Sep 2024

Sep 2024

Gold's Bull Run: Key Insights on Market Movements, CPI, and FOMC Rate Decisions

By Rhona O'Connell, Head of Market Analysis

This is a highly truncated report this week as your writer tested positive for COVID yesterday and needs to go back to bed!

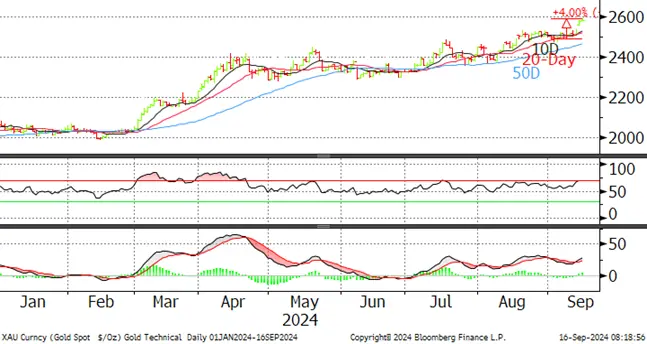

- Gold’s consolidation over ten days or so laid the foundations for higher prices with a bull run starting last Wednesday, $2,600 is in sight

- US CPI was in line with expectations; PPI was marginally higher than expected (services sector again); nonfarm payroll shows a cooling labour market but not a deteriorating one.

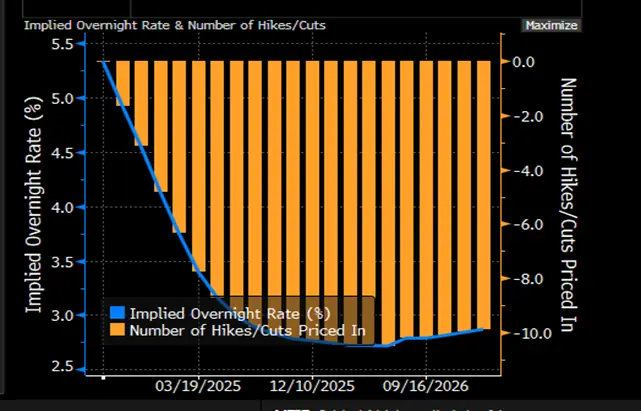

- The bond market is evenly split as to whether this week’s FOMC meeting (concludes Wednesday) will hike rates by 25 or 50 basis points. We incline towards 25 given the Fed’s caution

- Gold has gapped upwards to wards $2,600 and needs to come down to fill the gap at $2,550. The gain since the start of September is 4% with momentum traders on board again and some fresh interest from those expecting more gains given the financial and geopolitical environment.

- Silver has crested $31 this morning for a September gain to date of 10%

- The ratio tested 90 in early September and is now down to 83

- Gold State of Play: a Cheat Sheet

- The ECB cut rates by 25 basis point and Chirstine Lagarde was very cautious in her Press conference as Europe remains on an economic tightrope

- France Italy and Germany manufacturing PMIs have all been below 50 since April of last year (one exception – Italy this past March).

Outlook; gold’s tailwinds still remain stronger than the headwinds for professional investors Silver is overbought and may need to correct, especially if gold fills that gap.

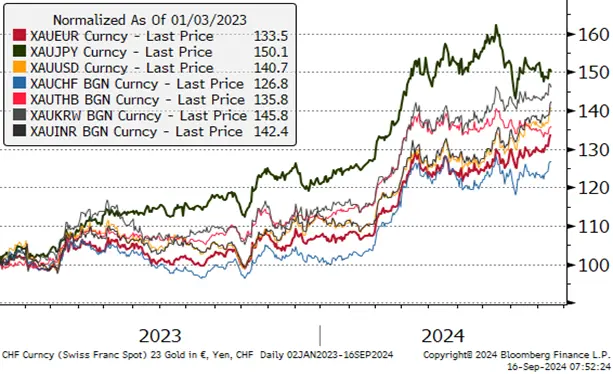

Gold in key local currencies

Source: Bloomberg, StoneX

It's still all about monetary policy, at the professional level. At Jackson Hole, Fed Chair Powell made several key points, of which the two most important were

“The time has come for policy to adjust”

And

“We do not seek or welcome further cooling in labor market conditions.”

Gold, year-to-date; technical indicators positive

Source: Bloomberg, StoneX

Silver, year-to-date; technical indicators neutral but the 50-day is about to cross the 10-Day to the upside

Source: Bloomberg, StoneX

The swaps market is evenly balanced between expecting a 25-point or a 50-point cut at the September meeting.

Source: Bloomberg

A 25-point cut would likely be supportive for gold in the short term while a 50-point hike would potentially take some froth out of the market

Tailwinds for gold exceed the headwinds

For the longer term, the tailwinds substantially outweigh the headwinds and are summarised in this note that we published at the end of August: Precious Metals Talking points 083024: Gold: state of play and key influences going forward

Key points from this note are as follows

Current tailwinds include: -

- Geopolitical risk – not just the overt international tensions (Ukraine, Middle East, potential Taiwan issues, etc) but the number of elections around the world this year, which has been generating uncertainty.

- Increasing trade tensions

- Stresses in the banking systems in the three major regions, notably in the small-to-medium sized sector, and especially exposure to property, and (in the US) Commercial Real Estate.

- Emergence of the Shadow Banking sector i.e. unregulated transactions), reminiscent of the Sub-Prime issues in 2007 that led to the Global Financial Crisis in 2008

- The equities rout of early August (now more than recovered) may be a signal not to be too complacent about equities valuations

- Continued strong Official sector purchases – not just because they are taking tonnage off the market but because of the signal that it sends to the markets because the Official Sector dislikes uncertainty

- Retail investors in Asia are chasing the market higher in the expectation of yet higher prices

- And so are some High-Net-Worth individuals, Family offices and other professionals who are back in the market for the long haul.

Headwinds:

- Reduction in international political or trade tensions; Harris more of a bearish influence than Trump on this score

- Any strong inflationary forces and / or associated expectation thereof could force a reversal in monetary policy

- Official sector going on the retreat (unlikely)

- Investors’ conclusion that risks have declined (likely to take a matter of years, compare GFC of 2008); it wasn’t until 2013 that professionals bailed out of gold (over 300t of ETF metal went straight into private hands in China)

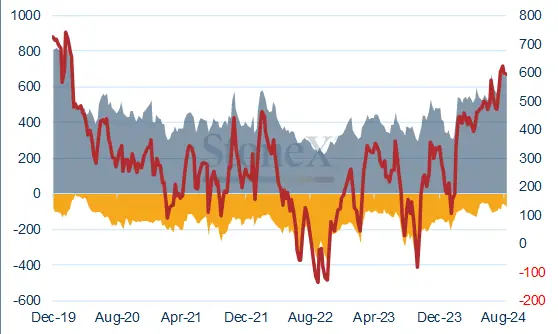

COMEX

Gold longs up 0.7% (5t) to 665, shorts up 16% (10t) to 72.t We are almost bound to have seen short covering since then. Net long was down 5t to 592t vs a 12M average of 456t.

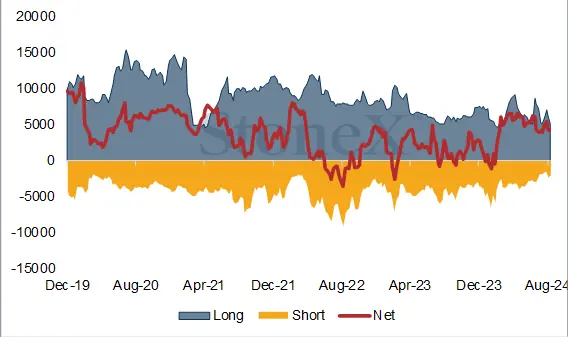

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

Silver longs down 2% 9131t) and shorts down 208t (9%). Net long up 2% (77t) to 4,222t vs a 12M average of 3,25t

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

Source: Bloomberg, StoneX