver has a robust fundamental outlook but for now it has completed a 23.6% Fibonacci retracement of the 12% gain that it enjoyed in the first half of June. Gold’s reactions to notionally supportive developments, particularly this past weekend in the Middle East, are increasingly guarded, and this underpins our view that the risk premium is fully priced in for the current circumstances. Now we await the rection of Iran’s Leadership.

Comment

The end of the 90-day “pause” in US tariff implementation on Wednesday 9th July and the recent US economic numbers would tend to confirm anecdotal evidence of pre-stocking, with retail sales weak last month and vehicle sales noticeably week (retail sales excluding autos were down “only” 0.3% against the headline figure of -0.9%.

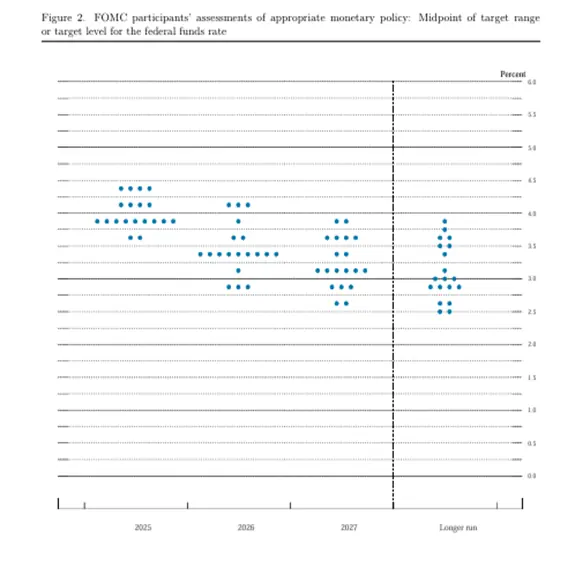

March

June

The Special Economic projections (above) show how the FOMC has shifted against imminent rate cuts, albeit that the shift is subtle. The markets continue to price in two rate cuts before year-end, although our strategists are more cautious looking for a maximum of one. Everything remains in a degree of sclerosis until 9th July – and quite possibly beyond as we don’t yet have any clarity on how any tariffs are to be priced and where they are directed.

Gold and silver are similarly somnolent, both in the professional and markets and at the retail level, with high prices continuing to deter jewellery purchases although there is still underlying interest in gold investment products. The only lively sector, for now at least, is in the ETFs.

World Gold Council annual central bank survey was released last week: key takeways

Of 73 responding central banks (58 EMDE, 15 advanced economies) 48% of EMDE countries expected to increase their reserves in the next 12 months and 29% of the advanced economies. The overall weighting of 43% is a record. None expected to reduce their holdings.

A record 95% of respondents expected overall gold reserves to increase over the coming year (81% last year).

Those who actively manage their reserves have risen from 37% last year to 44% in 2025.

Possibly one of the most interesting results is that 62% of respondents expected an increased weighting of RMB in the next five years, second behind 76% that expected higher gold reserves. This is for total reserves, not the individual banks themselves.

Only 10% expected the dollar weighting to increase and 73% expected a reduction. IMF figures show that the dollar’s weighting in FX reserves has been declining (see below).

Economic and geopolitical considerations remain at the forefront in reserve management decisions. Gold’s primary characteristics under consideration remain long-term store of value, its performance in a crisis and diversification properties.

In the main, EMDE and advanced economy nations were broadly in line, but there is a divergence in influences affecting reserve management; 84% of EMDE countries look at inflation and 81% consider geopolitics as key; but only 67% and 60% of advanced economies. Advanced nations were less interested in trade conflicts/tariffs at 40% vs 64% of EMDE’s. As far as ESG is concerned, 67% of advanced economies take it into account, but it features only with 41% of EMDE.

Gold Standard Legacy distorts official sector gold holdings

When it comes to holding gold, the largest component, with 57%, of respondents was “Our gold holdings is a historical position” as a key influence. We have looked at this several times before so I have gone through the IMF numbers afresh to see how things stand now. The exercise involves looking at gold as a percentage of gold+FX for all countries, and then to strip out those nations that have legacy holdings from having been on the gold standard. This gives us a good snapshot of how the newer countries are looking at their holdings. Clearly the change in price over the past eighteen months has raised gold as a component of reserves. The figures and charts here refer to end 2024.

It is also interesting to look at who are the larger holders, in tonnage and % terms, outside the gold standard countries; see the charts to the right. Of those countries in the upper chart, the Netherlands, Switzerland, France, Italy, Germany and the States all have legacy holdings. So too do the UK, Belgium, Portugal and Spain.

Including all reporting countries across the world, at end-2024 gold comprised 18% of gold+FX combined. Stripping out the legacy holders takes this down to 8%, which is more or less in line with what most portfolio managers would be looking at.

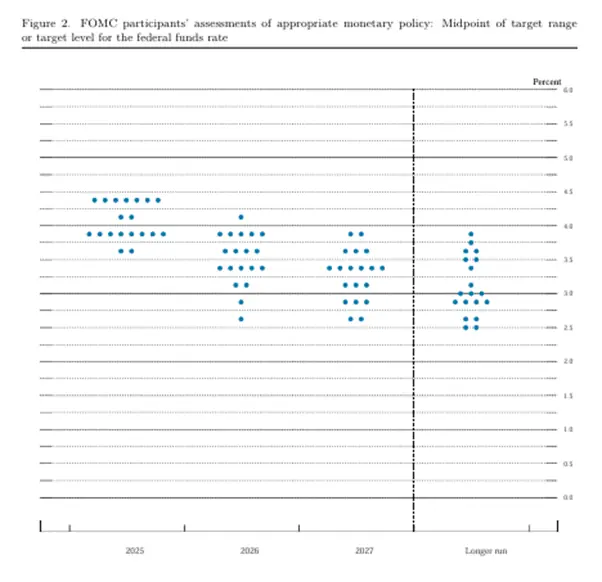

Gold, one-year view; stable, not reacting to US/Iran developments

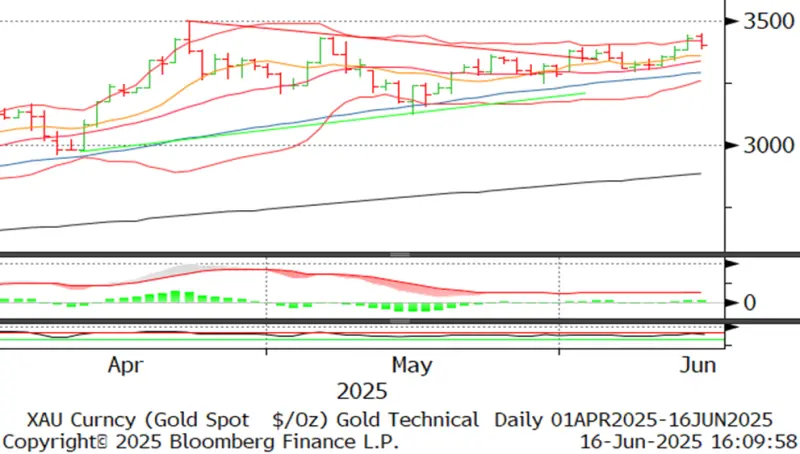

Gold:dollar correlation; high at -0.72

Source: Bloomberg, StoneX

Silver, one-year view; unwinding a massively overbought situation

Source: Bloomberg, StoneX

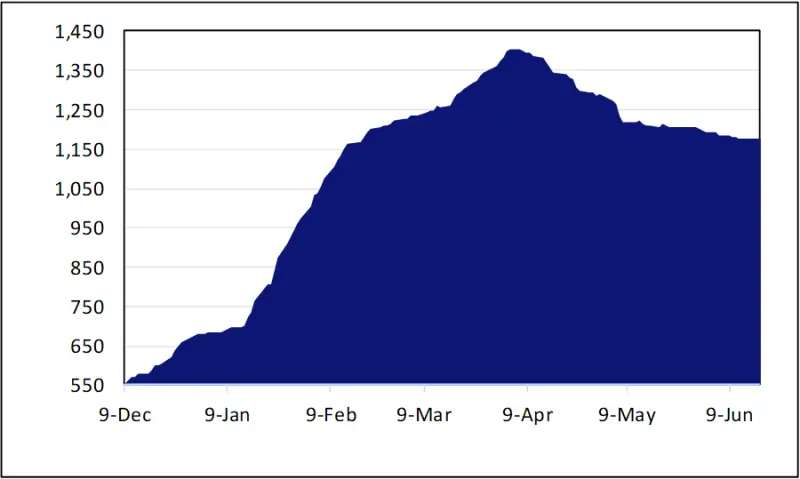

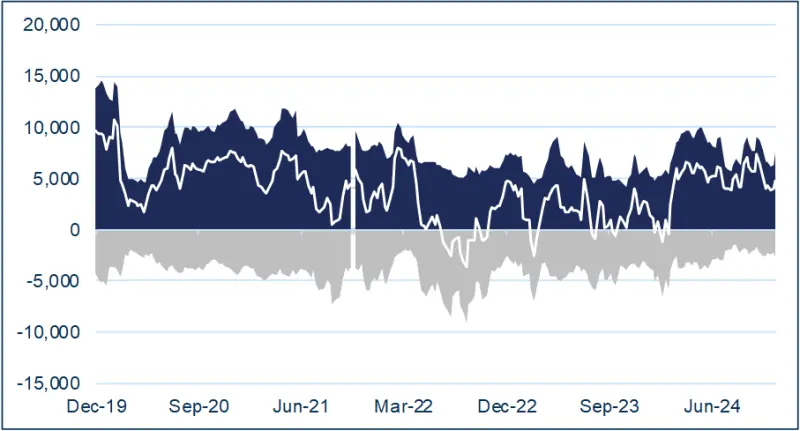

COMEX gold inventories, tonnes

Source CME via Bloomberg, StoneX

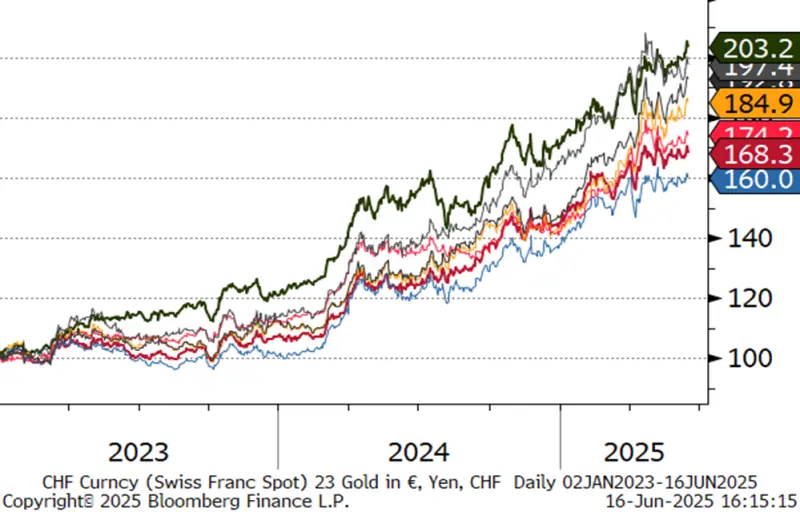

Gold in key local currencies

Source: Bloomberg, StoneX

Gold:silver ratio, January 2024 to-date; support at 90

Source: Bloomberg, StoneX

Background

The latest CFTC report is that for 10th June as last Thursday was a Public Holiday in the US.

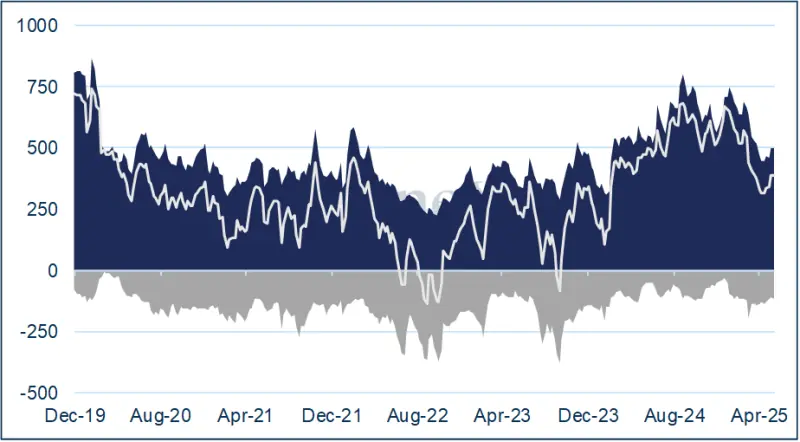

The positioning for the week to 10th June for gold(narrowly lower, at $3,323 from $3,392 via $3,292) saw very small net changes in the outright Managed Money longs – a rise of just two tonnes in longs and a reduction of less than one tonne of shorts, leaving longs at 500t (87% of the 12m average) and shorts at 114t (19% over the 12M average).

Silver prices, as noted, broke higher on 5th June; for the week as a whole they opened at $34.7, peaked at $36.9 on the 9th and finished the week at $36.5. Outright longs up just 2%, shorts down 16%. Longs now 26% above the 12M moving average and shorts; 26% below.

Gold COMEX positioning, Money Managers (t)

COMEX Managed Money Silver Positioning (t)

Source for both charts: CFTC, StoneX

ETFs: silver twelve days of net creations in the first 15 trading days of June, adding 564t (3%) and taking the year-to-date change to 1,336t. In other words, 42% of the net gain year-to-date have been in June.

Gold: the latest figures from the World Gold Council, to 13th June, show an increase of 21.7t globally, with small increases across each region. Current regional split: North America, 1.832t; Europe, 1,353t; Asia. 31t; and other, 71t. These increases were generally 0.7% of total, although Europe was just 0.5%. The Bloomberg numbers (not as comprehensive as the WGC) suggest that the following five trading says all saw net creations with a particularly large jump of17t last Friday, for an overall increase of 34t,taking the total to roughly 380t for the year to date, to roughly 3600t. Global holding of 3,572t compares with world gold mine production of 3,661t (Metals Focus figures).

Source: Bloomberg, StoneX