Feb 2025

Feb 2025

Gold Hits $2,800 as Fed Holds Steady & Tariffs Loom

President Trump’s tariff policy is still in the cross hairs and attracting retaliation

- It’s still all about tariffs

- While the Fed stands its ground

- Gold remains in focus as a risk mitigator although at the start of this week the dollar is centre stage

- Shipping times out of London are now as much as a month - usually it is only ten days from London into CME vaults

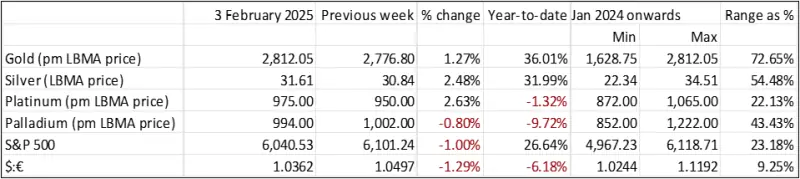

- New intra-day high prices posted last week, with $2,800 briefly breached

- Prices remain supported despite China being on holiday

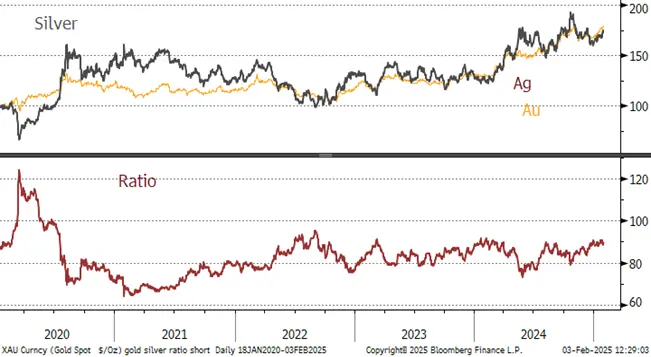

- While silver underperforms gold as it keeps a wary eye on industrial activity,

Outlook; the overall outlook for gold is effectively unchanged. We continue to expect further gains in gold in the first part of this year as geopolitics remains dominant, but much of this is already priced-in and we would not be at all surprised to see gold prices peak this year. For the longer term, if gold does go onto the retreat silver is likely to go with it, but any dips may well be shallower than those of gold. This would be a fundamental shift in the long-standing relationship between the two as we see the start of some decoupling. For the short term, though, silver remains troubled by economic activity – or the lack thereof – in Europe and China.

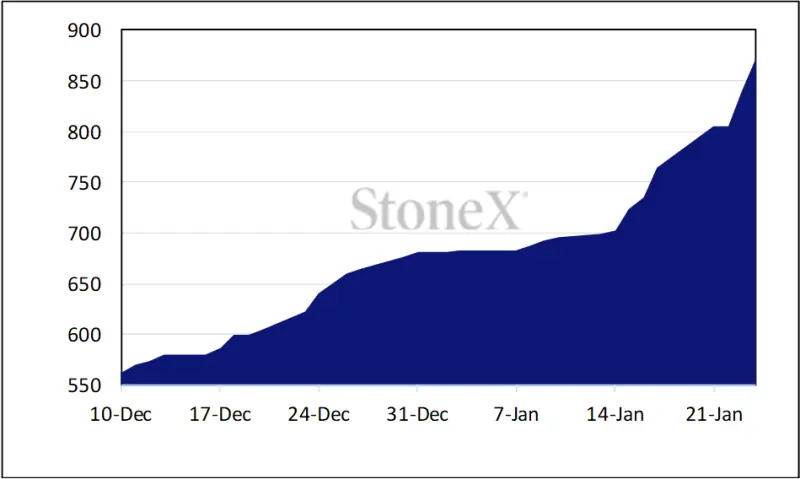

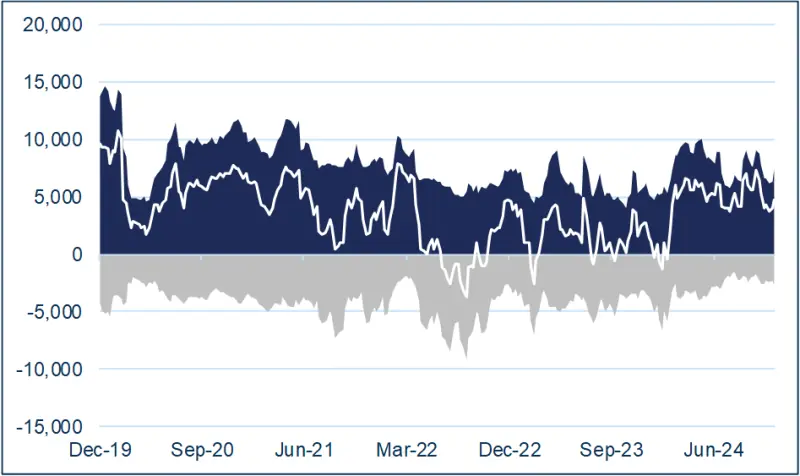

Metal has continued to be delivered into CME warehouses. As with last week, the most dramatic changes have been in platinum, but gold is capturing the headlines and there is a degree of hype in some headlines, sowing the seeds of uncertainty. Although it is still unlikely that there will be tariffs on gold imports, risk managers are taking no chances. Since 10thDecember the changes have been as follows (tonnes): -

Gold and silver inventories in COMEX warehouses

Gold

Silver

Source: Bloomberg, StoneX

Is the tariff policy any clearer? What messages is the Fed sending?

President Trump’s proposed 25% tariffs on Mexican and Canadian imports, plus an additional 10% on those of China, are due to take effect tomorrow 4thFebruary and the markets’ reaction at the start of this week has been defensive, with equities coming under pressure and the dollar showing independent strength, taking some of the heat out of gold’s recent run to new highs. Gold printed an intra-day high of $2,817 at the end of last week, before retreating to find support from the ten-day moving average at $2,770. Silver, meanwhile, traded up to $31.7 towards the end of last week but turned down before gold corrected, and retreated to $30.7 before finding some tentative support.

In the background the automotive sector is also on the retreat as car makers warn that tariffs on Mexican and Canadian imports could potentially cripple the sector, which is already struggling with shifting investment patterns over electrification of the fleet and the possibility of this being thrown into reverse given the President’s views on ICE vehicles and fossil fuels. This is yet another an area of uncertainty that puts pressure on the equities markets and by association is supportive for gold – but less so for silver, given its role in the EV sector. Meanwhile Canada has announced that as of 4th

February it will be imposing 25% tariffs of roughly $30Bn of goods imported from the United States; and that these will remain in force for as long as the States imposes tariffs on Canadian goods. These cover food, drinks, tobacco, cosmetics and a range of household goods.

S&P, DAX index, gold; year-to-date

Source: Bloomberg, StoneX

Meanwhile the Fed met last week and left its federal funds target rate unchanged. The tone of the accompanying Statement was slightly different from previously, noting that the “unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid. Inflation remains somewhat elevated”. The financial markets are reflecting that, with the break-even rate of inflation for the five-year TIPS index (Treasury inflation-protected bonds) rising to 2.6%.

The President wants rates sharply lower, but the Fed is keeping its eyes on both elements of its dual mandate (contained inflation and strong labour) and it was clear last week that if it needs to maintain a somewhat restrictive stance, then it will do so. Bond yields, which picked up after a solid labour market report in mid-month, have eased since.

Gold, technical

Source: Bloomberg, StoneX

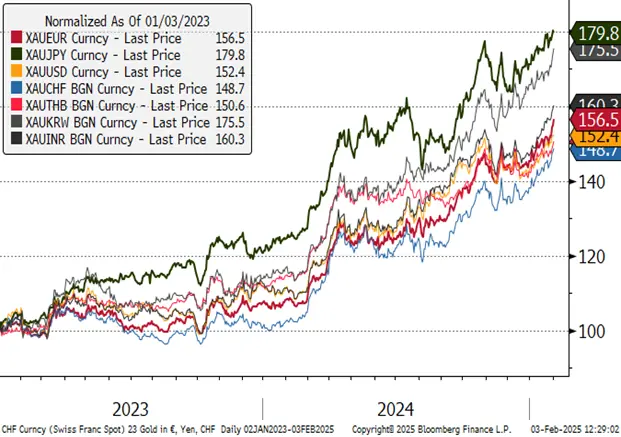

Gold in key local currencies

Source: Bloomberg, StoneX

Silver technical

Source: Bloomberg, StoneX

Gold:silver ratio, 2020-to-date

Source: Bloomberg, StoneX

In the background:

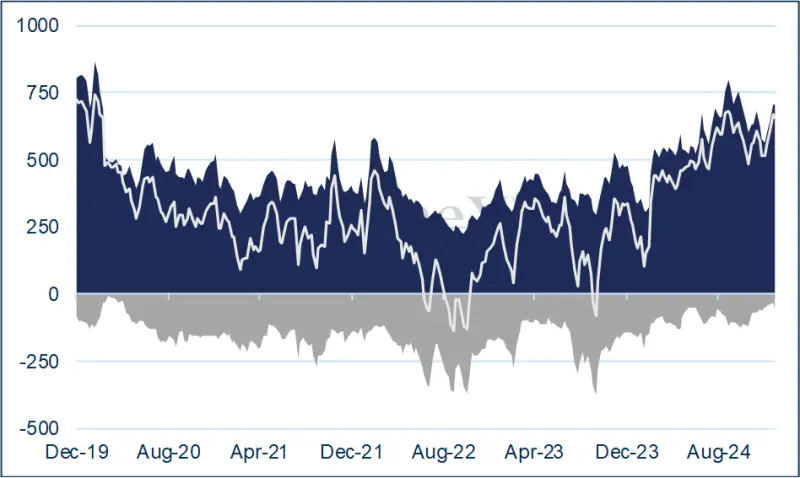

CFTC: turns against both gold and silver

Gold longs-added a minuscule amount in the week to 28th January, while shorts expanded by 56% from 34.5t to 53.9t, the highest since late December. Silver longs contracted by 3% while shorts rose by 9% to four-week highs.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

ETFs:

World Gold Council figures record a small loss 2024, at just 6.8t, although dollar flows were positive at $3.4Bn, taking assets under management to $271Bn. North America added eight tonnes, Europe dropped 98t, while Asia added 78t, a gain of 57%. As we have noted before, at just 115t, Chinese holdings are minimal by comparison with the 1,582t in the States and 1,288t in Europe, there is considerable upside scope.

January was mixed, with 12 days of net creations from a total of 22 trading days for a net gain of 18t tonnes, to a total of 3,237t. Global Mine production is ~3,600tpa.

Silver – added a net 506t over 2024, to reach 22,276t; January activity was cautious, with only nine days of net creations, for a net decline of 312t, against global silver mine production of ~26,000t.

So what is the EFP and how does it work?

“EFP” is the acronym for Exchange of futures for physical. While the futures market forms part of the transaction, EFP trading is between two counterparties and is not centrally cleared. Last week the gold EFP shot out to more than $60 between spot and the active contract (February 2025 in this case); i.e. between 2% and 3%; that of silver reached a dollar, or just over 3%.

How does it work? Trading the EFP is a way of hedging market exposure. By buying the EFP, a holder of physical metal contracts with a counterparty to sell the physical position while simultaneously buying the futures. That way the exposure in the metal itself is unchanged; but the delivery date shifts. Some market stakeholders have been using the EFP in order to deliver metal into the United States ahead of 20th January in order to reduce the risk attached to long positions in case of tariff imposition. In our view tariffs on either metal, especially gold, are unlikely, but it is understandable that some traders – or their risk officers (as was the case during the pandemic) want to eliminate any possibility of being caught up in any fall-out.

Tailwinds for gold exceed the headwinds for the longer term, the tailwinds substantially outweigh the headwinds and are summarised in this note t

Current tailwinds include: -

- Geopolitical risk.

- Increasing trade tensions

- Stresses in the banking systems in the three major regions, notably in the small-to-medium sized sector, and especially exposure to property, and (in the US and to a lesser extent) Commercial Real Estate.

- Emergence of the Shadow Banking sector (i.e. unregulated transactions), reminiscent of the Sub-Prime issues in 2007 that led to the Global Financial Crisis in 2008

- Continued strong Official Sector purchases – not just because they are taking tonnage off the market but because of the signal that it sends to the markets because the Official Sector dislikes uncertainty

- Widespread investor interest, notably from High-Net-Worth individuals, Family offices and other professionals who are back in the market for the long haul.

Headwinds:

- Reduction in international political or trade tensions; Scott Bessant could well be instrumental here

- Any strong inflationary forces and / or associated expectation thereof could force a reversal in monetary policy

- Official sector going on the retreat (unlikely)

- Investors’ conclusion that risks have declined (likely to take a matter of years, compare GFC of 2008); it wasn’t until 2013 that professionals bailed out of gold (over 800t of ETF metal went straight into private hands in China).