Jun 2024

Jun 2024

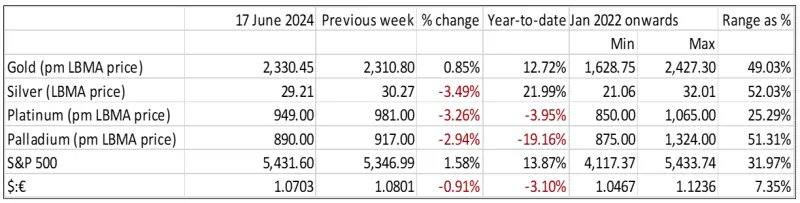

Gold and Silver’s Performance Amid June’s Economic and Geopolitical Events

By Rhona O'Connell, Head of Market Analysis

- In the first half of June, gold rose from $2,320 to $2,380 in the first week then slid on strong employment headline numbers and some misleading press coverage of China’s gold policy

- Support held good below $2,290 and prices are attempting to consolidate above $2,300

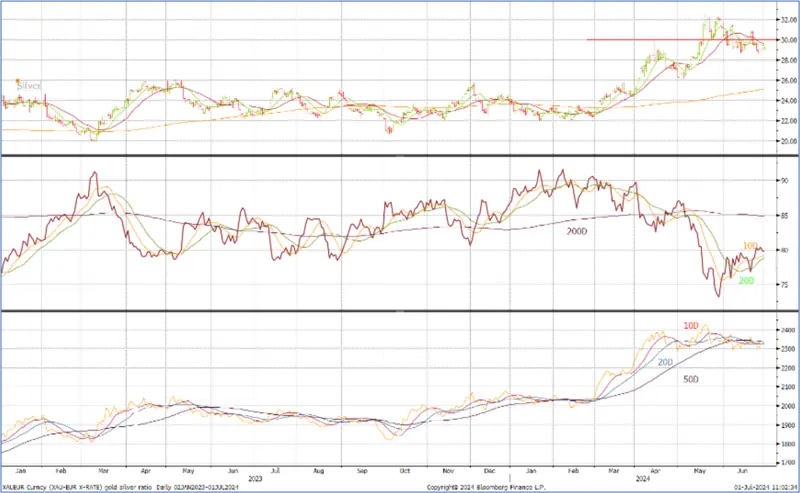

- Silver followed a similar pattern but was slightly more vulnerable than gold

- Nerves over potential geopolitical risk after the European elections are likely to prove supportive for gold, while fresh sanctions on Chinese products are more peripheral but also potentially supportive

- The FOMC meeting (last Tuesday and Wednesday) flags just one rate cut this year but inflation slippage is prompting the market to expect two

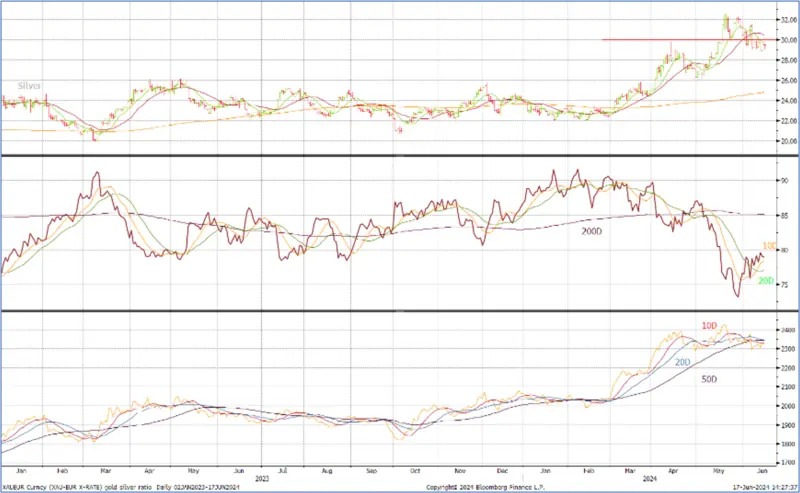

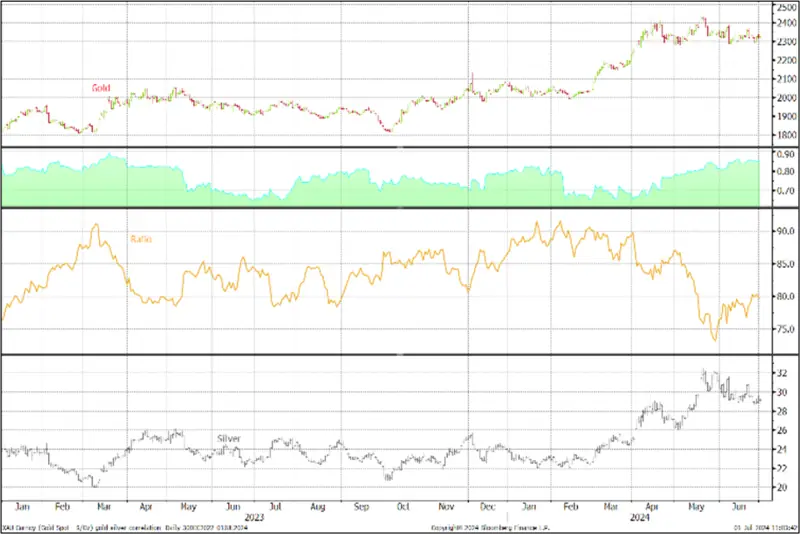

- The gold:silver ratio rose over much of the period, reaching 80 (from 76) but has declined subsequently to trade at 79 as we write

- Support at $29 has proved resilient

Outlook; with COMEX gold positions contracting on both sides of the market and shorts at their lowest since May 2020 (48t), plus the overall price retreat it is arguable that speculative froth has been taken off gold. This points to continued consolidation above $2,300 but as a word of warning it does also render the market vulnerable to sharp moves in either direction on any unexpected external development. The overall outlook remains positive on the back of geopolitics and economic uncertainty. Silver is similar but likely with more risk given the overall weaker tone to the metals markets (base and precious).

Gold, silver and the ratio, January 2023-to-date

Source: Bloomberg, StoneX

Gold was rising steadily in the first week of June as physical demand kept prices supported and then some technically-driven buying came in as prices moved above $2,350. Conditions were quiet overall, however, as professional market participants awaited the nonfarm payroll figures from the United States, one of the key economic numbers in determining market sentiment given the Federal Reserve Board’s dual mandate of 2% inflation and “full employment”. This latter is something of a moving target, but a rule of thumb is 3%, more or less. US headline unemployment was most recently reported as 3.9% so there is in theory some way to go, but the labour market overall has actually been strong in recent months, with the Quits rate falling and some businesses reporting difficulty in finding workers.

Gold, silver and copper; silver correlation with gold, 0.81; with copper, 0.28

Source: Bloomberg, StoneX

When the payroll number was released on Friday 7th, it was a lot higher than any economists had forecast and sent yields running higher and pushed gold down towards $2,280.

There was more to it than that, though. During the London morning hours the People’s Bank of China released its foreign exchange reserves for May, in which the reported gold holdings were unchanged. This caused some lively activity in the press in which some sources were slightly misleading. I have reproduced a note here that I put out at the time and published into our Market Intelligence, which runs through why the position needed clarification.

PBoC reported gold reserves by quarter, tonnes

Source: IMF, StoneX

“Given the hype that has been surrounding the importance of official sector activity in the gold market over the past few years, and its significance with respect to price action and the signals that this activity sends to the markets about official sector concern over geopolitics and potential distress, it is hardly surprising that the headlines this morning are awash with the fact that China reported no change in its gold reserves in May – after 18 months’ consecutive reports of increase.

It’s overdone, though. The fact that the PBoC announced no change in reserves in May (and only a very small increase in April) was almost certainly the trigger for the price fall in mid-morning London time, but it’s only dropped to yesterday’s levels – hardly a “slump” – the word used by at least one Agency. It is important also to bear in mind that there has been more than one occasion in the past when the PBoC has not reported any change in gold reserves for an extended period of time and then has released figures showing a quantum leap – which clearly implies that reserve building was taking place over time, possibly not directly into the PBoC but perhaps into another instrument such as a Sovereign Wealth Fund, and then experienced a bulk transfer. Examples include the resumption of reporting (after a long period of silence) when China was applying for membership of the SDR, and in May 2009, when after many months reporting 600t of holdings, there was a sudden jump in May, to a reported 1,054t (IMF numbers). Note also that I carried out an exercise recently netting off domestic production and demand (Metals Focus numbers), PBoC reported reserves to the IMF and United Nations international trade figures over the past ten years, and the results suggest that the country has amassed over 6,700t more than reported. If these numbers are anywhere near correct, and the sources are high quality, then it is perfectly possible that this metal has gone into government hands in one form or another.

Precious Metals Talking Points 042624; China Gold ETFs Are Flying; Massive Upside Scope. And we look at the fundamental numbers’ imbalance

So while it is of course a possibility that the next few reserve statements may not show any change in gold holdings it would be extremely rash to assume that the Chinese Government is not continuing to increase its gold exposure.

Gold was thus on the defensive when the nonfarm payroll numbers cam out and prices dropped again.

Those falls have been unwound, though, aided by geopolitical concerns with President Macron of France calling a snap election, the Belgian Prime Minster resigning and a number of European countries appearing to move towards more extreme political parties, notably on the right.

Finally the market gained further buoyancy when the US Producer Price index posted a negative month-on month print on 13th May, at minus 0.2% month-on-month, with PPI excluding food and energy reported as zero against forecasts of 0.3%. This reignited the bond market expectations for a 25-point cut from the Fed in September. In his Press Conference following the June meeting, in which the FOMC members appeared to be flagging just the one rate cut this year, Jay Powell noted that “Longer-term inflation expectations appear to remain well anchored, as reflected in a broad range of surveys of households, businesses, and forecasters, as well as measures from financial markets. The median projection in the SEP for total PCE inflation is 2.6 percent this year, 2.3 percent next year, and 2.0 percent in 2026”.

Bond markets’ expectations for the rate cycle; now looking at a 60% chance of a September cut

Source: Bloomberg

US Inflation, employment

Source: Bloomberg, StoneX

In the background the gold Exchange Traded Products have been cautiously positive. In the first half of June (after a net gain of 8.2t in May) the gold ETFs added 4.7t, for a year-to-date fall of 133t to 3,093t (world mine production is roughly 3,700tpa). North American funds were just negative (0.1% or 2.3t), while Europe added 5.6t or 0.4% and Asia continued to show interest, adding 5.0t or 3.0%. Silver has added 100t over the period (0.5%) in mixed trade with six days of net creations from a total of ten, to take the total to 21,384t. Year-to-date the loss is 386t (global mine production is ~26,000tpa).

COMEX; sentiment mixed

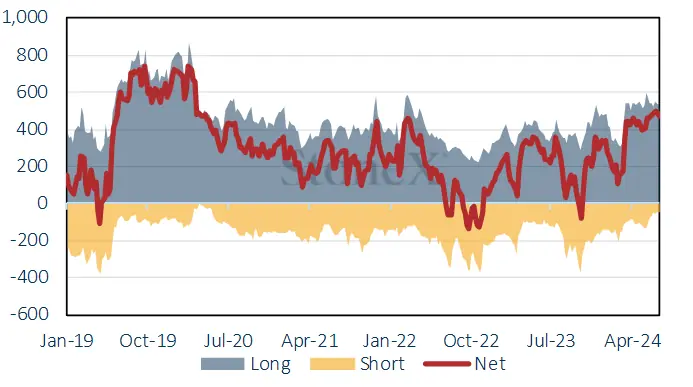

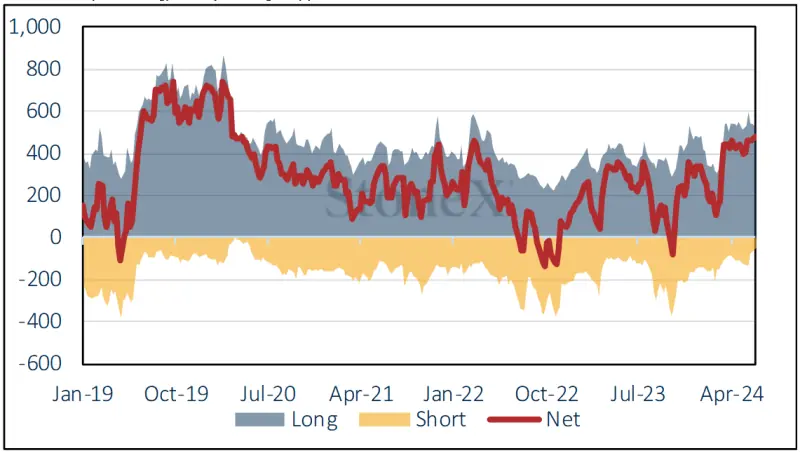

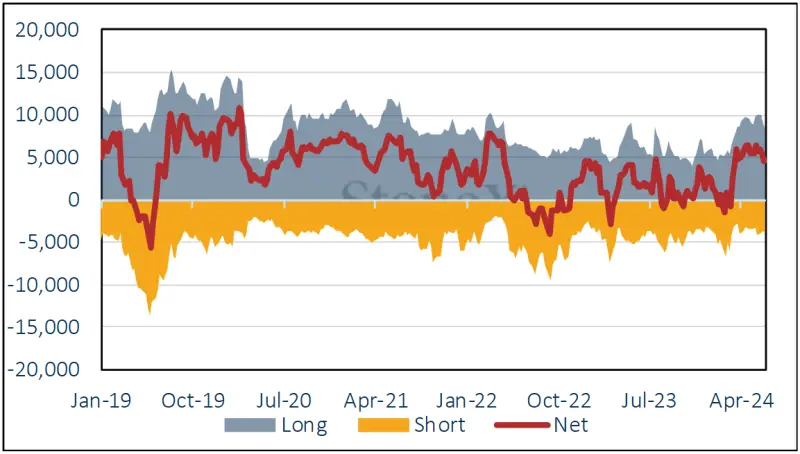

The Commitments of Traders reports show that over the fortnight the outright gold long position on COMEX came down by just 19t or 3.5% to 524t, while outright shorts dropped by 40% to 48t, the smallest position since May 2020,leaving the net at 476t. The outright long stood at 22% over the twelve month average which , while still a little toppy, is not as overwhelming as a few months ago.The silver position has cleared out quite a bit of its COMEX overhang, shedding 1,613t over the fortnight, a reduction of 16% to 8,392t, while the shorts contracted very slightly, losing just 55t or 1.4%to 4,511. This leaves the net position at 4,511t, the smallest net long since mid-March.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

Source: Bloomberg, StoneX