Jan 2023

Jan 2023

StoneX Bullion round-up Monday 30th January 2023

By StoneX Bullion

Gold consolidating in new range; downward pressure on US inflation levels is fading.

Gold has continued its period of price consolidation over the past week and has essentially been trading sideways in a range between $1,908 and $1,946 (intraday). While still in its uptrend, it is now dicing with the 10-day moving average and if it were to break convincingly below that level (i.e., a $55 drop) then the recent bull run would be partially negated. Silver has also been steady and now been in a range between $23.0 and $24.5 for the past five weeks, with the ratio also roughly steady around 81.

Spot Gold, technical annotations

Conditions were relatively quiet last week as the Chinese markets were closed until Friday to celebrate the Lunar New Year. This year is the Year of the Rabbit, which signifies peace, serenity, and prosperity. Since the Chinese markets have re-opened the domestic premium of Shanghai over loco London has strengthened, and although it is nowhere near the heady levels of September and October, the recent improvement does suggest that there is some underlying strength developing in that market also.

While looking at China, it is worth noting hat Swiss reported exports to China and Hong Kong last year exceeded 450t, more than 200t higher than in 2021 (for context, global mine production is approximately 3,600 tonnes). World Gold Council figures show Hong Kong + China’s combined jewellery and coin demand was actually down by 104t at 622t in the first three quarters of the year and we would guess that they probably came to roughly 700t for the full year. China’s mine production is typically approximately 350t so there is a shortfall of roughly 350t to make up. This suggests that overall imports into China were substantially higher than domestic demand requires and while it is possible that some of this metal may have come back out of the country and not necessarily shown up in all the trade numbers, the extra would certainly account for the reported increase in Central Bank reserves of more than 60t in the latter part of the year. There is chatter in the markets about the lack of reported increases in China’s central bank holdings and these numbers are likely to increase those views.

Meanwhile in North America the CFTC figures for the week to 24th January, when gold was about to reach the highs of its recent run, show additional length among the Money Managers, with the outright longs rising to 409t. This is the highest since late April last year and 16% higher than the twelve-month average of 353t. So, there is a risk of profit taking or some stale bull liquidation if prices lose momentum. The net position stood at 248t, the highest since early May last year. Shorts were also expanded, which may have contributed to the loss of upward momentum.

Silver saw a reversal of the bullish activity of the previous week, with longs falling by 6% and shorts increasing by 21% to take the net long to 3,186t from 4,255t.

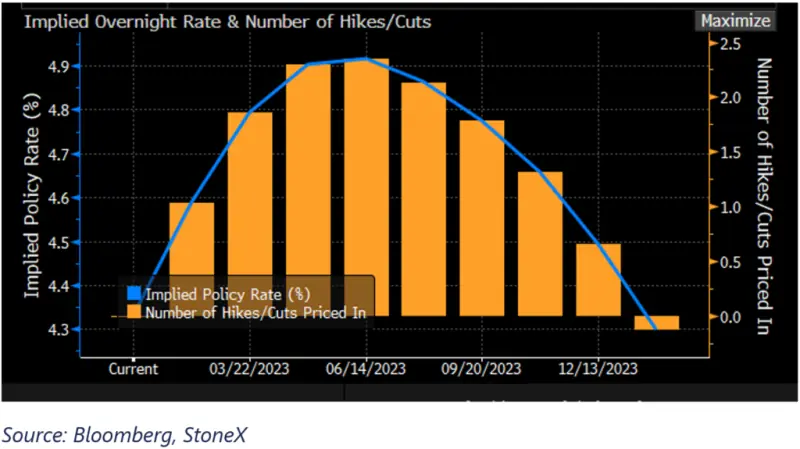

This week sees the next meeting of the Federal Open Market committee (Tuesday/Wednesday 31 January/1st February). The general consensus in the markets is that the rate hike will be only 25 basis points and on the back of more disappointing economic numbers over the past few weeks, that seems like a fair assessment.

US fed funds implied overnight rates.

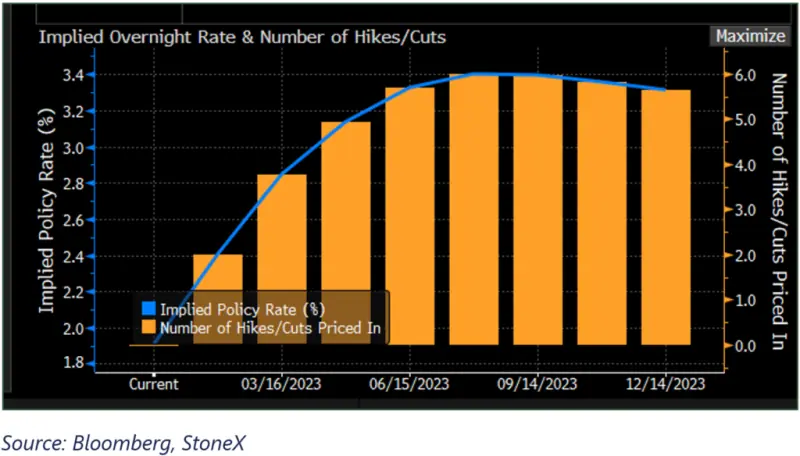

EU bond markets implied rates

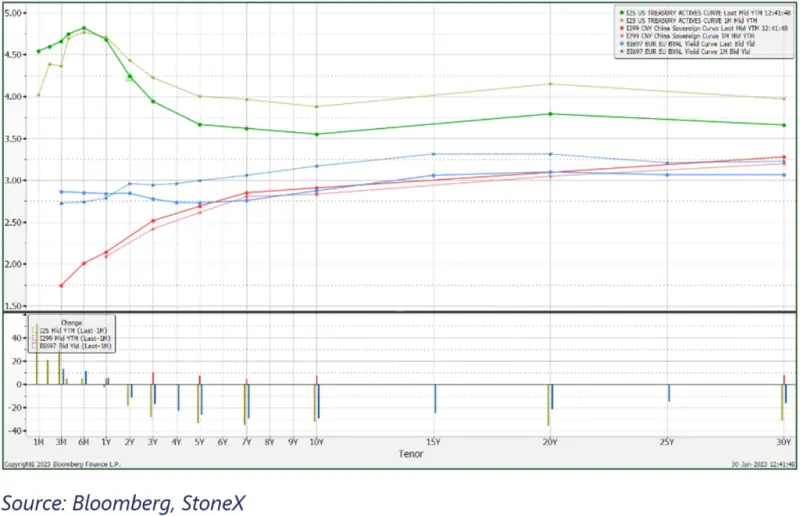

The U.S., E.U. and China yield curves

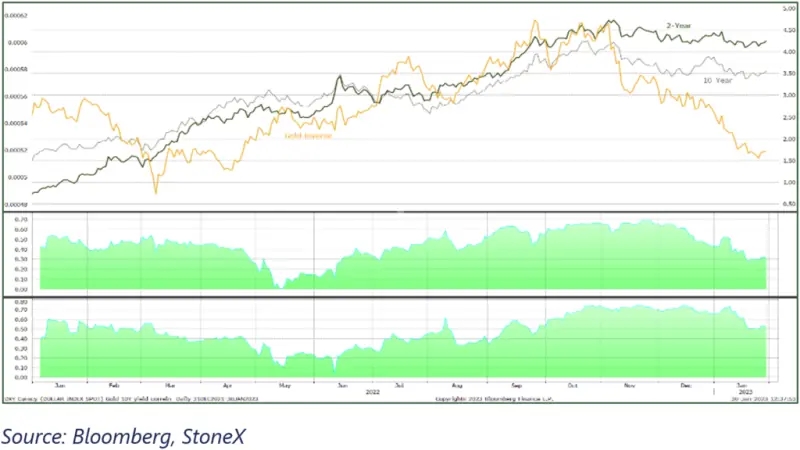

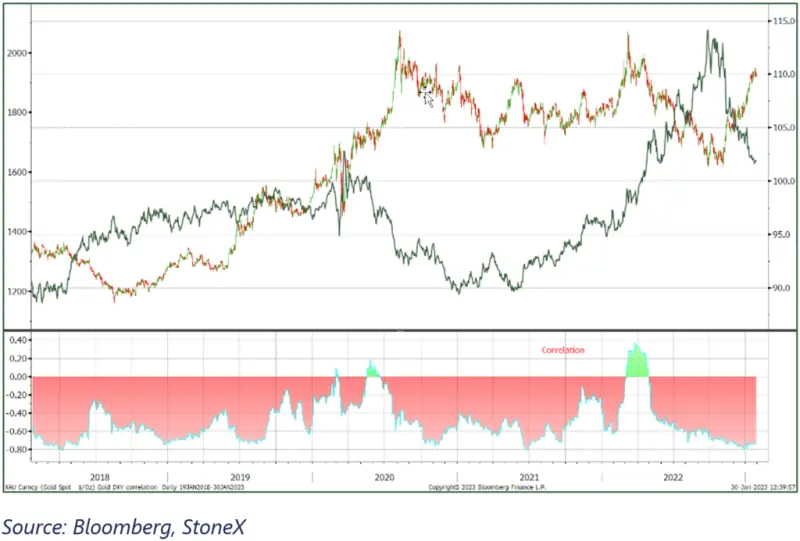

Gold, the dollar, and their correlation

Gold (inverted) and the two and ten-year yields; correlation with the 10Y