Aug 2024

Aug 2024

Gold and Silver Market Update: Turbulence, Trends, and the Fed's Impact

By Rhona O'Connell, Head of Market Analysis

- Gold performs its usual role as an insurance policy amid equity market turbulence

- Silver unwound some losses last week then fell heavily at the turn of the week to wipe out those gains; oversold at $27

- Silver ETFs were mixed last week, net additions

- Gold ETFs also mixed, but net small redemption; technicals are turning neutral to negative

- Gold:silver ratio now at 88, the highest since early February; overbought

- Press headlines about the Fed being “behind the curve”

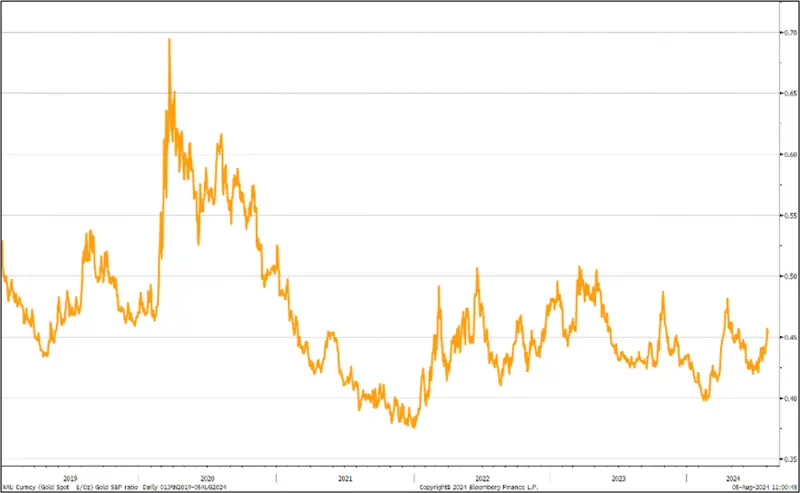

- The Gold/S&P ratio has gained 9% since late June

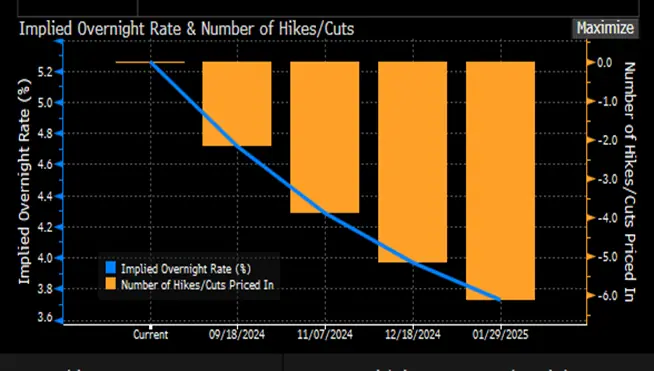

- Swaps markets now pricing in 125 point rate cuts this year

Outlook; in the short term gold could well remain under some pressure, but the overall outlook is positive on the back of geopolitics and economic uncertainty, and the evolution of the US political scene will remain supportive as a bull case can be made for both likely Presidential election outcomes. Rising Middle Eastern tensions are also supportive and the fragility of the equities markets are a further positive element although that may take a little time to develop. Silver is attuned to the economic outlook and while the gold:silver ratio is overbought it is expected to continue to underperform.

Gold/S&P ratio January 2019 to date

Source: Bloomberg, StoneX

Roughly a year ago the markets were talking about how the Federal Reserve Board and the Federal Open Market Committee (FOMC) had done too much too late in terms of rate hikes, and there were fears of recession, as well as pressures on small-to-medium-sized industries and medium-sized the banking sector. All of which was supportive for gold.

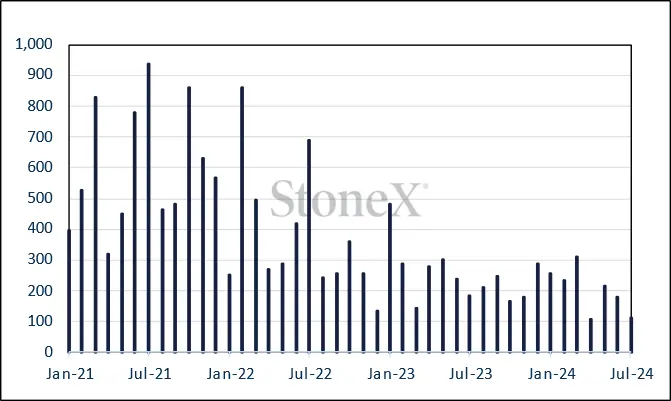

US NonFarm Payrolls

Source: Bloomberg, StoneX

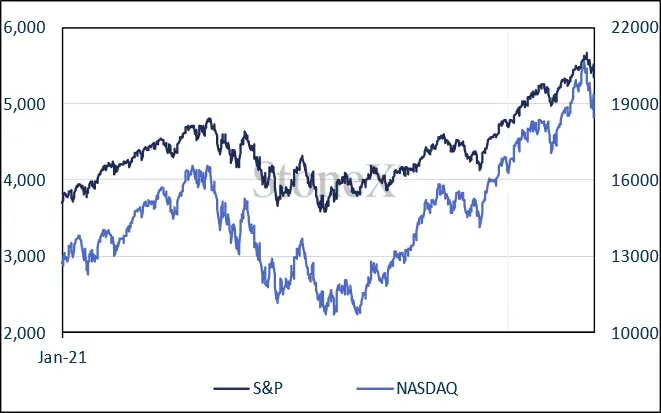

S&P, NASDAQ

Source: Bloomberg, StoneX

Now, after a long period in which the resilience of the US economy has continued to confound any number of economists, not just in the Fed, the talk is of recent US economic numbers in particular that could be pointing towards a recession and there are suggestions that the Fed has sat on its hands for too long, that it may yet make three rate cuts before year-end, or even that there may be a 50 point cut in the offing.

All of which is also supportive for gold (unless of course it doesn’t happen).

The end of last week, following employment numbers that were below expectations and with a rise in unemployment, the US equity markets came under pressure with the S&P losing 1.8% on the day and NASDAQ 3.4%. Concern that the US performance was under threat spilled over into the Asian markets and turned into something of a rout. The Nikkei was particularly hard hit, partly because it is a deep and liquid market, but partly also in response to the change in the Bank of Japan’s policy and the associated 12% gain in the yen over the dollar in the past four weeks

Gold and the S&P from the COVID crash

Gold initially came down with the equity markets before recovering mildly but is still under a degree of pressure. This is not unusual; more often than not when equity markets turn down sharply gold is sold as a hedge against risk, in order to raise liquidity against potential margin calls. Those sellers almost invariably then re-establish their positions when the dust settles. A good case in point is gold’s performance in the meltdown at the onset of COVID; gold fell along with everything else, but unwound its losses in four weeks, while it took the S&P six months to claw its way back.

So gold may still stay under some pressure in the near term, but the external forces at work favour higher prices. Silver, however, may struggle.

Gold, year-to-date; technical indicators turning neutral to bearish

Source: Bloomberg, StoneX

Silver is continuing to suffer from the overflow of weakness in the base metals markets, and the latest economic numbers, which were partly responsible for the equities markets’ falls have continued to undermine silver, which has now unwound all the gains that it made through July. We referred last week to the frequent chatter about Chinese overcapacity in the solar market likely undermining sentiment in silver; there is little reason to change that view. Metals Focus analysis for 2023 shows solar demand of 6,017t last year, 20% of global fabrication (excluding investment) demand.

Silver, year-to-date; technical indicators

Source: Bloomberg, StoneX

Meanwhile gold ETFs were mixed last week, with three days of redemption and a small loss of 3.4t overall, taking the year-to-date losses to 76t for holdings of 3,146t. Global mine production is ~3,750t. Silver ETFs were also mixed with three days of creations, adding 150t over the week, for a year-to-date gain of 568t. Global mine production is ~25,800tpa.

Silver, year-to-date; technical indicators

Source: Bloomberg, StoneX

Bond markets’ expectations for the rate cycle; now looking at a 219% chance of a September cut -which means they are discounting 50 points , 170% for November and 128 of one in December to clos ethe year at 3.97%

Source: Bloomberg

COMEX

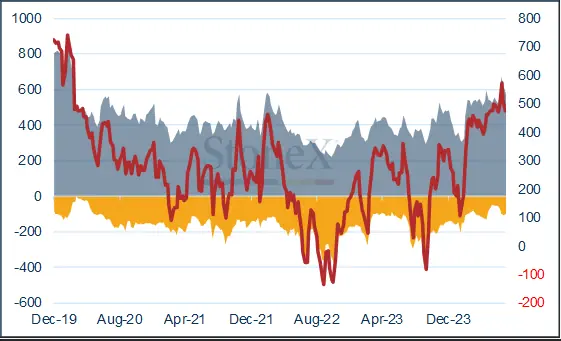

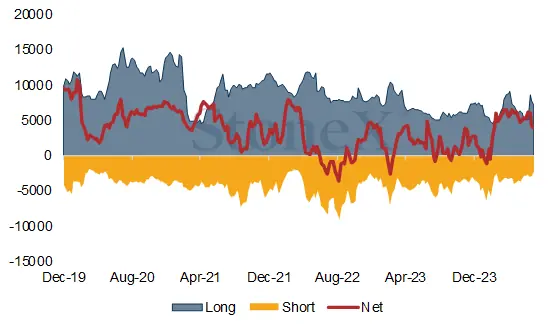

Gold made small gains in the week to 30th July, adding 0.6% to $2,411 and silver dropping again, losing 2.3% to finish at $28.37. Gold outright longs dropped by 6% or 38t to 577t; outright shorts fell by 5% to 103t. Net long down from 507t to 474t. Silver outright longs fell by 11% to 6,092t and shorts contracted by 25%or 103t to 2,128t. Net long down 4% to 3,964t.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

Source: Bloomberg, StoneX