Jul 2024

Jul 2024

Gold and Silver Shine Amid US Labor Market Slowdown and Global Political Unrest

By Rhona O'Connell, Head of Market Analysis

- A change of range at last and an uptrend developing

- More signs of a slowdown in the US labour market have boosted gold and silver

- As usual, silver posted the larger gains

- Gold’s recent peak may be in sight as technicals turn positive

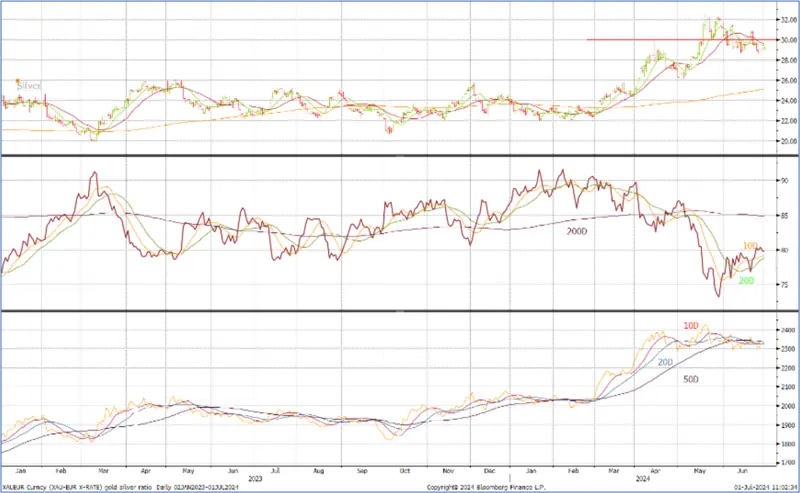

- But silver is overbought at $31 and needs to correct

- Gold:silver ratio now below 77 – just

- ETFs strong in the first week of July

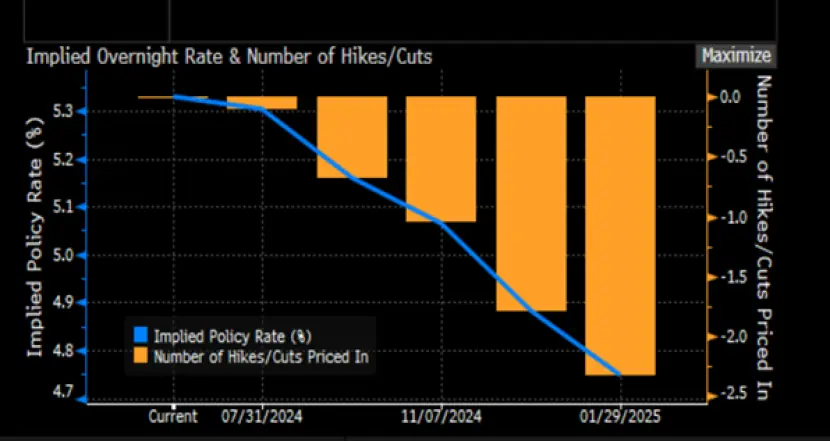

- Financial futures are again looking for two rate cuts this year and Jay Powell had an easier tone last week

A hung French Parliament and turmoil in the Democratic Party in the States are both supportive as gold thrives on uncertainty

Outlook; the overall outlook for gold remains positive on the back of geopolitics and economic uncertainty. Silver needs to correct from overbought conditions, but the long-term outlook remains favourable from automotive, solar and electrical considerations.

Gold, silver and the ratio, January 2023-to-date

Source: Bloomberg, StoneX

Once again, the States was firmly in focus last week, with the release of the Minutes from the June Federal Open Market Committee meeting mid-week and the NonFarm Payroll figures on Friday – plus Jay Powell at the ECB Banking Forum at Sintra at the start of the week. In fact the Sintra development and then NonFarm Payroll overshadowed the Minutes, but it is always worth taking a quick look at them to try and dig out any change of tone or different nuances. These latest Minutes still showed differences of opinion, but that is to be expected. Probably the key points to note are that

- The Staff said that progress towards 2% inflation had been moderate with total PCE (Personal Consumption Expenditure, which is more all-embracing than CPI) at 2.7% in April [2.6% now] while core CPI was 3.4%

- Staff outlook included expecting unemployment to edge down through 2024/25 and be flat in 2026

- Participants remain concerned over high prices’ impact on domestic purchasing power

- Continued disinflation is supported by easing labour and the lagged effect of monetary tightening

- It is possible that the longer-run equilibrium rate is higher than previously assessed, and could be a better guide for longer-term fed funds targets, while additional favourable data are required to deliver greater confidence about achieving a 2% target. Monetary policy now “well-positioned” to deal with risks to achieving the dual mandate.

Meanwhile Jay Powell had said at the start of the week that there had been “quite a lot of progress” in containing inflation and he acknowledged the risk of cutting too late (thereby helping gold up towards $2,360).

This set the scene for a sharp rise in gold at the end of the week. After spending much of the week trading between $2,350 and $2,360, gold was boosted to test $2,390 on Friday in New York hours following the NonFarm Payroll, which rose by just 206 thousand after 272 thousand the previous month. Manufacturing numbers actually dropped. Only by eight thousand, and small in the greater scheme of things, but it does at least flash an amber signal.

Silver, year-to-date; technical indicators

Source: Bloomberg, StoneX

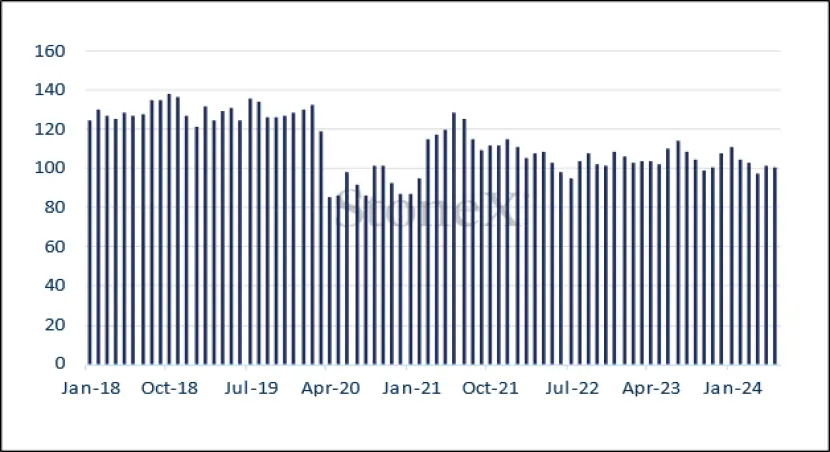

At the start of this week gold is easing towards $2,370, which it needed to do after that sharp move on Friday, but with the French general election now throwing another spanner in the works as it points to a hung Parliament, and with the German economy still showing signs of fragility, there are more supportive elements creeping into gold’s fundamentals, at least from a geopolitical standpoint. This economic uncertainty may hinder silver when gold loses momentum, but for the longer term silver’s fundamentals are bright.

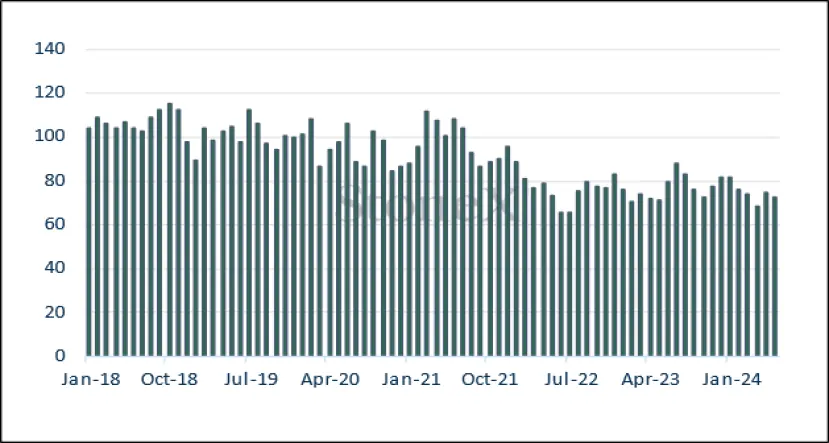

German IP month-on-month

Source: Bloomberg, StoneX;

Germany Business Climate Index

Source: Ifo Institute

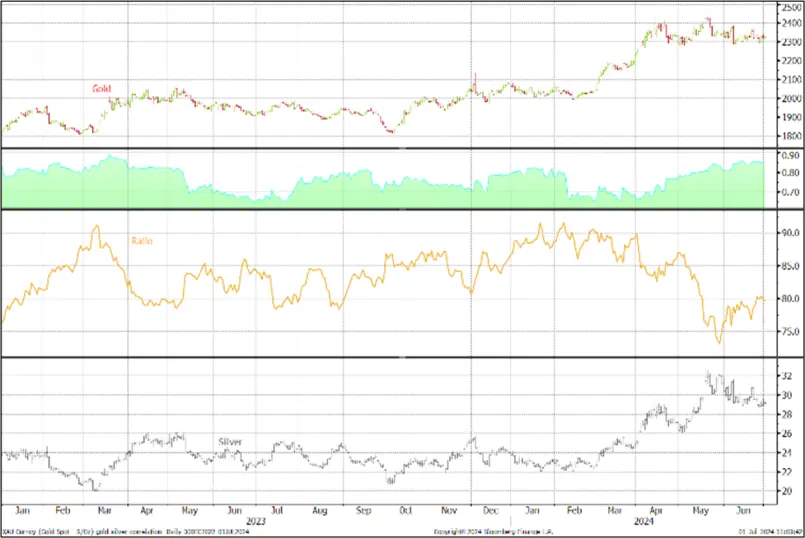

Gold, silver and copper; silver correlation with gold, 0.85; with copper, 0.76

Source: Bloomberg, StoneX

Bond markets’ expectations for the rate cycle; now looking at a 71% chance of a September cut and 77% of one in December

Source: Bloomberg

In the background the gold Exchange Traded Products have been increasingly positive. In June (after a net gain of 8.2t in May) the gold ETFs added 7.6t, but in the first five days in July they have added a net 8.3t for a year-to-date fall of 116t to 3,109t (world mine production is roughly 3,700tpa). In the year to 21st June (the latest figures available from the World Gold C council) North American funds lost 74t or 4.5%, Europe dropped by 90.4t (6.5%) and Asia stayed positive, adding 38t or 28%.

Silver added 178t in June in mixed trade with nine days of net creations from a total of twenty; in the first five days of July they have added 143t with one particularly chunky day last week adding 134t on 4th July, after silver had crossed above $30/ounce. Year-to-date the loss is 166t to a total of 21,604t (global mine production is ~26,000tpa).

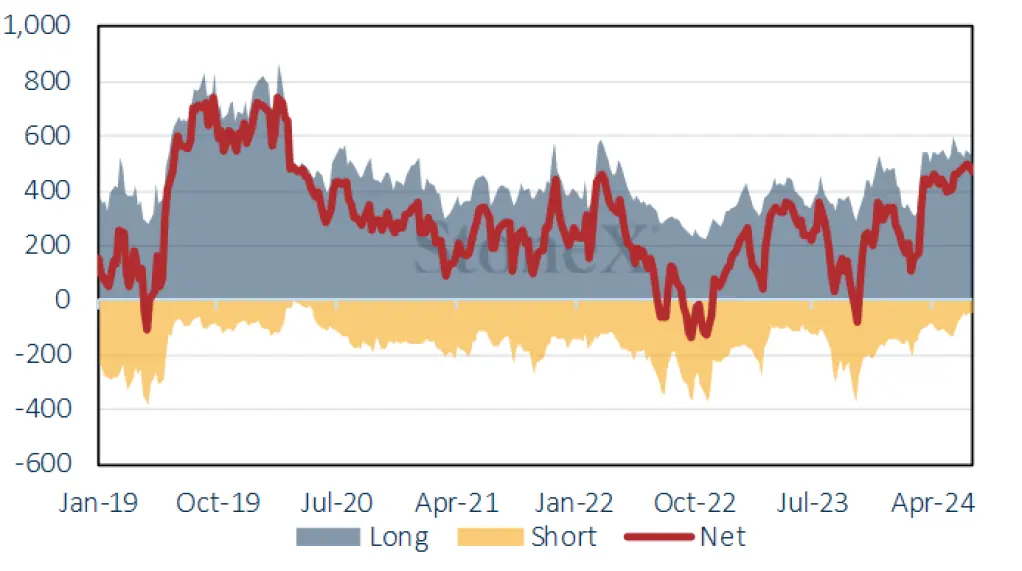

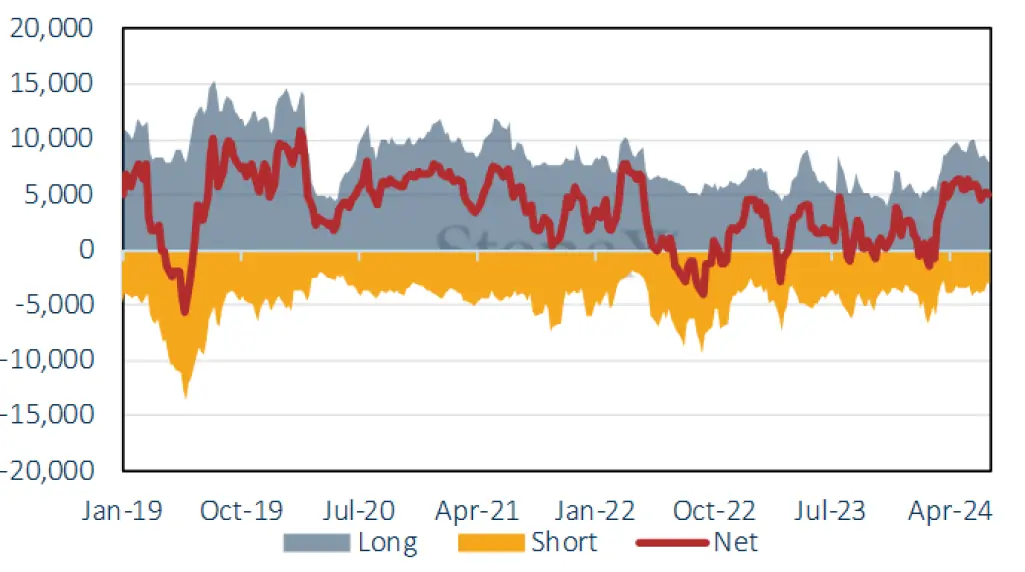

COMEX; no CFTC figures today due to 4th July holiday – so this is last week’s comment

The Commitments of Traders reports show that over the fortnight the outright gold long position on COMEX came down by just 19t or 3.5% to 524t, while outright shorts dropped by 40% to 48t, the smallest position since May 2020,leaving the net at 476t. The outright long stood at 22% over the twelve month average which , while still a little toppy, is not as overwhelming as a few months ago. The silver position has cleared out quite a bit of its COMEX overhang, shedding 1,613t over the fortnight, a reduction of 16% to 8,392t, while the shorts contracted very slightly, losing just 55t or 1.4%to 4,511. This leaves the net position at 4,511t, the smallest net long since mid-March.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

Source: Bloomberg, StoneX