Jan 2023

Jan 2023

StoneX Bullion round-up Monday 16th January 2023

By StoneX Bullion

Gold pushes through $1,900 after the Golden Cross

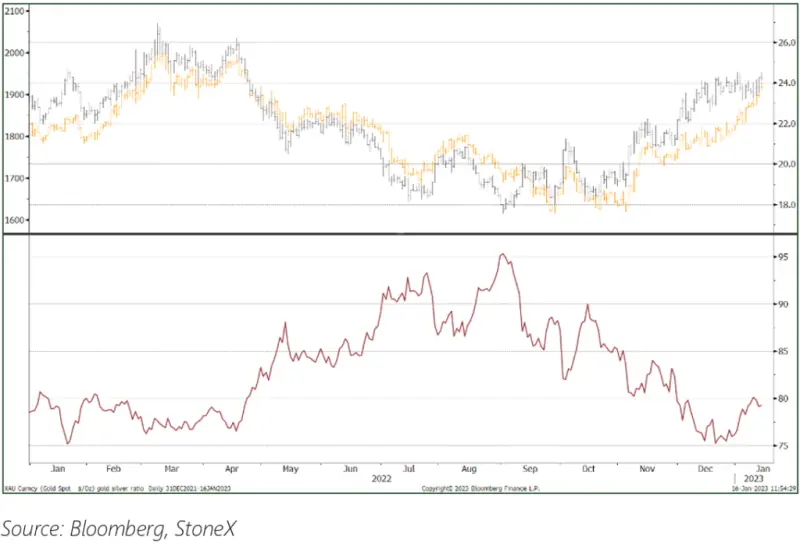

Gold, Silver, and the Ratio

Last week we wrote as follows: -

“It feels to us as if there has been some substantial pre-positioning by professional investors, possibly with a view to the U.S.’ rate cycle peaking this year (which may or may not happen – the bond market is still more benign than the Fed’s rhetoric, which is still “higher for longer”). In addition, the European Central Bank remains hawkish and is talking of a sustained period of aggressive moves in order to bring inflation (Harmonised CPI currently 11.1%, core at 7.8%) back towards 2%”.

Not much has changed. Gold has continued to push upwards, and a time of writing is challenging $1,920. The market is clearly overbought and ready for a correction, but underlying sentiment remains friendly. The latest figures from the CFTC, which date to last Tuesday (when gold was at $1,877 after $1,827 a week previously) showed an additional 24t of outright longs (to 363t) and no overall change in the outright shorts, which is unusual. The net long now stands at 192t, the highest since 10th May, and compared with a twelve-month average of 138t.

Silver, by contrast, saw some long liquidation plus some fresh shorts, taking the net long down to 3,735t, a drop of 16%. Having made the first move, rallying shortly in the first half of December, and leaving gold behind, at least at that stage, silver has been labouring at $24, although it did rally through that level at the end of last week to test $24.50. The ratio with gold widened accordingly, but has hit resistance again at 80, suggesting that there may well have been some ratio trading going on.

U.S. CPI

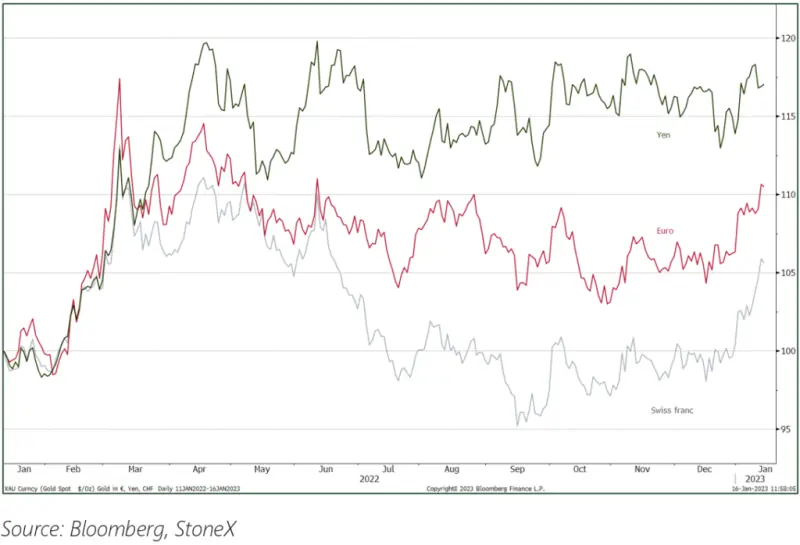

Gold’s continued ascent applied in other local currencies, confirming independent strength, although a small correction is kicking in here, also. Part of the additional gains last week can be attributed to a technical construction on the charts known as the Golden Cross, when the 50-Day moving average crosses the 200-Day moving average to the upside (the reverse is called a Death Cross). Then a negative CPI number from the United States again raised talk of the possibility of the Fed slowing its rate cycle, with some observers suggesting that the next rate change will be just 25 basis points, by comparison with the 50-point hike in lasty December, preceded by four 75-point hikes plus a 50 and a 25 earlier in the year. The fed funds target rate thus moved from zero to a target range of 4.25-4.50% year-on-year. CPI inflation in the States came down in December to 6.4% from over 8% in mid-year.

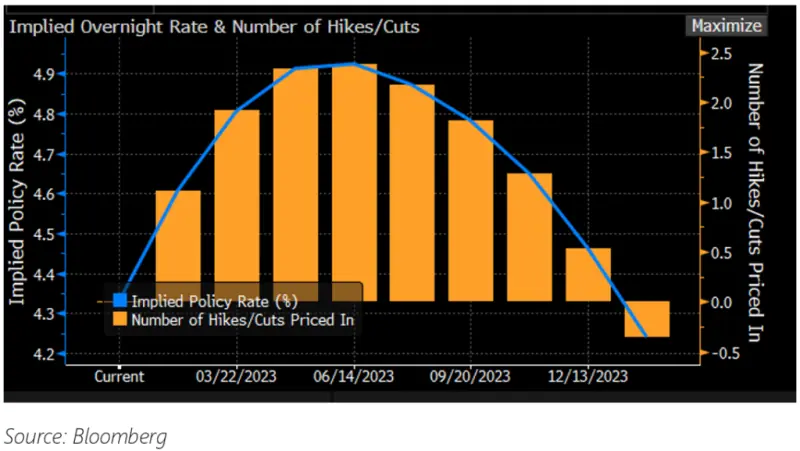

US Bond market - fed funds futures

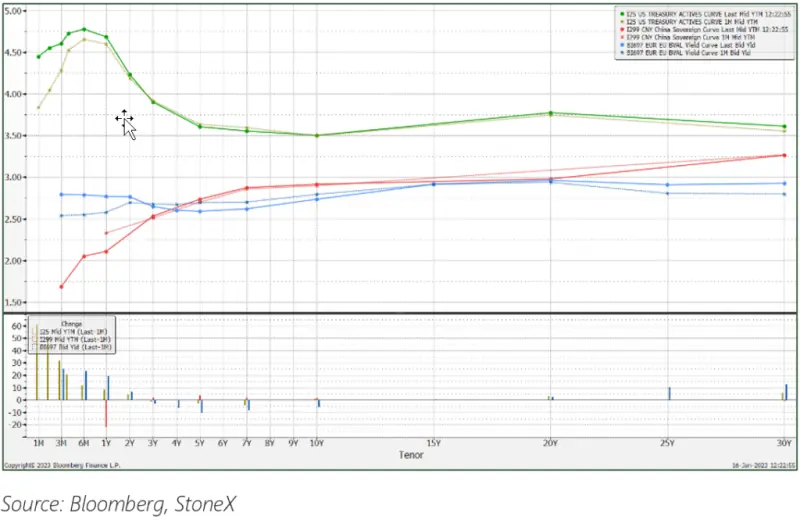

The next Fed meeting is on the 31st January – 1st February and the bond markets are currently expecting a 25-basis point hike and still looking for rates to peak in June. The yield curve has steepened to the downside in the medium-term tenors (one-year to five-years) and has remained pretty flat with the 30-year yield standing at 3.5%. This, too, peaks in June this year and while one negative CPI number is hardly a trend, the reduction in inflationary pressures came more or less across the board. Food inflation has been easing for some months, while the energy subsector fell by 4.5% month-on-month in December. Taken on a year-on-year basis, food inflation is still high, at 10.4%, while energy overall posted a gain of 7% - as recently at last August it was at 24%.

Whether gold has fully priced in a slowdown in the Fed’s rate cycle is debatable, but the uncertain economic environment in Europe and the risk to emerging markets of a too strong dollar and high rates are all supportive for gold, as is the geopolitical climate. Silver is likely to continue to ride on gold’s coattails, having paused for a much-needed breath.

Meanwhile when gold starts to falter, we should probably expect some profit taking coming out of COMEX positions as well as OTC.

The U.S., E.U. and China yield curves

Key charts

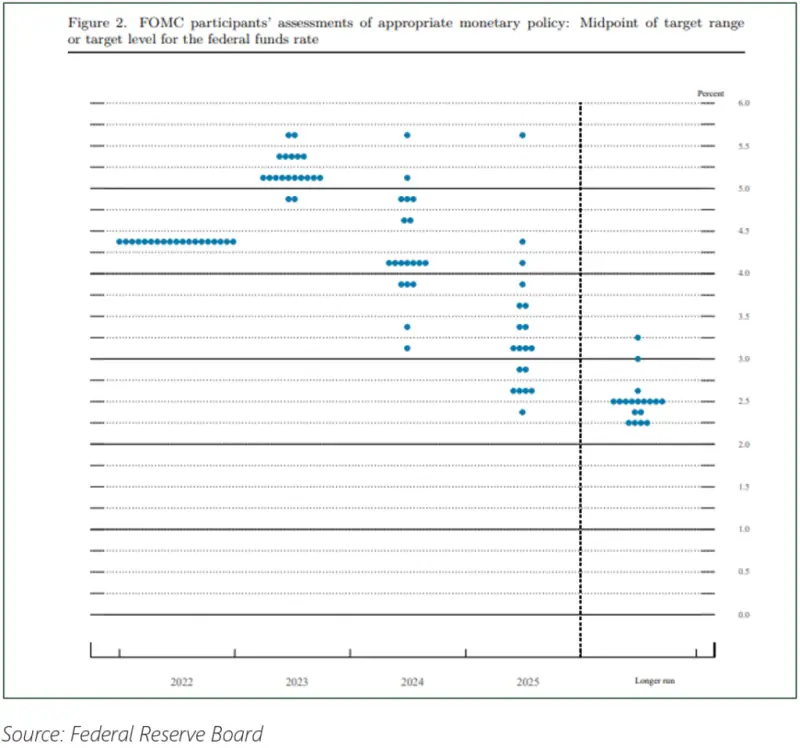

FOMC December dot plot

Gold, the Dollar, and their correlation

Gold (inverted) and the two and ten-year yields; correlation with the 10Y

Gold and the S&P; Ratio