Oct 2025

Oct 2025

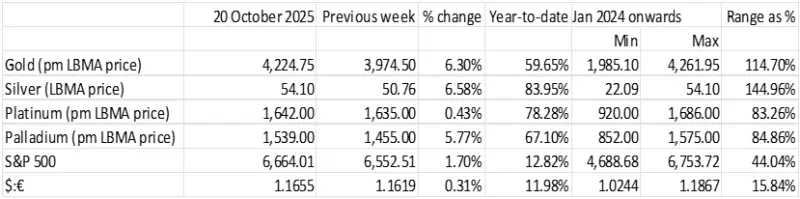

Gold & Silver Prices Surge Amid Global Uncertainty

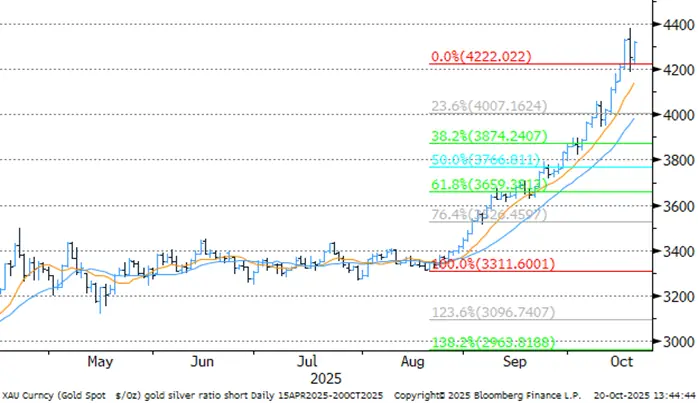

Gold clears $4,300 some loss of momentum recently - Silver topping out?

- Gold continued its exponential rise over the past fortnight, approaching $4,380 at the end of last week before retreating. It continues to catch bids, however, as geopolitical risk persists. Developments in the Middle East have been looking promising, but there is still uncertainty as to whether the seaside is holding

- Meanwhile, it looks as if Presidents Trump and Zelinskiy clashed swords (metaphorically speaking) at the end of last week

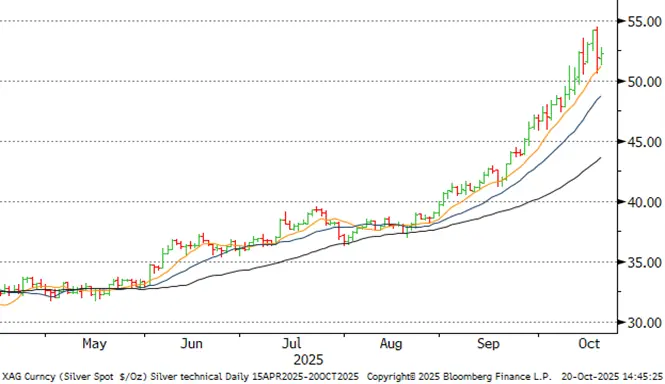

- Spor silver touched $54.48 on Friday (intraday) a record in nominal terms.

- In real terms, however, the $50 high of 21st January 1980 would equate to $207.93

- The recent volatility in the silver price may be suggesting that it is now in conflict and this could be a sign that it is topping out

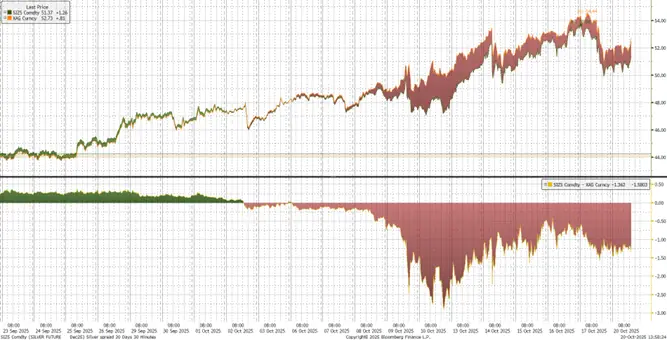

- The immense strain on the London silver market appears to have been easing slightly, although it does remain in a backwardation against the active contract on COMEX, albeit that that is much reduced

- COMEX inventories have fallen by 697t since the 3rd of October. CME vault withdrawals amounted to 404t – but it is possible, of course, that there is some overlap between these two numbers. We will not see the LBMA vaulting numbers until the fifth working day of the next month

- With the government shutdown we have not had any CFTC numbers since 23rd September.

- We are still awaiting clarification on the silver tariff position, and also on the result of the Critical Minerals Review.

- We have commented from time to time about the growth of private credit and the potential risks that this might bring into the financial sector as banks pass risk books into the private sector. This is now attracting increasing attention in the press and will remain a supportive factor for gold prices.

- Renewed volatility in the Sino-US trade environment is also supportive.

- In the physical markets, European activity in coin and bar investment has remained robust, while Turkey continues to take in gold with alacrity.

- We now start the Diwali season as of today, 20th of October. This suggests that the incredibly strong domestic gold and silver buying that we have seen over the past three to four weeks or so will start to tail off as the gold will already have been purchased, to a large extent, ahead of the gifting season.

- Diwali is widely regarded as the most auspicious day of the Hindu calendar for the giving of gold gifts, and so the recent buying momentum may slow slightly in the short term.

- We should however remember that the festival season will be followed by the wedding seasons, which is also supportive, both for gold and for silver purchases with the latter particularly in the form of silverware

- India is the world's largest consumer of silver in jewellery and silverware and the two combined typically account for 47% of the global total and roughly 11% of global silver fabrication in all forms.

- Outlook: For the much longer term, silver has a robust fundamental outlook but for now, it is starting to look as if it is topping out as the recent dislocation starts to resolve itself. Gold has been carried higher by its own momentum. The solar market remains oversupplied, but still has a constructive future, while AI and vehicle electrification will also help to keep the market in a pre-investment deficit. Gold is still pricing in concerns over Fed independence and the possibility of stagflation as well as underlying geopolitical risk and international tensions. The Fed Beige Book is pointing to further slowdowns in the US and question marks persist over the state of the labour market.

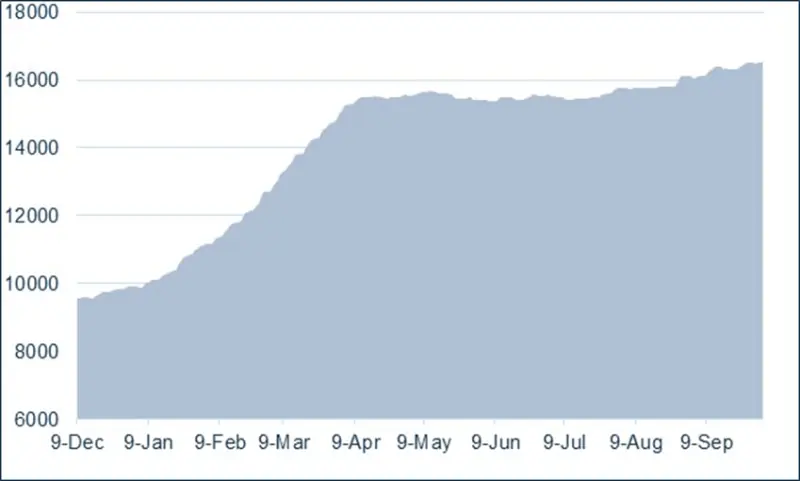

Gold, year-to-date; new records in real and nominal terms

Silver; new records – but not in real terms. Topping out?

Source: Bloomberg, StoneX

Silver easier in London- but still in backwardation against the active COMEX contract

Source: Bloomberg

To recap: - Silver inventories on COMEX are divided into registered and eligible. “Eligible” inventories are inventories in a CME-approved warehouse, not necessarily delivered onto the Exchange itself; the owners of that metal may just be using the warehouse as a secured storage space. Eligible metals may belong to a range of different market participants. The CME does not have any direct control over these inventories.

When the holder of the metal delivers it onto the Exchange, then a warehouse receipt is issued and the inventories become “registered” and can then be used for delivery against futures contracts.

The gold inventories have an additional sub-division, namely “pledged” warrants. These warrants are pledged to the Exchange as collateral, which gives CME a first priority security interest in the relevant warrants. When a clearing member initiates a pledge, the warrant status changes from “Registered” to “Pledged_PB_Pending”. When the transfer to CME is complete the status becomes “Pledged_PB”. The warrants remain registered with the Exchange. Currently 54% of COMEX inventories are registered.

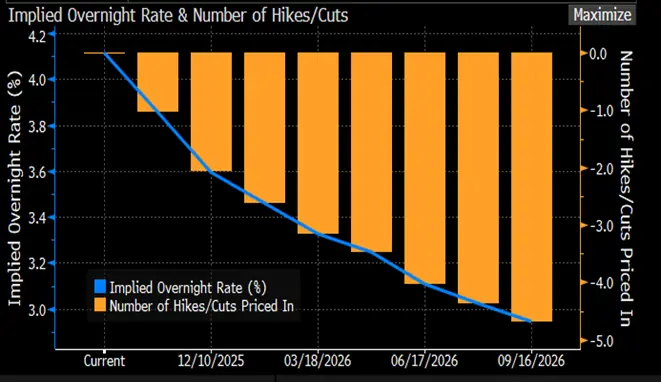

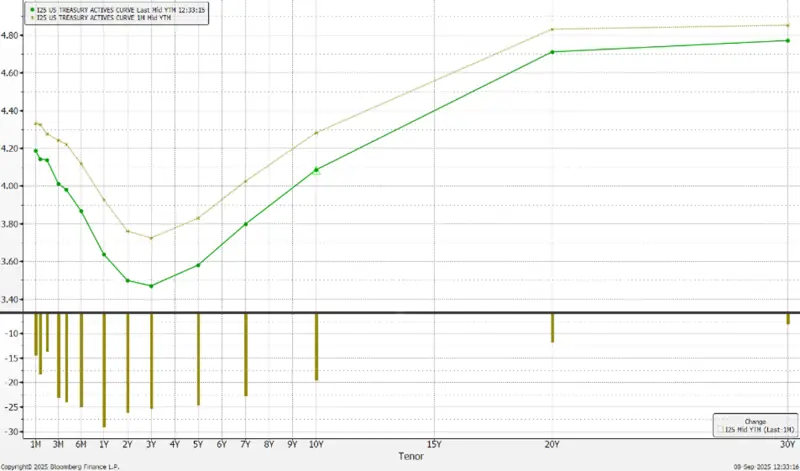

Meanwhile the US bond markets are fully pricing in a further two 25-point cuts this year. The next FOMC meeting is scheduled for 28-29 October, so the Fed Committee members are now in the mandatory black-out period ahead of the meeting.

Source: Bloomberg

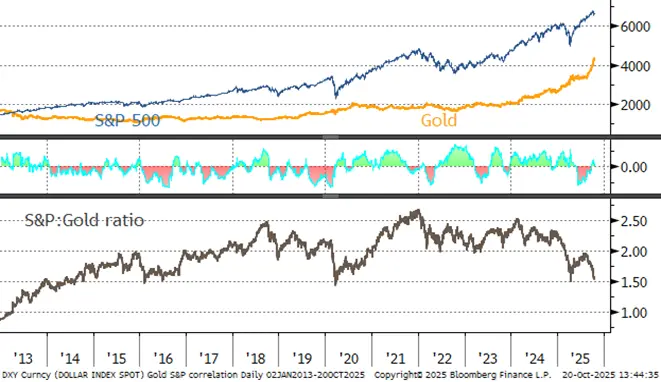

The S&P, gold and the dollar

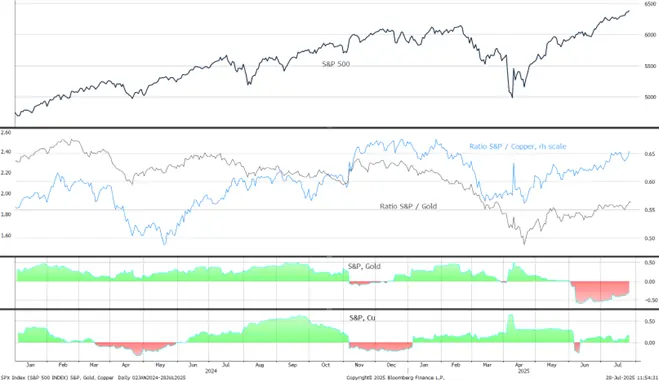

The S&P, gold and copper

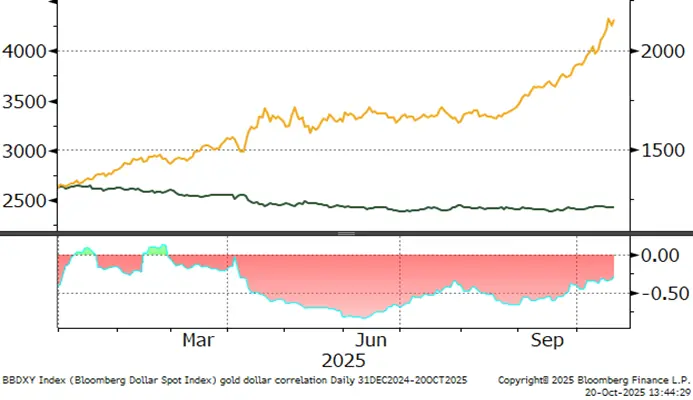

Gold:dollar correlation; easing again; now down to -0.29

Source: Bloomberg, StoneX

US yield curve: still steepening as the short end prices in rate cuts while the longer tenors are rising on fears of a longer-term inflationary impact; overall levels continue to drift lower, however

Source: Bloomberg, StoneX

COMEX silver inventories, tonnes

Source CME via Bloomberg, StoneX

COMEX silver inventories peaked on 3rd October since when they have shed 697t to stand at 15,845t. It is not really possible to quantify, as yet, how much of this is making its way into London. The same can be said about the reduction of 582t in the CME vaults – and there may be some double-counting risk here also. Silver ETFs have oscillated over the same period, with reasonably chunky movements in both direction for a net gain (basis the Bloomberg figures) of 75t to 25,606t.

Gold COMEX inventories are also easing after touching a recent peak of 1,249t on 6th

October, to stand last at 1,216t. Holdings in ETFs stood at 3,924.8t (World Gold Council figures) for a year-to-date gain of 705.9t. North American holdings are up 24.4% or 402.9t; Europe holdings are up 11.9% or 153.3t; Asia has expanded by 56.9% to 142.6t and “other” up 11.1% to 7.1t.

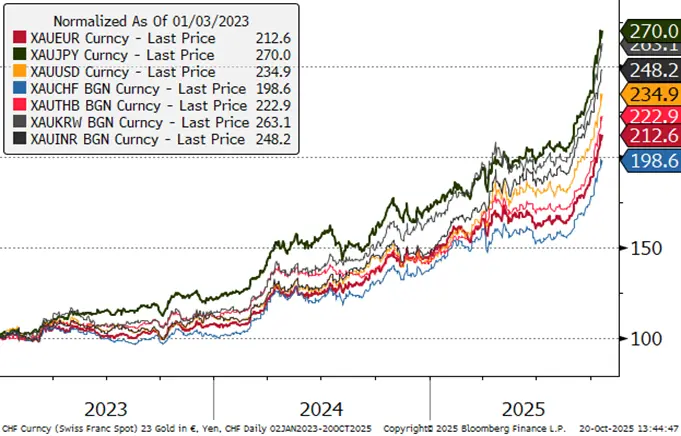

Gold in key local currencies

Gold:silver ratio, year to-date

Source: Bloomberg, StoneX

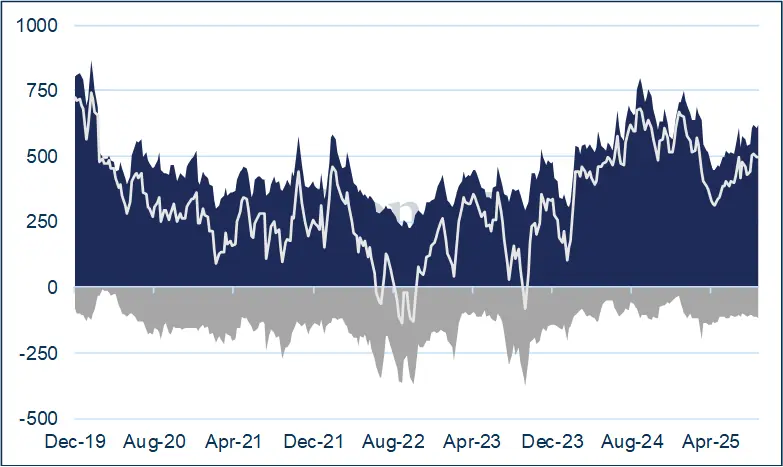

The CFTC numbers run only as far as 23rd September due to the shutdown

Gold COMEX positioning, Money Managers (t) –

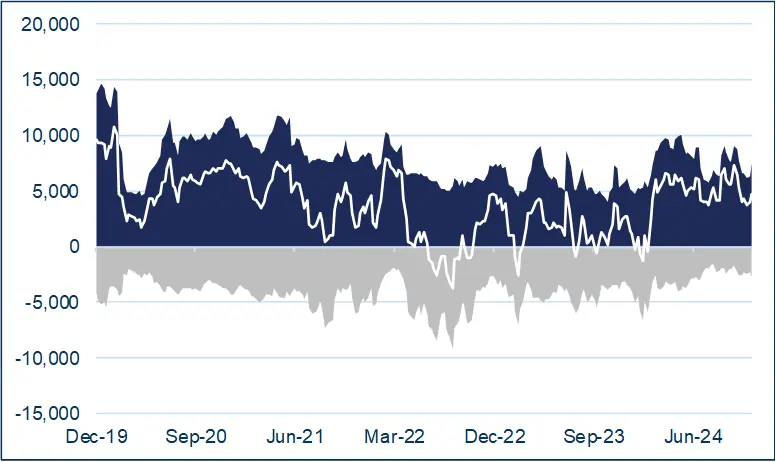

COMEX Managed Money Silver Positioning (t)

Source for both charts: CFTC, StoneX

CFTC: - As of 23rd September, the net gold long position among COMEX Money Managers was broadly unchanged over the previous four weeks – in a range of 509t to 499t, which is the most recent figure. At 618t, the outright longs were only 17t higher than the 12-month average and so there is no real overhang there. At 119t, the outright shorts were 13% higher than their 12-month average of 105t.

The silver position is different, with outright longs of 8,235t just 3% higher than the 12-monthaverage, while the outright shorts (2,197t) are 8% below the 12-month average.