Jan 2025

Jan 2025

President Trump is inaugurated, all eyes on the White House

- President Trump is in the White House and reiterating Mexicoa and Canada as tariff targets for 1st February.

- But note that this was in answer to a question rather than being set out in more formal terms

- These two nations between them accounted for almost 60% of US silver imports in 2023

- Neither gold nor silver spot prices are really reacting – yet?

- But the managed money positions on COMEX are definitely responding

- As are inventories on the CME, which have been rising since before December in an attempt to pre-empt any move

- And bear in mind that the CME is not the only US destination for metal

- Broader tariffs are probably going to be universal to prevent taking material via a third party country

- Platinum and palladium prices are likely beneficiaries of proposals for the auto sector

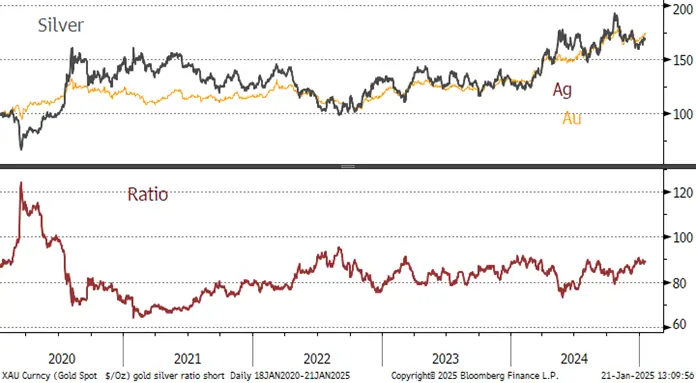

Outlook; the overall outlook for gold is effectively unchanged. The market has known for a long while that the Administration was changing and has had ample time to adjust accordingly. We continue to expect further gains in gold in the first part of this year as geopolitics remains dominant, but a lot of this is already in the price and we would not be at all surprised to see gold prices peak this year. The story for silver may be more robust as the longer term fundamental picture will continue to strengthen. If gold does go onto the retreat silver is likely to go with it, but any dips may well be shallower than those of gold. This would be a fundamental shift in the long-standing relationship between the two as we see the start of some decoupling.

President Trump’s inaugural speech, while robust, was perhaps more measured than some observers had been expecting, which put the dollar under short-lived pressure, but with the US markets closed for Martin Luther King Day, most participants would have been averse to taking any aggressive fresh positions and this applies as much to gold and silver as to anything else.

After showing a marked indifference to the speech while it was underway, gold then posted a mild rise in the early Asian hours, probably in response to the dip in the dollar. Silver was equally agnostic, but then came off during Asian trading.

The changes that the President outlined in his inaugural speech are not necessarily market moving in the short term as it will take weeks for the patterns to become clear. I would expect a cautious approach here and if there is anything coming out of the blue from the White House in the next few days, that would be the most likely trigger for any decisive move. The markets remain firmly in risk-off mode so I would expect any gold price dips to catch bids.

Looking further out the tailwinds continue to dominate, especially in the geopolitical sphere, but much of the prevailing environment is already in the price and I would not be at all surprised to see this year marking the peak of this bull market, although the timing is nigh on impossible to call.

The area that needs to be concerned as of Day 1 is the electric vehicle sector, which, if it really gets hit, would reduce the longer-term outlook for silver (but this would be marginal by comparison with the advent of solar), while being heavily beneficial for platinum and palladium demand. That area, of course, is still up for grabs as far as tariffs are concerned.

The most tangible element in the gold and silver markets are, as far as a market observer is concerned, as opposed to the dealers at the coalface, are the inventory changes on the CME since early December. And bear in mind also that these numbers only reflect what has gone into CME warehouses. Other entities will have been receiving metal also.

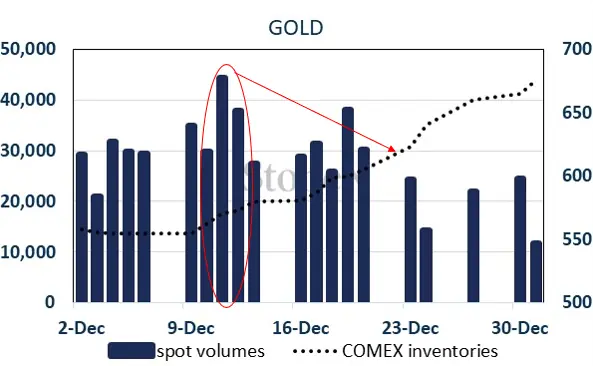

These charts show how volumes in the LBMA loco London spot markets started to jump in December as increasing numbers of participants employed the EFP (we have discussed this before – examination is at the end of this note). Typically it takes ten days to deliver metal out of London and into COMEX warehouses and the relationship is shown nicely here, especially in gold: -

CME gold and silver inventories against spot volumes

Source: Bloomberg, StoneX

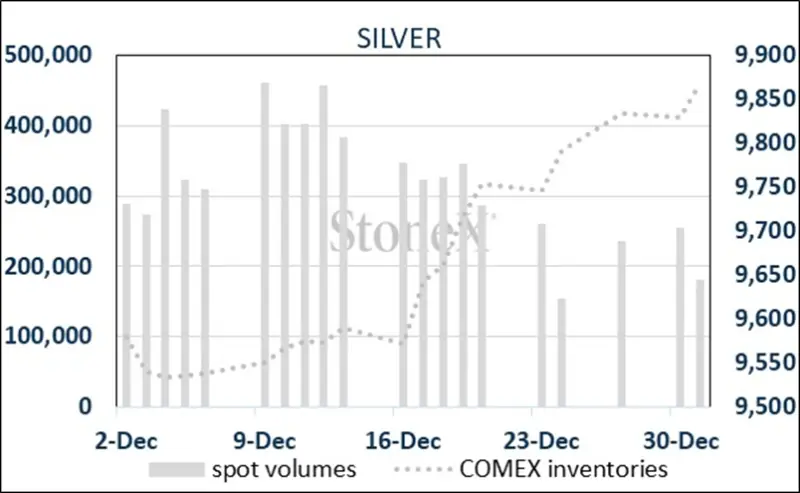

The LBMA numbers are only released monthly, so here is an up-to-date record of the CME warehouse inventories:-

Gold, tonnes

Source: Bloomberg, StoneX

Silver, 000t

Source: Bloomberg, StoneX

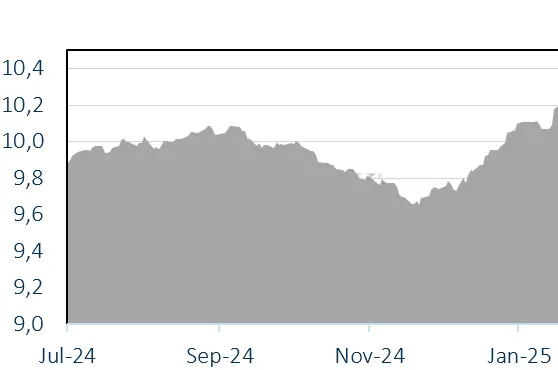

Gold, technical

Source: Bloomberg, StoneX

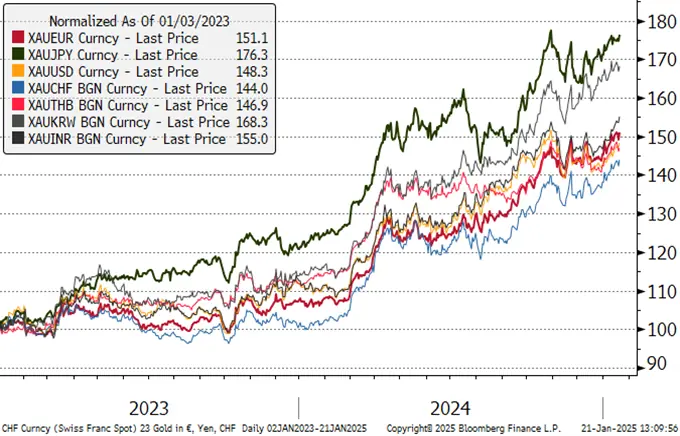

Gold in key local currencies

Source: Bloomberg, StoneX

Silver, short-term; failed at $32

Silver technical

Source: Bloomberg, StoneX

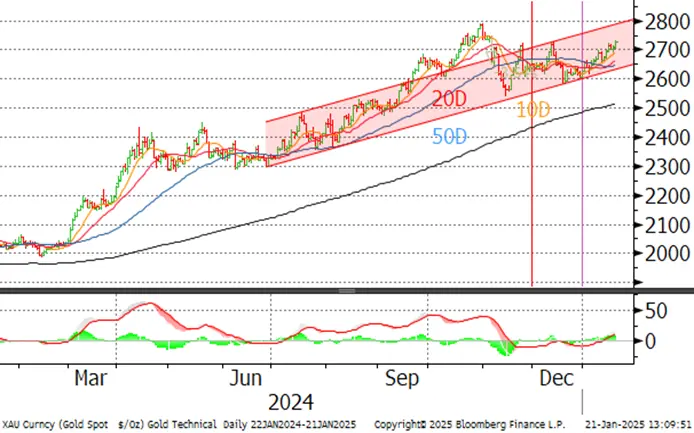

Gold:silver ratio, 2020-to-date

Source: Bloomberg, StoneX

In the background:

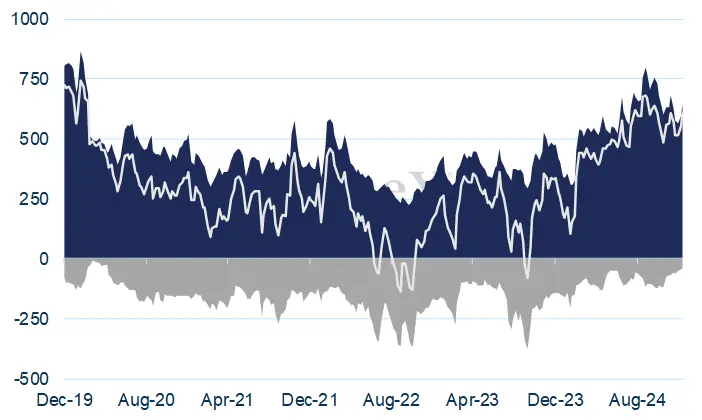

CFTC: positive attitude to gold; silver mixed

The longs-up, shorts-down pattern has continued into the week ended Tuesday 14thJanuary, with outright longs at 644t, 24% over the 12-month average, and shorts into just 35t, the smallest since early May 2020. This is not only favourable sentiment towards gold, it is much more a function of concern over the possibility of US tariffs, even though the fact that gold is a reserve asset would militate against tariffs on that metal.

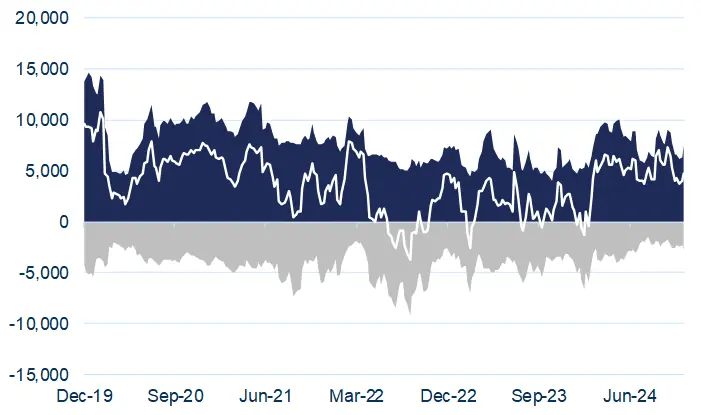

Silver is a different issue. International trade figures from the United Nations show that Mexico was in fact responsible for 42% of US silver imports in 2023, and Canada, 15%.

Gold COMEX positioning, Money Managers (t) – a week out of date due to Thanksgiving

Source: CFTC, StoneX

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

ETFs:

World Gold Council figures record a small loss over the year, at just 6.8t, although dollar flows were positive at $3.4Bn, taking assets under management to $271Bn. North America added eight tonnes, Europe dropped 98t, while Asia added 78t, a gain of 57%. As we have noted before, at just 115t, Chinese holdings are minimal by comparison with the 1,582t in the States and 1,288t in Europe, there is considerable upside scope. December saw a net inflow, all of which came from Asia, with a tiny amount coming out of Europe and almost five tonnes from North America. Thus far January has been mixed, with a couple of chunky net creation days, for a month-to-date gain of 22t to a total of 3,231t. Global mine production is ~3,600t.

Silver – added a net 506t over 2024, to reach 22,276t; in early January there have been a couple of days of noticeable redemptions, for a net decline of 92t, against global silver mine production of ~26,000t. In January to date silver has also been mixed, with 233t going in and 191t coming out for a net gain of 42t.

So what is the EFP and how does it work?

“EFP” is the acronym for Exchange of futures for physical. While the futures market forms part of the transaction, EFP trading is between two counterparties and is not centrally cleared. Last week the gold EFP shot out to more than $60 between spot and the active contract (February 2025 in this case); i.e. between 2% and 3%; that of silver reached a dollar, or just over 3%.

How does it work? Trading the EFP is a way of hedging market exposure. By buying the EFP, a holder of physical metal contracts with a counterparty to sell the physical position while simultaneously buying the futures. That way the exposure in the metal itself is unchanged; but the delivery date shifts. Some market stakeholders have been using the EFP in order to deliver metal into the United States ahead of 20th January in order to reduce the risk attached to long positions in case of tariff imposition. In our view tariffs on either metal, especially gold, are unlikely, but it is understandable that some traders – or their risk officers (as was the case during the pandemic) want to eliminate any possibility of being caught up in any fall-out.

Tailwinds for gold exceed the headwinds

For the longer term, the tailwinds substantially outweigh the headwinds and are summarised in this note

Current tailwinds include: -

- Geopolitical risk.

- Increasing trade tensions

- Stresses in the banking systems in the three major regions, notably in the small-to-medium sized sector, and especially exposure to property, and (in the US and to a lesser extent) Commercial Real Estate.

- Emergence of the Shadow Banking sector (i.e. unregulated transactions), reminiscent of the Sub-Prime issues in 2007 that led to the Global Financial Crisis in 2008

- Continued strong Official Sector purchases – not just because they are taking tonnage off the market but because of the signal that it sends to the markets because the Official Sector dislikes uncertainty

- Widespread investor interest, notably from High-Net-Worth individuals, Family offices and other professionals who are back in the market for the long haul.

Headwinds:

- Reduction in international political or trade tensions; Scott Bessant could well be instrumental here

- Any strong inflationary forces and / or associated expectation thereof could force a reversal in monetary policy

- Official sector going on the retreat (unlikely)

- Investors’ conclusion that risks have declined (likely to take a matter of years, compare GFC of 2008); it wasn’t until 2013 that professionals bailed out of gold (over 800t of ETF metal went straight into private hands in China).