May 2025

May 2025

Gold Price Tests $3,200: Is a Double Top Forming?

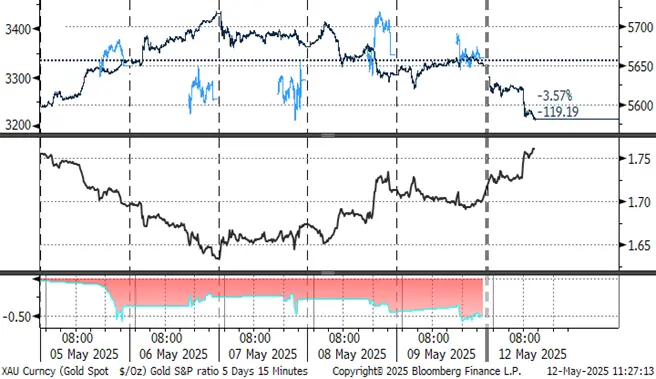

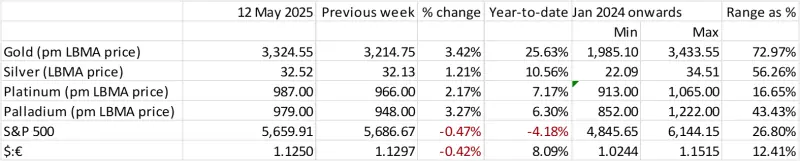

Risk premium still unwinding in gold, especially after the Sino-US trade talks over this past weekend

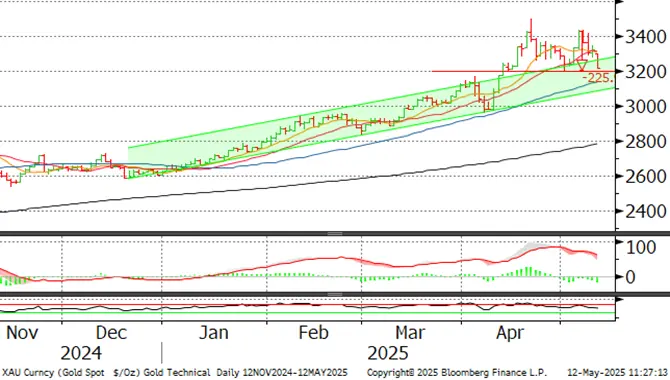

- Gold has now unwound more than 50% of its most recent strong rally and is testing $3,200.

- If it trades below $3,199 it will have completed a technical double-top formation, which could - could – herald a further $235 decline

- In our view this is unlikely as the background influences remain supportive, but the progress in the tariff talks definitely takes some heat out of the market and we maintain our view that the high is in

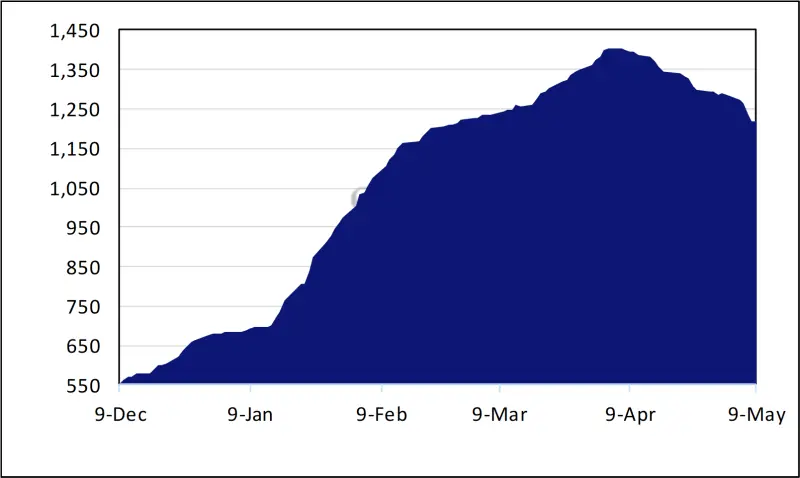

- Gold inventories on COMEX peaked at 1,402t on April 4th. Thereafter they dropped by 185t to 1,217t by last Thursday, before a very small increase on Friday to 1,218t.

- The Inventory/Open Interest cover is 89%, still substantially higher than the more normal 40%+

- The Fed is standing firm, but the bond markets are still looking for fresh easing, pricing in fed funds of 3.76% at year-end vs 4.5% now.

- Concern over tariffs has virtually halted coin imports from Europe to the US

- Some gold coins’ premia are under hefty pressure, notably Krugerrands and Eagles

- Silver has been comparatively steady in the face of gold’s decline, as tariff talks take some pressure out of macroeconomic headwinds

- Gold ETFs have dropped by just 19t over the past fortnight. World mine production is ~3,600t.

- Silver ETFs are attracting attention, with a net gain of 392t since the start of April, to 22,780t, a gain of 1,010t year-to-date. Global mine production is 25,497t (Metals Focus numbers)

- Shorter term outlook is unchanged: gold is still correcting, but remains well underpinned. We expect prices to remain supported while the markets contend with continued uncertainty, but we continue to believe that the high is in. The gold:silver ratio, still just over 100, should start to decline as and when the economic clouds start to clear.

The S&P/Gold ratio continues to recover as risk appetite increases, but cautiously

Source: Bloomberg

Comment: -

The Federal Open Market Committee (FOMC) met last week and maintained the federal funds target rate at its prevailing level of 4.35-4.50%. The Statement that accompanies the meeting was couched in stronger terms than previously, noting at the outset that “Although swings in net exports have affected the data [our italics] recent indicators suggest that activity has continued to expand at a solid pace…. Uncertainty about the economic outlook has increased further”. There is a wide variety of views in the markets about the Fed’s likely course of action and with the tariff negotiations appearing to make headway, any change of rates at the June meeting is looking increasingly unlikely.

Meanwhile the US and UK have agreed a trade deal that may yet serve as a template for others, but the major change came over the weekend with Treasury Secretary Scott Bessent and China’s Vice-Premier He Lifeng leading the negotiations. The US is to reduce tariffs from 145% to 30% while China is to reduce duties from 125% to 10%. There is a 90-day period to work through, so the changes are not necessarily cast in stone.

China re-opened for business last week after the Labour Day holidays and this has helped to give gold some support as buying interest kicked in, with the Shanghai / loco London differential widening to a premium of $130% or 4% as we write. Demand for silver bars is picking up in the Middle East and gold bar demand is also robust, while silver is benefiting in Asia from gold’s high price.

COMEX gold inventories, tonnes

Source CME via Bloomberg, StoneX,

Gold, one-year view; back towards neutral territory

Source: Bloomberg, StoneX

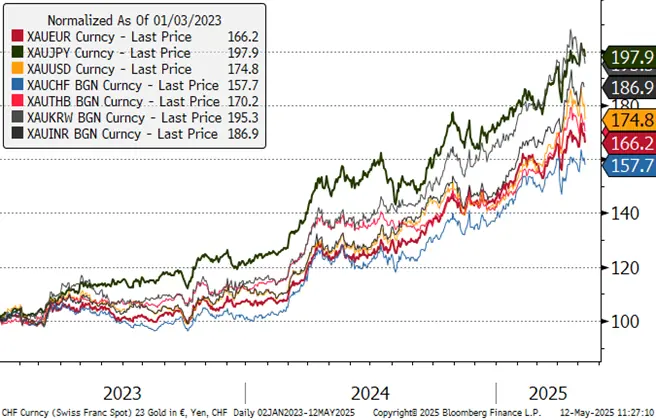

Gold in key local currencies.

Source: Bloomberg, StoneX

Silver, January 2024 to date; stabilising (insofar as silver can ever be stable!); still in an uptrend

Source: Bloomberg, StoneX

Gold:silver ratio, January 2024 to-date; back to100

Source: Bloomberg, StoneX

CFTC: Gold long liquidation continues, with 299t coming of the outright longs since the 2025 high of 799t on 4thFebruary, a drop of 40%. Shorts are up by 35t or 37% to 132t, although there has been some light short-covering over the past fortnight. Net long; 318t.

Silver’s high long position for the year so far was 10,086t in mid-March, since when they have come down by 32%% or 3,076t to 7,010t while over the same period shorts have increased by 73t or 3%. Net long, 4,875t.

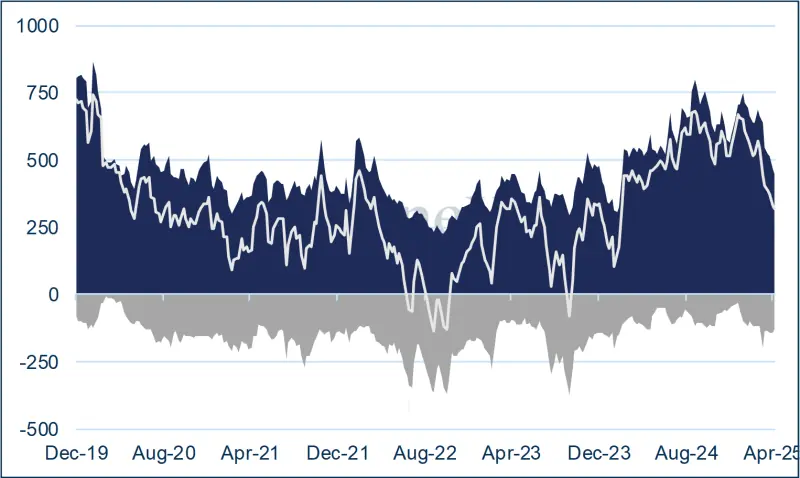

Gold COMEX positioning, Money Managers (t) –

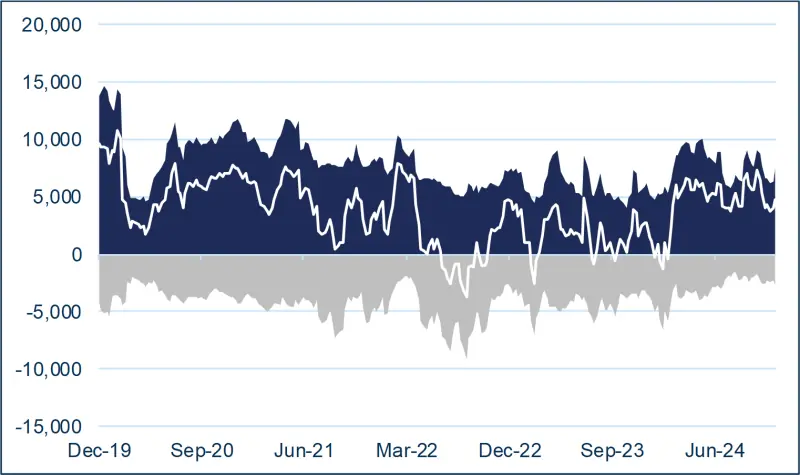

COMEX Managed Money Silver Positioning (t)

Source for both charts: CFTC, StoneX

Source: Bloomberg, StoneX

Repeat from our last note: -

So, what is the Fed doing and how does it work?

Quantitative tightening: not rolling over Treasuries as they mature. Buying bonds from the open market. Both of these actions would alleviate some upward pressure on bond yields.

The standing repo facility (SRF): this was implemented in July 2021. This is designed to keep monetary policy running smoothly, by limiting any overnight upward pressure on interest rates; the use of the SRF means that the Fed makes funds available to primary dealers, and some banks also, by accepting short-term high-quality US Treasuries, agency mortgage-backed securities and agency debt. The SRF can be used proactively, taking potential heat out of the markets, and is used only intermittently, in periods of financial stress.

The reverse repo rate is used to keep the fed funds target rate in the band specified by the Fed. In a repo, the Fed’s open Market Trading Desk (“The Desk”) buys securities from a counterparty with an agreement to resell at a later date. In a reverse repo the Desk sells securities to a counterparty with an agreement to repurchase at a later date. A reverse repo thus reduces the supply of reserves in the system.