Feb 2023

Feb 2023

StoneX Bullion round-up Monday 13th February 2023

By StoneX Bullion

Gold and silver consolidating after retreat

More “restrictive” comments from Federal Open Market Committee (FOMC) members

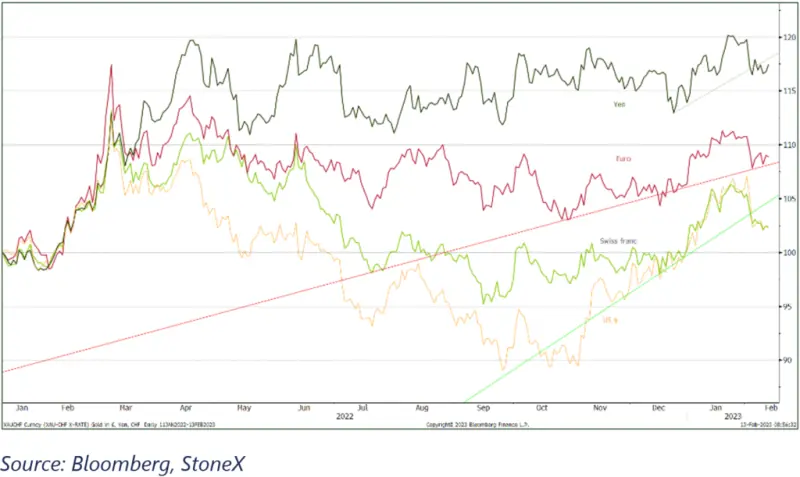

Rather than buying on dips, gold is now running into selling into any short-term rally. This is partly self-fulfilling as the technical constructions have become increasingly negative, with the 10-day moving average crossing below the 20-day and gold is now testing support offered by the 200-day average. As the first two charts show, this is largely a dollar story; the first shows how the dollar has picked up over the past week, while gold prices in the other major currencies are broadly flat.

Inflationary forces in the United States are an ever-constant feature in market commentary, not least because developments in the States have a knock-on effect – if not globally, then certainly through most economies. This week is no different, with the U.S. Consumer Price Index (CPI) due to be released tomorrow (Tuesday 14th). The consensus among economists is that this January’s CPI will post a 0.5% month-on-month gain and that December’s recorded fall of 0.1% month-on-month will be revised upwards, to plus 0.1%. The rate excluding food & energy, which is the parameter that the Fed watches, is called at +0.4% month-on-month.

On a year-on-year basis the headline CPI is forecast at 6.2% (after 6.5% the previous month) and 5.5% ex-food and energy, after 5.7% in December.

Spot Gold, technical annotations

Spot gold, in major currencies

This needs to be taken in conjunction with economic news from last week, which showed strong consumer sentiment (the University of Michigan sentiment survey, which is closely followed, posted 66.4, the highest in thirteen months) and another fall in unemployment numbers, while job vacancies continued to rise – notably in construction and retail trade, and especially in Leisure and Hospitality.

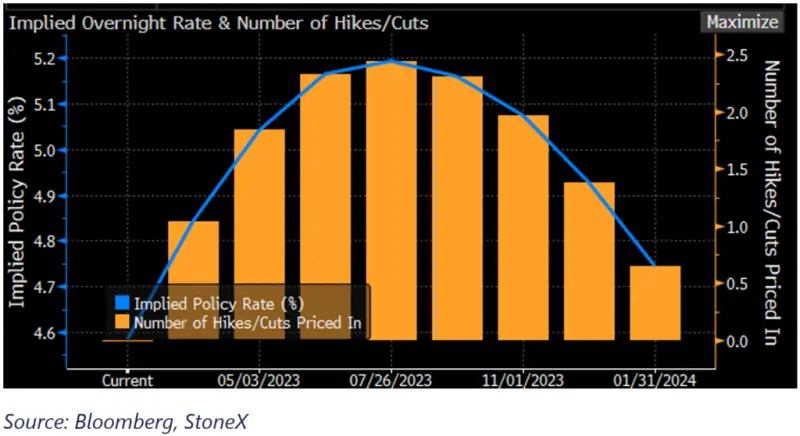

So, while some headline inflationary forces (largely in the goods sector) appear to be dissipating to some extent in the States, the FOMC rhetoric seems to be justified in remaining robust with more FOMC members talking of maintaining higher rates for a longer period of time and the bond market is reacting accordingly. Well, almost. The fed funds futures rates are now pointing to a higher peak than before, at 5.2% and they have pushed this out to July now, having been aiming for May from some months and then edging out towards June.

US fed funds implied overnight rates

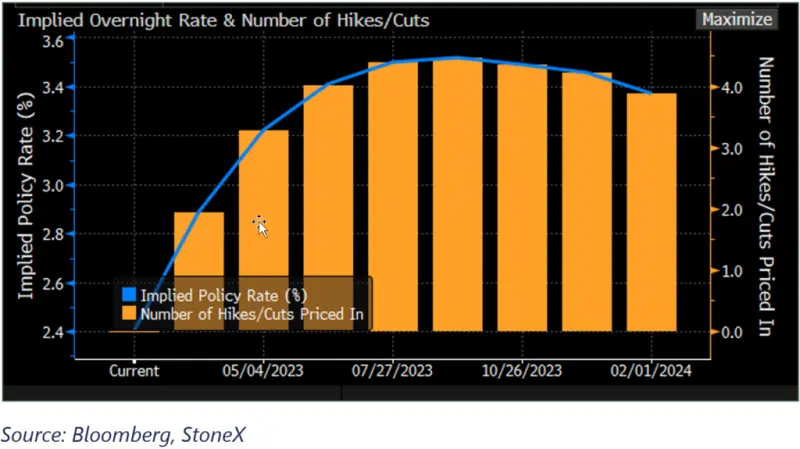

EU bond markets’ implied rates

So, all of this has conspired to keep gold under some pressure and taken silver down with it, so that as we write gold is trading just above $1,860 and silver just under $22, for year-on-year falls of 0.5% and 7.9% respectively. Interestingly it looks as if silver is starting to attract some industrial buying interest at these levels, where there is some chart support; also, we notice that there were two days last week that enjoyed some chunky silver ETP purchases (over 95t on each day); for the year to date the silver products have added 484t (2%) to stand at 23,780t. Global mine production is just over 26,000tpa. The gold ETPs, meanwhile, continue to bleed metal but at a relatively low rate with a loss of 24t (less than 1%) so far this year to stand at 2,892t (compare global mine production of close to 4,000t).

Meanwhile the pressure on silver supplies into the Mints appears to have eased slightly, while demand remains relatively sturdy.

So, it is all about U.S. inflation numbers this week and how the bond markets react; arguably the retreat in gold and silver prices has already discounted increased pressure on the bond markets, but it will all be in the numbers.

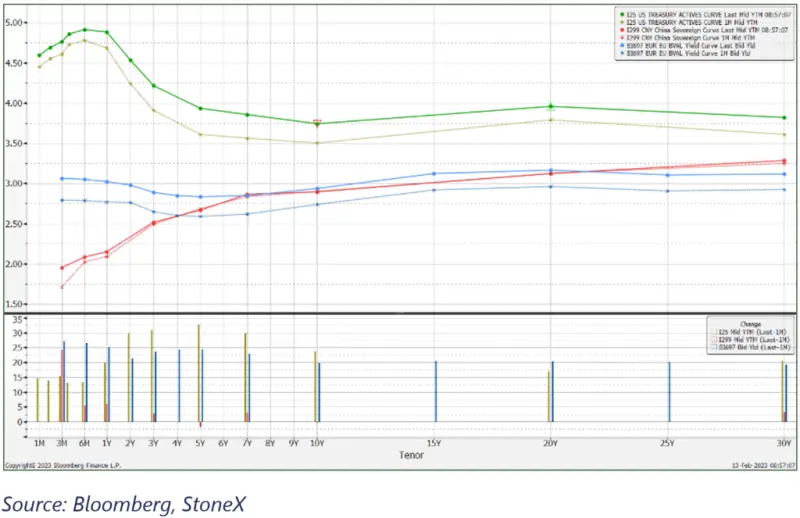

The U.S., E.U. and China yield curves

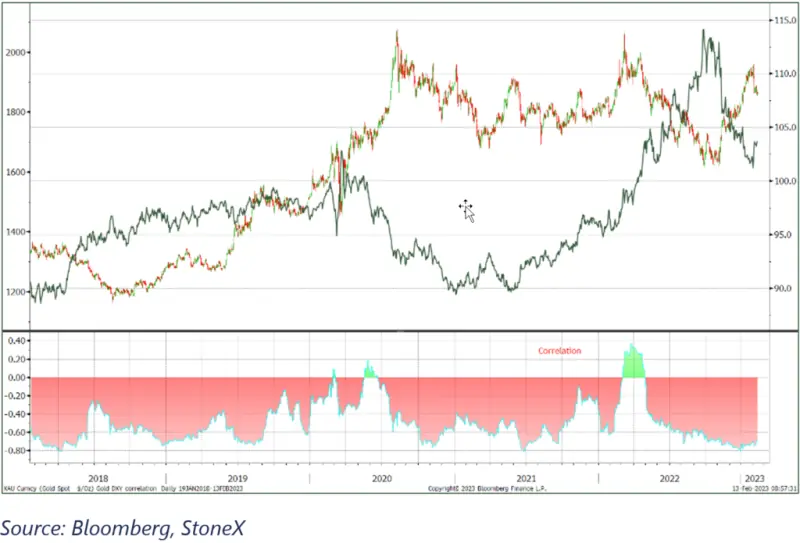

Gold, the dollar, and their correlation

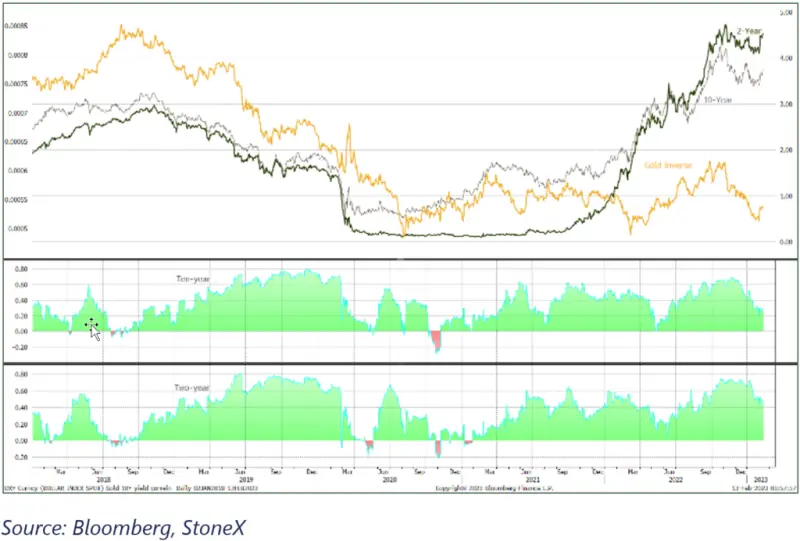

Gold (inverted) and the two and ten-year yields; correlation with the 10Y