Nov 2024

Nov 2024

Gold & Silver Market Shifts: US Election, Fed Cut, and China Demand

By Rhona O'Connell, Head of Market Analysis

- Gold was steady around $2,740 at the start of last week then dropped 3.5% on the day after the US election and some froth was duly blown off

- It then unwound 64% of the fall, rising to a Fibonacci resistance level –

- - but is below the lower band of its recent rising trend and a bearish moving average pattern is developing

- Silver was similar, around $32.5 then fell 6.3% to $30.9 then recovering towards $31.6

- The Federal Reserve opted for a 25-point fed funds cut, as expected, to 4.50-4.75%

- Jay Powell pins recent rises in Treasury yields on perception of stronger growth prospects rather than inflationary fears

- Equity markets are also positive on growth expectations

- Disappointment over the size of China’s latest stimulus may keep the lid on local jewellery demand

- BUT China has been the largest gold ETF buyer this year at 51t to end-October, an 83% gain and with plenty more upside

- US inflation numbers due; CPI on Wednesday, called at 2.6% Y/Y with core at 3.3%

- Silver ETFs mixed, some profit taking

- Year-to-date gold is up 28% and silver, 32%

Outlook; we noted last week that a clear election victory would likely see a dip, but we would expect that to be bought. This did come about, but the fall has not been fully unwound and a further slide towards $2,600 cannot be ruled out. For the longer term, geopolitics and central banks’ rate-cutting cycles remain supportive; and in turn, especially with solar power on the March, especially in Japan, this bodes well for silver prices in the medium term.

Gold, short-term; technical indicators turning down

Source: Bloomberg, StoneX

Gold turnover on the day after the election

And on the day of, plus the day after, the election

Source: Bloomberg

Note the high volume in COMEX gold (December contract) turnover when the price approached a turning point, both at the highs and the lows. This is normal as sentiment changes and some positions are closed while others, in the opposite direction, are opened.

Jay Powell’s prepared comments outlined solid economic expansion, with GDP at an annualised 2.8% in Q3, similar to Q2. Consumer spending growth has remained resilient, while housing is still weak. The labour market is described as solid, with slower payroll gains exacerbated by hurricanes and strikes in October. Unemployment is notably higher than a year ago but remains low at 4.1% in Q3. Conditions are now just less tight than pre-pandemic and labour is not seen as a source of inflationary pressures. Core PCE is at 2.7% and inflation is much closer to the Fed’s longer-run goal, although it remains “elevated”.

Unsurprisingly the first question from the floor was how the Committee was taking into account the likely impact on the economy of the new Administration; and how proactive or reactive the Fed is prepared to be in that context?

His answer: in the near term the election result will have no effect on policy decisions; they don’t know what the “timing and substance” of any policy changes will be, and therefore what the economic impact of any changes will be. “We don’t guess, we don’t speculate and we don’t assume” but of course - along with “countless” other influences, any developments will be factored into their calculations.

Another key question came from the Wall Street Journal, thus: “Given that you said you believe policy is restrictive and the Fed is now dialling back that restriction, are the growth risks presented by higher US Treasury yields today any different from those you identified one year ago when inflation was still meaningfully above your target?”

Response: the Fed has watched the run-up in bond rates and it’s nowhere near where it was a year ago, and also it is too early to really say where they will settle. He takes the view that the recent moves have not been driven by inflationary expectations, but more on a likelihood of stronger growth and perhaps less in the way of downside risks.

The key point here is maintaining the balance that underpins a solid labour market while reducing inflation; the Fed is very much on a path towards a neutral stance, but understandably he can’t pre-judge any decisions from the December meeting before seeing the next few weeks’ sets of data. The Fed is also cautious about delivering too much forward guidance in its Statement because they need to be flexible with regard to economic developments and therefore the dropping of the comment in the Statement about “gaining further confidence” is not significant.

Source: StoneX

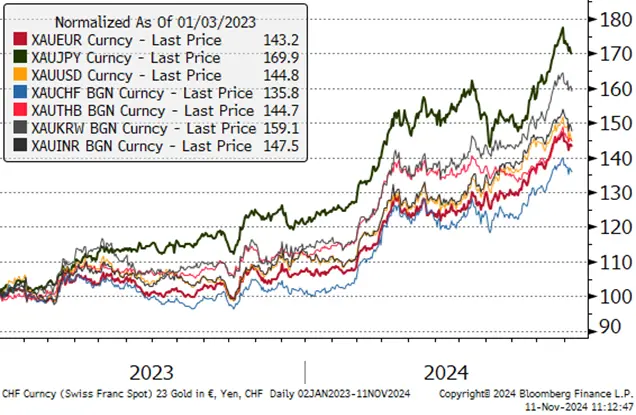

Gold in key local currencies

Source: Bloomberg, StoneX

Silver, year-to-date; technical indicators positive; the 10D average still providing close support

Source: Bloomberg, StoneX

Gold:silver ratio, year-to-date

Source: Bloomberg, StoneX

In the background:

Source: Bloomberg

The next FOMC meeting is 17-18 December.

COMEX

Gold; position closures on both sides

Managed Money positions saw longs shed 47t (6.5%) in the week to 5th February, having come off its record price levels; while shorts also contracted, losing 7.6% or 9.3t. The outright longs at 683t are now only 40% higher than the 12-month average and at eight-week lows. Net long; down 6.2% to 569t.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

Silver; longs down, shorts up as $35 present resistance at end-October

Silver’s fall from almost $35 to $32.5 (prior to the post-election drop) was accompanied by a 10.4% (907t) contraction in outright longs and a 12.6% (283t) increase in shorts by close of business on 5th November. Outright longs were 7,804t, to stand at just 7.5% over the 12-month average. Shorts stood at 2,527t for a net long of 5,277t.

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

ETFs:

Gold ETFs; We have just had six consecutive days of net redemptions for losses of 11.3t, and taking the year-to-date change into a small gain of 6.5t. the year to 31st October. World Gold Council numbers show a ytd gain of 12t in the States but a 71t drop in Europe. China has added 51t, or 72%, to 105t, the largest buyer this year .

Silver has had more interest on the buy side and in a mixed start to November therefore lost 42t, just 0.2% to 23,096t. This gives a year to-date gain of 1,326t or 6%. Global mine production is ~26,000tpa.

Source: Bloomberg, StoneX

Tailwinds for gold exceed the headwinds

For the longer term, the tailwinds substantially outweigh the headwinds and are summarised in this note that we published at the end of August: Precious Metals Talking points 083024: Gold: state of play and key influences going forward

Key points from this note are still relevant, and as follows

Current tailwinds include: -

- Geopolitical risk.

- Increasing trade tensions

- Stresses in the banking systems in the three major regions, notably in the small-to-medium sized sector, and especially exposure to property, and (in the US) Commercial Real Estate.

- Emergence of the Shadow Banking sector (i.e. unregulated transactions), reminiscent of the Sub-Prime issues in 2007 that led to the Global Financial Crisis in 2008

- Continued strong Official Sector purchases – not just because they are taking tonnage off the market but because of the signal that it sends to the markets because the Official Sector dislikes uncertainty

- Widespread investor interest, notably from High-Net-Worth individuals, Family offices and other professionals who are back in the market for the long haul.

Headwinds:

- Reduction in international political or trade tensions

- Any strong inflationary forces and / or associated expectation thereof could force a reversal in monetary policy

- Official sector going on the retreat (unlikely)

- Investors’ conclusion that risks have declined (likely to take a matter of years, compare GFC of 2008); it wasn’t until 2013 that professionals bailed out of gold (over 800t of ETF metal went straight into private hands in China)