Apr 2025

Apr 2025

Gold's Record Surge: Navigating the 2025 Precious Metals Landscape

Well, that was an interesting fortnight!

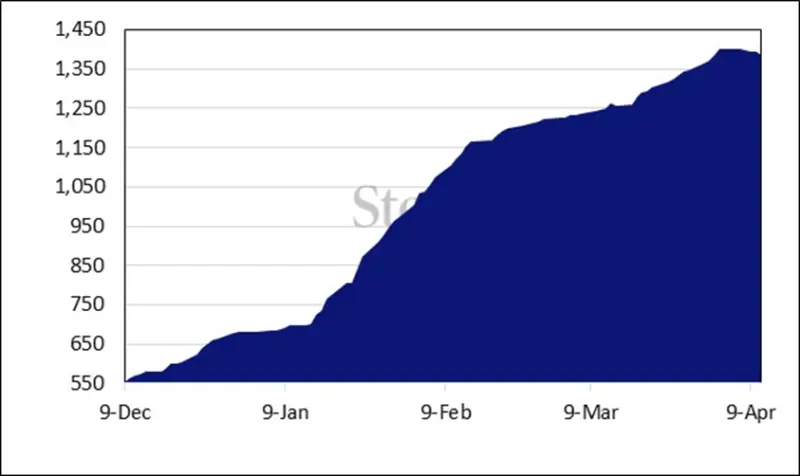

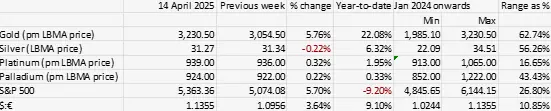

- Gold posts new record highs in nominal terms ($3,246), then retreats slightly.

- In real terms we are, at $3,200, now 8% below the intraday high (in today’s dollar terms) of $3,486. This was a nominal $850 on 21st January 1980 amidst the second oil crisis, the Afghanistan and Iranian crises and the failed attempt of the Hunt Brothers to corner silver.

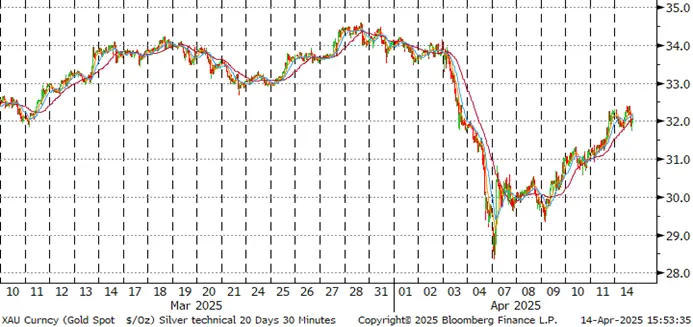

- The changing policy statements from the White House have fostered continued risk-off in the investment fraternity with silver dropping by 17% between the 2nd and 7th of April before a 61% retracement to test $32.

- The latter part of last week saw the markets’ influence (especially the bond market) helping to generate a softening in tone from the White House (other than with respect to China), but uncertainty persists over the level and geographical spread of any negotiations.

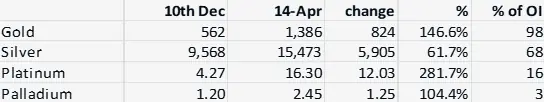

- The exclusion of metals from tariffs (apart from S. 232 aluminium and steel – and possibly copper in the future) was widely expected, but gold continued to filter into CME vaults until 3rd April – the so-called “Liberation Day”, when they reached 1,509t or a massive 93% of open interest. The subsequent reduction in open interest means that COMEX gold inventories are at 98% of open interest in mid-April.

- The Fed looks to be aiding liquidity in the markets. The FOMC had already announced a reduction in Quantitative Tightening, and our Chief Strategist has also pointed out the use of standing repo facility and a drop in reverse repo balance (see below for explanation).

- Silver inventories have continued to arrive, but this may well be because the transportation time can be lengthy; currently they stand at 15,473t (equivalent to just over six months’ global fabrication demand), or 68% of open interest.

- This increase in open interest cover is also more a function of reduced open interest as inventories were only dribbling higher.

- The gold:silver ratio hit 103 on 4th April and is still just over 100 as the markets focus on silver’s industrial demand profile.

- Gold ETFs have added 21t so far this month, including two days last week with additions of over 10t each to stand at 3,460t. World mine production is ~3,600t.

- Silver ETFs were under pressure in the first week of April, but have subsequently attracted some sizeable interest, leading to a net gain of 113t so far in April.

- Shorter term outlook: gold has lost its upward momentum but remains well underpinned. We continue to believe that the market is crowded and may yet be due for a further correction but expect prices to remain well-supported while the markets contend with continued uncertainty. The gold:silver ratio is likely to remain broadly steady.

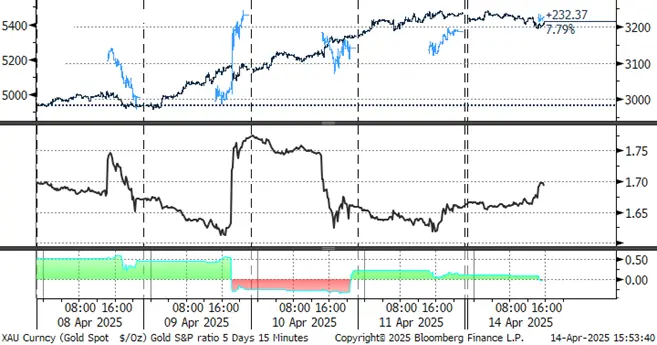

The S&P/Gold ratio is recovering on the postponement of some, and deletion of some other, tariffs (notably part of the tech sector for the latter)

Source: Bloomberg

We have noted above that gold is starting – slowly - to come out of COMEX inventory. It is also worth noting that gold in London vaults, as reported monthly by the London Bullion Market Association, nudged higher by 11t in March, after a cumulative loss of 298t from November through to end-February. Gold in London vaults now amounts to 8,488t (although some of this will be ETF metal), while silver has now posted five months of losses amounting to 4,500t, standing at 22,127t at end-March.

COMEX gold inventories, tonnes

Source CME via Bloomberg, StoneX,

Gold, one-year view; still overbought, but starting to consolidate.

Source: Bloomberg, StoneX

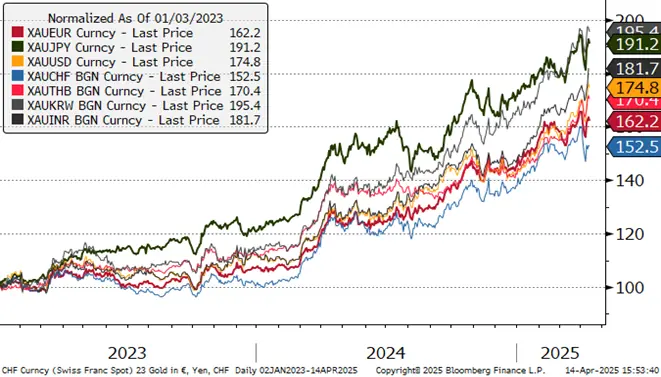

Gold in key local currencies.

Source: Bloomberg, StoneX

Silver, March 2025 to date; recovering from a heavy fall

Source: Bloomberg, StoneX

Gold:silver ratio, January 2024 to-date; clear of 100

Source: Bloomberg, StoneX

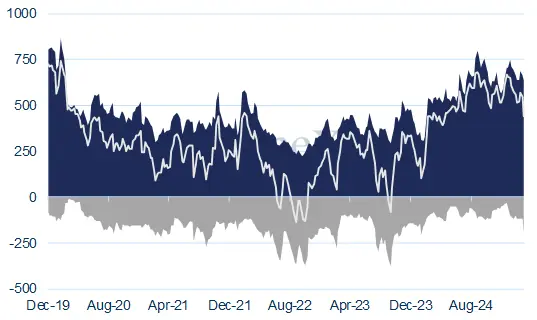

CFTC: In the week to 8th April, gold rose fractionally at the outset, to touch a high of $3,168 on the 3rd; then posted four successive days of decline (before a fresh rally to new record levels thereafter). Positions contracted in both the Managed Money longs and shorts, with the longs shedding 92t (14%) to 546t and the shorts coming down by 57t (29%) to 138t. The outright long on 8th April was below the twelve-month average by 5%.

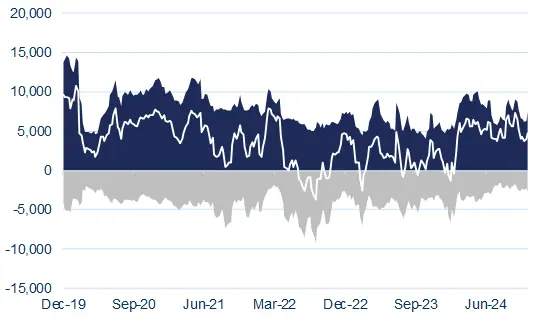

Over the same period silver initially slipped from $34.0 to $33.3 before a precipitous fall to a low of 28.4, a drop of 17% before a recovery towards $30.5. The change in positioning saw outright longs drop by 5% or 466t while shorts gained 9% or 186t to 2,247t.

Gold COMEX positioning, Money Managers (t) –

COMEX Managed Money Silver Positioning (t)

Source for both charts: CFTC, StoneX

So, what is the Fed doing and how does it work?

Quantitative tightening: not rolling over Treasuries as they mature. Buying bonds from the open market. Both of these actions would alleviate some upward pressure on bond yields.

The standing repo facility (SRF): this was implemented in July 2021. This is designed to keep monetary policy running smoothly, by limiting any overnight upward pressure on interest rates; the use of the SRF means that the Fed makes funds available to primary dealers, and some banks also, by accepting short-term high-quality US Treasuries, agency mortgage-backed securities and agency debt. The SRF can be used proactively, taking potential heat out of the markets, and is used only intermittently, in periods of financial stress.

The reverse repo rate is used to keep the fed funds target rate in the band specified by the Fed. In a repo, the Fed’s open Market Trading Desk (“The Desk”) buys securities from a counterparty with an agreement to resell at a later date. In a reverse repo the Desk sells securities to a counterparty with an agreement to repurchase at a later date. A reverse repo thus reduces the supply of reserves in the system.

And what is the EFP and how does it work?

How does it work? Trading the EFP is a way of hedging market exposure. By buying the EFP, a holder of physical metal contracts with a counterparty to sell the physical position while simultaneously buying the futures. That way the exposure in the metal itself is unchanged, but the delivery date shifts. Some market stakeholders had been using the EFP to deliver metal into the United States ahead of 2nd April to reduce the risk attached to long positions in case of tariff imposition. We were correct in our view that we would not see tariffs on either metal, but it is understandable that some traders – or their risk officers (as was the case during the pandemic) wanted to eliminate any possibility of being caught up in any fall-out.

Source: Bloomberg, StoneX