Aug 2024

Aug 2024

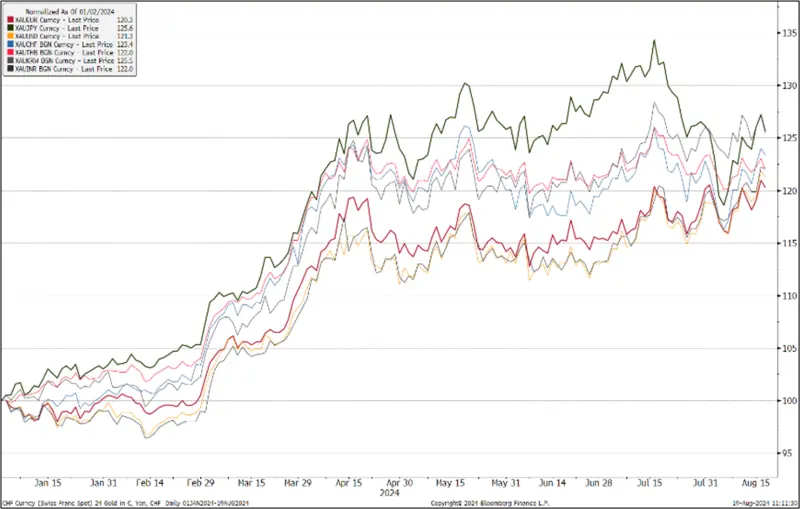

Gold Surges Past $2,500 Amid Rate Cut Expectations, Silver Outshines, and Shadow Banking Risks Resurface

By Rhona O'Connell, Head of Market Analysis

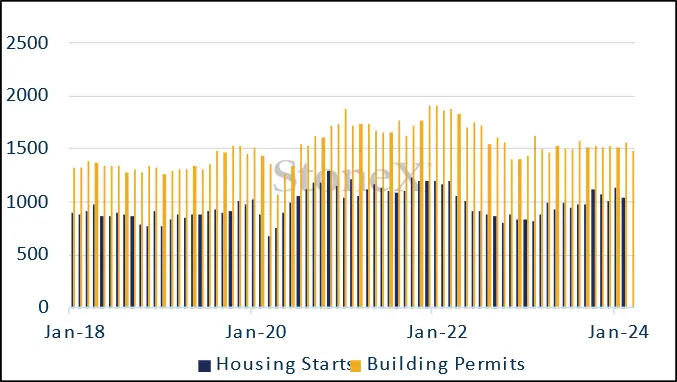

- Gold clears $2,500 as poor US housing triggers expectations of deeper US rate cuts

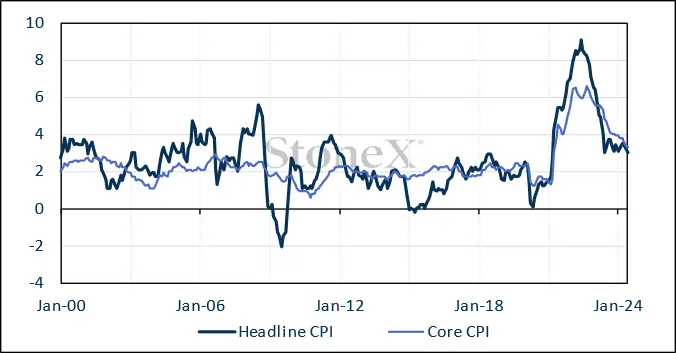

- The inflation numbers suggest continued cooling, but retail sales are strong

- Shadow banking-related risks are rearing their heads again

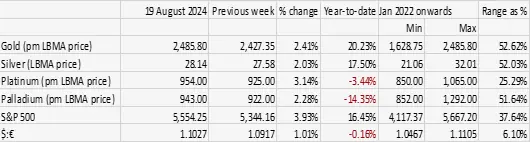

- Gold gains 4% over the week and silver, 7%

- Gold and silver ETFs are mixed with silver attracting more attention than gold

- Fed Chair Powell to speak at Jackson Hole this week

- Professional investors are increasingly looking at inflation-adjusted vehicles

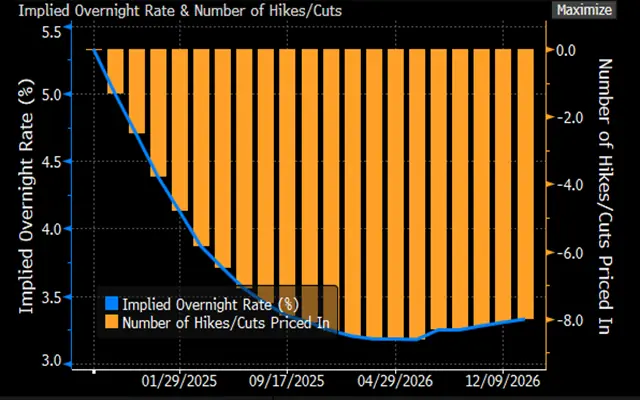

- Swaps markets still pricing in 125 point rate cuts this year and expecting 50 points in September

Outlook; clearing the $2,500 level naturally attracts headlines but that is arguably less significant than the clearance of $2,450, which had been the level of resistance. The tailwinds remain stronger than the headwinds for professional investors but the price-elastic markets in Asia have yet to reconcile themselves to higher price ranges and this will take some of the gloss off the market. Silver is consolidating around $29 but remains caught in a bind and if, as we expect, gold loses some of its recent momentum, silver could again underperform.

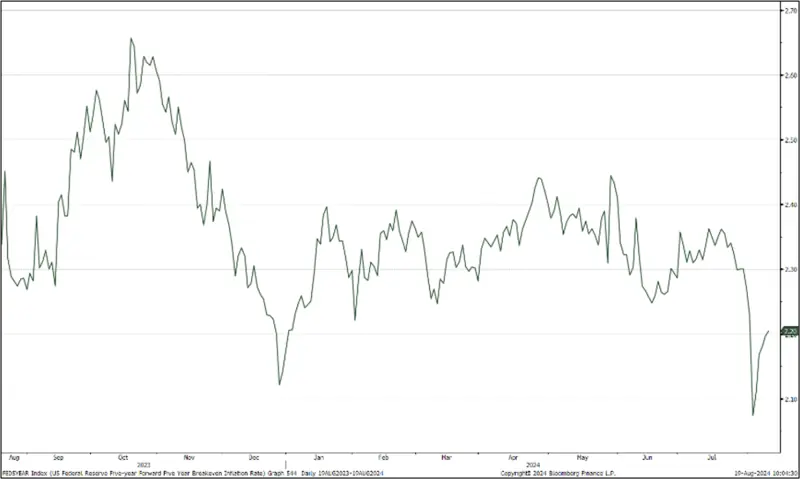

While gold is gaining support on increasing expectations of sizeable rate cuts, not just in the United States, it is also important to remember that in the professional sector there are vehicles that are more effective as an inflation hedge than gold; these come in the form of inflation-adjusted bonds, notably the TIPS, or Treasury inflation-protected bonds. Tied in with these is what is known as the break-even interest rate, which is the yield on a vehicle such as TIPS minus the nominal prevailing rate. This has been attracting attention from the professional investor sector to the extent that it is starting to make headlines in the press, because it demonstrates that there is a body of investors who believe that there is a risk of fresh inflationary forces – regardless of who gains the White House in November.

This is not to say that gold has lost its role as an inflation hedge, but its more important role is as a mitigator of risk because of its contrarian nature and relatively low correlation with other asset classes.

US five-year forward break-even rate

Source: Bloomberg, StoneX

Last week’s action saw fresh investor interest in gold, again predicated on interest rate cuts and heightened geopolitical tension, notably in the Russia/Ukraine conflict, but there is a feeling in the financial markets that (not for the first time) the bond market has got ahead of itself; this could well spill over into gold. For the short term gold is unlikely to do very much this week as we await the much-anticipated speech from Fed Chair Powell at Jackson Hole this week. Jackson Hole is an annual central bank symposium, taking place in Wyoming on 22-24 August. Speakers include other central bankers, economists, financiers and US government members. Mr. Powell speaks on Friday and we would expect him to be his usual cautious self and not give a definitive signal to the markets although we may get some clarity. The theme of this year’s symposium will be “Reassessing the Effectiveness and Transmission of Monetary Policy”.

Ahead of that we have the release on Wednesday of the Minutes of the July Fed meeting, and it will be interesting to detect any change of nuance from the June Minutes.

US CPI, PPI

Source: Bloomberg, StoneX

Housing starts, building permits

Source: Bloomberg, StoneX

Meanwhile the simmering tensions in the US small-to-medium sized banks are again drawing attention. This is one of our key tailwinds and it should not go unnoticed that in the Senate Q&A at his semi-annual Congressional testimony, this subject was raised, and Mr. Powell said the problems would be with us “for years”.

The Financial Times is carrying a story at the start of this week about First & People’s Bank, which is the only bank in a town called Russell in Kentucky. The paper reports that the bank has “received notices from three regulators this year warning about its precarious finances. the issues arise from ties to so-called “shadow banks” and if this bank fails then some $200M of customer deposits could be at risk. The FT describes the bank as one of a growing number of small banks in the States that are facing similar problems with shadow banking, which involves unregulated institutions or under unregulated conditions. The bank is working with the Federal Deposit Insurance Corporation and Kentucky bank regulators and is “aggressively” pursuing its counterparty to recover funds.

Gold in key local currencies

Source: Bloomberg, StoneX

Gold, year-to-date; technical indicators turning positive

Source: Bloomberg, StoneX

Silver rallied with gold and with almost twice as much a range and challenged $29; in so doing it cleared short-term resistance from the 109-day and 20-day moving averages, but has slipped back below both of them as the market continues to fret about the economic outlook, despite the fact that for the longer term the fundamentals remain very supportive, via solar, net zero carbon transport (even though those deadlines are likely to slip) and the heavier precious metal loadings necessary for chips supporting AI.

Silver, year-to-date; technical indicators

Source: Bloomberg, StoneX

Meanwhile gold ETFs saw some hefty redemptions last Friday after four days of light buying interest, taking the year-to-date losses to 75t for holdings of 3,151t. Global mine production is ~3,750t. Silver ETFs enjoyed six consecutive days of net creation until last Friday when there was some light liquidation, giving a year-to-date , for a year-to-date gain of 561t. Global mine production is ~25,800tpa.

Bond markets’ expectations for the rate cycle; now looking at a 131% chance of a September cut -which means they are discounting 50 points and is also a moderation from this time last week), 120% for November and 128% of one in December, to close the year at 4.38%.

Source: Bloomberg

COMEX

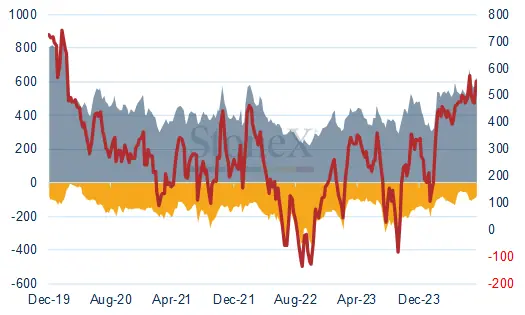

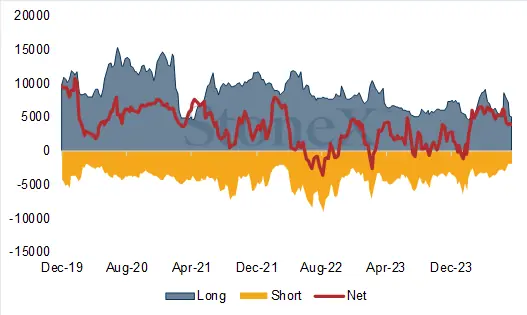

Gold rallied over the whole week to 13th August, reaching $2,478 on the 13 itself, but correcting to close at$2,447. Gold outright longs added 73t (13%) to 634t; outright shorts fell by 11% to 81t. Net long up from 469t to 553t. Silver outright longs fell by 2% (118t) to 5,756t and shorts contracted by 2% or 50t to 1,939t. Net long down 4% to 3,816t.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

Source: Bloomberg, StoneX